What is group accident insurance information

Home » Trend » What is group accident insurance informationYour What is group accident insurance images are available. What is group accident insurance are a topic that is being searched for and liked by netizens today. You can Get the What is group accident insurance files here. Download all free vectors.

If you’re searching for what is group accident insurance images information related to the what is group accident insurance interest, you have pay a visit to the ideal blog. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

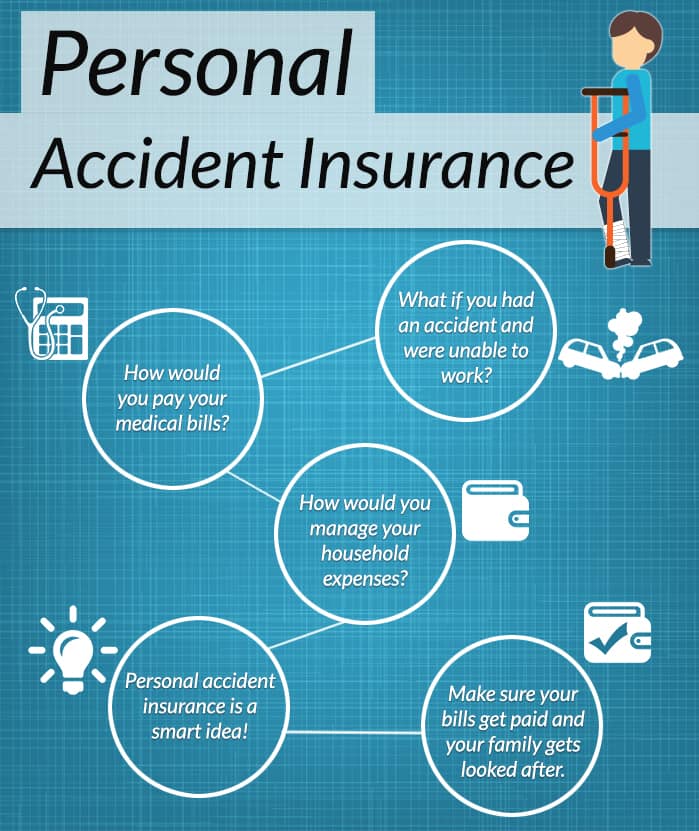

What Is Group Accident Insurance. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of. The cost is low and payouts are relatively easy to get. Voluntary accident insurance is an accident insurance policy (aka, an accident supplement) that an employer offers to employees. Benefits of group accident insurance.

Personal Accident Insurance Policy From alankitinsurance.com

Personal Accident Insurance Policy From alankitinsurance.com

Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident. Accident insurance is commonly used to fill gaps in other types of coverage, such as health and disability insurance. The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage. Ad compare top 50 expat health insurance in indonesia. Accident insurance isn�t the only way to offset your medical costs. Some options to consider may include:

Chances are, you are not fully covered if you’re injured in an accident.

Accident insurance pays cash benefits for injuries resulting from an accident. Some options to consider may include: Close i have a retirement account, annuity account, life insurance policy, group benefits policy or brokerage account. Metlife’s accident insurance is a limited benefit group insurance policy. Employees can buy protection for their spouse and/or kids. Payouts can be as high as $10,000 for expensive accidents, or as little as a few hundred dollars.

Source: policybazaar.com

Source: policybazaar.com

It is a comprehensive cover that can be bought for large as well as. Accident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. If employees wish to enroll in the coverage, the premiums are deducted from their paychecks. Unlike medical payments insurance (medpay), accident insurance is not a form of auto insurance.accident insurance doesn’t technically fall in the same category as health or disability insurance plans, either; There are other types of supplemental insurance and financial products available that could help relieve the burden.

Source: taxguru.in

Source: taxguru.in

A group personal accident insurance policy covers employees of ac pvt. There are actually quite a few distinctions to be. It is a comprehensive cover that can be bought for large as well as. One of the employees, kirti shukla had an accident while driving and got several injuries. The insurance company will pay you cash as long as you’ve been paying your premiums (often a monthly payment).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Group rates for accident supplements make the coverage more affordable than it would be if each employee had to purchase an. You can include an accidental death and dismemberment (ad&d) benefit, wellness, and portability. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of. Accident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. If you get injured and it’s caused by a specific accident covered by your accident insurance policy, you or your family can file a claim.

Source: igreenrisk.com

Source: igreenrisk.com

If employees wish to enroll in the coverage, the premiums are deducted from their paychecks. Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident. Accident insurance pays cash benefits for injuries resulting from an accident. Simplified design, minimal paperwork, and quick claims. If you get injured and it’s caused by a specific accident covered by your accident insurance policy, you or your family can file a claim.

Source: slideshare.net

Source: slideshare.net

Metlife’s accident insurance is a limited benefit group insurance policy. Each accident insurance company is different, but you should learn what they cover before taking out an accident insurance policy. Proof of good health is never required. Common injuries such as burns, dislocations, fractures, concussions, eye injuries, lacerations, and brain trauma. These policies usually provide fixed benefits for qualifying injuries as a supplement to a major medical policy.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

Though it depends on your situation, group accident insurance could be worth offering to your employees. Group travel policy includes personal accident insurance as well to provide for the hospital and emergency carriage expenses if anything untoward happens to any of the travellers. We could help with the unexpected expenses that medical insurance doesn’t fully cover. Accident insurance isn�t the only way to offset your medical costs. Metlife’s accident insurance is a limited benefit group insurance policy.

