What is key person insurance Idea

Home » Trend » What is key person insurance IdeaYour What is key person insurance images are ready in this website. What is key person insurance are a topic that is being searched for and liked by netizens today. You can Download the What is key person insurance files here. Download all royalty-free photos.

If you’re searching for what is key person insurance images information related to the what is key person insurance topic, you have visit the right site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

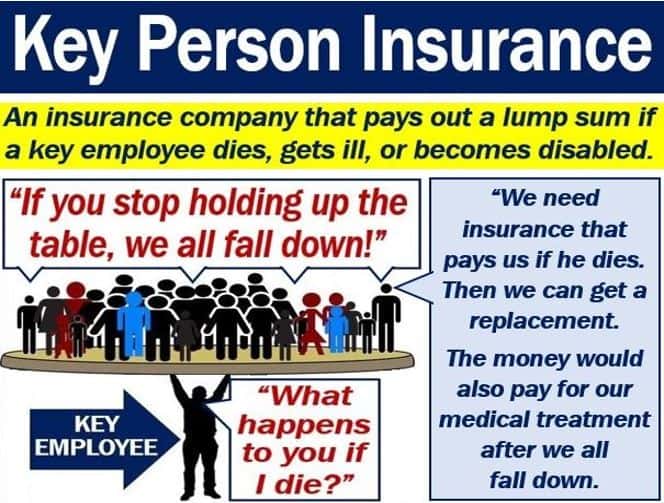

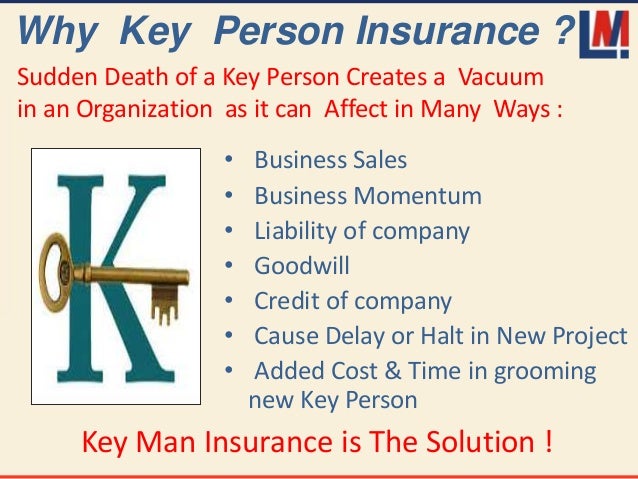

What Is Key Person Insurance. A key person is an individual whose skill, knowledge, experience or leadership contributes This is where key person insurance may be helpful. It’s simply a business insuring itself against the financial loss it may suffer as a result of the death (or critical illness if chosen) of a key person. If so, it may be worth considering a more comprehensive small business life insurance policy or multiple policies.

