What is liquor liability insurance Idea

Home » Trend » What is liquor liability insurance IdeaYour What is liquor liability insurance images are ready. What is liquor liability insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is liquor liability insurance files here. Get all royalty-free photos and vectors.

If you’re looking for what is liquor liability insurance pictures information connected with to the what is liquor liability insurance interest, you have pay a visit to the right blog. Our site always gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

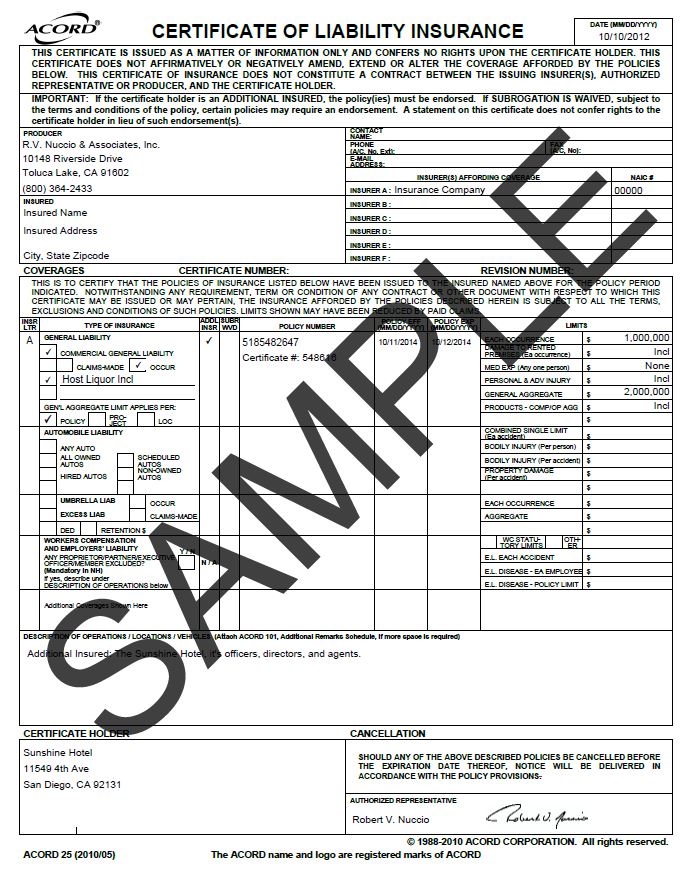

What Is Liquor Liability Insurance. A liquor liability insurance policy protects a business from cases in which an intoxicated patron causes bodily injury or property damage after drinking at their establishment. An intoxicated customer leaves your establishment and goes on to vandalize a building. Most of the time host liquor liability is included on your general liability policy. The policy provides coverage for legal fees, settlements, and medical costs associated with bodily injury or.

Liquor Liability Application Conifer Insurance From coniferinsurance.com

Liquor Liability Application Conifer Insurance From coniferinsurance.com

Liquor liability insurance protects businesses that manufacture, sell or serve alcohol, against claims that occur when a patron drinks too much and injures themselves or someone else. You may also want to purchase a policy if you are a caterer. A liquor liability insurance policy protects a business from cases in which an intoxicated patron causes bodily injury or property damage after drinking at their establishment. It is meant to protect any establishment that serves alcohol in any form from damages caused by an inebriated patron. Contrary to popular belief, general liability is not enough, especially when the situation stems from an incident involving intoxication. Liquor liability insurance can help to cover you and your business in cases of assault and battery (if someone you serve hurts another person), drunk driving (if someone you served is in an accident related to driving intoxicated), and property damage (if someone you served alcohol to causes damage to another person’s belongings while intoxicated).

Depending on the nature of your business, you might need a full liquor liability insurance or.

The purpose of liquor liability insurance the reason that liquor liability insurance exists is to protect businesses that serve alcohol from claims that patrons may make against them. Liquor liability insurance pays the fees and judgments arising from liquor liability claims rather than it coming out of your own pocket. It also covers medical costs and other expenses of any injury or damages sustained by the consumer or a third party. You may also want to purchase a policy if you are a caterer. The insurance policy can provide coverage for settlements, legal costs, and medical expenses. In most states, “dram laws” hold liable any business that serves alcohol to a visibly intoxicated individual.

