What is modified whole life insurance Idea

Home » Trending » What is modified whole life insurance IdeaYour What is modified whole life insurance images are available in this site. What is modified whole life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What is modified whole life insurance files here. Download all royalty-free photos.

If you’re looking for what is modified whole life insurance pictures information related to the what is modified whole life insurance keyword, you have come to the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

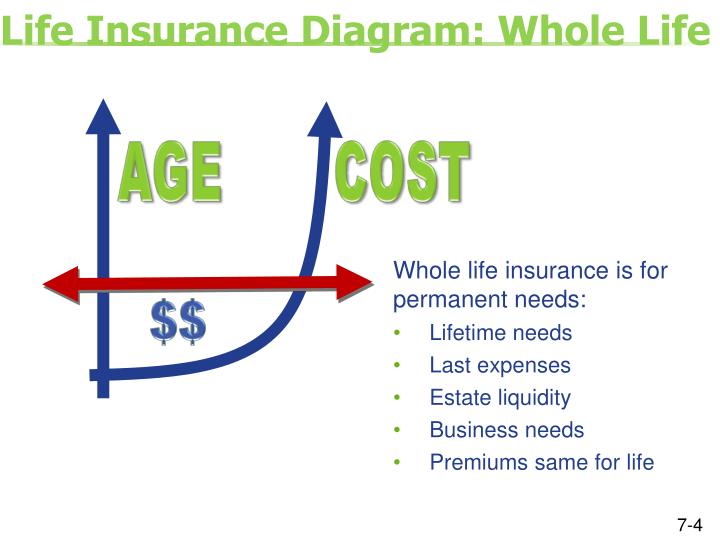

What Is Modified Whole Life Insurance. Modified life insurance is a whole life insurance policy that allows you to pay lower premiums for the first few years — typically three to five years, but sometimes as many as 10 — then you pay slightly higher premiums for the remaining life of the policy. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years.

What is Modified Whole Life Insurance? Insurance Noon From insurancenoon.com

What is Modified Whole Life Insurance? Insurance Noon From insurancenoon.com

The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life. Modified whole life insurance is a whole life insurance policy with a waiting period. At this point, cash value starts accumulating like a. Modified life insurance, also known as modified whole life insurance, is a type of permanent life insurance that provides a lower premium for the first few policy years in exchange for a higher premium after the introductory period. It is a form of permanent insurance, meaning that it is intended to be kept for a person’s whole life, as opposed to insurance for a temporary need, such as term insurance. Modified whole life insurance is really a company specific question.

For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years.

What is modified premium whole life insurance? With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. The term “modified premium whole life insurance contract” refers to a life insurance policy that has a decreased premium during the first few years of the policy’s duration. For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history.

Source: medicarelifehealth.com

Source: medicarelifehealth.com

Modified premium whole life insurance is very similar to basic traditional whole life insurance. Modified whole life insurance is a type of whole life coverage that offers an alternative premium structure to purchasers who wish to lay out less money for premiums in the first few years of the policy. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward. Modified life insurance is a type of insurance policy in which premiums remain fixed for a set number of years before increasing. Modified life insurance is a whole life insurance policy that allows you to pay lower premiums for the first few years — typically three to five years, but sometimes as many as 10 — then you pay slightly higher premiums for the remaining life of the policy.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/proscons-1.jpg) Source: choicemutual.com

Source: choicemutual.com

These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. With a modified premium whole life insurance contract, the amount of. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward. Modified premium whole life insurance is very similar to traditional whole life insurance.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/faqsmodifiedplan.jpg) Source: choicemutual.com

Source: choicemutual.com

It is a form of permanent insurance, meaning that it is intended to be kept for a person’s whole life, as opposed to insurance for a temporary need, such as term insurance. If the insured were to die during the waiting period, the insurance company will only refund premiums paid plus interest. Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy.

Source: taxsavingsinvestor.com

Source: taxsavingsinvestor.com

The term “modified premium whole life insurance contract” refers to a life insurance policy that has a decreased premium during the first few years of the policy’s duration. If the insured were to die during the waiting period, the insurance company will only refund premiums paid plus interest. Modified whole life insurance can also be called → graded life insurance →. For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history. Aci/cli final expense (whole life) insurance can help minimize the emotional and financial burden a loss could have on a family.

Source: insurancenoon.com

Source: insurancenoon.com

How is the premium modified? What is modified whole life insurance? Modified whole life insurance works the same as an ordinary whole life insurance policy except in how it is funded. With a modified premium whole life insurance contract, the amount of. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period.

