What is key person disability insurance Idea

Home » Trending » What is key person disability insurance IdeaYour What is key person disability insurance images are available in this site. What is key person disability insurance are a topic that is being searched for and liked by netizens now. You can Get the What is key person disability insurance files here. Download all free vectors.

If you’re searching for what is key person disability insurance pictures information connected with to the what is key person disability insurance topic, you have come to the right site. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

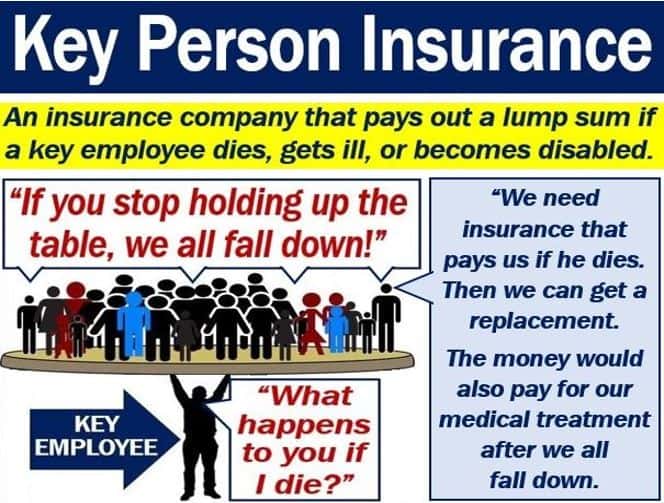

What Is Key Person Disability Insurance. The insurance proceeds can be used to fund one or more of the following: It’s essentially key person income protection, and it doubles up as an employee benefit too. Key person disability is an executive benefit employers use in two ways: It is to protect the business if the movers and shakers of the business were to become disabled or die.

Key Person Disability Insurance Guide Key Person Insurance From keypersoninsurance.com

Key Person Disability Insurance Guide Key Person Insurance From keypersoninsurance.com

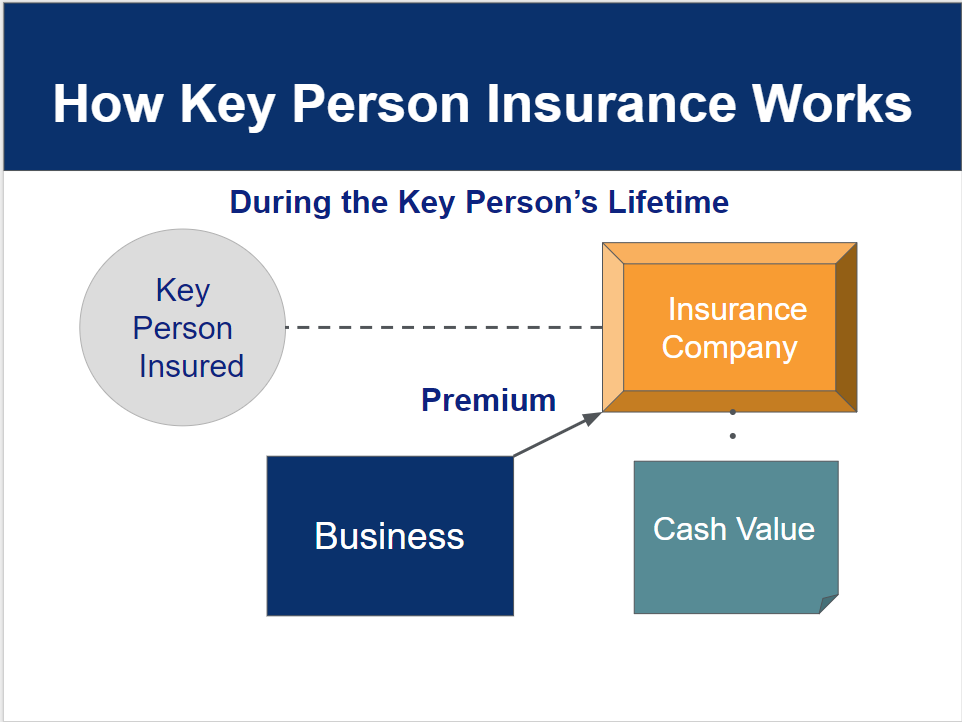

Key person disability insurance protects a company against the risk that a key employee will become disabled to the extent he is unable to perform his job. If that person dies unexpectedly or becomes disabled, key person insurance. Key persons can be those significantly impacting operation or generating revenue for the firm. Key person insurance for disability the ability to liquidate business assets to protect personal assets a buy/sell agreement, where joint business partners purchase insurance on each other essentially, key person insurance is one form of small business life insurance. The insurance payout is a lump sum and is used to offset the costs (such as recruiting a successor) and losses (such as a decreased ability to. Guaranteed premiums once the policy is set up, the premium (cost) cannot change, and the policy can only be canceled.

