What is ordinance or law insurance coverage Idea

Home » Trending » What is ordinance or law insurance coverage IdeaYour What is ordinance or law insurance coverage images are available. What is ordinance or law insurance coverage are a topic that is being searched for and liked by netizens today. You can Get the What is ordinance or law insurance coverage files here. Download all royalty-free photos and vectors.

If you’re looking for what is ordinance or law insurance coverage images information connected with to the what is ordinance or law insurance coverage interest, you have come to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

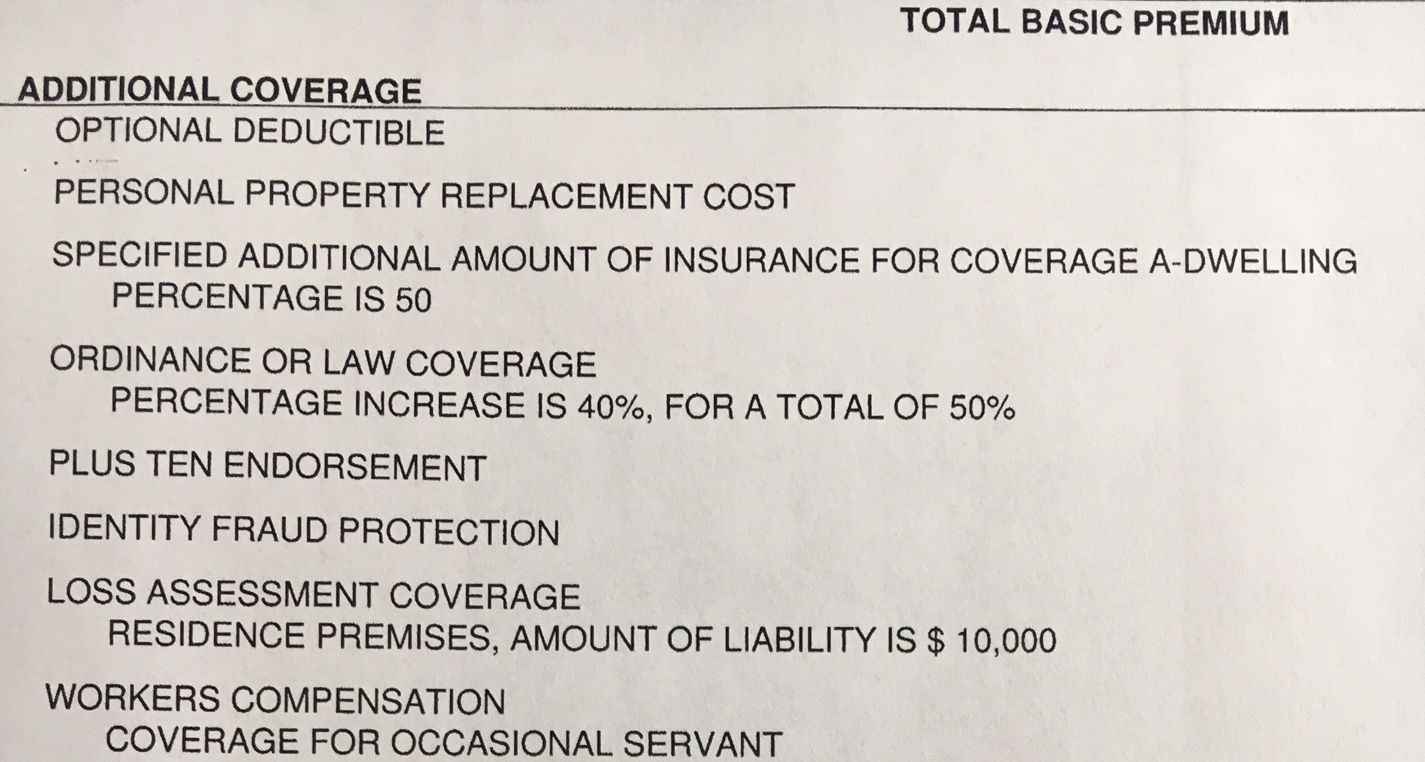

What Is Ordinance Or Law Insurance Coverage. But a partial loss could trigger the enforcement of an ordinance or law that could cause you to have to pay more than the amount of loss covered by your policy. This is where ordinance or law coverage comes into play. Often, fixing extensive property damage while also ensuring the construction is up to code standards can be a costly venture. But in florida, it’s likely to be 25% to 50% due to the threat of serious storms and regularly fluctuating building codes.

