What is ho4 insurance Idea

Home » Trend » What is ho4 insurance IdeaYour What is ho4 insurance images are ready in this website. What is ho4 insurance are a topic that is being searched for and liked by netizens today. You can Get the What is ho4 insurance files here. Find and Download all royalty-free vectors.

If you’re searching for what is ho4 insurance images information connected with to the what is ho4 insurance keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

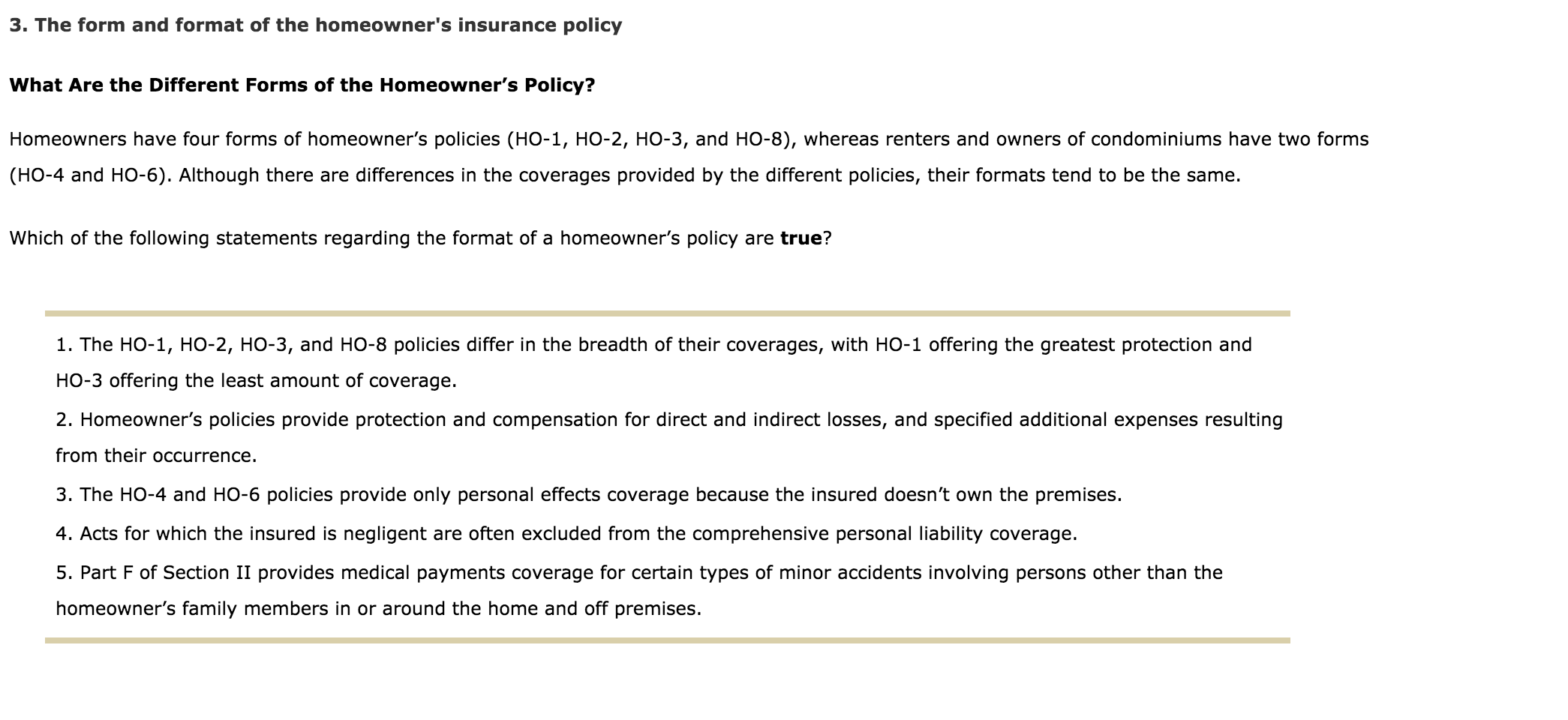

What Is Ho4 Insurance. If you own your condo, you will want to purchase an ho6 policy.this policy covers your individual unit in the same way that a standard homeowners policy covers a house. This insurance also covers liability, medical payments, and additional living expenses. It provides personal property coverage, liability coverage and specific coverage of improvements to the owner’s unit. Renters insurance policies cover personal property and liability, but don’t cover the physical structure of the house.

