What is ho5 insurance Idea

Home » Trend » What is ho5 insurance IdeaYour What is ho5 insurance images are available in this site. What is ho5 insurance are a topic that is being searched for and liked by netizens today. You can Download the What is ho5 insurance files here. Find and Download all royalty-free images.

If you’re searching for what is ho5 insurance pictures information linked to the what is ho5 insurance interest, you have come to the right blog. Our site frequently gives you suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

What Is Ho5 Insurance. This means your insurer covers damage to your home and personal property when it’s caused by an event, or peril, as long. Reinsurance is insurance for insurance companies, to ensure that no insurance company has too much exposure to a large event or disaster. An ho5 policy is a total coverage insurance policy option. In this case, it features open perils coverage.

What You Should Know About Your HO5 Insurance Policy From lemonade.com

What You Should Know About Your HO5 Insurance Policy From lemonade.com

If you are a homewoner is worth looking into so you can evaluate all your insurance options. Ho5 insurance policy explained an ho5 homeowners policy will provide you with the most complete type of coverage that you can find. An ho5 policy is a total coverage insurance policy option. An insurance policy covers certain types of disasters, called “perils.” It also costs more than standard homeowners insurance. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options.

Both ho3 and ho5 insurance offer open perils for the structure of your home.

Having insurance on your home is a necessity. The first difference between ho3. In this case, it features open perils coverage. As the name implies, it is the type of homeowner�s insurance that provides the widest coverage. An ho5 policy is a total coverage insurance policy option. It takes your basic homeowners insurance coverage and adds a number of significant perks.

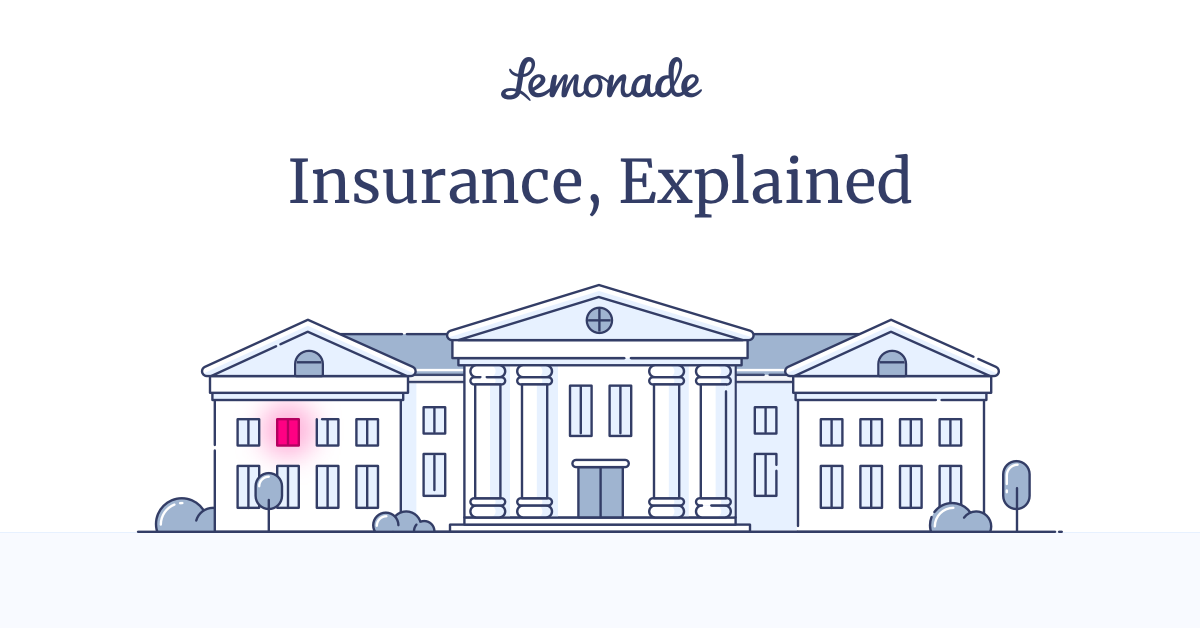

Source: youngalfred.com

Source: youngalfred.com

This means the policy protects against loss or damage caused by any perils except any that are specifically named and excluded. It includes four components of. Ho5 insurance provides the most extensive homeowners coverage. An ho5 policy is a type of premium insurance policy that provides broader protection and higher coverage limits than your typical homeowners policy. As the name implies, it is the type of homeowner�s insurance that provides the widest coverage.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Think of an ho5 policy like the tesla model x of insurance policies. An ho3 policy only covers your personal property on a named peril basis, whereas an ho5 plan provides coverage on an open peril basis. Ho3 policies are available to all home types (it’s at the insurance company’s discretion whether to accept your application for insurance). What is an ho5 homeowners policy? An insurance policy covers certain types of disasters, called “perils.”

