What is insurable risk information

Home » Trend » What is insurable risk informationYour What is insurable risk images are available. What is insurable risk are a topic that is being searched for and liked by netizens today. You can Download the What is insurable risk files here. Get all royalty-free photos and vectors.

If you’re searching for what is insurable risk pictures information connected with to the what is insurable risk interest, you have come to the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

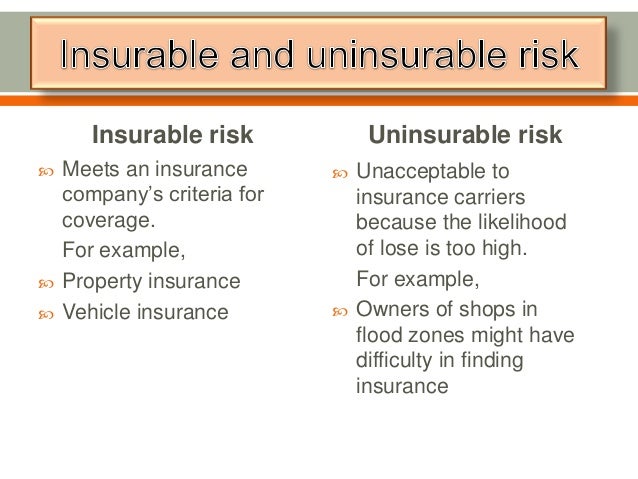