Renters Liability Insurance Cost Renters Ho4 Insurance From tempestadealmaletraseimagens.blogspot.com

Renters Liability Insurance Cost Renters Ho4 Insurance From tempestadealmaletraseimagens.blogspot.com

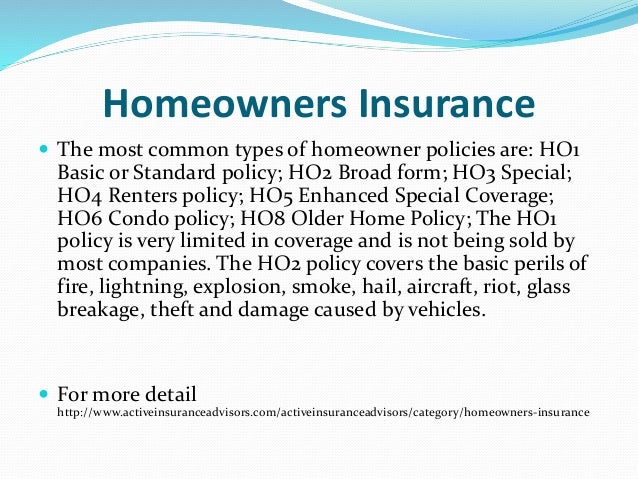

The ho6 is similar to the ho3 but designed specifically for condo owners. Aug 11, 2021 — an ho4 insurance policy, popularly known as renters insurance, provides coverage of personal property for tenants—those who lease (rather (24). For starters, there are eight main types of homeowner’s insurance: Ho4 insurance is insurance for renters. While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types. Condominium owners can get ho6 insurance.

While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types.

While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types. The ho4 is a named perils policy. Renters insurance policies cover personal property and liability, but don’t cover the physical structure of the house. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. Ho4 insurance is insurance for renters. To tell you why your camp pendleton renters insurance policy says “homeowners”, we’ll have to dig a bit into the history of insurance.

Source: trustedchoice.com

Source: trustedchoice.com

This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. Ho6 policies cover the walls, floors and ceiling of your unit but not the rest. In other words, it can help pay for: This insurance policy covers personal property for 16 specific named perils. Renters insurance protects your personal property against damage or loss and insures you in case someone is injured while on the rented property.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Renters insurance policies cover personal property and liability, but don’t cover the physical structure of the house. An ho4 policy is a renters insurance policy. An ho4 will offer coverage for your belongings as well as some personal liability coverage. An ho4 does not cover the building structure itself. What is the difference between an ho6 (condo) and ho4 (renters) insurance policy?

Source: univistainsurance.com

Source: univistainsurance.com

Ho4 insurance is insurance for renters. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. What’s another name for ho4 insurance? While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types. The ho4 is a named perils policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Named perils and open perils. Renters insurance protects your personal property against damage or loss and insures you in case someone is injured while on the rented property. It provides personal property coverage, liability coverage and specific coverage of improvements to the owner’s unit. What’s another name for ho4 insurance? This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo.

Ho4 insurance covers your personal property and legal liability if you rent your home instead of owning it. This policy type covers both your home. Ho4 policies usually cover damage caused by these 16 named perils: While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types. The ho6 and ho4 both cover your personal property and personal liability, but only the ho6 condo policy has additional coverage a for the interior finishing of the unit.