Source: orchidinsurance.com

Source: orchidinsurance.com

An ho5 policy is a type of premium insurance policy that provides broader protection and higher coverage limits than your typical homeowners policy. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. This means your insurer covers damage to your home and personal property when it’s caused by an event, or peril, as long. Think of an ho5 policy like the tesla model x of insurance policies. Ho3 policies are available to all home types (it’s at the insurance company’s discretion whether to accept your application for insurance).

Source: transactly.com

Source: transactly.com

As the name implies, it is the type of homeowner�s insurance that provides the widest coverage. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. Reinsurance is insurance for insurance companies, to ensure that no insurance company has too much exposure to a large event or disaster. That includes your furniture, clothes, electronics, etc. This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later).

Source: lemonade.com

Source: lemonade.com

It includes four components of. Both ho3 and ho5 insurance offer open perils for the structure of your home. What is ho5 homeowners insurance? The first difference between ho3. Ho5 policies are available to newer homes in areas with a low risk of natural disasters, crime, and other bad things that could cause losses or damages.

Source: youngalfred.com

Source: youngalfred.com

Think of an ho5 policy like the tesla model x of insurance policies. This differs slightly from a standard. An ho5 policy is a total coverage insurance policy option. Ho5 insurance provides the most extensive homeowners coverage. It also costs more than standard homeowners insurance.

Source: youtube.com

Source: youtube.com

Both ho3 and ho5 insurance offer open perils for the structure of your home. Ho5 insurance policy explained an ho5 homeowners policy will provide you with the most complete type of coverage that you can find. It includes four components of. Ho5 policies are available to newer homes in areas with a low risk of natural disasters, crime, and other bad things that could cause losses or damages. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options.

Source: blog.thimmeschkastner.com

Source: blog.thimmeschkastner.com

This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). Ho3 policies are available to all home types (it’s at the insurance company’s discretion whether to accept your application for insurance). It includes four components of. Ho5 insurance, a type of home insurance, covers everything and will put the onus on your insurance provider. Ho5 insurance is open peril for both personal property and structures on your property.

Source: lamburt.com

Source: lamburt.com

Ho5 policies are available to newer homes in areas with a low risk of natural disasters, crime, and other bad things that could cause losses or damages. Ho5 policies are available to newer homes in areas with a low risk of natural disasters, crime, and other bad things that could cause losses or damages. This means the policy protects against loss or damage caused by any perils except any that are specifically named and excluded. An ho5 policy is a type of premium insurance policy that provides broader protection and higher coverage limits than your typical homeowners policy. That includes your furniture, clothes, electronics, etc.

Source: investingport.com

Source: investingport.com

Reinsurance is insurance for insurance companies, to ensure that no insurance company has too much exposure to a large event or disaster. It includes four components of. Having insurance on your home is a necessity. With open peril, you don�t need to name specific items for coverage. Ho5 insurance, a type of home insurance, covers everything and will put the onus on your insurance provider.

