What is level funding insurance information

Home » Trending » What is level funding insurance informationYour What is level funding insurance images are ready. What is level funding insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What is level funding insurance files here. Get all royalty-free photos.

If you’re searching for what is level funding insurance pictures information related to the what is level funding insurance keyword, you have come to the ideal site. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

What Is Level Funding Insurance. It is far easier to manage a. However, this number will not fluctuate each month based on claim experience. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year. Funding covers act as a resource pool that can be drawn down to pay for claims, with unused funds returned.

Level Funded Health Insurance Plans YouTube From youtube.com

Level Funded Health Insurance Plans YouTube From youtube.com

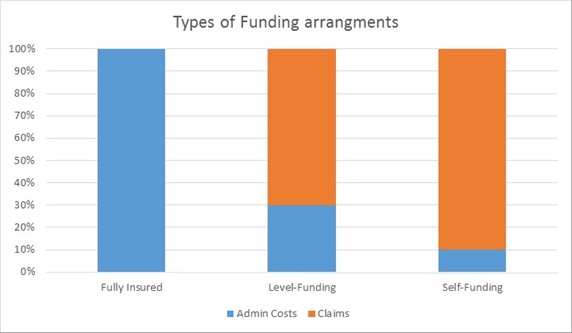

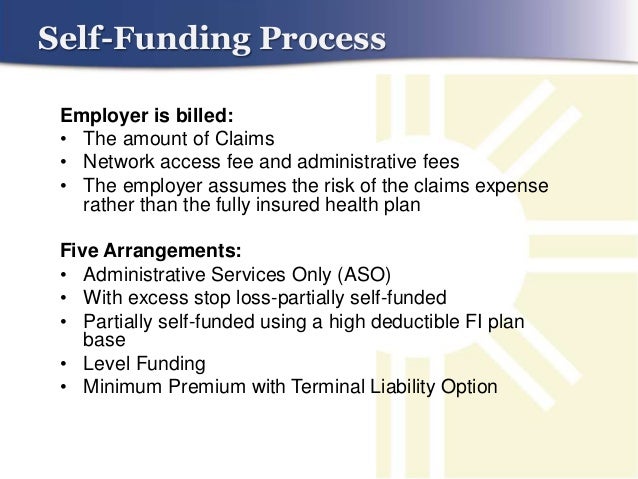

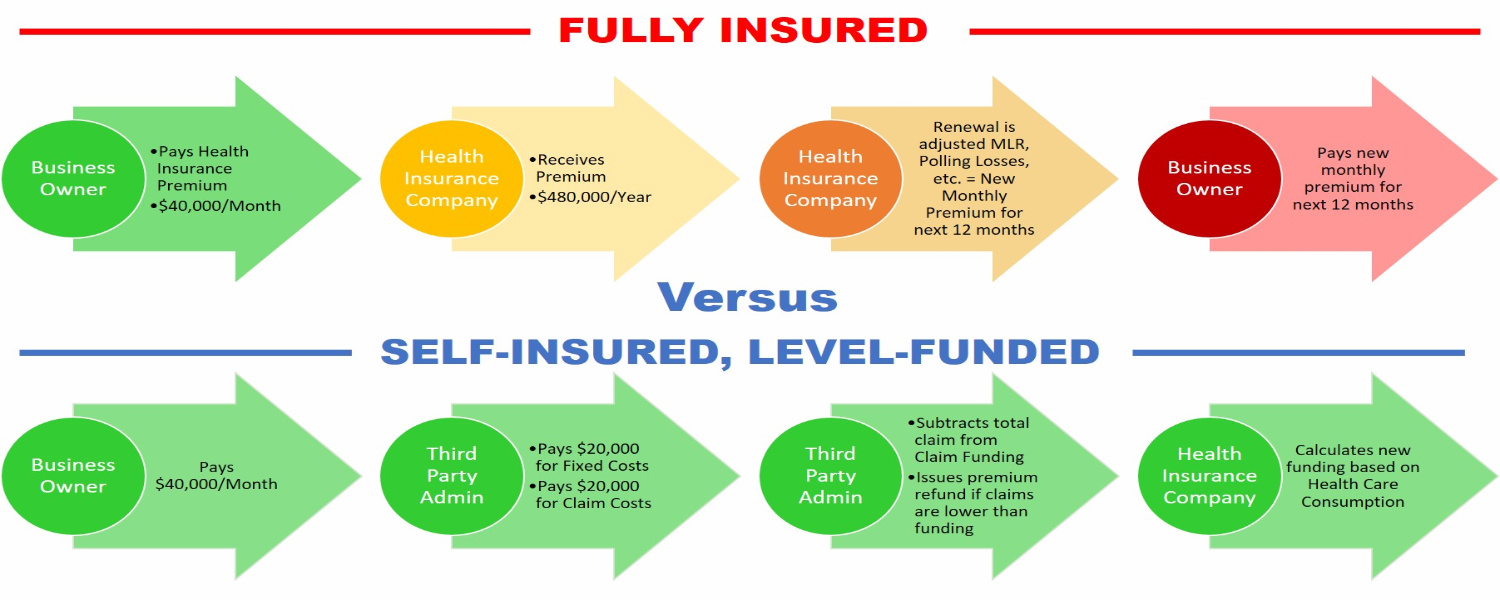

Fully insured fully insured plans pay a premium to the insurance carrier and the carrier pays the healthcare claims based on the coverage of benefits outlined in the policy purchased. With level funding, employers pay a set amount each month to a carrier. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. With this model, companies will pay a fixed monthly premium which includes administrative costs, stop loss insurance costs, and the projected claims. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. In the simplest of terms, the total monthly premium is divided into three buckets.

