What is income for private health insurance rebate information

Home » Trending » What is income for private health insurance rebate informationYour What is income for private health insurance rebate images are available in this site. What is income for private health insurance rebate are a topic that is being searched for and liked by netizens today. You can Download the What is income for private health insurance rebate files here. Get all royalty-free photos.

If you’re searching for what is income for private health insurance rebate pictures information linked to the what is income for private health insurance rebate interest, you have come to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

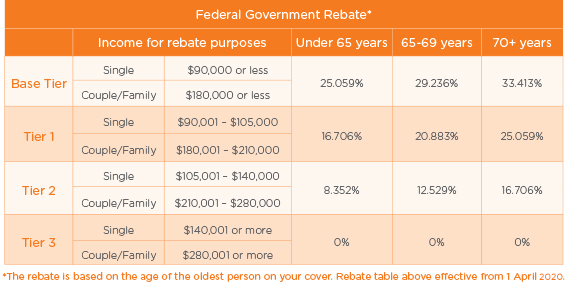

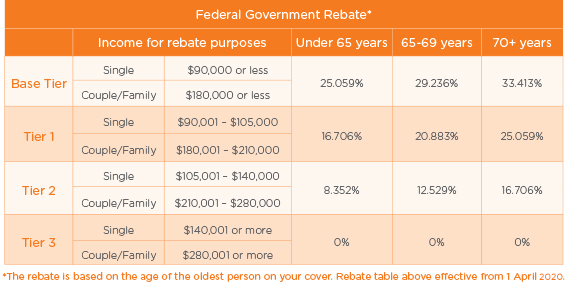

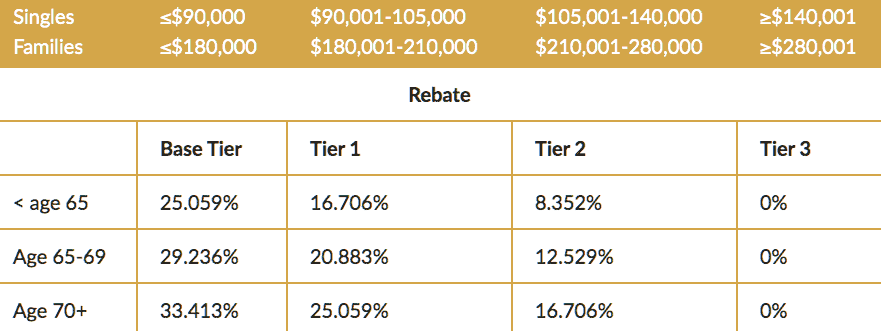

What Is Income For Private Health Insurance Rebate. Your entitlement to a private health insurance rebate or tax offset depends on both: The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. You have private health insurance that provides hospital cover, general treatment (‘extras’) cover, or both your income is below a certain limit. For families with multiple children, the income threshold increases by $1,500 for each dependent child after the first.