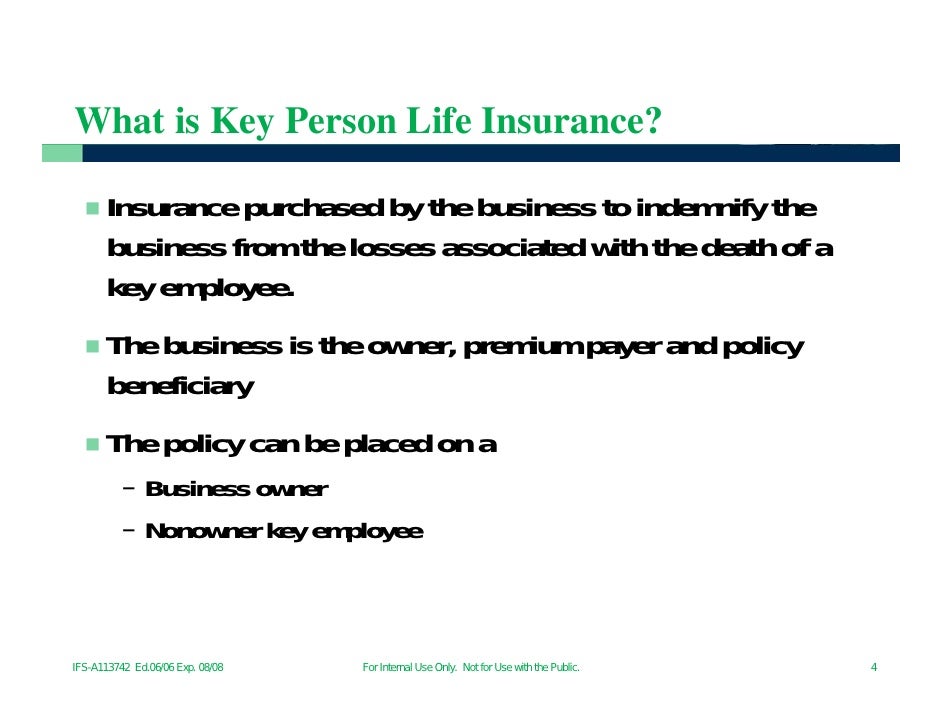

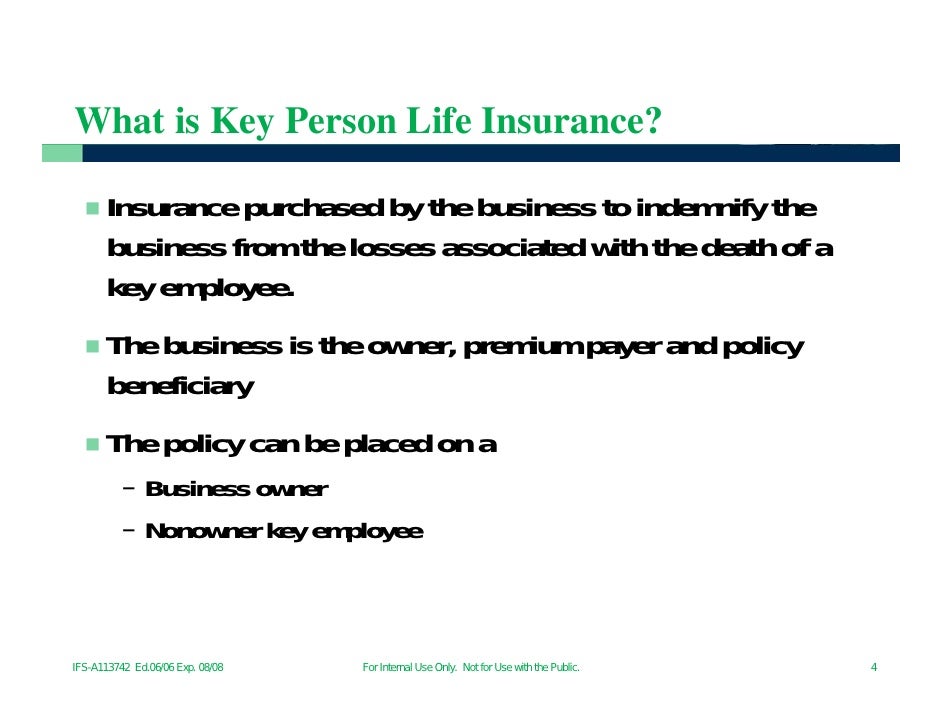

Key Man Life From slideshare.net

Key Man Life From slideshare.net

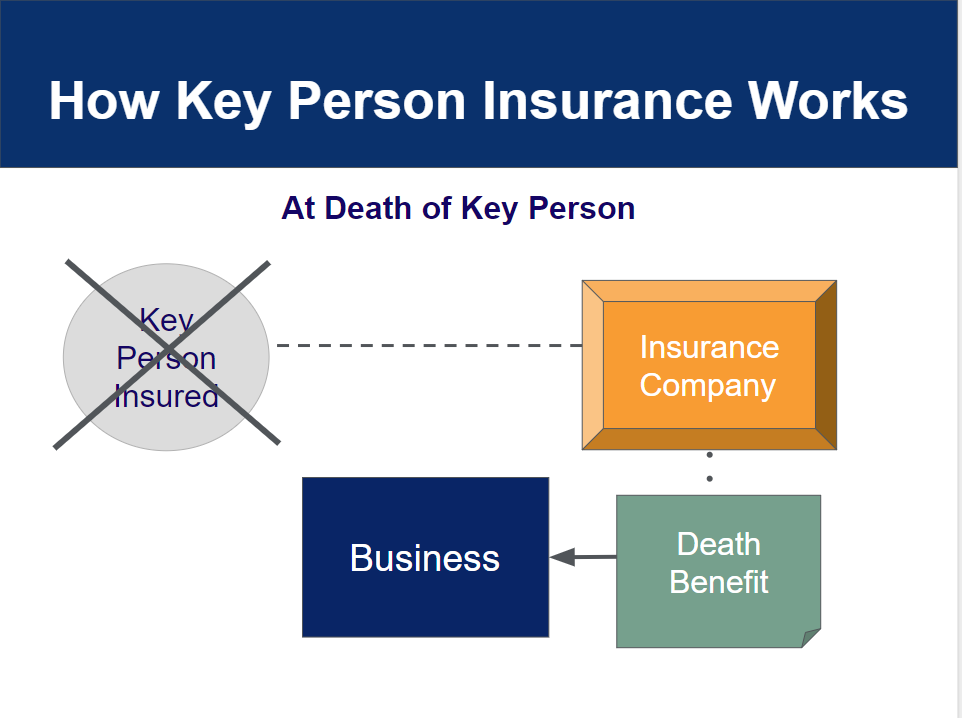

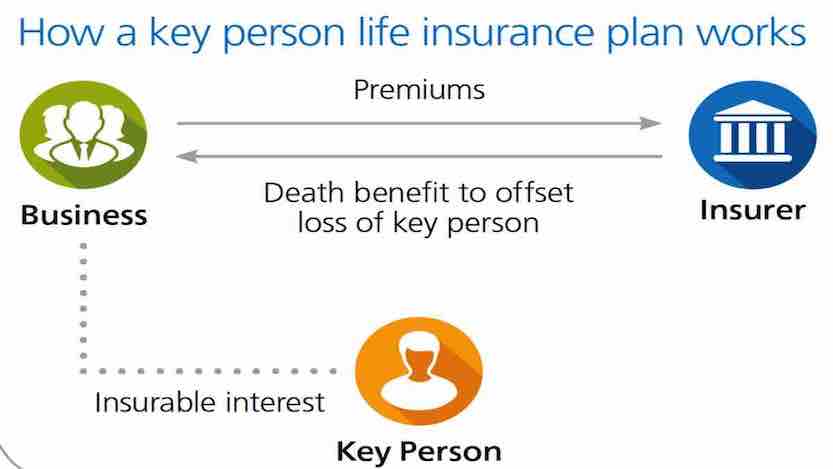

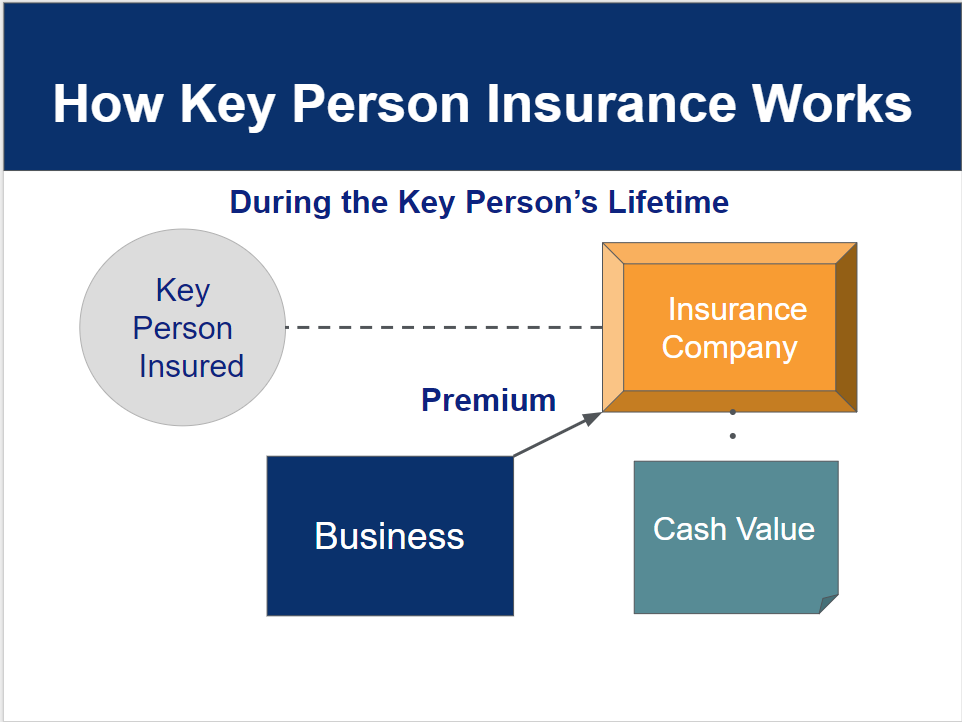

It falls under the umbrella of life insurance, and at its most basic form, can be viewed as a life insurance policy taken out by the business on one of its key contributors. Key person insurance is taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. This is where key person insurance may be helpful. If the individual who is covered unexpectedly dies, the company receives the insurance proceeds. Key person insurance is essentially a life insurance policy that you take out on a key person in your business. For example, a small business owner may choose to take out a policy on himself and make the business the beneficiary.

