What is personal lines insurance Idea

Home » Trending » What is personal lines insurance IdeaYour What is personal lines insurance images are ready in this website. What is personal lines insurance are a topic that is being searched for and liked by netizens now. You can Download the What is personal lines insurance files here. Get all royalty-free vectors.

If you’re searching for what is personal lines insurance images information linked to the what is personal lines insurance interest, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

What Is Personal Lines Insurance. Personal lines insurance is purely the term used to discern personal insurance from their commercial and business equivalents. Meaning, one license for personal and commercial lines insurance products. Commercial lines, that accounts for almost half of u.s. To illustrate, suppose that you injure another party in a vehicular accident and the total.

Easytouse Personal Lines Insurance Software for Brokers From zywave.com

Easytouse Personal Lines Insurance Software for Brokers From zywave.com

These insurance lines generally protect people. • proficient in usage of the computer, voip phone systems, virtual meetings, etc. Examples of personal lines policies may include: The most common personal lines are automobile insurance and home insurance. Personal lines insurance is insurance that is offered to individuals and families rather than organizations and businesses. Meaning, one license for personal and commercial lines insurance products.

Examples of personal lines policies may include:

You can also purchase an umbrella policy , also considered personal lines insurance,. Property and casualty insurance (p&c insurance) is a category of insurance coverages that protect property and business owners from potential costs stemming from property damage and personal liability claims. Personal lines insurance refers to any type of insurance that protects you and covered loved ones personally, including your home, car, health and life. The focus of personal lines is on protecting the financial interests of an individual or family, rather than a corporate or business entity. Here, property and casualty insurance pros will find the. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and.

Source: youtube.com

Source: youtube.com

To illustrate, suppose that you injure another party in a vehicular accident and the total. Personal lines insurance refers to any kind of insurance that covers individuals against loss that results from death, injury, or loss of property. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and. In order to get this license you must pass the texas department of insurance license exam. • knowledge in cms hawksoft, a plus.

Source: youtube.com

Source: youtube.com

They analyze the personal insurance needs of their clients to recommend suitable insurance products. In order to get this license you must pass the texas department of insurance license exam. The exam has 100 scoreable questions and you have 2 hours to answer the questions. Here, property and casualty insurance pros will find the. Meaning, one license for personal and commercial lines insurance products.

Source: pbaonpatrol.com

Source: pbaonpatrol.com

Personal lines insurance is insurance that is offered to individuals and families rather than organizations and businesses. The term “line” in the insurance industry, refers to a class of insurance. The most common personal lines are automobile insurance and home insurance. Personal lines insurance includes property and casualty insurance products that protect individuals from losses they couldn’t cover on their own. Commercial and business insurance performs a vital role in the world economy.

Source: hegarty-haynesinsurance.com

Source: hegarty-haynesinsurance.com

Examples of personal lines policies may include: Personal and commercial lines each of the four major categories of insurance can be further subdivided into both personal and commercial lines. Meaning, one license for personal and commercial lines insurance products. To illustrate, suppose that you injure another party in a vehicular accident and the total. Personal lines of insurance include a range of insurance policies for individuals.

Source: babbins.com

Source: babbins.com

Personal lines insurance includes property and casualty insurance products that protect individuals from losses they couldn’t cover on their own. Commercial and business insurance performs a vital role in the world economy. Home and auto insurance policyholders count on insurance professionals to help them safeguard their most precious assets. Examples of personal lines policies may include: • no insurance experience necessary, but preferred.

Source: pcitplus.wordpress.com

Source: pcitplus.wordpress.com

Personal lines of insurance include a range of insurance policies for individuals. Commercial and business insurance performs a vital role in the world economy. Personal excess liability insurance is often equated with umbrella insurance. For example, your homeowner’s insurance policy is designed to address liabilities involving guests, nature, theft, etc. Like the name insinuates, personal lines are geared towards policies bought by individuals.

Source: wizehire.com

Source: wizehire.com

These insurance lines generally protect people. While property insurance and casualty insurance are two different lines of insurance coverage, most insurance agencies require their agents to. For example, your homeowner’s insurance policy is designed to address liabilities involving guests, nature, theft, etc. Personal lines insurance is property and casualty insurance coverage sold to individuals and families for primarily noncommercial purposes. Personal excess liability insurance is often equated with umbrella insurance.

Source: jblbinsurance.com

Source: jblbinsurance.com

Here, property and casualty insurance pros will find the. Commercial lines, that accounts for almost half of u.s. Personal lines customer service representative requirements. Personal lines insurance includes property and casualty insurance products that protect individuals from losses they couldn’t cover on their own. The exam has 100 scoreable questions and you have 2 hours to answer the questions.