Law & Ordinance On Your Insurance Policy From blog.homesteadroofingcolorado.com

Law & Ordinance On Your Insurance Policy From blog.homesteadroofingcolorado.com

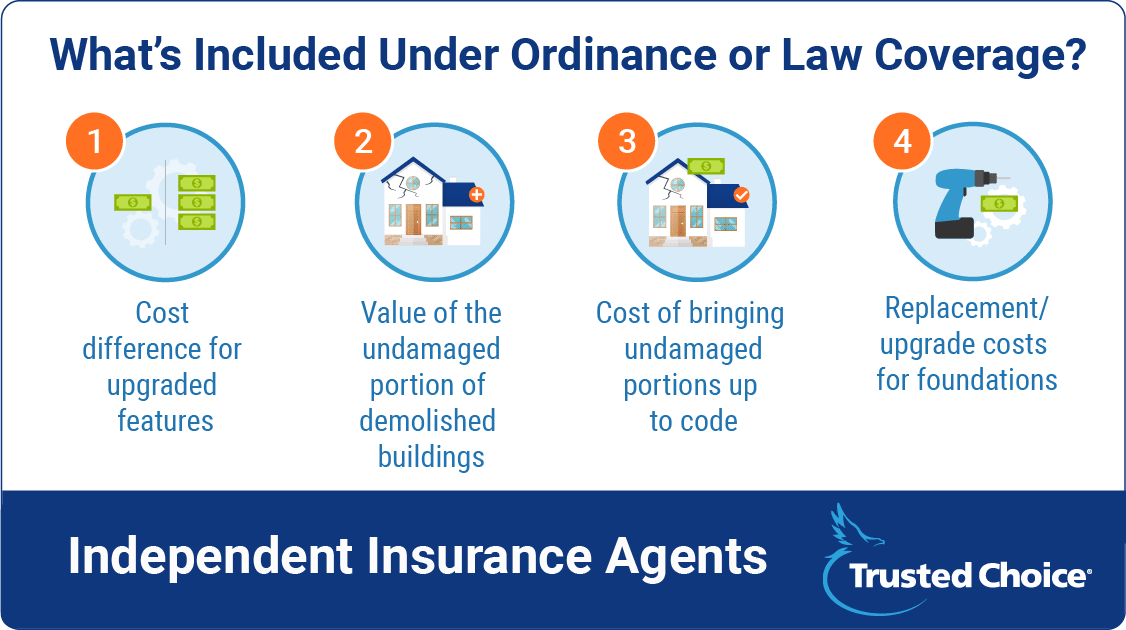

Loss of undamaged portion coverage applies when only one portion of a building has been damaged, but the code requires demolition of the entire structure. Of course, this doesn’t mean that all insurance policies will provide for law and ordinance coverage, and the parties may agree to any type of coverage they desire. And plumbing units based on city codes. Loss to the undamaged portion of the building. What is ordinance or law coverage? Ordinance or law coverage — coverage for loss caused by enforcement of ordinances or laws regulating construction and repair of damaged buildings.

It covers the loss in value of the undamaged portion of the building.

This is where ordinance or law coverage comes into play. It states in the code that the building must comply with florida building code 706. All homes are required, by law, to meet a certain set of standards. Without this important endorsement, you must pay the additional costs. And plumbing units based on city codes. But in florida, it’s likely to be 25% to 50% due to the threat of serious storms and regularly fluctuating building codes.

Source: adjustersinternational.com

Source: adjustersinternational.com

To understand how these coverages work together let’s use an example like when a major calamity strikes such as a large fire. It states in the code that the building must comply with florida building code 706. Ordinance or law insurance, also known as building ordinance or law coverage, helps pay for construction and repair costs if your building is damaged and needs to be brought up to code during repairs. Therefore, ordinance and law provisions should not be invoked because this is how the claim should be settled to begin with, outside of any regulations. Partial losses are far more likely.