Source: buylifeinsuranceforburial.com

Modified premium whole life insurance is very similar to basic traditional whole life insurance. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. At this point, cash value starts accumulating like a. Premiums typically increase only one time, after which they usually remain consistent for the rest of the policy’s term. Modified life insurance, also known as modified whole life insurance, is a type of permanent life insurance that provides a lower premium for the first few policy years in exchange for a higher premium after the introductory period.

Source: willamettelifeinsurance.com

Source: willamettelifeinsurance.com

It is a form of permanent insurance, meaning that it is intended to be kept for a person’s whole life, as opposed to insurance for a temporary need, such as term insurance. Aci/cli final expense (whole life) insurance can help minimize the emotional and financial burden a loss could have on a family. What is modified premium whole life insurance? Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. The term “modified premium whole life insurance contract” refers to a life insurance policy that has a decreased premium during the first few years of the policy’s duration.

Source: youtube.com

Source: youtube.com

Modified whole life insurance is a type of whole life coverage that offers an alternative premium structure to purchasers who wish to lay out less money for premiums in the first few years of the policy. Modified premium whole life insurance is very similar to traditional whole life insurance. Modified whole life insurance is a type of whole life coverage that offers an alternative premium structure to purchasers who wish to lay out less money for premiums in the first few years of the policy. It is a form of permanent insurance, meaning that it is intended to be kept for a person’s whole life, as opposed to insurance for a temporary need, such as term insurance. Modified whole life insurance can also be called → graded life insurance →.

Source: insurancediaries.com

Source: insurancediaries.com

For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history. For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history. With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. Modified premium whole life insurance is very similar to traditional whole life insurance. Modified premium whole life insurance is very similar to basic traditional whole life insurance.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://choicemutual.com/wp-content/uploads/2020/04/modifiedwholelife.jpg) Source: choicemutual.com

Source: choicemutual.com

Premiums typically increase only one time, after which they usually remain consistent for the rest of the policy’s term. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history. “modified” whole life insurance has an initial “modified” level of coverage that typically lasts a specific number of years at the beginning of the insurance policy.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

How is the premium modified? Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. Modified whole life insurance can also be called → graded life insurance →. The difference between the two products lies in the premium structure of the contracts. If the insured were to die during the waiting period, the insurance company will only refund premiums paid plus interest.

Source: jamesturnerinsurance.com

Source: jamesturnerinsurance.com

Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. “modified” whole life insurance has an initial “modified” level of coverage that typically lasts a specific number of years at the beginning of the insurance policy. If the insured were to die during the waiting period, the insurance company will only refund premiums paid plus interest. With a modified premium whole life insurance contract, the amount of. The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life.

Source: lifeinsuranceguideline.com

Source: lifeinsuranceguideline.com

Modified whole life insurance is a type of whole life coverage that offers an alternative premium structure to purchasers who wish to lay out less money for premiums in the first few years of the policy. How is the premium modified? For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years. Premiums typically increase only one time, after which they usually remain consistent for the rest of the policy’s term. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years.

Source: insuranceandestates.com

Source: insuranceandestates.com

For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years. Modified whole life insurance works the same as an ordinary whole life insurance policy except in how it is funded. Modified premium whole life insurance is very similar to basic traditional whole life insurance. It is a form of permanent insurance, meaning that it is intended to be kept for a person’s whole life, as opposed to insurance for a temporary need, such as term insurance. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward.

Source: slideserve.com

Source: slideserve.com

For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years. Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years but occasionally up to five or 10), followed by a higher rate for the remainder of the policy. Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. What is modified whole life insurance? According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward. Modified life insurance is a type of insurance policy in which premiums remain fixed for a set number of years before increasing. With a modified premium whole life insurance contract, the amount of. Modified whole life insurance is really a company specific question.

Source: seniorslifeinsurancefinder.com

Source: seniorslifeinsurancefinder.com

According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. Modified life insurance is a whole life insurance policy that allows you to pay lower premiums for the first few years — typically three to five years, but sometimes as many as 10 — then you pay slightly higher premiums for the remaining life of the policy. With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. Premiums typically increase only one time, after which they usually remain consistent for the rest of the policy’s term.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

The difference between the two products lies in the premium structure of the contracts. The term “modified premium whole life insurance contract” refers to a life insurance policy that has a decreased premium during the first few years of the policy’s duration. Modified whole life insurance can also be called → graded life insurance →. According to the insurance company that offered the policy, this period of reduced premiums might last anywhere between five and ten years. For one of the companies i work with, modified whole life is designed for someone who has a medical history which most companies would decline or highly rate because of the medical history.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is modified whole life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information