The goal of key man disability insurance is protect the company from the loss of a key employee or executive do to a disability.

Guaranteed premiums once the policy is set up, the premium (cost) cannot change, and the policy can only be canceled. Key person insurance is a life insurance policy that a company purchases for the business owner or a leading executive. Policies include two important elements: Key person insurance is a life insurance policy a company buys on the life of a top executive or another critical individual. Key person insurance is life insurance and/ or illness insurance on a key employee of a business. It provides peace of mind to companies and business owners alike knowing that the business can continue operations without major disruption if a disability strikes a top salesperson, executive or key employee.

Source: carrickaland.com.au

Source: carrickaland.com.au

Policies include two important elements: What is the purpose of key person insurance? It is to protect the business if the movers and shakers of the business were to become disabled or die. It is especially important for small businesses, as the loss of a key person could result in the death of the business. Key man disability insurance is purchased on one or more key people in a business to protect the business from the economic loss associated with the disability of a key employee.

Source: keypersoninsurance.com

Source: keypersoninsurance.com

It falls under the umbrella of life insurance, and at its most basic form, can be viewed as a life insurance policy taken out by the business on one of its key contributors. Benefits are received by the business tax free because the premium paid is not tax deductible. By paying the business in those situations, the business is able to stay on their feet until that employee returns or a replacement can be found. It protects your business if they are diagnosed with a terminal illness or passes away. Key man disability insurance is purchased on one or more key people in a business to protect the business from the economic loss associated with the disability of a key employee.

Source: msvlife.com

Key person insurance is a risk management strategy, called risk transferring, that deliberately passes on risk to another party. Key person disability insurance protects a company against the risk that a key employee will become disabled to the extent he is unable to perform his job. Key man disability insurance is designed to protect the business in the unfortunate event that a key employee or executive suffers a disabling accident, injury or illness. Key person insurance policies cover the untimely death, disability, or sudden departure of a key person, but they can also provide financial support while the person is recovering from an illness or injury and is unable to work in their previous capacity. Policies include two important elements:

Source: noclutter.cloud

Source: noclutter.cloud

Benefits are received by the business tax free because the premium paid is not tax deductible. Key person insurance is a risk management strategy, called risk transferring, that deliberately passes on risk to another party. Key person coverage provides cash flow to help companies move forward and maintain a profit in the event that a key employee becomes disabled. Coverage that guarantees a healthy partner enough cash to buy out a partner who becomes disabled. Having key person insurance means the plan pays out a lump sum to cover any loss in revenue.

Source: youtube.com

Source: youtube.com

It’s essentially key person income protection, and it doubles up as an employee benefit too. Key person insurance is a life insurance policy a company buys on the life of a top executive or another critical individual. Key person insurance is life insurance and/ or illness insurance on a key employee of a business. Features of a key person disability insurance policy elimination period. Benefits are payable to the company, are usually tax free and can be used for any purpose.

Source: elawtalk.com

Source: elawtalk.com

Such insurance is needed if that person�s death would be devastating to. The elimination period is the time which must pass after the date of the injury or sickness, prior. What is key person disability insurance? Key man disability insurance is designed to protect the business in the unfortunate event that a key employee or executive suffers a disabling accident, injury or illness. Key person insurance is a life insurance policy that a company purchases on an owner, a top executive, or another individual critical to the business.

Source: keypersoninsurance.com

Source: keypersoninsurance.com

An elimination (waiting) period and a benefit period. The insurance payout is a lump sum and is used to offset the costs (such as recruiting a successor) and losses (such as a decreased ability to. It provides peace of mind to companies and business owners alike knowing that the business can continue operations without major disruption if a disability strikes a top salesperson, executive or key employee. Key person disability insurance provides crucial benefits to protect the company financially in the event that a key employee can no longer work due to a disability. Key person insurance is taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business.

Source: keypersoninsurance.com

Source: keypersoninsurance.com

It’s essentially key person income protection, and it doubles up as an employee benefit too. Benefits are received by the business tax free because the premium paid is not tax deductible. What is the purpose of key person insurance? What is key person disability insurance? Key person disability insurance protects a company against the risk that a key employee will become disabled to the extent he is unable to perform his job.