Source: ontophome.com

Source: ontophome.com

Therefore, ordinance and law provisions should not be invoked because this is how the claim should be settled to begin with, outside of any regulations. Ordinance or law coverage, also referred to as ordinance and law coverage, building ordinance coverage, code compliance insurance, code upgrade coverage, and building code upgrade coverage is part of your standard home insurance policy. What is ordinance or law insurance coverage? This means that if you lose your 1920’s craftsman to a hurricane, you won’t have to pay out of pocket to bring it up to the 2021 building code. Ordinance or law coverage pays for those costs, which insurance carriers would otherwise consider an improvement to your property absent the coverage.

Source: trustedchoice.com

Source: trustedchoice.com

Specifically, the statute requires that whenever a homeowner’s insurance policy is issued, the insurer has a statutory duty to offer this type of coverage. Adding ordinance or law insurance to your property insurance coverage is a good idea for any property owner. Without this important endorsement, you must pay the additional costs. This can create a nightmare situation for an insured and this is where ordinance or law coverage can be triggered. And plumbing units based on city codes.

Source: youtube.com

Source: youtube.com

Since fire departments respond quickly usually the entire building is not lost. Loss to the undamaged portion of the building. Since fire departments respond quickly usually the entire building is not lost. Partial losses are far more likely. What is ordinance or law insurance coverage?

Source: einsurance.com

Source: einsurance.com

For example, if you have $300,000 of dwelling coverage, and you’ve got ordinance or. It covers the loss in value of the undamaged portion of the building. Ordinance or law insurance, also known as building ordinance or law coverage, helps pay for construction and repair costs if your building is damaged and needs to be brought up to code during repairs. Ordinance or law coverage covers the costs of rebuilding your home up to current building standards after a covered loss. Ordinance or law coverage, also referred to as ordinance and law coverage, building ordinance coverage, code compliance insurance, code upgrade coverage, and building code upgrade coverage is part of your standard home insurance policy.

Source: ijacademy.com

Source: ijacademy.com

But a partial loss could trigger the enforcement of an ordinance or law that could cause you to have to pay more than the amount of loss covered by your policy. Therefore, ordinance and law provisions should not be invoked because this is how the claim should be settled to begin with, outside of any regulations. Often, fixing extensive property damage while also ensuring the construction is up to code standards can be a costly venture. Ordinance or law coverage, also referred to as ordinance and law coverage, building ordinance coverage, code compliance insurance, code upgrade coverage, and building code upgrade coverage is part of your standard home insurance policy. Ordinance or law coverage is an additional feature of a property policy that helps cover the costs of repairing a damaged building to comply with updated building codes.

Source: issuu.com

Source: issuu.com

There are very few total losses; Partial losses are far more likely. Without this important endorsement, you must pay the additional costs. Therefore, ordinance and law provisions should not be invoked because this is how the claim should be settled to begin with, outside of any regulations. Ordinance or law coverage pays for those costs, which insurance carriers would otherwise consider an improvement to your property absent the coverage.

Source: marindependent.com

Source: marindependent.com

What is ordinance or law insurance coverage? What is law and ordinance coverage? Ordinance or law insurance covers the cost to rebuild your home if it’s been destroyed by a natural disaster, fire, or any other unexpected event. It covers the loss in value of the undamaged portion of the building. This coverage is supplied in three parts;

Source: issuu.com

Source: issuu.com

This coverage indemnifies a property owner for the undamaged portion of the building even though there was no direct damage to it. In such situations, ordinance or law coverage provides the insurance coverage needed to cover the undamaged portion of the building as well as the costs to demolish and rebuild the building. Of course, this doesn’t mean that all insurance policies will provide for law and ordinance coverage, and the parties may agree to any type of coverage they desire. This means that if you lose your 1920’s craftsman to a hurricane, you won’t have to pay out of pocket to bring it up to the 2021 building code. What is law or ordinance coverage?

Source: davemooreinsurance.com

Source: davemooreinsurance.com

Coverages a, b and c. Ordinance or law insurance, also known as building ordinance or law coverage, helps pay for construction and repair costs if your building is damaged and needs to be brought up to code during repairs. What is 25 ordinance law coverage in florida? This can create a nightmare situation for an insured and this is where ordinance or law coverage can be triggered. What is law or ordinance coverage?