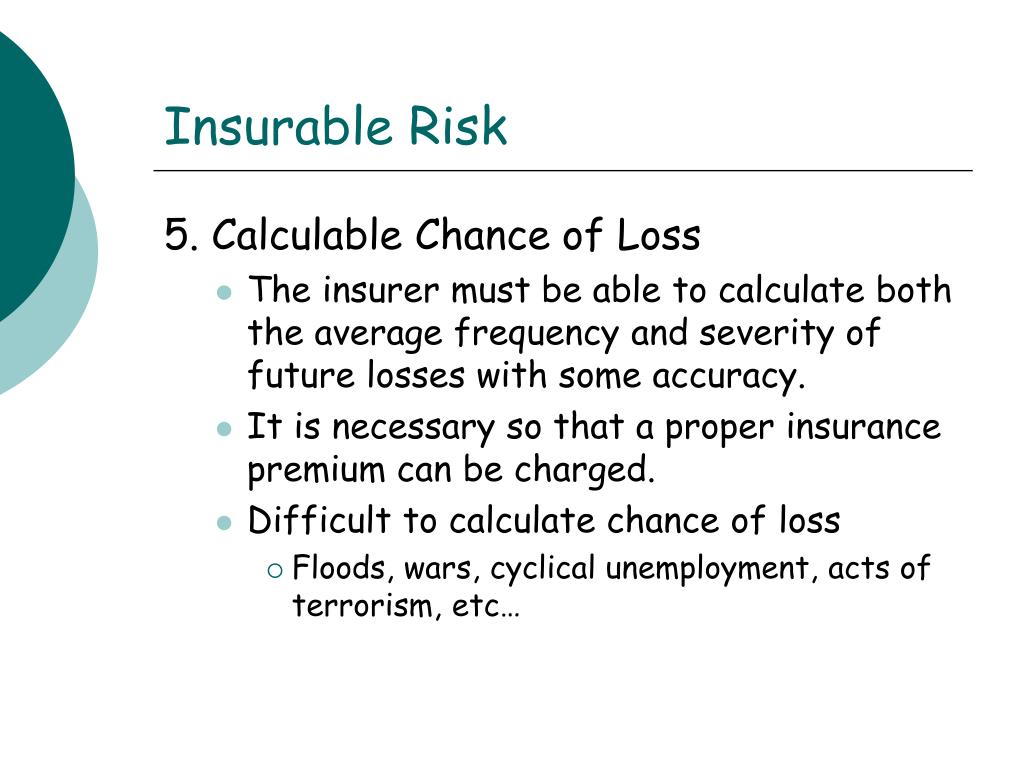

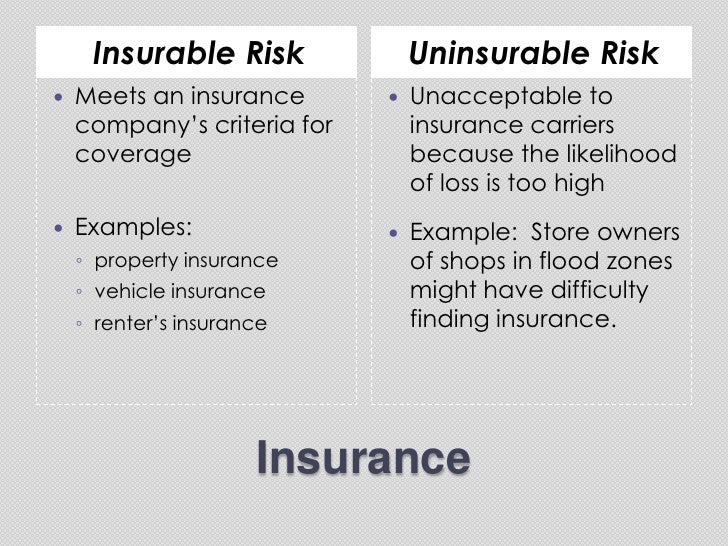

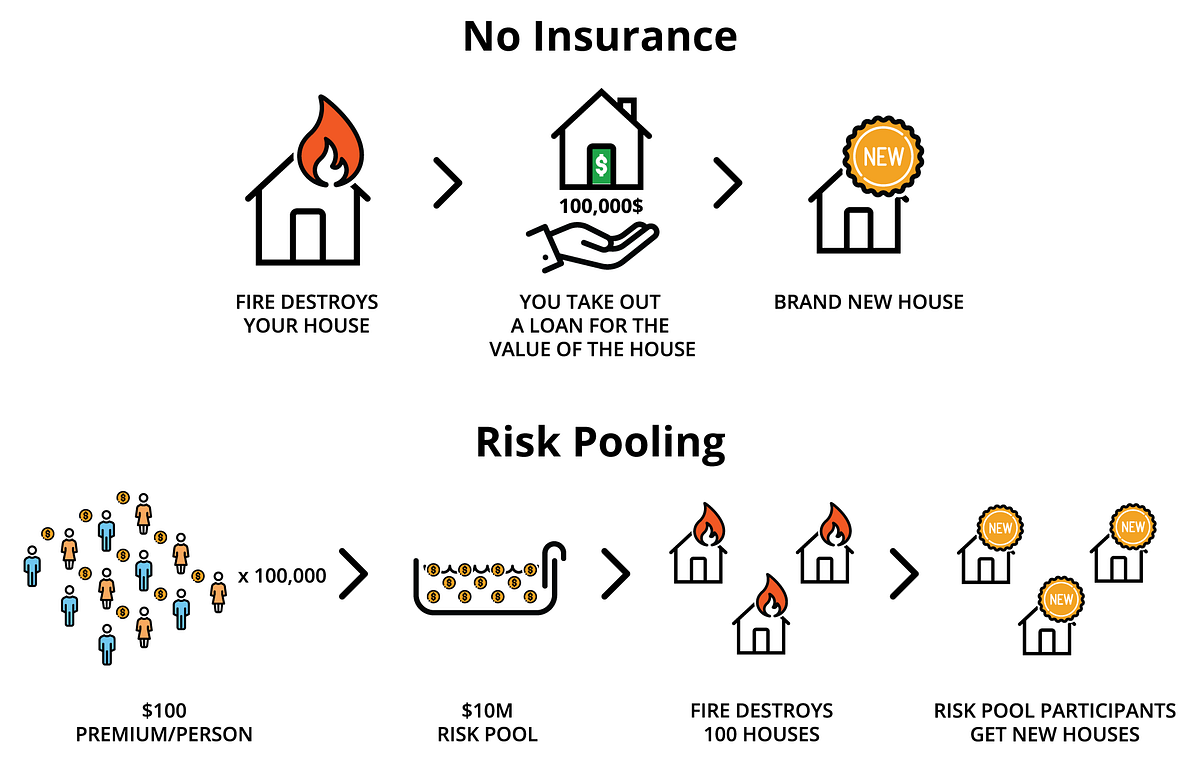

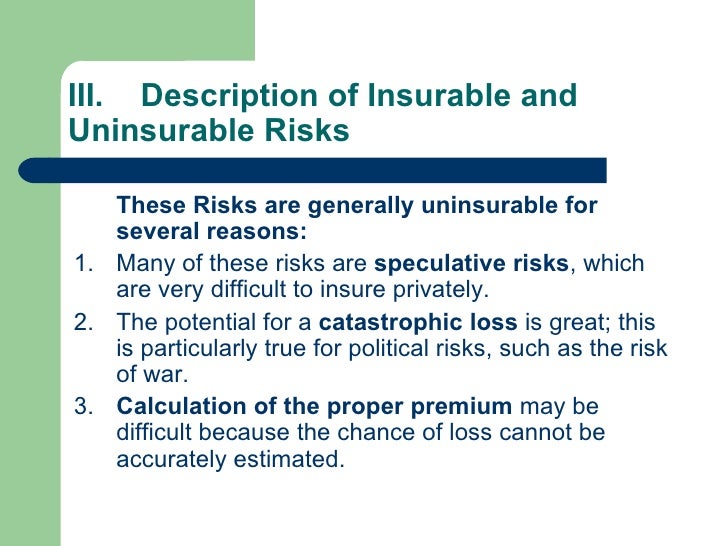

What Is Insurable Risk. These include a wide range of losses, including those from fire, theft, or lawsuits. What does insurable risk mean? The premium payments must be considered been reasonable enough to settle the likely financial loss for it to be insurable. In case of a scenario where the loss is too huge that no insurer would want to pay for it, the risk is said to be uninsurable.