Source: bfsinsurance.com

Source: bfsinsurance.com

Liquor liability is the vicarious. You may also want to purchase a policy if you are a caterer. In most states, “dram laws” hold liable any business that serves alcohol to a visibly intoxicated individual. Contractors installation, tools & equipment. What liquor liability insurance covers.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

What is liquor liability insurance? The insurance policy can provide coverage for settlements, legal costs, and medical expenses. Liquor liability insurance aims to protect businesses that serve, sell, distribute, manufacture or supply alcoholic beverages from any legal responsibilities incurred by their patrons. Most classically, such claims involve damages as a result of the actions of an intoxicated person, such as a lawsuit filed by someone involved in a crash caused by someone who was drunk. The most common cases in which business owners use liquor liability insurance are where damages to people or property come about due to:

Source: youtube.com

Source: youtube.com

Liquor liability insurance protects businesses that manufacture, sell or serve alcohol, against claims that occur when a patron drinks too much and injures themselves or someone else. The policy provides coverage for legal fees, settlements, and medical costs associated with bodily injury or. Most liquor liability policies are sold as a stand alone policy or packaged with a general liability policy. Liquor liability insurance protects businesses that manufacture, sell or serve alcohol, against claims that occur when a patron drinks too much and injures themselves or someone else. Liquor liability is just one type of liability insurance endorsement.

Source: shoppoin.blogspot.com

Source: shoppoin.blogspot.com

Most liquor liability policies are sold as a stand alone policy or packaged with a general liability policy. The purpose of liquor liability insurance is to protect businesses against lawsuits and other financial liabilities levied against them related to liquor. What is liquor liability insurance and who needs it? Most classically, such claims involve damages as a result of the actions of an intoxicated person, such as a lawsuit filed by someone involved in a crash caused by someone who was drunk. Drunk drivers fights sexual assault & harassment trips, falls, slips, and other accidents alcohol poisoning

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Contractors installation, tools & equipment. What liquor liability insurance covers. This insurance is a policy that protects businesses that sell, serve, or allow consumption of liquor in their establishment. Its intended purpose is to protect the host of such events. It is meant to protect any establishment that serves alcohol in any form from damages caused by an inebriated patron.

Source: everquote.com

Source: everquote.com

It provides coverage for legal obligations and claims settlements. It is meant to protect any establishment that serves alcohol in any form from damages caused by an inebriated patron. The purpose of liquor liability insurance the reason that liquor liability insurance exists is to protect businesses that serve alcohol from claims that patrons may make against them. An intoxicated customer leaves your establishment and goes on to vandalize a building. A host liquor liability insurance policy protects businesses that serve alcohol to guests, occasionally.

Source: slideshare.net

Source: slideshare.net

Most classically, such claims involve damages as a result of the actions of an intoxicated person, such as a lawsuit filed by someone involved in a crash caused by someone who was drunk. It also covers medical costs and other expenses of any injury or damages sustained by the consumer or a third party. What is liquor liability insurance? A liquor liability insurance policy protects a business from cases in which an intoxicated patron causes bodily injury or property damage after drinking at their establishment. Assault and battery, like if a customer you served alcohol to physically hurts another person.

Source: roguerisk.com

Source: roguerisk.com

Liquor liability insurance pays the fees and judgments arising from liquor liability claims rather than it coming out of your own pocket. Liquor liability insurance can help to cover you and your business in cases of assault and battery (if someone you serve hurts another person), drunk driving (if someone you served is in an accident related to driving intoxicated), and property damage (if someone you served alcohol to causes damage to another person’s belongings while intoxicated). Liquor liability insurance aims to protect businesses that serve, sell, distribute, manufacture or supply alcoholic beverages from any legal responsibilities incurred by their patrons. The purpose of liquor liability insurance is to protect businesses against lawsuits and other financial liabilities levied against them related to liquor. Liquor liability insurance can cover the cost of repairing or replacing another person’s property that was damaged by an individual who became intoxicated at your business.

Liquor liability is a type of insurance which covers businesses in the event that claims related to liquor are made against the business. The most common cases in which business owners use liquor liability insurance are where damages to people or property come about due to: The purpose of liquor liability insurance the reason that liquor liability insurance exists is to protect businesses that serve alcohol from claims that patrons may make against them. What does liquor legal liability insurance cover? The policy provides coverage for legal fees, settlements, and medical costs associated with bodily injury or.