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

Older structures that are damaged may need upgraded electrical; Ordinance or law insurance coverage pays for the additional costs associated with upgrading your primary dwelling or other structures to comply with local building codes or ordinances. Usually, these building upgrades must be implemented after a partial or total loss to your property caused by a covered peril. What is ordinance or law coverage? In such situations, ordinance or law coverage provides the insurance coverage needed to cover the undamaged portion of the building as well as the costs to demolish and rebuild the building.

Source: blog.homesteadroofingcolorado.com

Source: blog.homesteadroofingcolorado.com

It states in the code that the building must comply with florida building code 706. Ordinance or law coverage, also referred to as ordinance and law coverage, building ordinance coverage, code compliance insurance, code upgrade coverage, and building code upgrade coverage is part of your standard home insurance policy. In such situations, ordinance or law coverage provides the insurance coverage needed to cover the undamaged portion of the building as well as the costs to demolish and rebuild the building. Older structures that are damaged may need upgraded electrical; Ordinance and law coverage is insurance coverage for loss caused by the enforcement of ordinances or laws regulating construction and repair of damaged buildings.

Source: safehavensinsurance.com

Source: safehavensinsurance.com

Ordinance or law insurance, also known as building ordinance or law coverage, helps pay for construction and repair costs if your building is damaged and needs to be brought up to code during repairs. For the safety of those living in your home, it’s important to stay up to date on any code changes pertaining to weather, fire safety, plumbing, wiring, and handicap accessibility. Since fire departments respond quickly usually the entire building is not lost. Often, fixing extensive property damage while also ensuring the construction is up to code standards can be a costly venture. Ordinance or law coverage pays for those costs, which insurance carriers would otherwise consider an improvement to your property absent the coverage.

Source: youtube.com

Source: youtube.com

Ordinance or law insurance, also known as building ordinance or law coverage, helps pay for construction and repair costs if your building is damaged and needs to be brought up to code during repairs. Adding ordinance or law insurance to your property insurance coverage is a good idea for any property owner. All homes are required, by law, to meet a certain set of standards. And plumbing units based on city codes. Ordinance or law coverage is an additional feature of a property policy that helps cover the costs of repairing a damaged building to comply with updated building codes.

Source: adjustersinternational.com

Source: adjustersinternational.com

You may also be able to add more coverage depending on your insurer. Loss to the undamaged portion of the building. This is where ordinance or law coverage comes into play. Ordinance or law insurance covers the cost to rebuild your home if it’s been destroyed by a natural disaster, fire, or any other unexpected event. Partial losses are far more likely.

Source: slideshare.net

Source: slideshare.net

Ordinance and law coverage is insurance coverage for loss caused by the enforcement of ordinances or laws regulating construction and repair of damaged buildings. For the safety of those living in your home, it’s important to stay up to date on any code changes pertaining to weather, fire safety, plumbing, wiring, and handicap accessibility. Adding ordinance or law insurance to your property insurance coverage is a good idea for any property owner. It covers the loss in value of the undamaged portion of the building. Ordinance or law coverage is an additional feature of a property policy that helps cover the costs of repairing a damaged building to comply with updated building codes.

Source: elementrisk.com

Source: elementrisk.com

Ordinance or law coverage is an additional feature of a property policy that helps cover the costs of repairing a damaged building to comply with updated building codes. This is where ordinance or law coverage comes into play. Add these costs to your deductible and you can see why this coverage can be so critical to your budget. What is law or ordinance coverage? Loss to the undamaged portion of the building.

Source: adjustersinternational.com

Source: adjustersinternational.com

Therefore, ordinance and law provisions should not be invoked because this is how the claim should be settled to begin with, outside of any regulations. Ordinance or law coverage is an additional feature of a property policy that helps cover the costs of repairing a damaged building to comply with updated building codes. Most standard homeowners insurance policies include a clause that states that the insurer will not cover the costs associated with the enforcement of any ordinance or law which regulates the use, construction, repair and demolition (including removal of debris) of any property after an insured event has occurred. Usually, these building upgrades must be implemented after a partial or total loss to your property caused by a covered peril. This can create a nightmare situation for an insured and this is where ordinance or law coverage can be triggered.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is ordinance or law insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information