What is insurable interest beneficiary Idea

Home » Trend » What is insurable interest beneficiary IdeaYour What is insurable interest beneficiary images are available in this site. What is insurable interest beneficiary are a topic that is being searched for and liked by netizens today. You can Download the What is insurable interest beneficiary files here. Find and Download all free photos.

If you’re searching for what is insurable interest beneficiary images information related to the what is insurable interest beneficiary interest, you have come to the ideal site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

What Is Insurable Interest Beneficiary. “insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. Insurable interest is a type of investment that protects anything subject to a financial loss. There’s no requirement to prove your beneficiaries have an insurable interest in you. It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing.

Insurance & survey From slideshare.net

Insurance & survey From slideshare.net

This is the interest of the beneficiary of the policy to prove the need for being the one receiving the proceeds. Insurable interest is a type of investment that protects anything subject to a financial loss. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. This has to do with who or what can be insured and who can insure them. The creditor can be the beneficiary of your life insurance policy for the amount of any outstanding loan. The person who is purchasing the policy needs to have an insurable interest in the insured person.

“insurable interest” means, in simple terms, that someone would experience financial hardship upon your death.

In the general insurance industry in the united states today, insurable interest refers to the amount of financial need that the beneficiary on a life insurance policy will have when the insured passes away or the property is lost or damaged. Insurable interest is one of the most important concepts in insurance. Or, you are a ceo and your employer might want life insurance coverage on you. In the previous life insurance example, the insurable interest beneficiary is you. Insurable interest is another significant notion in insurance. For example, you might take out a life insurance policy on your spouse.

Source: istherelifeinsurancetanyogo.blogspot.com

Source: istherelifeinsurancetanyogo.blogspot.com

The insurable interest definition is a simple one. There’s no requirement to prove your beneficiaries have an insurable interest in you. In terms of life insurance, it means that you would financially suffer if the person who’s insured died. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. An insurable interest beneficiary is just the person who receives compensation in the event that the insurable interest is destroyed.

Source: everquote.com

Source: everquote.com

What is insurable interest in life insurance? The person who is purchasing the policy needs to have an insurable interest in the insured person. In the previous life insurance example, the insurable interest beneficiary is you. This is the interest of the beneficiary of the policy to prove the need for being the one receiving the proceeds. This has to do with who or what can be insured and who can insure them.

Source: paradigmlife.net

Source: paradigmlife.net

With regards to life insurance, someone having an insurable interest in you means that they would experience financial loss and hardship should you die. A beneficiary can be a person or a business. While you can name anyone as your beneficiary, only those who can prove an interest in the insured�s life can take out life insurance. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. A beneficiary is a person who benefits when the insurance gets paid out.

Source: istherelifeinsurancetanyogo.blogspot.com

Source: istherelifeinsurancetanyogo.blogspot.com

For survivor benefit election purposes, an insurable interest is presumed to exist if you name any of the following persons a beneficiary of the insurable interest: What is an insurable interest beneficiary? With regards to life insurance, someone having an insurable interest in you means that they would experience financial loss and hardship should you die. In general, a person is deemed to have insurable interest in the subject matter insured where he ha a relation or connection with or concern in it that he will derive pecuniary benefit or advantage from its preservation and will suffer pecuniary loss or damage from its destruction, termination or injury by the happening of the event insured. Insurable interest is an insurance term that applies to someone who would reasonably expect to derive financial benefit from your continued life.

