What is general aggregate insurance information

Home » Trending » What is general aggregate insurance informationYour What is general aggregate insurance images are ready in this website. What is general aggregate insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is general aggregate insurance files here. Download all royalty-free images.

If you’re searching for what is general aggregate insurance images information connected with to the what is general aggregate insurance interest, you have visit the right site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

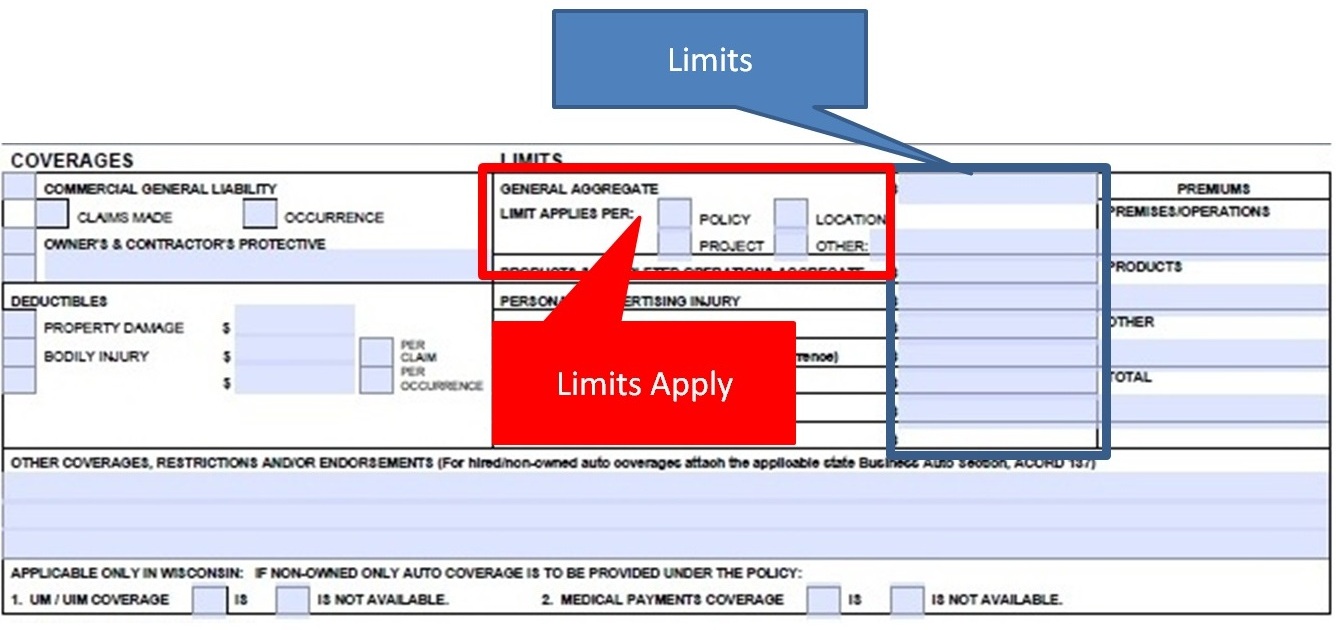

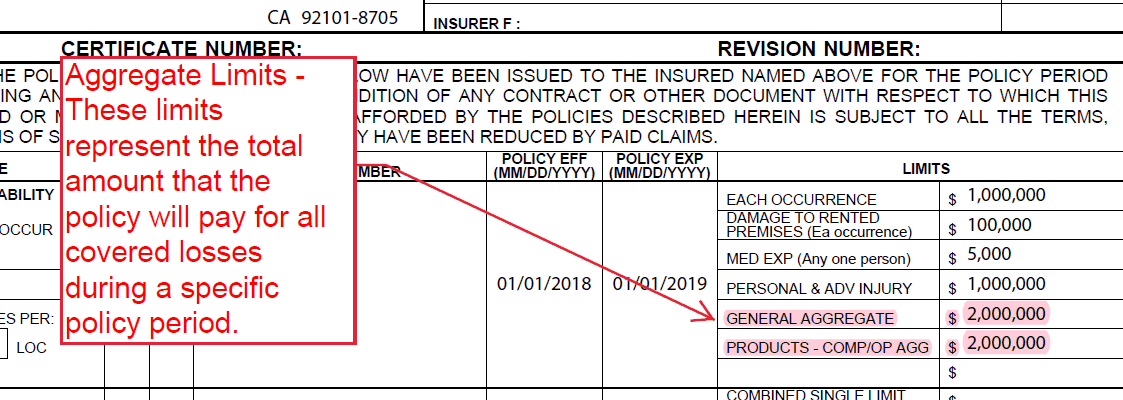

What Is General Aggregate Insurance. Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. These clauses determine what constitutes a claim for the purposes of excesses and maximum liability under the policy, by either aggregating or segregating multiple losses on a policy. The aggregate helps the insurance company create an incentive for its policyholders to avoid lawsuits. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year.

What Does General Aggregate Mean In Insurance saintjohn From payforessayz.com

What Does General Aggregate Mean In Insurance saintjohn From payforessayz.com

Cgl insurance policies carry liability limits , which means that during the term of coverage, the insurance will pay only up to a certain amount. Aggregate also is referred to as an aggregate limit or general aggregate limit. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for. A small construction company may have a general liability policy with an aggregate limit of $2,000,000. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand.

Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time.

Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time. The aggregate limits are part of commercial general. Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time. A small construction company may have a general liability policy with an aggregate limit of $2,000,000. Aggregation clauses are used to define the coverage limits (that is, the maximum amount to be paid per claim) in a policy. What is general aggregate on an insurance policy?

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

Aggregation clauses are used to define the coverage limits (that is, the maximum amount to be paid per claim) in a policy. A general aggregate sets the limits of your commercial general liability (cgl) policy. The aggregate helps the insurance company create an incentive for its policyholders to avoid lawsuits. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims,. The aggregate helps the insurance company create an incentive for its policyholders to avoid lawsuits.