Source: generalnewyorksystems.com

Source: generalnewyorksystems.com

Property and casualty insurance (p&c insurance) is a category of insurance coverages that protect property and business owners from potential costs stemming from property damage and personal liability claims. • proficient in usage of the computer, voip phone systems, virtual meetings, etc. Property/casualty insurance premium, includes the many kinds of insurance products designed for businesses. Many agencies will have two departments,. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and.

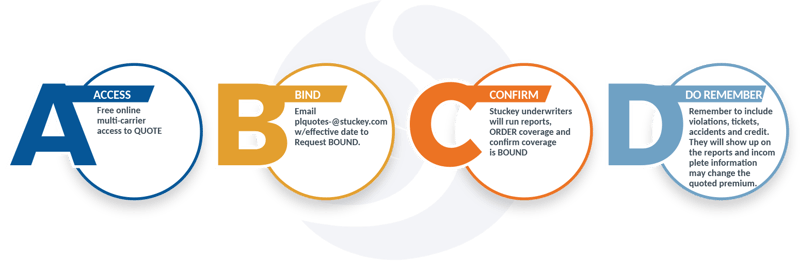

Source: stuckey.com

Source: stuckey.com

The focus of personal lines is on protecting the financial interests of an individual or family, rather than a corporate or business entity. Home and auto insurance policyholders count on insurance professionals to help them safeguard their most precious assets. Personal excess liability insurance is often equated with umbrella insurance. Personal lines insurance is purely the term used to discern personal insurance from their commercial and business equivalents. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and.

Source: trueassoc.com

Source: trueassoc.com

• no insurance experience necessary, but preferred. Personal lines insurance is property and casualty insurance coverage sold to individuals and families for primarily noncommercial purposes. You can also purchase an umbrella policy , also considered personal lines insurance,. The focus of personal lines is on protecting the financial interests of an individual or family, rather than a corporate or business entity. A personal lines insurance agent is licensed to sell multiple types of insurance policies including property and casualty, life, health, liability, and umbrella insurance to protect individuals and families against financial loss.

Source: frankelinsurance.com

Source: frankelinsurance.com

Examples of personal lines policies may include: Personal lines insurance includes property and casualty insurance products that protect individuals from losses they couldn’t cover on their own. Commercial lines insurance includes auto, liability, homeowners, liability, and personal property policies. The focus of personal lines is on protecting the financial interests of an individual or family, rather than a corporate or business entity. Personal lines of insurance include a range of insurance policies for individuals.

Source: investopedia.com

Source: investopedia.com

Commercial lines insurance includes auto, liability, homeowners, liability, and personal property policies. Commercial and business insurance performs a vital role in the world economy. The focus of personal lines is on protecting the financial interests of an individual or family, rather than a corporate or business entity. In order to get this license you must pass the texas department of insurance license exam. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

Source: youtube.com

Source: youtube.com

A personal insurance policy won’t cover the liabilities associated with. While both provide coverage beyond the liability policy�s limit, personal excess liability insurance does not provide the broader protection that umbrella insurance affords. Here, property and casualty insurance pros will find the. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. • proficient in usage of the computer, voip phone systems, virtual meetings, etc.

Source: youtube.com

Source: youtube.com

Commercial lines, that accounts for almost half of u.s. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and. Commercial and business insurance performs a vital role in the world economy. Property and casualty insurance (p&c insurance) is a category of insurance coverages that protect property and business owners from potential costs stemming from property damage and personal liability claims. Commercial lines insurance includes auto, liability, homeowners, liability, and personal property policies.

Source: insuranceprojects.ie

Source: insuranceprojects.ie

The exam has 100 scoreable questions and you have 2 hours to answer the questions. The most common personal lines are automobile insurance and home insurance. A personal lines insurance agent is licensed to sell multiple types of insurance policies including property and casualty, life, health, liability, and umbrella insurance to protect individuals and families against financial loss. Personal lines insurance refers to any type of insurance that protects you and covered loved ones personally, including your home, car, health and life. They analyze the personal insurance needs of their clients to recommend suitable insurance products.

Source: zywave.com

Source: zywave.com

For example, your homeowner’s insurance policy is designed to address liabilities involving guests, nature, theft, etc. They analyze the personal insurance needs of their clients to recommend suitable insurance products. Meaning, one license for personal and commercial lines insurance products. In order to get this license you must pass the texas department of insurance license exam. Examples of personal lines policies may include:

Source: slideserve.com

Source: slideserve.com

Personal lines insurance refers to any kind of insurance that covers individuals against loss that results from death, injury, or loss of property. • no insurance experience necessary, but preferred. Personal excess liability insurance is often equated with umbrella insurance. The most common types of personal line insurance are property and casualty insurance, which includes automobile, homeowner and. Personal lines insurance refers to any kind of insurance that covers individuals against loss that results from death, injury, or loss of property.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is personal lines insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information