PPT The Use of Captive Insurance in Business and Estate From slideserve.com

PPT The Use of Captive Insurance in Business and Estate From slideserve.com

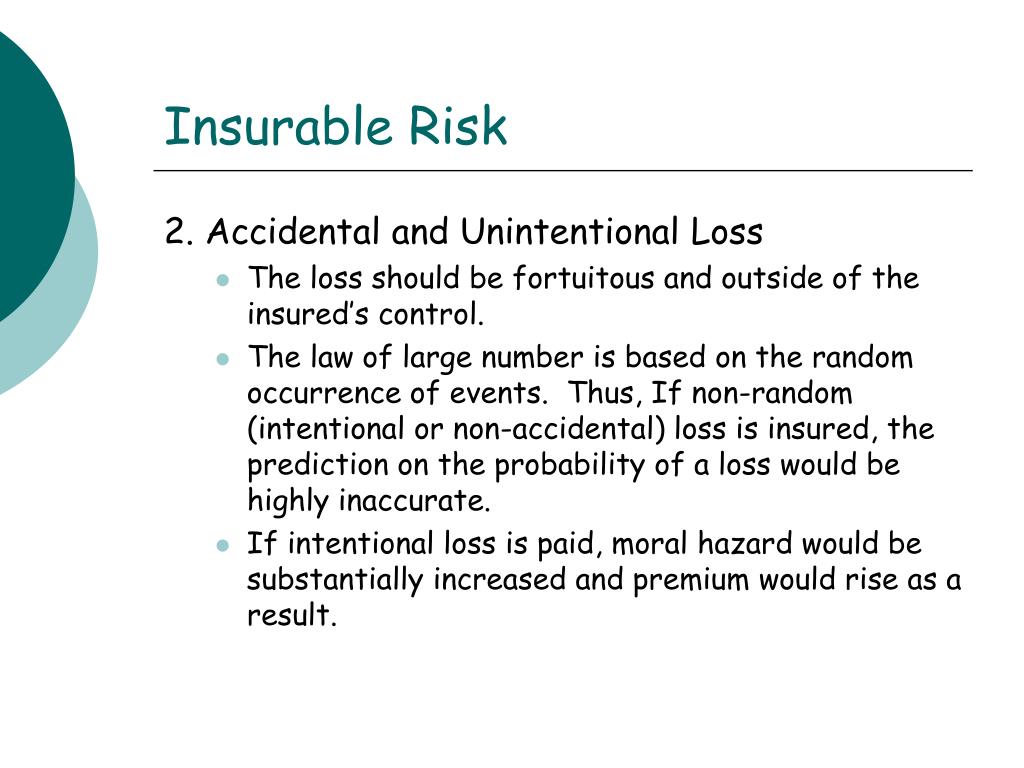

However, if an owner burns their own business down, that’s intentional and expected. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk. Risk management practice aligns with all federal and state legislation. A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. When you buy commercial insurance, you pay premiums to your insurance company. This typically requires that the risk have a few basic elements, including the fact that the risk must be random or due to chance and not something someone can control.

In case of a scenario where the loss is too huge that no insurer would want to pay for it,.