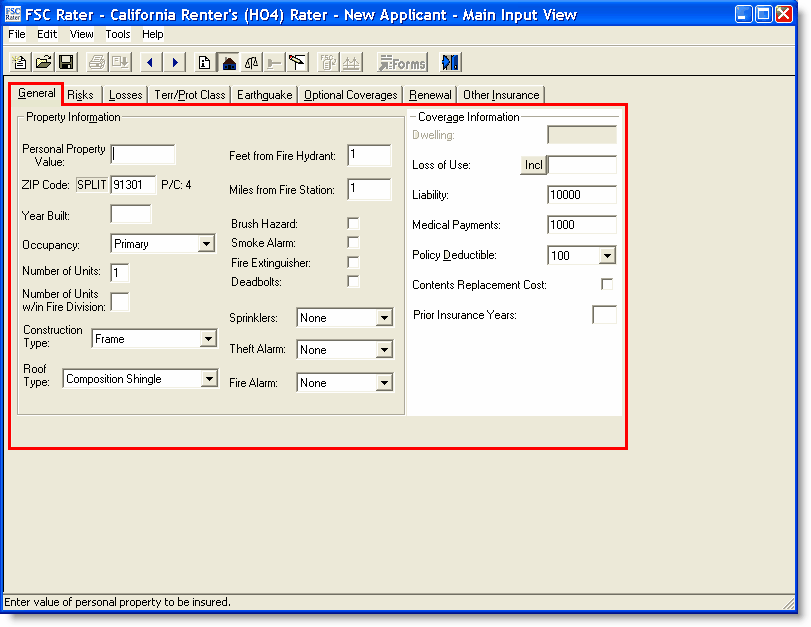

Source: help.vertafore.com

Source: help.vertafore.com

Condominium owners can get ho6 insurance. This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. It provides personal property coverage, liability coverage and specific coverage of improvements to the owner’s unit. Instead, the owner of the house or building would have the policy to cover the property. The ho6 and ho4 both cover your personal property and personal liability, but only the ho6 condo policy has additional coverage a for the interior finishing of the unit.

Source: lamz-droid.blogspot.com

Source: lamz-droid.blogspot.com

However, the ho6 policy will cover your interior walls that you own. Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff. While many of these policies share common features, such as customizable premium plans and coverage extras, each one is designed to insure very specific property types. There are two categories of insurance policies; An ho4 policy is a renters insurance policy.

Source: youtube.com

Source: youtube.com

An ho4 does not cover the building structure itself. It provides personal property coverage, liability coverage and specific coverage of improvements to the owner’s unit. To tell you why your camp pendleton renters insurance policy says “homeowners”, we’ll have to dig a bit into the history of insurance. There are two categories of insurance policies; Renters insurance policies cover personal property and liability, but don’t cover the physical structure of the house.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. These policies are usually inexpensive. Ho6 policies cover the walls, floors and ceiling of your unit but not the rest. Renters insurance protects your personal property against damage or loss and insures you in case someone is injured while on the rented property. Ho1, ho2, ho3, ho4, ho5, ho6, ho7, and ho8 policies.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Ho4 policies usually cover damage caused by these 16 named perils: An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. Ho1, ho2, ho3, ho4, ho5, ho6, ho7, and ho8 policies. This policy type covers both your home. For starters, there are eight main types of homeowner’s insurance:

Source: tempestadealmaletraseimagens.blogspot.com

Source: tempestadealmaletraseimagens.blogspot.com

Ho4 insurance is insurance for renters. However, the ho6 policy will cover your interior walls that you own. Ho4 insurance, also called renters insurance, protects renters from unexpected accidents or incidents in the rented apartment. Ho6 policies cover the walls, floors and ceiling of your unit but not the rest. This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo.

Source: youtube.com

Source: youtube.com

However, the ho6 policy will cover your interior walls that you own. An ho6 policy comes down to ownership. What is an ho4 policy? This insurance also covers liability, medical payments, and additional living expenses. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable.

Source: lemonade.com

Source: lemonade.com

What’s another name for ho4 insurance? Some ho4 policies also include loss of use coverage. This is an ideal policy for someone renting an apartment or house. What is an ho4 policy? Named perils and open perils.

Source: slideshare.net

Source: slideshare.net

Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. Ho4 vs ho6 homeowners policy. Renters insurance policies cover personal property and liability, but don’t cover the physical structure of the house. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. Named perils and open perils.

Source: aztechnet.com

Source: aztechnet.com

To tell you why your camp pendleton renters insurance policy says “homeowners”, we’ll have to dig a bit into the history of insurance. This policy type covers both your home. There are two categories of insurance policies; An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability. What’s another name for ho4 insurance?

Source: slideshare.net

Source: slideshare.net

Instead, the owner of the house or building would have the policy to cover the property. This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. Condo insurance is important to have though since your association’s policy will not cover your belongings or. An ho4 policy is a renters insurance policy. What is a renters insurance ho4 and why does it say homeowners policy whether you’re on base or you live elsewhere in the area and have a san diego renters insurance , the answer is the same.

Source: dulcineainsurance.com

Source: dulcineainsurance.com

This is an ideal policy for someone renting an apartment or house. There are two categories of insurance policies; Ho4 insurance covers your personal property and legal liability if you rent your home instead of owning it. The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo. Ho4 vs ho6 homeowners policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Instead, the owner of the house or building would have the policy to cover the property. Ho4 policies usually cover damage caused by these 16 named perils: This is an ideal policy for someone renting an apartment or house. This insurance also covers liability, medical payments, and additional living expenses. Ho4 insurance, also called renters insurance, protects renters from unexpected accidents or incidents in the rented apartment.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is ho4 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information