If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application.

For example, a small business owner may choose to take out a policy on himself and make the business the beneficiary. Key person insurance is simply life insurance on the key person in a business. Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible. It can also pay out if they are diagnosed with a terminal illness. It’s simply a business insuring itself against the financial loss it may suffer as a result of the death (or critical illness if chosen) of a key person. Key person insurance is a life insurance policy that a business takes out on its most valuable employee or employees.

![Key Person Insurance The Scoop [Best Coverages + 2020 Rates] Key Person Insurance The Scoop [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2020/03/3f949db9-keypersoninsurance-1024x647.png) Source: effortlessinsurance.com

Source: effortlessinsurance.com

Key person insurance is an insurance policy that provides a lump sum if an owner or key employee passes away. What is key person insurance? Like a standard life insurance policy, there’s no exact method to determining how much coverage you need. Key person insurance is a life insurance policy a company buys on the life of a top executive or another critical individual. Essentially, key person insurance is one form of small business life insurance.

Source: youtube.com

Source: youtube.com

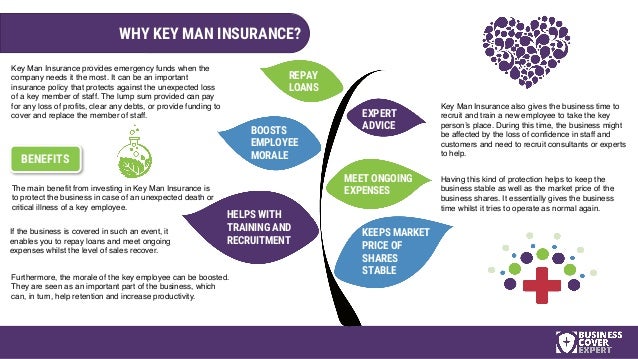

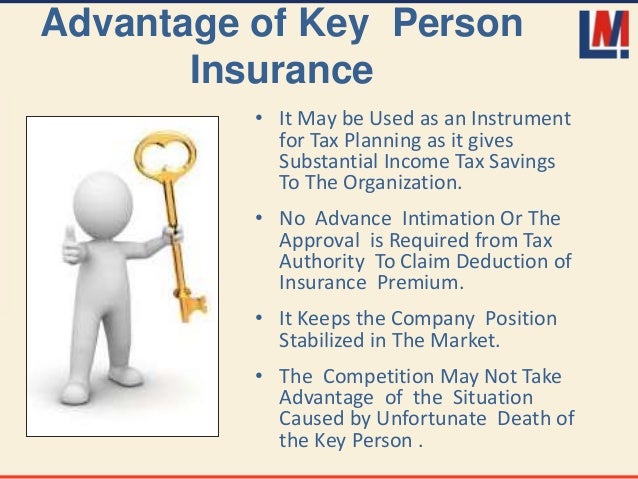

Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible. If so, it may be worth considering a more comprehensive small business life insurance policy or multiple policies. The term key person insurance refers to a form of life insurance policy that a corporation buys on the lives of particular important people regarded as. Personal life insurance provides benefits to family members or other loved ones after a death. Key person insurance can provide your business with the working capital it needs to keep operating and to fund the recruitment and training of a replacement should a key person pass away or become totally disabled.

Source: allinsgrp.com

Source: allinsgrp.com

Key person insurance is essentially a life insurance policy that you take out on a key person in your business. If so, it may be worth considering a more comprehensive small business life insurance policy or multiple policies. This is where key person insurance may be helpful. Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible. Key person insurance helps safeguard a small business if an imperative employee dies or becomes disabled.

Source: termlife2go.com

Source: termlife2go.com

Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. Key person insurance policies provide a death benefit to a business if crucial employees die or become disabled. What is key person insurance? Like a standard life insurance policy, there’s no exact method to determining how much coverage you need.

Source: australianexpatriategroup.com

Source: australianexpatriategroup.com

Key man or key person insurance is crucial coverage that provides financial relief and protects your business if one of your critical employees suffers death or disability. How would your business cope if one of its key people passed away or was unable to work? The term key person insurance refers to a form of life insurance policy that a corporation buys on the lives of particular important people regarded as. Key person insurance is a type of life insurance that helps compensate a business if the owner or main employee dies. Key person insurance policies provide a death benefit to a business if crucial employees die or become disabled.