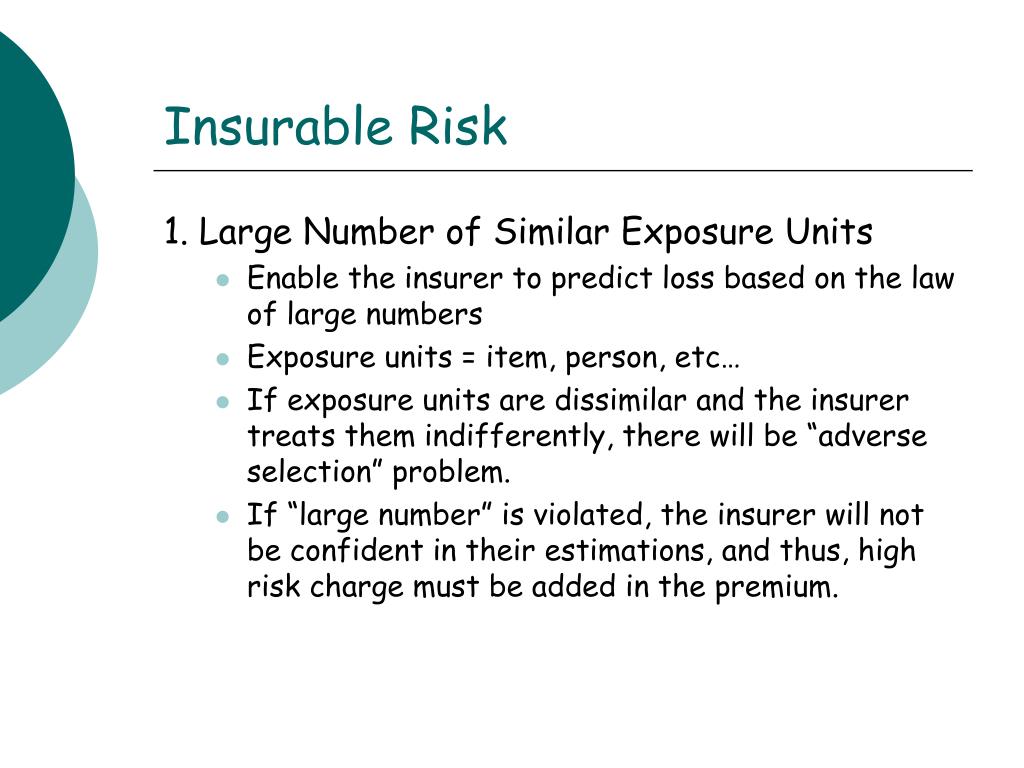

Some examples of insurable risk. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk. Insurable risks are those factors that must exist before any risk can be insured and they are as follows. Another aspect of insurable risk is that it has to be random. When you buy commercial insurance, you pay premiums to your insurance company. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: slideshare.net

Source: slideshare.net

When you buy commercial insurance, you pay premiums to your insurance company. When you buy commercial insurance, you pay premiums to your insurance company. Insurable risks are risks that insurance companies will cover. When you buy commercial insurance, you pay premiums to your insurance company. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk.