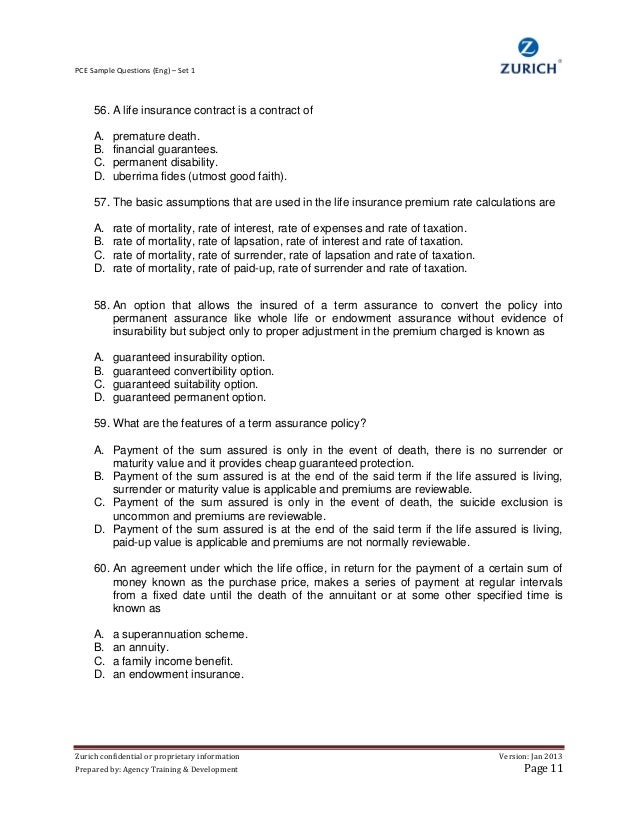

Source: slideshare.net

Source: slideshare.net

It has a slightly different meaning depending on whether we’re talking about renters, homeowners, or life insurance. For survivor benefit election purposes, an insurable interest is presumed to exist if you name any of the following persons a beneficiary of the insurable interest: In any case, a beneficiary must have an insurable interest in the person who is being insured. Insurable interest the insurable interest option is available only if you are unmarried with either no dependent children or one dependent child. Insurable interest is a legal requirement of life insurance and determines who you.

Source: family-protection-center.com

Source: family-protection-center.com

For example, you might take out a life insurance policy on your spouse. What is insurable interest in life insurance? Example of insurable interest beneficiary In any case, a beneficiary must have an insurable interest in the person who is being insured. Insurable interest is an insurance term which applies to someone who would reasonably expect to derive financial benefit from your continued life.

Source: thebalance.com

Source: thebalance.com

If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. What is insurable interest in life insurance? Otherwise, people could take out insurance on strangers to take advantage of the death benefit. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. You may elect insurable interest coverage for that.

Source: youtube.com

Source: youtube.com

For survivor benefit election purposes, an insurable interest is presumed to exist if you name as beneficiary of the insurable interest, any of the following individuals: There’s no requirement to prove your beneficiaries have an insurable interest in you. With regards to life insurance, someone having an insurable interest in you means that they would experience financial loss and hardship should you die. Insurable interest is an insurance term which applies to someone who would reasonably expect to derive financial benefit from your continued life. Insurable interest is one of the most important concepts in insurance.

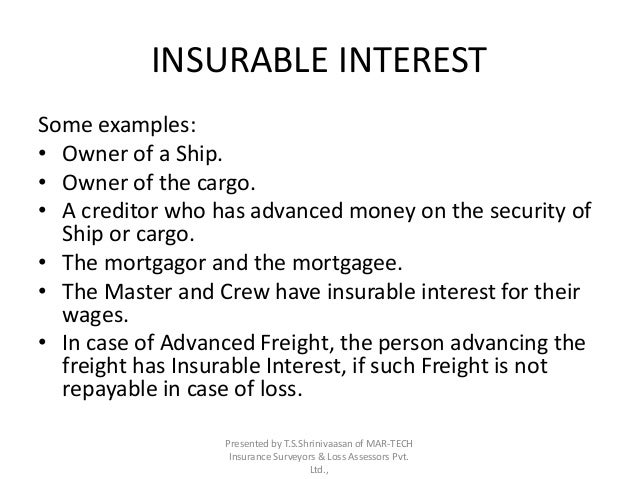

Source: slideserve.com

Source: slideserve.com

A beneficiary is a person who benefits when the insurance gets paid out. Insurable interest is another significant notion in insurance. This has to do with who or what can be insured and who can insure them. Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured. In any case, a beneficiary must have an insurable interest in the person who is being insured.

