What is pf insurance Idea

Home » Trend » What is pf insurance IdeaYour What is pf insurance images are available. What is pf insurance are a topic that is being searched for and liked by netizens today. You can Get the What is pf insurance files here. Download all free images.

If you’re looking for what is pf insurance pictures information connected with to the what is pf insurance interest, you have visit the right site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

What Is Pf Insurance. There are three different types of travel insurance policies: While the focus of the esi scheme is healthcare, provident fund is focused towards post retirement income and benefits. Know what is pf, its benefits & interest rates. Here we will learn complete details about pf like what is pf, what are different rates of pf like epf, eps, difference, pf admin charges, edli admin charges etc)what is provident fundit is a scheme for the benefit of employees,in this scheme,certain amount is deducted from employee salary.some amoun

title sep sitename From healthnewsreporting.com

title sep sitename From healthnewsreporting.com

Epf is divided into two parts which are provident fund and employee pension scheme. Earlier, the death cover for pf. It represents the state, regional office, establishment, and pf member code. Comprehensive insurance is car insurance that covers damage to your car from causes other than a collision. Learn about comprehensive insurance costs. 164 n powerline road, 33069.

Here we will learn complete details about pf like what is pf, what are different rates of pf like epf, eps, difference, pf admin charges, edli admin charges etc)what is provident fundit is a scheme for the benefit of employees,in this scheme,certain amount is deducted from employee salary.some amoun

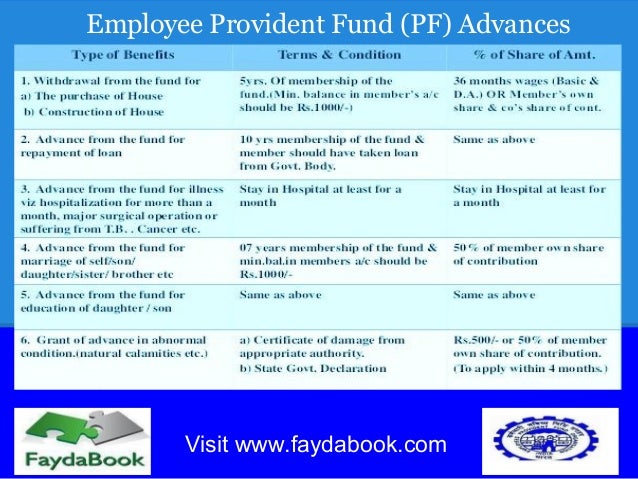

Earlier, the death cover for pf. The purpose of eps is to generate pension for employees after the age of 58 years. Towards provident fund the employees share of 12% (as also whatever his voluntary contributions is) and 3.67% of the employer�s contribution are credited. Insurance is support for the insured’s credit. Professional liability/ e & o; The third and final part of epf is the employee deposit linked insurance scheme or edli, which is a life insurance cover.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

Single trip, annual, and group. The extent of the benefit is decided by the last drawn salary of the employee. 164 n powerline road, 33069. The good thing is you don’t need to register separately for all these benefits. The employees� deposit linked insurance scheme or edli is an insurance cover provided by the epfo (employees� provident fund organisation) for private sector salaried employees.

Source: paisabazaar.com

Source: paisabazaar.com

Edli scheme is applicable to employees (private organizations) registered under the employee provident fund (epf). Epf is divided into two parts which are provident fund and employee pension scheme. The board administers a contributory provident fund, pension scheme and an insurance scheme for the workforce engaged in the organized sector in india. Employees provident fund has three schemes, viz, provident fund, pension fund and employees deposit linked insurance. The employees� deposit linked insurance scheme or edli is an insurance cover provided by the epfo (employees� provident fund organisation) for private sector salaried employees.

Source: pinterest.com

Source: pinterest.com

More often policies pay out 50% to 60% of your income. While a universal account number (uan) is a unique number allotted to pf members. There are three different types of travel insurance policies: Each month there is a contribution that is. While the employee enjoys the benefits of insurance coverage under the edli scheme, s/he does not contribute to it directly.