Source: slideserve.com

Source: slideserve.com

What does requirements of insurable risk mean? A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. When you buy commercial insurance, you pay premiums to your insurance company. An insurable risk must have the prospect of accidental loss, meaning that the loss must be the result of an unintended action and must. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: embroker.com

Source: embroker.com

What does requirements of insurable risk mean? Another aspect of insurable risk is that it has to be random. In case of a scenario where the loss is too huge that no insurer would want to pay for it,. When you buy commercial insurance, you pay premiums to your insurance company. If a river floods 800 times in a.

Source: pinterest.com

Source: pinterest.com

What does requirements of insurable risk mean? It is impossible to predict and measure the risk. An insurable risk must have the prospect of accidental loss, meaning that the loss must be the result of an unintended action and must. Insurable risks are those factors that must exist before any risk can be insured and they are as follows. The requirements of insurance risk are the elements that an insurance company considers before crafting and selling a policy.

Source: toppr.com

Source: toppr.com

For example, if a building burns down after a lightning strike, there’s no way to predict that. You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss. An insurable risk must have the prospect of accidental loss, meaning that the loss must be the result of an unintended action and must. It is impossible to predict and measure the risk. These include a wide range of losses, including those from fire, theft, or lawsuits.

Source: slideshare.net

Source: slideshare.net

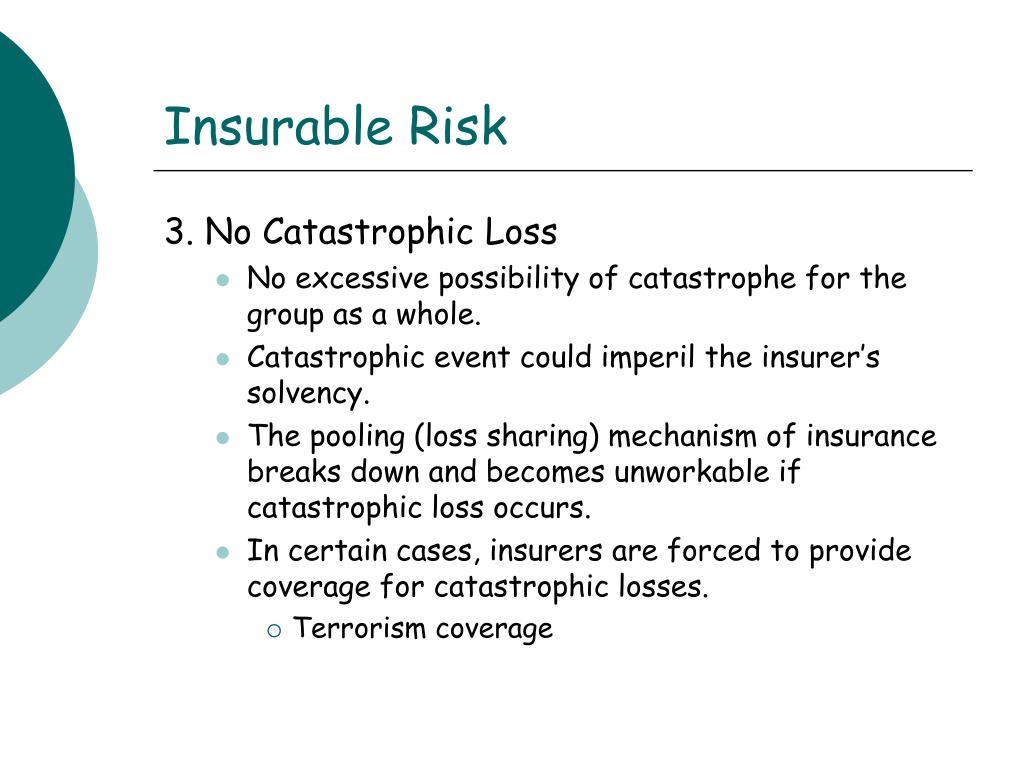

Another aspect of insurable risk is that it has to be random. What is meant by non insurable risk? A building and its contents can be insured against fire, but additional clauses must be added for damage by hail, wind or riot. A fire insurance contract is a contract of indemnity for losses suffered due to a fire. Knowing these elements safeguard the company from suffering a catastrophic financial loss or being taken advantage of by the insured.

Source: slideserve.com

Source: slideserve.com

For example, if a building burns down after a lightning strike, there’s no way to predict that. When you buy commercial insurance, you pay premiums to your insurance company. Knowing these elements safeguard the company from suffering a catastrophic financial loss or being taken advantage of by the insured. When you buy commercial insurance, you pay premiums to your insurance company. What is meant by non insurable risk?