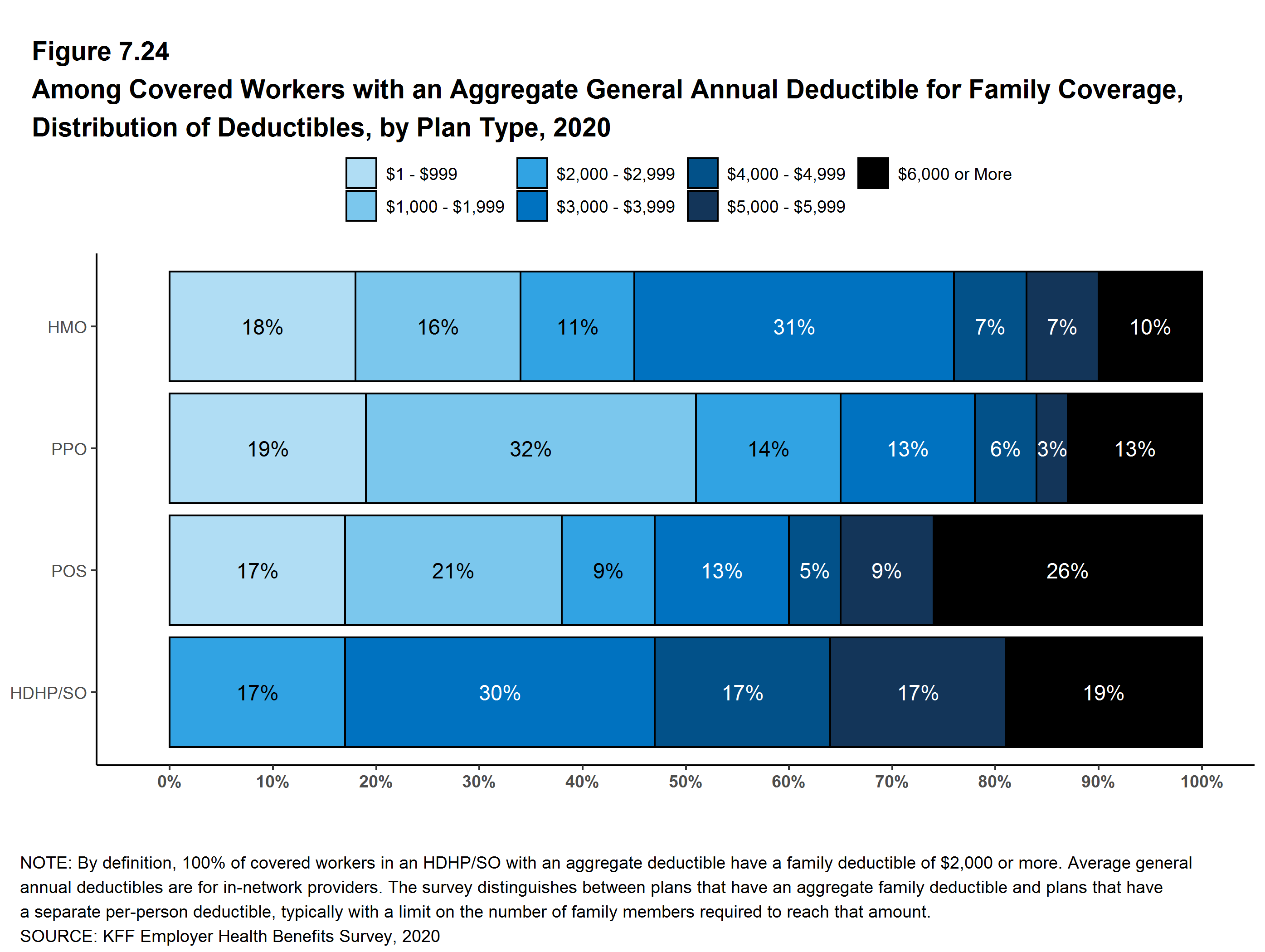

Source: kff.org

Source: kff.org

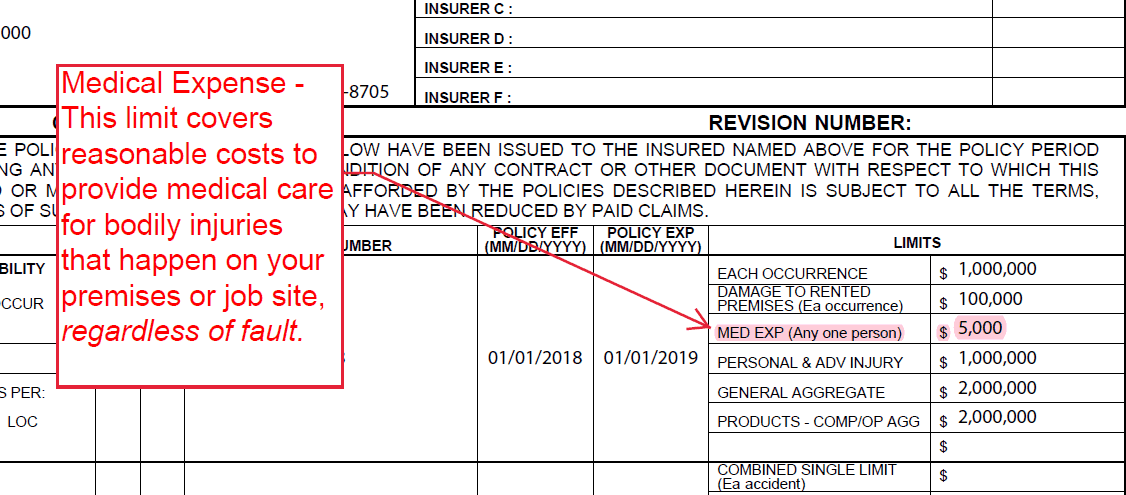

An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. What is the general aggregate limit? If unfortunately, you have multiple large claims in one given year, the aggregate limit will be there to help protect you. The policy contract defines your coverage limits, parameters, and policy period.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. What is the general aggregate limit? Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit.