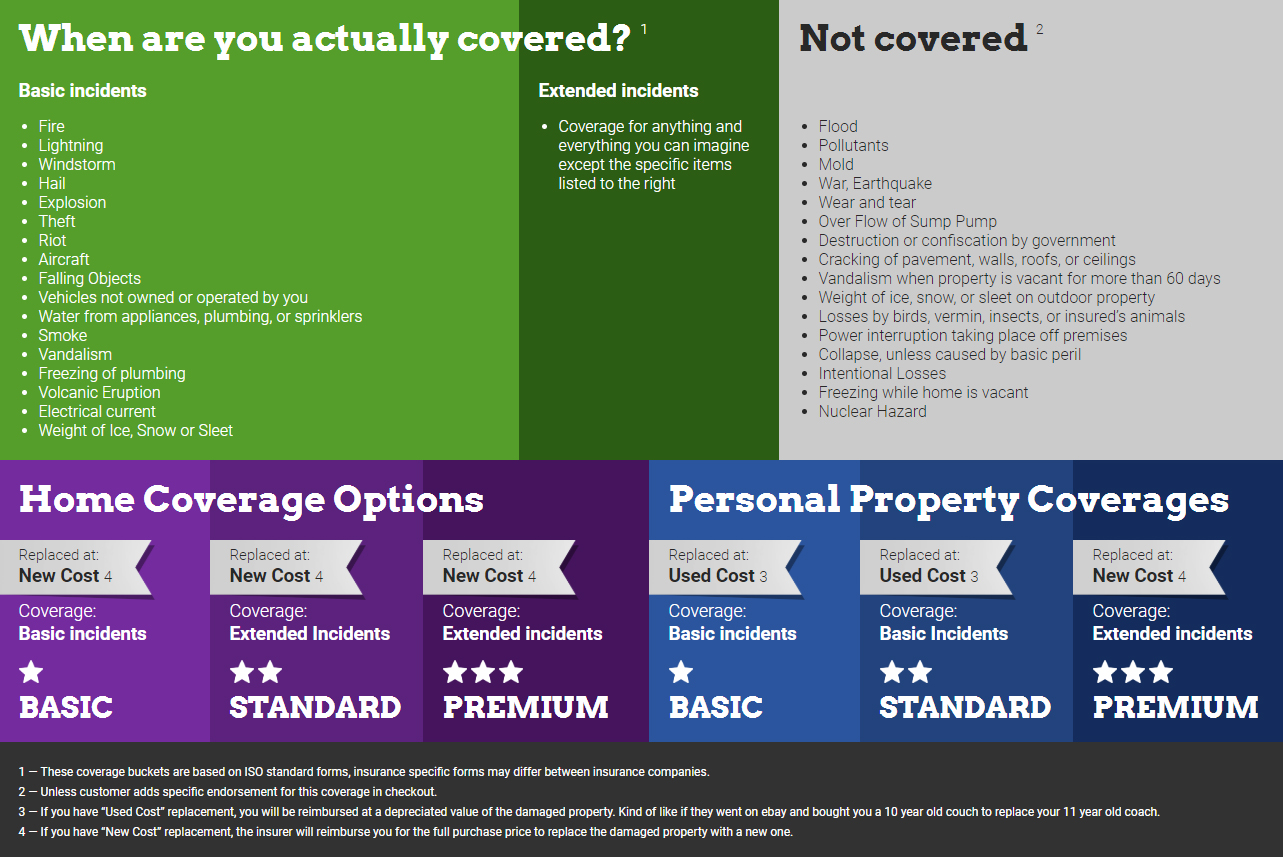

Source: slideshare.net

Source: slideshare.net

The first difference between ho3. Ho5 insurance, a type of home insurance, covers everything and will put the onus on your insurance provider. Ho5 insurance provides the most extensive homeowners coverage. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. This differs slightly from a standard.

Source: youngalfred.com

Source: youngalfred.com

Both ho3 and ho5 insurance offer open perils for the structure of your home. This means your insurer covers damage to your home and personal property when it’s caused by an event, or peril, as long. This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). An insurance policy covers certain types of disasters, called “perils.” It takes your basic homeowners insurance coverage and adds a number of significant perks.

Source: viaa4u.com

Source: viaa4u.com

Having insurance on your home is a necessity. An ho5 policy is a total coverage insurance policy option. What is an ho5 homeowners policy? As the name implies, it is the type of homeowner�s insurance that provides the widest coverage. This means the policy protects against loss or damage caused by any perils except any that are specifically named and excluded.

Source: insuranceproaz.com

Source: insuranceproaz.com

An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. An ho5 policy is a total coverage insurance policy option. Ho3 policies are available to all home types (it’s at the insurance company’s discretion whether to accept your application for insurance). In other words, it�s the premium version of homeowners insurance. Ho5 insurance policy explained an ho5 homeowners policy will provide you with the most complete type of coverage that you can find.

Source: pinterest.com

Source: pinterest.com

An ho5 policy is a total coverage insurance policy option. This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). It takes your basic homeowners insurance coverage and adds a number of significant perks. An ho5 policy is a total coverage insurance policy option. An ho5 policy is a total coverage insurance policy option.

Source: mybanktracker.com

Source: mybanktracker.com

This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). It also costs more than standard homeowners insurance. If you are a homewoner is worth looking into so you can evaluate all your insurance options. Ho5 insurance policy explained an ho5 homeowners policy will provide you with the most complete type of coverage that you can find. It takes your basic homeowners insurance coverage and adds a number of significant perks.

Source: tgsinsurance.com

Source: tgsinsurance.com

Both ho3 and ho5 insurance offer open perils for the structure of your home. It takes your basic homeowners insurance coverage and adds a number of significant perks. Reinsurance is insurance for insurance companies, to ensure that no insurance company has too much exposure to a large event or disaster. That includes your furniture, clothes, electronics, etc. An ho3 policy only covers your personal property on a named peril basis, whereas an ho5 plan provides coverage on an open peril basis.

Source: tgsinsurance.com

Source: tgsinsurance.com

An ho3 policy only covers your personal property on a named peril basis, whereas an ho5 plan provides coverage on an open peril basis. With open peril, you don�t need to name specific items for coverage. In other words, it�s the premium version of homeowners insurance. As the name implies, it is the type of homeowner�s insurance that provides the widest coverage. Think of an ho5 policy like the tesla model x of insurance policies.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is ho5 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information