What is insurable interest Idea

Home » Trending » What is insurable interest IdeaYour What is insurable interest images are ready in this website. What is insurable interest are a topic that is being searched for and liked by netizens today. You can Find and Download the What is insurable interest files here. Download all free photos.

If you’re searching for what is insurable interest pictures information related to the what is insurable interest topic, you have visit the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

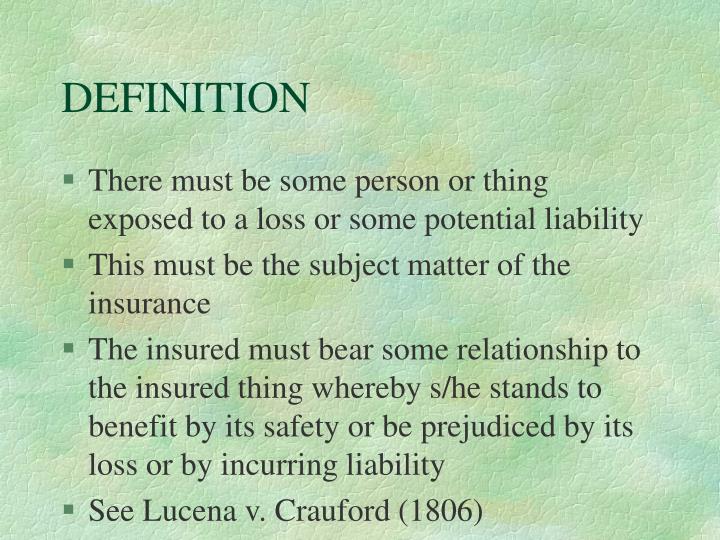

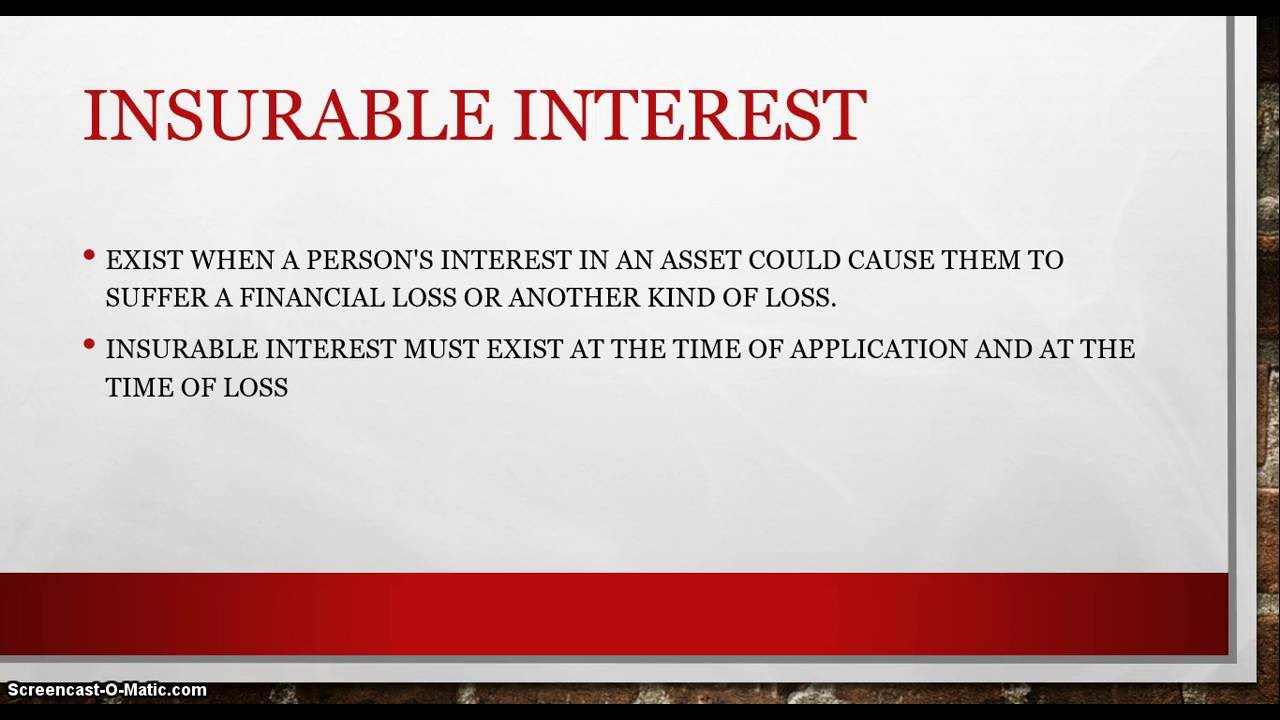

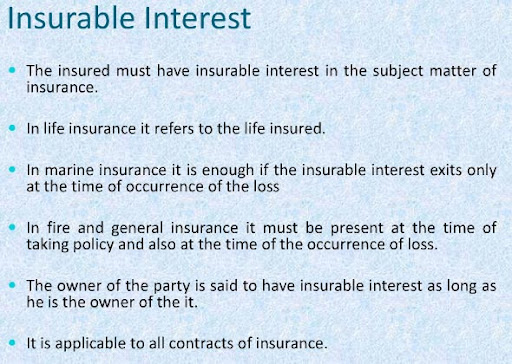

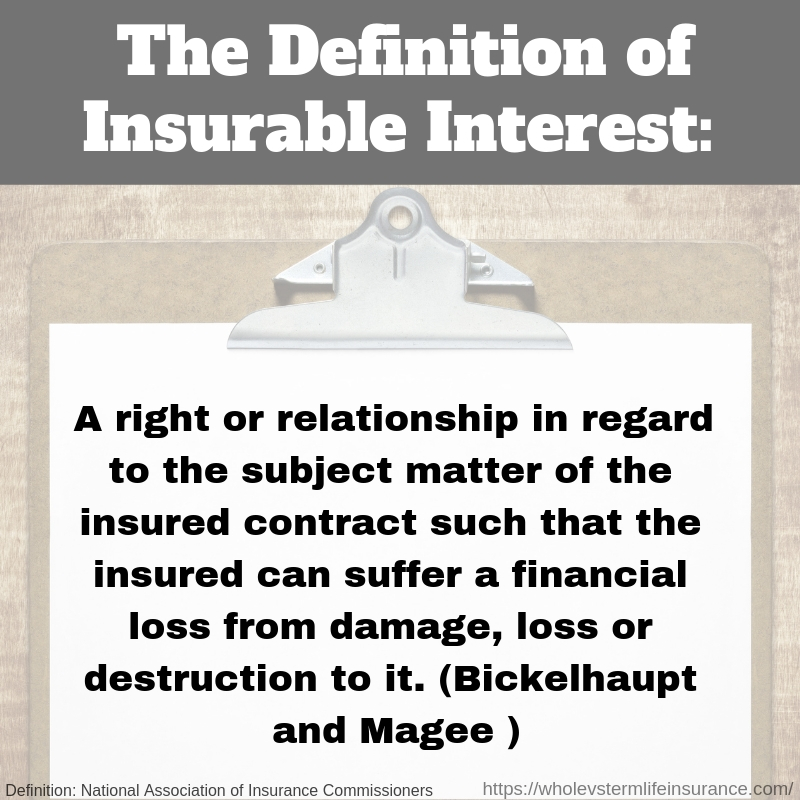

What Is Insurable Interest. A person or entity holds an insurable interest in any item, event, or action when the loss of or damage to that object would cause that person a financial loss or hardship. The person taking an insurance policy must have an insurable interest in the property or life insured. What is an insurable interest? Insurable interest is simply having a financial interest in something.