Source: pinterest.com

Source: pinterest.com

Pf and epf are terms used to denote the same, employees provident fund. Epf is divided into two parts which are provident fund and employee pension scheme. Comprehensive insurance is car insurance that covers damage to your car from causes other than a collision. The extent of the benefit is decided by the last drawn salary of the employee. Towards provident fund the employees share of 12% (as also whatever his voluntary contributions is) and 3.67% of the employer�s contribution are credited.

Source: relakhs.com

Source: relakhs.com

The third and final part of epf is the employee deposit linked insurance scheme or edli, which is a life insurance cover. Employees provident fund or epf is a retirement benefit that is offered by the employees provident fund organisation. A policyholder will pay taxes on any withdrawals they make from the excess cash value of the universal life insurance plan. Epf is divided into two parts which are provident fund and employee pension scheme. Single trip, annual, and group.

Source: neusourcestartup.com

Source: neusourcestartup.com

The purpose of eps is to generate pension for employees after the age of 58 years. Contributions are made by the employer. More often policies pay out 50% to 60% of your income. There are three different types of travel insurance policies: Most universal life insurance policies contain a flexible premium option.

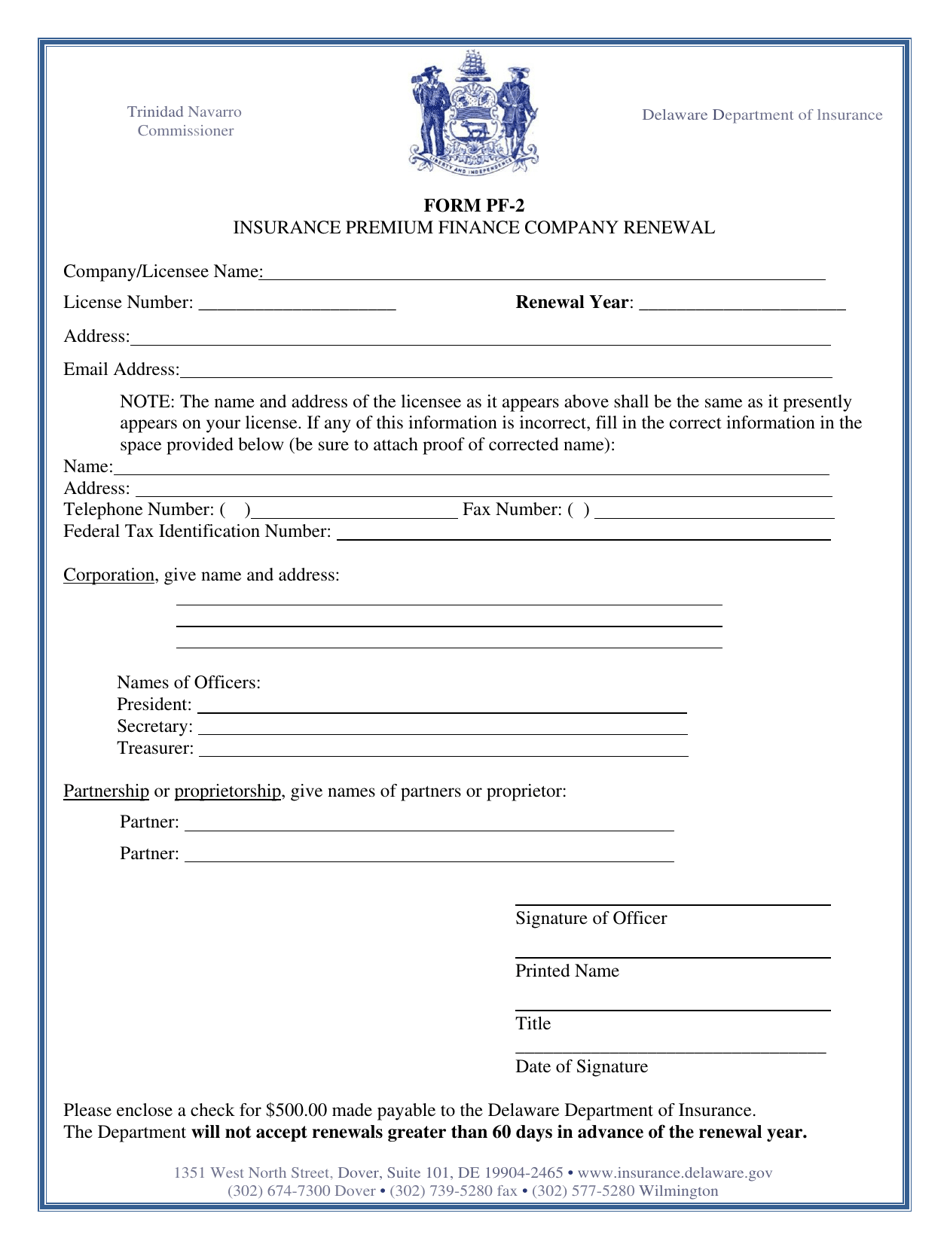

Source: templateroller.com

Source: templateroller.com

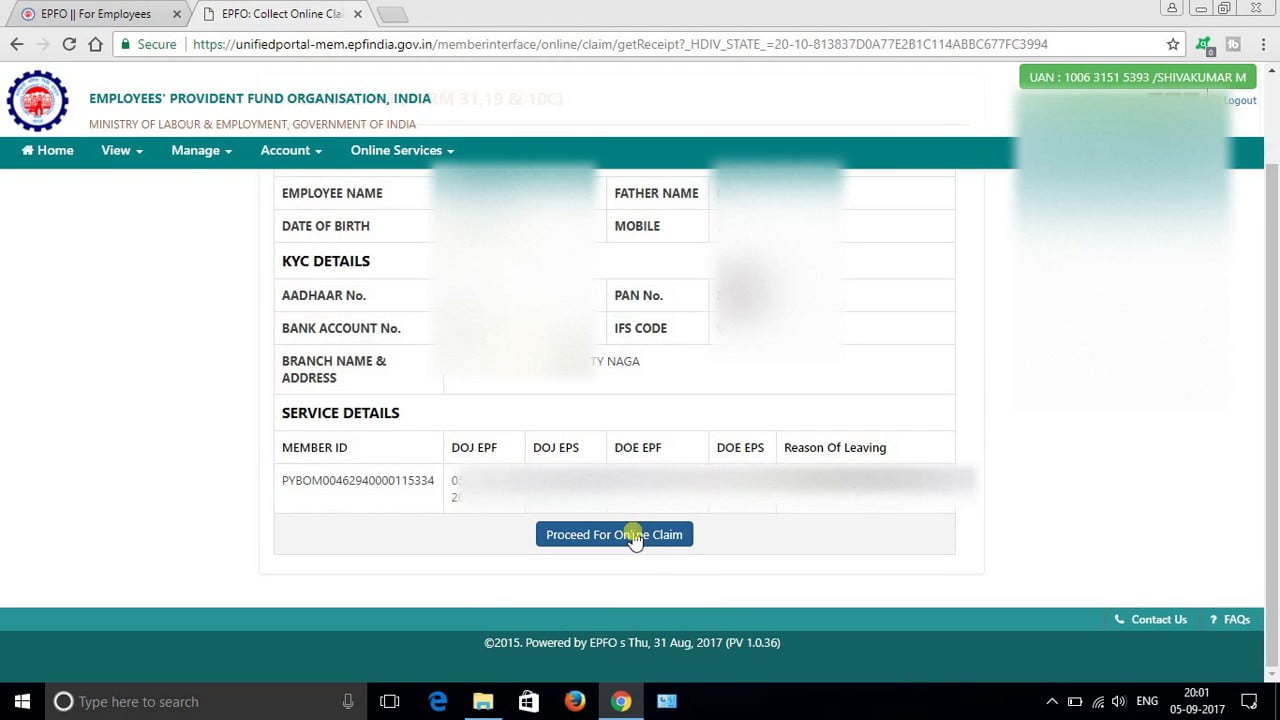

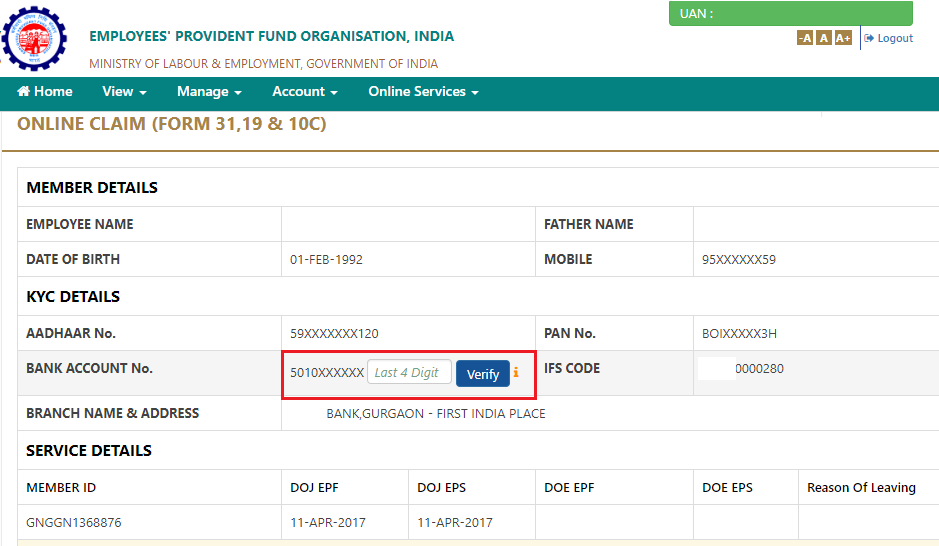

The pf number is an alphanumeric code. Employees provident fund has three schemes, viz, provident fund, pension fund and employees deposit linked insurance. Keep reading at karvy corporate! Popular benefits on a travel insurance policy include coverage for trip cancellations, medical emergencies, travel delays, and luggage. The pf trust manages the pf number.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

The pf number is an alphanumeric code. Employee deposit linked insurance (edli scheme) benefits and features. After registration under employee pf act, the employee of the company has following benefits. Each month there is a contribution that is. There are three different types of travel insurance policies:

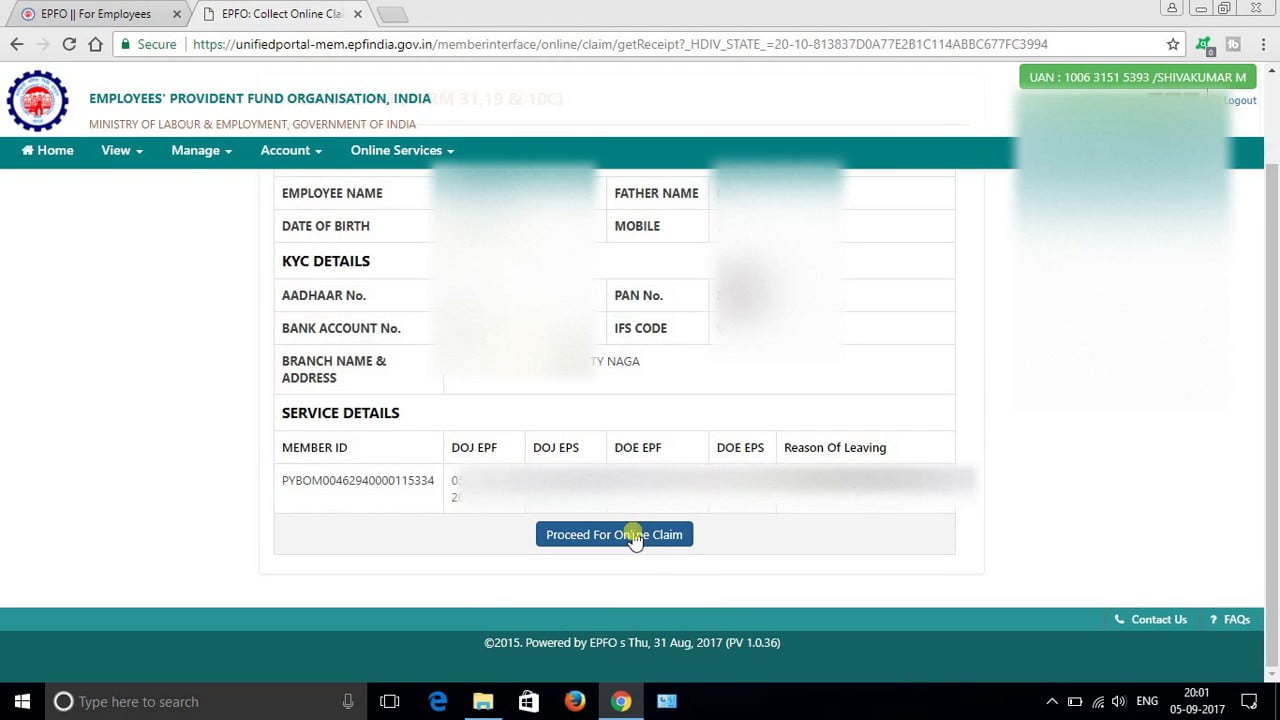

Source: youtube.com

Source: youtube.com

Employee’s provident fund (epf) contribution by employee: Keep reading at karvy corporate! There are three different types of travel insurance policies: Each month there is a contribution that is. Earlier, the death cover for pf.

Source: latestgazette.com

Source: latestgazette.com

Pf and epf are terms used to denote the same, employees provident fund. While a universal account number (uan) is a unique number allotted to pf members. The general provident fund is a type of pf maintained by government bodies, including local authorities, the railways, and other such bodies; Contributions are made by the employer. Earlier, the death cover for pf.

Source: slideshare.net

Source: slideshare.net

Popular benefits on a travel insurance policy include coverage for trip cancellations, medical emergencies, travel delays, and luggage. A pf account holder by default becomes eligible for free insurance up to ₹ 7 lakh in case of death during the service period under edli scheme. After registration under employee pf act, the employee of the company has following benefits. Contributions are made by the employer. Travel insurance is designed to provide financial protection for unexpected events that impact a traveler’s trip.

Source: epfoinfo.in

Source: epfoinfo.in

Here we will learn complete details about pf like what is pf, what are different rates of pf like epf, eps, difference, pf admin charges, edli admin charges etc)what is provident fundit is a scheme for the benefit of employees,in this scheme,certain amount is deducted from employee salary.some amoun A policyholder will pay taxes on any withdrawals they make from the excess cash value of the universal life insurance plan. Earlier, the death cover for pf. Employees provident fund has three schemes, viz, provident fund, pension fund and employees deposit linked insurance. & push forward realty inc.

Source: templateroller.com

Source: templateroller.com

Travel insurance is designed to provide financial protection for unexpected events that impact a traveler’s trip. There are mainly three different types of pfs, which are as follows: Learn about comprehensive insurance costs. The pf number is an alphanumeric code. Contributions to the scheme are done in accordance with a formula of a fixed percentage of da and salary.