Source: geinsuranceforlife.com

Source: geinsuranceforlife.com

Key man or key person insurance is crucial coverage that provides financial relief and protects your business if one of your critical employees suffers death or disability. Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. Alena miles looks at the importance of key person insurance in a business and how it protects the business if there is a key person death, disability, or a serious illness. Who is a key person? The insurance payout is a lump

Source: slideshare.net

Source: slideshare.net

Key person insurance, also known as keyman or keywoman insurance, is designed to protect businesses when someone who is key to the operation of the company dies or becomes unable to work due to ill health. Key person insurance is an insurance policy that provides a lump sum if an owner or key employee passes away. In a small business , this is usually the owner, the founders or perhaps a key employee or two. A key person is an individual whose skill, knowledge, experience or leadership contributes This is where key person insurance may be helpful.

Source: rkhenshall.com

Source: rkhenshall.com

Key person insurance helps safeguard a small business if an imperative employee dies or becomes disabled. Essentially, key person insurance is one form of small business life insurance. If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. Key person insurance can provide your business with the working capital it needs to keep operating and to fund the recruitment and training of a replacement should a key person pass away or become totally disabled.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Like a standard life insurance policy, there’s no exact method to determining how much coverage you need. A key person is an individual whose skill, knowledge, experience or leadership contributes Key person insurance is purchased by a company, who then owns the policy, pays the premiums, and is the beneficiary of the policy. Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible. What is key person insurance?

Source: infographicsshowcase.com

Source: infographicsshowcase.com

If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. What is key person insurance? If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. Key person insurance, also known as keyman or keywoman insurance, is designed to protect businesses when someone who is key to the operation of the company dies or becomes unable to work due to ill health.

Source: slideshare.net

Source: slideshare.net

A key person is an individual whose skill, knowledge, experience or leadership contributes Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. Key person insurance can provide your business with the working capital it needs to keep operating and to fund the recruitment and training of a replacement should a key person pass away or become totally disabled. How would your business cope if one of its key people passed away or was unable to work? What is key person insurance?

Source: johnstricklandinsurance.com

Source: johnstricklandinsurance.com

If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. A key person is an individual whose skill, knowledge, experience or leadership contributes Key person insurance is essentially a life insurance policy that you take out on a key person in your business. This is where key person insurance may be helpful. If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application.

Source: entredeliriosylocura.blogspot.com

Source: entredeliriosylocura.blogspot.com

Key person insurance is essentially a life insurance policy that you take out on a key person in your business. Who is a key person? Key person insurance is essentially a life insurance policy that you take out on a key person in your business. A key person is an individual whose skill, knowledge, experience or leadership contributes Key person insurance is a life insurance policy that a business takes out on its most valuable employee or employees.

Source: dtfs.ca

Source: dtfs.ca

Key person insurance is a life insurance policy that a business takes out on its most valuable employee or employees. This is where key person insurance may be helpful. A policy can also include a rider for disability coverage to help if a key employee is disabled. How would your business cope if one of its key people passed away or was unable to work? Key person insurance is purchased by a company, who then owns the policy, pays the premiums, and is the beneficiary of the policy.

Source: allinsgrp.com

Source: allinsgrp.com

For example, a small business owner may choose to take out a policy on himself and make the business the beneficiary. If the individual who is covered unexpectedly dies, the company receives the insurance proceeds. Key person insurance is taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. A key person is an individual whose skill, knowledge, experience or leadership contributes What is key person insurance?

Source: carrickaland.com.au

Source: carrickaland.com.au

The term key person insurance refers to a form of life insurance policy that a corporation buys on the lives of particular important people regarded as. As a starting point, figure out what the financial impact of losing your key person would be. It’s intended to help the company recover from the loss of a key contributor whose death or disability would reduce the company’s value or operational capabilities. Key person insurance helps safeguard a small business if an imperative employee dies or becomes disabled. Such insurance is needed if.

Source: slideshare.net

Source: slideshare.net

Who is a key person? If the individual who is covered unexpectedly dies, the company receives the insurance proceeds. If the key person within your business leaves the business, the insurance is not usually transferable to another key person as they will have to be assessed through an application. Key person insurance is a life insurance policy that a business takes out on its most valuable employee or employees. For example, a small business owner may choose to take out a policy on himself and make the business the beneficiary.

Source: youtube.com

Source: youtube.com

What is key person insurance? How would your business cope if one of its key people passed away or was unable to work? The insurance payout is a lump This is where key person insurance may be helpful. Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is key person insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information