The Problem of Insurable Interest under UK and Irish Law From baloise-international.lu

It is defined as the concern of an individual towards obtaining an insurance policy for an item or an individual against any type of unforeseen events such as losses or death. Example of insurable interest beneficiary “insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. Insurable interest means having a financial stake in a person, a home, or a piece of personal property to the extent that if you were to suffer a loss, you’d stand to lose… a lot. It may also mean the interest of a beneficiary of a life insurance policy to prove need for the proceeds, called the insurable interest doctrine. Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured.

Conceptually speaking, an insurable interest can be defined as the amount of hardship that someone will face if they lose something or someone that they have insured.

Conceptually speaking, an insurable interest can be defined as the amount of hardship that someone will face if they lose something or someone that they have insured. Insurable interest means having a financial stake in a person, a home, or a piece of personal property to the extent that if you were to suffer a loss, you’d stand to lose… a lot. Insurable interest is said to exist when an insured person is. Insurable interest is no longer strictly an element of. It is a fundamental prerequisite for any insurance policy. Insurable interest is another significant notion in insurance.

Source: slideserve.com

Source: slideserve.com

Insurable interest is an investment with the intent to protect the purchaser from financial loss. This is a basic requirement for a life insurance contract: Insurable interest is another significant notion in insurance. The principle of insurable interest or insurable interest is one of the fundamental principles of insurance. Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured.

Source: slideserve.com

Source: slideserve.com

In the case of life insurance, it refers to the potential needs the beneficiary will require from the financial loss of the insured person. You owned a car and added it to your. Insurable interest is required so that you only benefit from insurance payouts for losses that would actually affect you financially. Conceptually speaking, an insurable interest can be defined as the amount of hardship that someone will face if they lose something or someone that they have insured. A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified.

Source: stitcher.com

Source: stitcher.com

Insurable interest refers to the right of property to be insured. “insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. Insurable interest refers to the right of property to be insured. A person is expected to have reasonable interest in a longer life for himself, his family, business and hence is in. You have an insurable interest in an item, property or person if loss, damage or destruction would cause financial loss or other hardship.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Insurance companies often require you to have insurable interest when you start the policy on the person or object and insurable interest at the time of the loss. You have an insurable interest in an item, property or person if loss, damage or destruction would cause financial loss or other hardship. A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified. Insurable interest refers to the right of property to be insured. A person is expected to have reasonable interest in a longer life for himself, his family, business and hence is in.

Source: youtube.com

Source: youtube.com

The person taking an insurance policy must have an insurable interest in the property or life insured. The principle of insurable interest or insurable interest is one of the fundamental principles of insurance. A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified. This means that you have some sort of financial stake in. Insurable interest means having a financial stake in a person, a home, or a piece of personal property to the extent that if you were to suffer a loss, you’d stand to lose… a lot.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

You owned a car and added it to your. A person or entity holds an insurable interest in any item, event, or action when the loss of or damage to that object would cause that person a financial loss or hardship. Insurable interest refers to the reasonable concern to secure insurance to protect against some form of loss. This is a basic requirement for a life insurance contract: Insurable interest refers to the right of property to be insured.

Source: ppt-online.org

Source: ppt-online.org

Insurable interest refers to the importance placed by an individual for certain things, events, or another person in their life. It is defined as the concern of an individual towards obtaining an insurance policy for an item or an individual against any type of unforeseen events such as losses or death. Insurable interest is no longer strictly an element of. It is a fundamental prerequisite for any insurance policy. “insurable interest” means, in simple terms, that someone would experience financial hardship upon your death.

Source: slideserve.com

Source: slideserve.com

This means that the policyholder must have a financial stake in. It is a fundamental prerequisite for any insurance policy. You owned a car and added it to your. Example of insurable interest beneficiary The person taking an insurance policy must have an insurable interest in the property or life insured.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

Example of insurable interest beneficiary Insurable interest is simply having a financial interest in something. It can be a financial hardship or other kinds of hardship, depending upon what or who was insured. You have an insurable interest in an item, property or person if loss, damage or destruction would cause financial loss or other hardship. The principle of insurable interest or insurable interest is one of the fundamental principles of insurance.