Funding covers act as a resource pool that can be drawn down to pay for claims, with unused funds returned.

However, this number will not fluctuate each month based on claim experience. This amount typically includes the cost of administration, stop loss coverage, administrative fees and the maximum claims. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. However, this number will not fluctuate each month based on claim experience. In the simplest of terms, the total monthly premium is divided into three buckets. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans.

Source: levelfunding.co

Source: levelfunding.co

Insurance premiums held in an account and used to pay insurance claims. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. This amount typically includes the cost of administration, stop loss coverage, administrative fees and the maximum claims. With level funding, employers pay a set amount each month to a carrier. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year.

Source: exceedenthealth.com

Source: exceedenthealth.com

It’s fair to say that level funding is a hybrid financial strategy in health benefit planning. With level funding, employers pay a set amount each month to a carrier. Know what you pay for It is far easier to manage a. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas.

Source: washingtontechnology.org

Source: washingtontechnology.org

With level funding, employers pay a set amount each month to a carrier. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. It’s fair to say that level funding is a hybrid financial strategy in health benefit planning.

Source: nevont.com

Source: nevont.com

You don’t have to pay premiums that are based on community rates, which might be higher than your employee group’s risk. Level funding offers several advantages to fully insured programs: Fully insured fully insured plans pay a premium to the insurance carrier and the carrier pays the healthcare claims based on the coverage of benefits outlined in the policy purchased. Now for the first time, level brings together dental, vision, and all. If all the money you set aside each month to cover claims is not used, you will receive a refund at the end of.

Source: ixshealth.com

With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. With this model, companies will pay a fixed monthly premium which includes administrative costs, stop loss insurance costs, and the projected claims. It is far easier to manage a. Funding covers act as a resource pool that can be drawn down to pay for claims, with unused funds returned. With level funding, employers pay a set amount each month to a carrier.

Source: mmains.net

Source: mmains.net

This amount typically includes the cost of administration, stop loss coverage, administrative fees and the maximum claims. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans. With this model, companies will pay a fixed monthly premium which includes administrative costs, stop loss insurance costs, and the projected claims. Level makes paying with your company benefits as simple as a tap or swipe. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the.

Source: ekmcconkey.com

Source: ekmcconkey.com

If all the money you set aside each month to cover claims is not used, you will receive a refund at the end of. However, this number will not fluctuate each month based on claim experience. It is far easier to manage a. Now for the first time, level brings together dental, vision, and all. With level funding, employers pay a set amount each month to a carrier.

Source: precisionwellness.io

Source: precisionwellness.io

However, this number will not fluctuate each month based on claim experience. It is far easier to manage a. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. Level makes paying with your company benefits as simple as a tap or swipe.

Source: trekinsurancegroup.com

Source: trekinsurancegroup.com

Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans. It is far easier to manage a. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year.

Source: slideshare.net

Source: slideshare.net

Fully insured fully insured plans pay a premium to the insurance carrier and the carrier pays the healthcare claims based on the coverage of benefits outlined in the policy purchased. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the. Funding covers act as a resource pool that can be drawn down to pay for claims, with unused funds returned. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans.

Source: youtube.com

Source: youtube.com

It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. However, this number will not fluctuate each month based on claim experience. You don’t have to pay premiums that are based on community rates, which might be higher than your employee group’s risk. This amount typically includes the cost of administration, stop loss coverage, administrative fees and the maximum claims.

Source: groupbenefitsexperts.com

Source: groupbenefitsexperts.com

It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year. If all the money you set aside each month to cover claims is not used, you will receive a refund at the end of. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. It is far easier to manage a. You don’t have to pay premiums that are based on community rates, which might be higher than your employee group’s risk.

Source: bradenbenefits.com

Source: bradenbenefits.com

It is far easier to manage a. With this model, companies will pay a fixed monthly premium which includes administrative costs, stop loss insurance costs, and the projected claims. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year. It’s fair to say that level funding is a hybrid financial strategy in health benefit planning. However, this number will not fluctuate each month based on claim experience.

Source: bradenbenefits.com

Source: bradenbenefits.com

In the simplest of terms, the total monthly premium is divided into three buckets. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. Now for the first time, level brings together dental, vision, and all. If all the money you set aside each month to cover claims is not used, you will receive a refund at the end of. In the simplest of terms, the total monthly premium is divided into three buckets.

Source: youtube.com

Source: youtube.com

The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. Level funding offers several advantages to fully insured programs: With level funding, employers pay a set amount each month to a carrier. It’s fair to say that level funding is a hybrid financial strategy in health benefit planning. It combines financial predictability and the control and information you want, with an opportunity to benefit from a favorable claims year.

Source: precisionwellness.io

Source: precisionwellness.io

The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. It’s fair to say that level funding is a hybrid financial strategy in health benefit planning. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

This amount typically includes the cost of administration, stop loss coverage, administrative fees and the maximum claims. If all the money you set aside each month to cover claims is not used, you will receive a refund at the end of. With this type of coverage, premiums are guaranteed to remain the same throughout the contract, while the amount of coverage provided. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. Know what you pay for

Source: bradenbenefits.com

Source: bradenbenefits.com

In the simplest of terms, the total monthly premium is divided into three buckets. Level funding is an aso product with integrated stop loss coverage offered by insurance companies, brokers, and tpas. Know what you pay for Funding covers act as a resource pool that can be drawn down to pay for claims, with unused funds returned. Regardless of a surplus, level funding can bring baseline savings compared to fully insured plans.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is level funding insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information