Source: paisabazaar.com

Source: paisabazaar.com

While the employee enjoys the benefits of insurance coverage under the edli scheme, s/he does not contribute to it directly. A policyholder will pay taxes on any withdrawals they make from the excess cash value of the universal life insurance plan. The extent of the benefit is decided by the last drawn salary of the employee. The nominee registered for edli scheme receive insured amount on the death of the person. While a universal account number (uan) is a unique number allotted to pf members.

Source: youtube.com

Source: youtube.com

It represents the state, regional office, establishment, and pf member code. Popular benefits on a travel insurance policy include coverage for trip cancellations, medical emergencies, travel delays, and luggage. Employee’s provident fund (epf) contribution by employee: Dwelling fire insurance (rental homes) commercial insurance. Most universal life insurance policies contain a flexible premium option.

Source: bhasinconsultancy.com

Source: bhasinconsultancy.com

Employee’s provident fund (epf) contribution by employee: Edli scheme is applicable to employees (private organizations) registered under the employee provident fund (epf). Some are the below advantage of the epf. A policy that guarantees income replacement is optimal. The pf number is an alphanumeric code.

Source: informalnewz.com

Source: informalnewz.com

A pf account holder by default becomes eligible for free insurance up to ₹ 7 lakh in case of death during the service period under edli scheme. Hence, reducing the uncertainty of the. While the employee enjoys the benefits of insurance coverage under the edli scheme, s/he does not contribute to it directly. Insurance is support for the insured’s credit. We are a family owned, full service insurance agency.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

A policy that guarantees income replacement is optimal. The good thing is you don’t need to register separately for all these benefits. Contributions are made by the employer. The employees� deposit linked insurance scheme or edli is an insurance cover provided by the epfo (employees� provident fund organisation) for private sector salaried employees. Generally we take a term insurance plan.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is pf insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information