Source: qsstudy.com

Source: qsstudy.com

Insurable interest is another significant notion in insurance. Conceptually speaking, an insurable interest can be defined as the amount of hardship that someone will face if they lose something or someone that they have insured. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. It is a fundamental prerequisite for any insurance policy. Example of insurable interest beneficiary

Source: sleadas.com

Source: sleadas.com

An insurable interest in life insurance is a legal term that refers to the relationship between the policyholder and the person or entity being insured. In an insurance contract, the term ‘insurable interest‘ refers to the legal right to insure arising out of a financial relationship, recognized at law, between the insured and the subject matter. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. “insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. What is an insurable interest?

Source: youtube.com

Source: youtube.com

In order to do so, you must have an insurable interest in the car. Insurable interest is the pecuniary interest; In the law of insurance, the insured must have an interest in the subject matter of his or her policy, or such policy will be void and unenforceable since it will be regarded as a form of gambling. A person or an entity (it may be a company, group, organization etc.) has an insurable interest on a property, an event or a person, if in case of a loss or damage of the property or death, would incur a financial loss or other hardships. The person who is purchasing the policy needs to have an insurable interest in the insured person.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Insurable interest is an investment with the intent to protect the purchaser from financial loss. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. Insurance companies often require you to have insurable interest when you start the policy on the person or object and insurable interest at the time of the loss. Insurable interest is defined as the reasonable concern of a person to obtain insurance for any individual or property against unforeseen events such as death, losses, etc. For example, say you want to insure your car.

Source: youtube.com

Source: youtube.com

Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured. You owned a car and added it to your. In order for an individual to purchase life insurance on another person, they must have an insurable interest in that person’s life. A requirement for obtaining an insurance policy, an insurable interest refers to the level of hardship someone would experience as a result of the loss of someone or something. The presence of such resources is essential for the individual’s life and contentment.

Source: wptechh.com

Source: wptechh.com

An insurable interest in life insurance is a legal term that refers to the relationship between the policyholder and the person or entity being insured. Insurable interest is an investment with the intent to protect the purchaser from financial loss. In an insurance contract, the term ‘insurable interest‘ refers to the legal right to insure arising out of a financial relationship, recognized at law, between the insured and the subject matter. What is an insurable interest? It is a fundamental prerequisite for any insurance policy.

Source: iedunote.com

Source: iedunote.com

You have an insurable interest in an item, property or person if loss, damage or destruction would cause financial loss or other hardship. The presence of such resources is essential for the individual’s life and contentment. In an insurance contract, the term ‘insurable interest‘ refers to the legal right to insure arising out of a financial relationship, recognized at law, between the insured and the subject matter. It may also mean the interest of a beneficiary of a life insurance policy to prove need for the proceeds, called the insurable interest doctrine. A person or an entity (it may be a company, group, organization etc.) has an insurable interest on a property, an event or a person, if in case of a loss or damage of the property or death, would incur a financial loss or other hardships.

Source: lifeinsure.com

Source: lifeinsure.com

This has to do with who or what can be insured and who can insure them. Insurable interest is required so that you only benefit from insurance payouts for losses that would actually affect you financially. A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified. For example, say you want to insure your car. A requirement for obtaining an insurance policy, an insurable interest refers to the level of hardship someone would experience as a result of the loss of someone or something.

Source: baloise-international.lu

Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured. Insurable interest is required so that you only benefit from insurance payouts for losses that would actually affect you financially. Insurable interest is another significant notion in insurance. Insurable interest refers to the reasonable concern to secure insurance to protect against some form of loss. The presence of such resources is essential for the individual’s life and contentment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is insurable interest by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information