Source: blog.etherisc.com

Source: blog.etherisc.com

Insurable risks are those factors that must exist before any risk can be insured and they are as follows. What does insurable risk mean? In return, the company agrees to pay you in the event you suffer a covered loss. What is meant by non insurable risk? However, if an owner burns their own business down, that’s intentional and expected.

Source: definitionus.blogspot.com

You pay your annual premium, while the insurer agrees to pay a claim should you experience a loss. In return, the company agrees to pay you in the event you suffer a covered loss. When you buy commercial insurance, you pay premiums to your insurance company. Uninsurable risk is a condition that poses an unknowable or unacceptable risk of loss or a situation in which the insurance would be against the law. There are various essential conditions that need to be fulfilled before acceptance of insurability of any risk.

Source: insights.intertelinc.com

It is impossible to predict and measure the risk. A building and its contents can be insured against fire, but additional clauses must be added for damage by hail, wind or riot. In return, the company agrees to pay you in the event you suffer a covered loss. Insurable risks are risks that insurance companies will cover. When you buy commercial insurance, you pay premiums to your insurance company.

Source: slideserve.com

Source: slideserve.com

In case of a scenario where the loss is too huge that no insurer would want to pay for it, the risk is said to be uninsurable. An insurable risk refers to a potential situation in which an insurance company evaluates the risk and determines insurability. A risk that conforms to the norms and specifications of the insurance policy in such a way that the criterion for insurance is fulfilled is called insurable risk. Knowing these elements safeguard the company from suffering a catastrophic financial loss or being taken advantage of by the insured. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: slideserve.com

Source: slideserve.com

In return, the company agrees to pay you in the event you suffer a covered loss. Insurable risks are risks that insurance companies will cover. This typically requires that the risk have a few basic elements, including the fact that the risk must be random or due to chance and not something someone can control. In return, the company agrees to pay you in the event you suffer a covered loss. What is meant by non insurable risk?