Private Health Insurance Rebate Navy Health From navyhealth.com.au

Private Health Insurance Rebate Navy Health From navyhealth.com.au

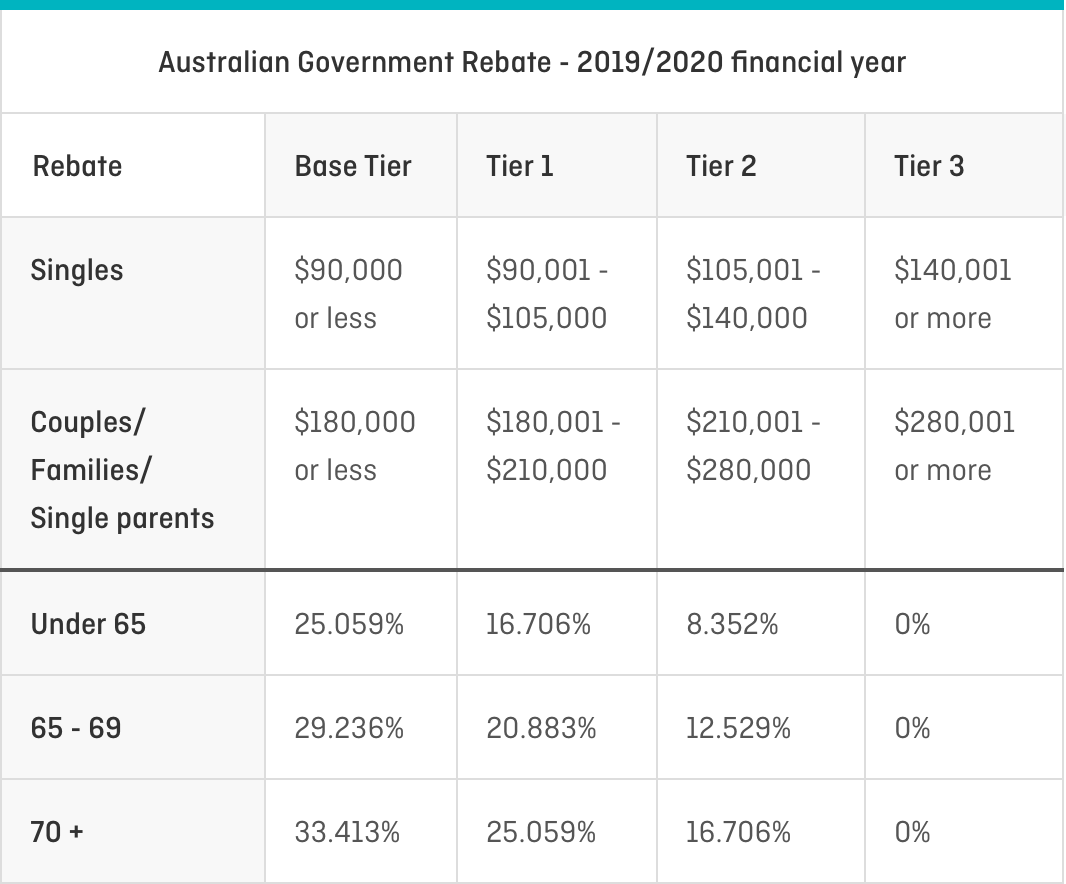

The australian government private health insurance rebate is the amount the government contributes towards the cost of your health insurance premiums. In the simplest form, rebates are calculated by dividing the total amount spent on qualified medical claims by the premiums collected, and then subtracting any federal and state taxes from that. The private health insurance rebate is income tested. To qualify for the private health. If you had a new spouse, or you separated from your spouse, during the year the mls is calculated considering the number of days you had a spouse and the number you were single. What is the private health insurance rebate?

For the private health insurance rebate, it means that if your taxable income level is within one of the three defined tiers, the amount of rebate you receive may be reduced (or removed completely).

How does the rebate work? The rebate applies to hospital, general treatment and ambulance policies. For families with multiple children, the income threshold increases by $1,500 for each dependent child after the first. The private health insurance rebate applies to people with taxable incomes of under $140,000 (singles) or $280,000 (couples or families). The private health insurance rebate is an amount the government contributes towards the cost of your private hospital health insurance premiums. The australian government rebate on private health insurance (the ‘rebate’) is an initiative where, depending on your income, the government contributes to the cost of your private health insurance.

Source: navyhealth.com.au

Source: navyhealth.com.au

Your single or family income depending on your family status. The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. The rebate is income tested, which means a higher income may reduce your rebate or you may not be entitled to any rebate at all. Single parents and couples (including de facto couples) are subject to the family tiers. The rebate is normally applied as a discount on your premiums, but can be applied at tax time.

Source: navyhealth.com.au

Source: navyhealth.com.au

If you have a higher income, your rebate entitlement may be reduced, or you may not be entitled to any. The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. If you had a new spouse, or you separated from your spouse, during the year the mls is calculated considering the number of days you had a spouse and the number you were single. The rebate is income tested, which means a higher income may reduce your rebate or you may not be entitled to any rebate at all. The rebate is income tested and can be claimed for premiums paid for a health insurance policy.

Source: insurance.qantas.com

Source: insurance.qantas.com

Your agr amount depends on your income and how old you are. For most people (aged under 65 and at the base income tier) their rebate will be around 24.6%. The rebate levels applicable from 1 april 2021* are: To qualify for the private health. 8 rows the private health insurance rebate is income tested.

Source: blog.lingoda.com

Source: blog.lingoda.com

If eligible, the tax rebate helps to reduce the costs of your insurance premiums when you lodge your tax claim. The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. It does not apply to overseas visitors cover. The private health insurance rebate is based on your: Single parents and couples (including de facto couples) are subject to the family tiers.

Source: news.com.au

Source: news.com.au

If you had a new spouse, or you separated from your spouse, during the year the mls is calculated considering the number of days you had a spouse and the number you were single. Every year, you’ll need to claim the rebate back from the government. It doesn’t apply to those on overseas visitors cover. What are the income thresholds for the government rebate? The rebate is income tested and can be claimed for premiums paid for a health insurance policy.

Source: theconversation.com

Source: theconversation.com

The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. What is the private health insurance rebate? The table below details the different rebate amounts. Single parents and couples (including de facto couples) are subject to the family tiers. To be eligible for the private health insurance rebate, your income for surcharge purposes must be less than the tier 3 income threshold.

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

How does the rebate work? If you�re eligible for the rebate, it�s important to understand that the rebate percentage you�re receiving will be reduced each year if the average premium increase for all health. The private health insurance rebate makes having health cover more accessible and affordable by applying a rebate to your premium. The rebate applies to hospital, general treatment and ambulance policies. Income for surcharge purposes is used to test your eligibility for the private health insurance rebate.