Source: gcrgroup.com.my

Source: gcrgroup.com.my

Even if your health insurance covers 100% of your medical costs from the accident, you may still receive benefits from your accident insurance plan. For the purposes of this benefit, coma means a profound state of unconsciousness caused by a covered accident. Characteristics and benefits of group personal accident cover to employees. Guardian direct accident insurance pays cash benefits to you if you have a covered accidental injury. Accidents create financial problems for the insured and dependents alike.

Source: guardiananytime.com

Source: guardiananytime.com

We could help with the unexpected expenses that medical insurance doesn’t fully cover. Voluntary accident insurance is an accident insurance policy (aka, an accident supplement) that an employer offers to employees. Characteristics and benefits of group personal accident cover to employees. These policies usually provide fixed benefits for qualifying injuries as a supplement to a major medical policy. Common injuries such as burns, dislocations, fractures, concussions, eye injuries, lacerations, and brain trauma.

Source: rowett-insurance.co.uk

Source: rowett-insurance.co.uk

Benefits of group accident insurance. Common injuries such as burns, dislocations, fractures, concussions, eye injuries, lacerations, and brain trauma. The cost is low and payouts are relatively easy to get. Accident insurance pays cash benefits for injuries resulting from an accident. Accident insurance isn�t the only way to offset your medical costs.

Source: radiantbroking.com

Source: radiantbroking.com

One of the employees, kirti shukla had an accident while driving and got several injuries. These policies usually provide fixed benefits for qualifying injuries as a supplement to a major medical policy. Group accident insurance is a type of insurance that is offered to employees (by the employer) to protect them against the medical expenses incurred due to injury or death resulting from an accident at the workplace.today, the employers worldwide have realised that their workforce is their greatest asset and therefore, are taking every step to. Accident insurance isn�t the only way to offset your medical costs. Accident insurance helps you get through a sudden injury by offering a monetary payout with flexible uses.

Source: revisi.net

Source: revisi.net

Metlife’s accident insurance is a limited benefit group insurance policy. Unlike medical payments insurance (medpay), accident insurance is not a form of auto insurance.accident insurance doesn’t technically fall in the same category as health or disability insurance plans, either; Accident insurance is like disability insurance in that you get paid after an injury. Simplified design, minimal paperwork, and quick claims. Group personal accident insurance offers complete coverage in the event of death or disablement of the policyholder due to accidents occurring anywhere in the world.

Source: alankitinsurance.com

Source: alankitinsurance.com

Group personal accident insurance offers complete coverage in the event of death or disablement of the policyholder due to accidents occurring anywhere in the world. Accident insurance is a type of insurance where the policy holder is paid directly in the event of an accident resulting in injury of the insured. Simplified design, minimal paperwork, and quick claims. Employees can buy protection for their spouse and/or kids. You can include an accidental death and dismemberment (ad&d) benefit, wellness, and portability.

Source: provincialinsurance.in

Source: provincialinsurance.in

Characteristics and benefits of group personal accident cover to employees. Even if your health insurance covers 100% of your medical costs from the accident, you may still receive benefits from your accident insurance plan. Workers� compensation only covers you for workplace accidents. Simplified design, minimal paperwork, and quick claims. Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident.

Source: youtube.com

Source: youtube.com

Accident insurance is commonly used to fill gaps in other types of coverage, such as health and disability insurance. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of. We could help with the unexpected expenses that medical insurance doesn’t fully cover. Get the best quote and save 30% today! Accident insurance pays cash benefits for injuries resulting from an accident.

Source: orientinsurance.lk

Source: orientinsurance.lk

The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage. Close i have a retirement account, annuity account, life insurance policy, group benefits policy or brokerage account. We could help with the unexpected expenses that medical insurance doesn’t fully cover. Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident. Group travel policy includes personal accident insurance as well to provide for the hospital and emergency carriage expenses if anything untoward happens to any of the travellers.

Accident expense insurance — accident insurance for short — is a type of supplemental policy that pays out a lump sum cash benefit if you are injured due to a covered accident. Guardian direct accident insurance pays cash benefits to you if you have a covered accidental injury. If your child is injured during an organized sport, the cash benefit paid increases by 20%. Group travel policy includes personal accident insurance as well to provide for the hospital and emergency carriage expenses if anything untoward happens to any of the travellers. Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident.

Source: charisha.org

Source: charisha.org

Group travel policy includes personal accident insurance as well to provide for the hospital and emergency carriage expenses if anything untoward happens to any of the travellers. Payouts can be as high as $10,000 for expensive accidents, or as little as a few hundred dollars. Unlike medical payments insurance (medpay), accident insurance is not a form of auto insurance.accident insurance doesn’t technically fall in the same category as health or disability insurance plans, either; Metlife’s accident insurance is a limited benefit group insurance policy. Key features of group accident insurance from principal.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A group personal accident insurance policy covers employees of ac pvt. Workers� compensation only covers you for workplace accidents. Accident insurance is a type of product sold by insurance companies. Each accident insurance company is different, but you should learn what they cover before taking out an accident insurance policy. Coma (once per accident) payable when an insured is in a coma lasting 30 days or more as the result of a covered accident.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is group accident insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information