Source: slideshare.net

Source: slideshare.net

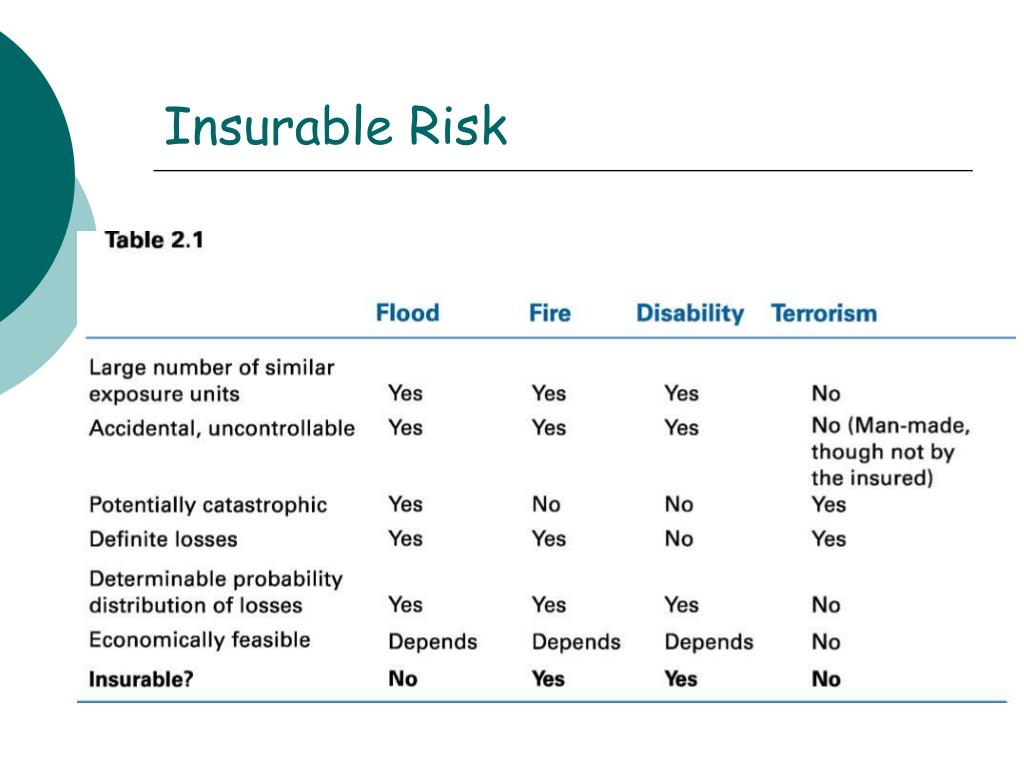

If a river floods 800 times in a. Example1 it will be hard to predict if the demand for a particular commodity will drop. These include a wide range of losses, including those from fire, theft, or lawsuits. An insurable risk refers to a potential situation in which an insurance company evaluates the risk and determines insurability. A risk may not be termed as insurable if it is immeasurable, very large, certain or not definable.

Source: sahouri.com

Source: sahouri.com

The requirements of insurance risk are the elements that an insurance company considers before crafting and selling a policy. In return, the company agrees to pay you in the event you suffer a covered loss. Another aspect of insurable risk is that it has to be random. What does insurable risk mean? When you buy commercial insurance, you pay premiums to your insurance company.

Source: slideserve.com

Source: slideserve.com

When you buy commercial insurance, you pay premiums to your insurance company. In return, the company agrees to pay you in the event you suffer a covered loss. Insurable risks are risks that insurance companies will cover. It can be both a source of loss and gain. The requirements of insurance risk are the elements that an insurance company considers before crafting and selling a policy.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

When you buy commercial insurance, you pay premiums to your insurance company. In return, the company agrees to pay you in the event you suffer a covered loss. A risk may not be termed as insurable if it is immeasurable, very large, certain or not definable. When you buy commercial insurance, you pay premiums to your insurance company. This typically requires that the risk have a few basic elements, including the fact that the risk must be random or due to chance and not something someone can control.

Source: slideserve.com

Source: slideserve.com

Insurable risks are risks that insurance companies will cover. If a river floods 800 times in a. Insurable risks are risks that insurance companies will cover. Beside this, what are insurable risks? A fire insurance contract is a contract of indemnity for losses suffered due to a fire.

Source: slideserve.com

Source: slideserve.com

Another aspect of insurable risk is that it has to be random. Insurable risks are risks that insurance companies will cover. Uninsurable risk is any type of situation or event that is considered to be outside the scope of the level of risk that an insurance provider is willing to assume in order to provide coverage for a client. Insurable risks are risks that insurance companies will cover. A risk may not be termed as insurable if it is immeasurable, very large, certain or not definable.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is insurable risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information