Source: torontocaribbean.com

Source: torontocaribbean.com

If that person dies unexpectedly or becomes disabled, key person insurance. What is the purpose of key person insurance? Coverage that guarantees a healthy partner enough cash to buy out a partner who becomes disabled. It provides peace of mind to companies and business owners alike knowing that the business can continue operations without major disruption if a disability strikes a top salesperson, executive or key employee. An elimination (waiting) period and a benefit period.

Source: 10xfinancial.ca

Source: 10xfinancial.ca

An elimination (waiting) period and a benefit period. It protects your business if they are diagnosed with a terminal illness or passes away. If that person dies unexpectedly or becomes disabled, key person insurance. Guaranteed premiums once the policy is set up, the premium (cost) cannot change, and the policy can only be canceled. Key person insurance for disability the ability to liquidate business assets to protect personal assets a buy/sell agreement, where joint business partners purchase insurance on each other essentially, key person insurance is one form of small business life insurance.

Source: keypersoninsurance.com

Source: keypersoninsurance.com

Key persons can be those significantly impacting operation or generating revenue for the firm. Benefits can be paid in a lump sum or a combination of monthly and lump sum, and are generally received income. Such insurance is needed if that person�s death would be devastating to. It falls under the umbrella of life insurance, and at its most basic form, can be viewed as a life insurance policy taken out by the business on one of its key contributors. It is especially important for small businesses, as the loss of a key person could result in the death of the business.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

It is especially important for small businesses, as the loss of a key person could result in the death of the business. Key man disability insurance is purchased on one or more key people in a business to protect the business from the economic loss associated with the disability of a key employee. Key person insurance policies cover the untimely death, disability, or sudden departure of a key person, but they can also provide financial support while the person is recovering from an illness or injury and is unable to work in their previous capacity. It is especially important for small businesses, as the loss of a key person could result in the death of the business. Key man or key person insurance is crucial coverage that provides financial relief and protects your business if one of your critical employees suffers death or disability.

Source: insubuy.com

Source: insubuy.com

Benefits are received by the business tax free because the premium paid is not tax deductible. It is especially important for small businesses, as the loss of a key person could result in the death of the business. Key person disability is an executive benefit employers use in two ways: What is key person disability insurance? The insurance proceeds can be used to fund one or more of the following:

Source: pic.co.nz

Source: pic.co.nz

It provides peace of mind to companies and business owners alike knowing that the business can continue operations without major disruption if a disability strikes a top salesperson, executive or key employee. Your business is protected and they get benefit from our partners. Key person disability insurance provides crucial benefits to protect the company financially in the event that a key employee can no longer work due to a disability. Coverage that guarantees a healthy partner enough cash to buy out a partner who becomes disabled. To attract and retain quality employees and to generate income if the key employee is unable to work due to prolonged sickness and/or recovery from an injury.

Source: keypersoninsurance.com

Source: keypersoninsurance.com

What is the purpose of key person insurance? Once the policy is set up, the premium (cost) cannot change, and the policy can only be. What is the purpose of key person insurance? It falls under the umbrella of life insurance, and at its most basic form, can be viewed as a life insurance policy taken out by the business on one of its key contributors. Having key person insurance means the plan pays out a lump sum to cover any loss in revenue.

Source: simplelifeinsure.com

Source: simplelifeinsure.com

Key person insurance is a life insurance policy that a company purchases on an owner, a top executive, or another individual critical to the business. Key man disability insurance is designed to protect the business in the unfortunate event that a key employee or executive suffers a disabling accident, injury or illness. Guaranteed premiums once the policy is set up, the premium (cost) cannot change, and the policy can only be canceled. Once the policy is set up, the premium (cost) cannot change, and the policy can only be. The goal of key man disability insurance is protect the company from the loss of a key employee or executive do to a disability.

Source: dtfs.ca

Source: dtfs.ca

Key man disability insurance is purchased on one or more key people in a business to protect the business from the economic loss associated with the disability of a key employee. Benefits are received by the business tax free because the premium paid is not tax deductible. It is especially important for small businesses, as the loss of a key person could result in the death of the business. By paying the business in those situations, the business is able to stay on their feet until that employee returns or a replacement can be found. The insurance payout is a lump sum and is used to offset the costs (such as recruiting a successor) and losses (such as a decreased ability to.

Source: allinsgrp.com

Source: allinsgrp.com

Your business is protected and they get benefit from our partners. Key person disability insurance provides crucial benefits to protect the company financially in the event that a key employee can no longer work due to a disability. Benefits can be paid in a lump sum or a combination of monthly and lump sum, and are generally received income. Key person disability insurance protects a company against the risk that a key employee will become disabled to the extent he is unable to perform his job. What is the purpose of key person insurance?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is key person disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information