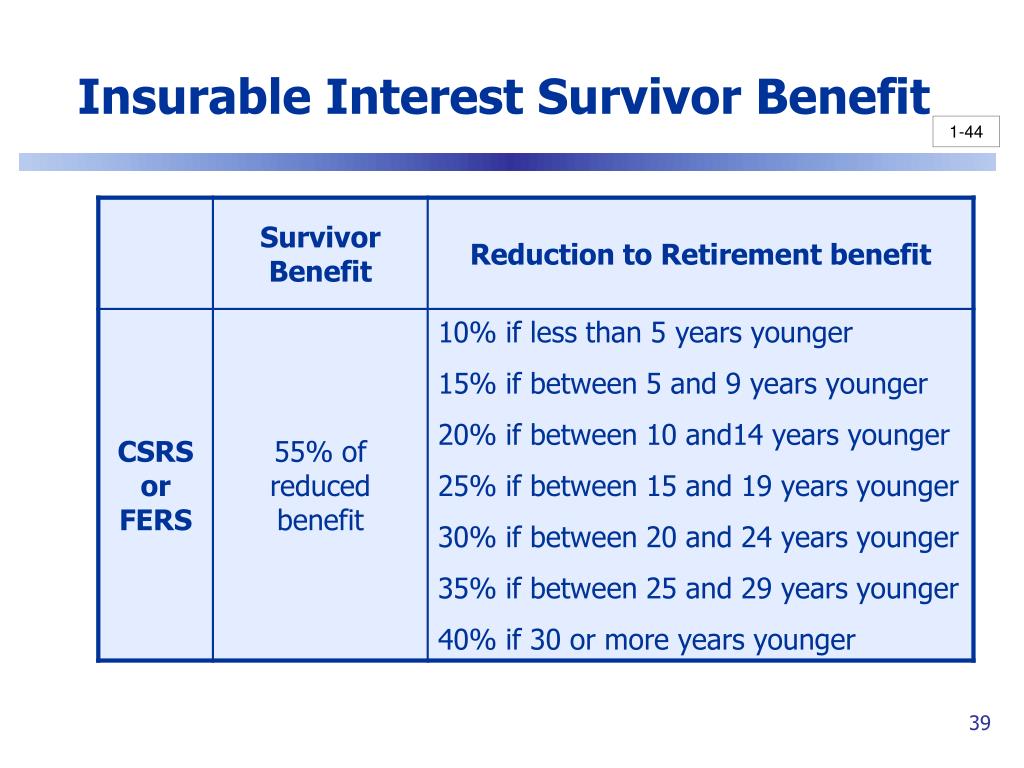

Source: slideserve.com

Source: slideserve.com

What is insurable interest in life insurance? Insurable interest is another significant notion in insurance. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest. Insurable interest is simply defined as the level of hardship (financial dependency and otherwise) a person will suffer from the loss of something or someone they have insured. What is insurable interest in life insurance?

Source: thebalance.com

Source: thebalance.com

In any case, a beneficiary must have an insurable interest in the person who is being insured. In any case, a beneficiary must have an insurable interest in the person who is being insured. Insurable interest becomes an issue when a person or entity initiates life insurance coverage on someone else. An insurable interest beneficiary is just the person who receives compensation in the event that the insurable interest is destroyed. Insurable interest is defined as having a reasonable expectation that you’d suffer a financial loss if the event you’re trying to insure against occurs.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

This has to do with who or what can be insured and who can insure them. Example of insurable interest beneficiary It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing. Insurable interest the insurable interest option is available only if you are unmarried with either no dependent children or one dependent child. Insurable interest becomes an issue when a person or entity initiates life insurance coverage on someone else.

Source: sproutt.com

Source: sproutt.com

Insurable interest is a type of investment that protects anything subject to a financial loss. Insurable interest is an insurance term which applies to someone who would reasonably expect to derive financial benefit from your continued life. Insurable interest is defined as having a reasonable expectation that you’d suffer a financial loss if the event you’re trying to insure against occurs. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. The person who is purchasing the policy needs to have an insurable interest in the insured person.

Source: pdffiller.com

Source: pdffiller.com

In the previous life insurance example, the insurable interest beneficiary is you. In the general insurance industry in the united states today, insurable interest refers to the amount of financial need that the beneficiary on a life insurance policy will have when the insured passes away or the property is lost or damaged. Insurable interest is an insurance term that applies to someone who would reasonably expect to derive financial benefit from your continued life. A person or entity has an insurable interest in an item, event or action when the damage or loss of. Insurable interest is a legal requirement of life insurance and determines who you.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

“insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. For survivor benefit election purposes, an insurable interest is presumed to exist if you name as beneficiary of the insurable interest, any of the following individuals: The insurable interest definition is a simple one. For survivor benefit election purposes, an insurable interest is presumed to exist if you name any of the following persons a beneficiary of the insurable interest: It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders.

Source: revisi.net

Source: revisi.net

In the previous life insurance example, the insurable interest beneficiary is you. Example of insurable interest beneficiary Otherwise, people could take out insurance on strangers to take advantage of the death benefit. Simply put, it is your right (and often financial interest) to be insured. If the party purchasing the policy would suffer economic loss if the person or item covered died, was harmed, destroyed, lost, or caused damage to another person or object, there is an insurable interest.

Source: stwserve.com

Source: stwserve.com

“insurable interest” means, in simple terms, that someone would experience financial hardship upon your death. It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing. Example of insurable interest beneficiary Insurable interest insurable interest means having a financial stake in a person, a home, or a piece of personal property to the extent that if you were to suffer a loss, you’d stand to lose… a lot. In the case of life insurance, it refers to the potential needs the beneficiary will require from the financial loss of the insured person.

Source: insurerereport.com

Source: insurerereport.com

It’s what makes you eligible to buy insurance, and it’s also what makes an insurer legally obligated to pay claims on your behalf. In the case of life insurance, it refers to the potential needs the beneficiary will require from the financial loss of the insured person. With regards to life insurance, someone having an insurable interest in you means that they would experience financial loss and hardship should you die. Simply put, it is your right (and often financial interest) to be insured. Insurable interest is one of the most important concepts in insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is insurable interest beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information