Source: weqmra.com

Source: weqmra.com

Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. What does ‘general aggregate’ mean in an insurance policy? Cgl insurance policies carry liability limits , which means that during the term of coverage, the insurance will pay only up to a certain amount. Aggregation clauses are used to define the coverage limits (that is, the maximum amount to be paid per claim) in a policy. Once the policy reaches those thresholds, its financial resources are exhausted.

Source: glquote.com

Source: glquote.com

General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

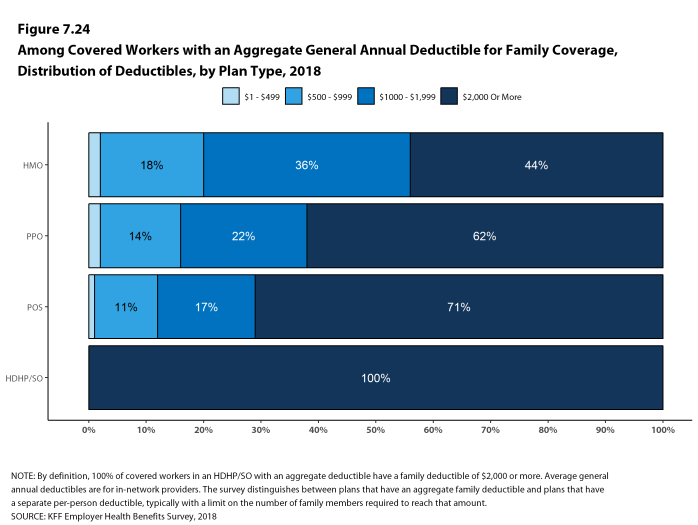

Source: kff.org

Source: kff.org

General liability insurance is purchased through any insurer that provides commercial insurance lines coverage. Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. What is general aggregate insurance? In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. That might represent a single large claim, or multiple smaller ones.

Source: ekinsurance.com

Source: ekinsurance.com

If unfortunately, you have multiple large claims in one given year, the aggregate limit will be there to help protect you. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims,. A general aggregate sets the limits of your commercial general liability (cgl) policy.

Source: namm.org

Source: namm.org

The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. What is general aggregate insurance? This may lead the company owner to believe that if a house his crew is working on is damaged in a fire, his insurance company will cover the damage up to the amount of $2,000,000. A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

Source: sadlersports.com

Source: sadlersports.com

This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit. The aggregate limits are part of commercial general. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for. A general aggregate sets the limits of your commercial general liability (cgl) policy.

Source: payforessayz.com

Source: payforessayz.com

Let’s go over the basics about general aggregate limits in general liability insurance. This common misconception is untrue. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims,. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for.

Source: softproductionafrica.com

Source: softproductionafrica.com

A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit. Let’s go over the basics about general aggregate limits in general liability insurance. In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure.

Source: thebluebook.com

Source: thebluebook.com

In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. This common misconception is untrue. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The aggregate limits are part of commercial general.

Source: kff.org

Source: kff.org

Aggregate also is referred to as an aggregate limit or general aggregate limit. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. Let’s go over the basics about general aggregate limits in general liability insurance. A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy.

Source: tempusproservices.com

Source: tempusproservices.com

A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. The aggregate limit is the total amount the insurer will pay in any one policy term. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit.

Source: verifiablee.com

Source: verifiablee.com

An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. What is general aggregate insurance? A general aggregate sets the limits of your commercial general liability (cgl) policy. Let’s go over the basics about general aggregate limits in general liability insurance. What is the general aggregate limit?

Source: verifiablee.com

Source: verifiablee.com

In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. The aggregate helps the insurance company create an incentive for its policyholders to avoid lawsuits. What is a general aggregate for insurance? General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year. An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year.

Source: glquote.com

Source: glquote.com

The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims,. A small construction company may have a general liability policy with an aggregate limit of $2,000,000. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. This may lead the company owner to believe that if a house his crew is working on is damaged in a fire, his insurance company will cover the damage up to the amount of $2,000,000.

Source: payforessayz.com

Source: payforessayz.com

What is general aggregate on an insurance policy? What is general aggregate on an insurance policy? Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. That might represent a single large claim, or multiple smaller ones.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is general aggregate insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information