Source: youtube.com

Source: youtube.com

Liquor liability is just one type of liability insurance endorsement. Liquor liability insurance can help your business cover claims related to: If you are having an event and would like to serve alcohol, this type of coverage protects you in the event someone files a liability claim for damages they. Liquor liability insurance protects businesses that manufacture, serve, or sell alcohol. What does liquor legal liability insurance cover?

Source: worldins.net

Liquor liability insurance protects businesses that manufacture, serve, or sell alcohol. Assault and battery, like if a customer you served alcohol to physically hurts another person. Liquor liability is the vicarious. It is often written on a standard iso form. Most liquor liability policies are sold as a stand alone policy or packaged with a general liability policy.

Source: davidsoninsurance.com

Source: davidsoninsurance.com

Liquor liability insurance can cover the cost of repairing or replacing another person’s property that was damaged by an individual who became intoxicated at your business. This insurance is a policy that protects businesses that sell, serve, or allow consumption of liquor in their establishment. Liquor liability insurance protects businesses that manufacture, sell or serve alcohol, against claims that occur when a patron drinks too much and injures themselves or someone else. Contractors installation, tools & equipment. An intoxicated customer leaves your establishment and goes on to vandalize a building.

Source: thebalancesmb.com

Source: thebalancesmb.com

Liquor liability is just one type of liability insurance endorsement. Most liquor liability insurance policies exclude the selling of alcohol illegally, such as selling liquor to a minor. Liquor liability insurance liquor liability insurance is a requirement for hosting events at most venues. These lawsuits and financial liabilities typically arise from an intoxicated person who was served alcohol at the establishment of the insured and who has suffered bodily injuries or property damage as a result. Liquor liability insurance can help your business cover claims related to:

Source: jaisin.com

Source: jaisin.com

Drunk drivers fights sexual assault & harassment trips, falls, slips, and other accidents alcohol poisoning Its intended purpose is to protect the host of such events. Liquor liability insurance can cover the cost of repairing or replacing another person’s property that was damaged by an individual who became intoxicated at your business. Liquor liability insurance can help to cover you and your business in cases of assault and battery (if someone you serve hurts another person), drunk driving (if someone you served is in an accident related to driving intoxicated), and property damage (if someone you served alcohol to causes damage to another person’s belongings while intoxicated). Most liquor liability policies are sold as a stand alone policy or packaged with a general liability policy.

Source: coniferinsurance.com

Source: coniferinsurance.com

The insurance policy can provide coverage for settlements, legal costs, and medical expenses. It also covers medical costs and other expenses of any injury or damages sustained by the consumer or a third party. It is often written on a standard iso form. Liquor liability insurance protects businesses that manufacture, sell or serve alcohol, against claims that occur when a patron drinks too much and injures themselves or someone else. The policy provides insurance coverage for legal fees, settlements, and medical costs associated with bodily injury or property damage caused by an intoxicated person, who was served or sold liquor by the business.

Source: bbgulfstates.com

Source: bbgulfstates.com

What is liquor liability insurance and who needs it? Liquor liability insurance protects businesses that manufacture, serve, or sell alcohol. Most classically, such claims involve damages as a result of the actions of an intoxicated person, such as a lawsuit filed by someone involved in a crash caused by someone who was drunk. Liquor liability insurance aims to protect businesses that serve, sell, distribute, manufacture or supply alcoholic beverages from any legal responsibilities incurred by their patrons. What does liquor legal liability insurance cover?

Source: wedgwoodinsurance.com

Source: wedgwoodinsurance.com

Contractors installation, tools & equipment. Liquor liability insurance can cover the cost of repairing or replacing another person’s property that was damaged by an individual who became intoxicated at your business. Drunk driving if an intoxicated person your business served or sold alcohol to damages property or. These lawsuits and financial liabilities typically arise from an intoxicated person who was served alcohol at the establishment of the insured and who has suffered bodily injuries or property damage as a result. Most liquor liability policies are sold as a stand alone policy or packaged with a general liability policy.

Source: accidentshappenatty.com

Source: accidentshappenatty.com

Liquor liability is just one type of liability insurance endorsement. This insurance is a policy that protects businesses that sell, serve, or allow consumption of liquor in their establishment. Liquor liability insurance protects businesses that manufacture, serve, or sell alcohol. What liquor liability insurance covers. Most liquor liability insurance policies exclude the selling of alcohol illegally, such as selling liquor to a minor.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is liquor liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information