Source: pingminghealth.com

Source: pingminghealth.com

All the people listed on the health insurance policy must be eligible to claim medicare for you to receive the rebate. If your rebate is to change, contact your private health insurer now and tell them which tier you are in to avoid a potential tax liability. The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. How much is the rebate? Your family income exceeds the threshold, but your own income for mls purposes was $22,801 or less.

Source: iselect.com.au

Source: iselect.com.au

The private health insurance rebate is income tested. Those earning an income of $140,000 or less as a single, or $280,000 or less as a family (see table below), and who are entitled to medicare can apply for the agr. In the simplest form, rebates are calculated by dividing the total amount spent on qualified medical claims by the premiums collected, and then subtracting any federal and state taxes from that. For the private health insurance rebate, it means that if your taxable income level is within one of the three defined tiers, the amount of rebate you receive may be reduced (or removed completely). Your entitlement to a private health insurance rebate or tax offset depends on both:

Source: researchgate.net

Source: researchgate.net

If your rebate is to change, contact your private health insurer now and tell them which tier you are in to avoid a potential tax liability. What are the income thresholds for the government rebate? This means your eligibility for the rebate depends on your annual income. To be eligible for the private health insurance rebate, your income for surcharge purposes must be less than the tier 3 income threshold. 6 rows are you eligible for the private health insurance rebate?

Source: mediweb.com.au

Source: mediweb.com.au

6 rows are you eligible for the private health insurance rebate? Single parents and couples (including de facto couples) are subject to the family tiers. Your single or family income depending on your family status. It doesn’t apply to those on overseas visitors cover. Those earning $140,000 or less as a single, or $280,000 or less as a family (see above), and who are entitled to medicare can apply.

Source: theconversation.com

Source: theconversation.com

Single parents and couples (including de facto couples) are subject to the family tiers. Depending on your income and age the rebate can help you reduce your premium. The rebate is an incentive for individuals and families to take our private health insurance. This means your eligibility for the rebate depends on your annual income. In the simplest form, rebates are calculated by dividing the total amount spent on qualified medical claims by the premiums collected, and then subtracting any federal and state taxes from that.

Source: ondostate.info

Source: ondostate.info

What are the income thresholds for the government rebate? Who can apply for the agr? It does not apply to overseas visitors health cover. This means your eligibility for the rebate depends on your annual income. The australian government private health insurance rebate is the amount the government contributes towards the cost of your health insurance premiums.

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

Those earning an income of $140,000 or less as a single, or $280,000 or less as a family (see table below), and who are entitled to medicare can apply for the agr. All the people listed on the health insurance policy must be eligible to claim medicare for you to receive the rebate. Your single or family income depending on your family status. You have private health insurance that provides hospital cover, general treatment (‘extras’) cover, or both your income is below a certain limit. The table below details the different rebate amounts.

Source: iselect.com.au

Source: iselect.com.au

For families with multiple children, the income threshold increases by $1,500 for each dependent child after the first. The age of the oldest person your policy covers; How much is the rebate? The private health insurance rebate is based on your: If you have a higher income, your rebate entitlement may be reduced, or you may not be entitled to any.

Source: iselect.com.au

Source: iselect.com.au

Who can apply for the agr? 6 rows are you eligible for the private health insurance rebate? If you earn an income of $140,000 or less as a single, or $280,000 or less as a family (see table below) you are eligible for the rebate. If your rebate is to change, contact your private health insurer now and tell them which tier you are in to avoid a potential tax liability. The australian government private health insurance rebate is the amount the government contributes towards the cost of your health insurance premiums.

Source: healthdeal.com.au

Source: healthdeal.com.au

It does not apply to overseas visitors cover. If you�re eligible for the rebate, it�s important to understand that the rebate percentage you�re receiving will be reduced each year if the average premium increase for all health. You have private health insurance that provides hospital cover, general treatment (‘extras’) cover, or both your income is below a certain limit. The rebate applies to hospital, general treatment and ambulance policies. The lifetime health cover component of a premium is not eligible for the australian government rebate on.

Source: bcvfs.com.au

You have private health insurance that provides hospital cover, general treatment (‘extras’) cover, or both your income is below a certain limit. For the private health insurance rebate, it means that if your taxable income level is within one of the three defined tiers, the amount of rebate you receive may be reduced (or removed completely). The age of the oldest person your policy covers; You have private health insurance that provides hospital cover, general treatment (‘extras’) cover, or both your income is below a certain limit. The australian government rebate on private health insurance (the ‘rebate’) is an initiative where, depending on your income, the government contributes to the cost of your private health insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is income for private health insurance rebate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information