What is pip insurance coverage in texas Idea

Home » Trend » What is pip insurance coverage in texas IdeaYour What is pip insurance coverage in texas images are ready in this website. What is pip insurance coverage in texas are a topic that is being searched for and liked by netizens now. You can Find and Download the What is pip insurance coverage in texas files here. Get all royalty-free vectors.

If you’re looking for what is pip insurance coverage in texas images information related to the what is pip insurance coverage in texas interest, you have visit the ideal blog. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

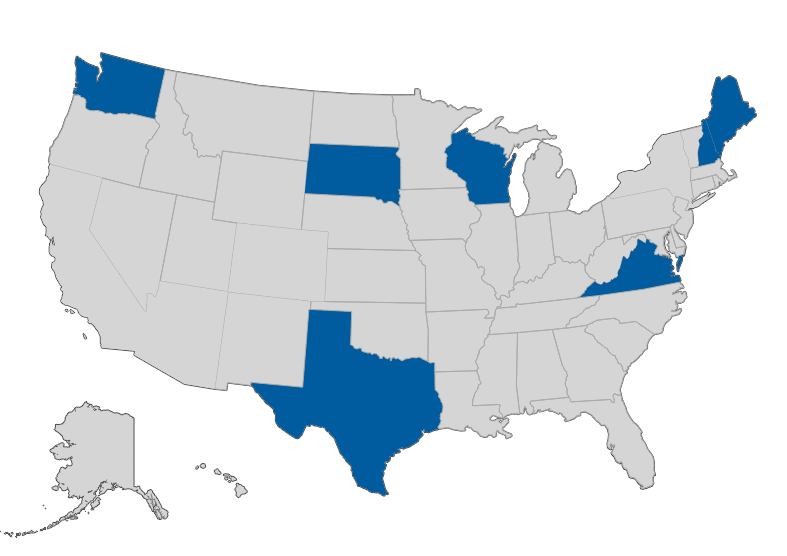

What Is Pip Insurance Coverage In Texas. However, you can get $5,000 or $10,000 in coverage for an additional cost. It pays your and your passengers’ medical bills. However, less than half of drivers in texas have pip insurance. Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile.

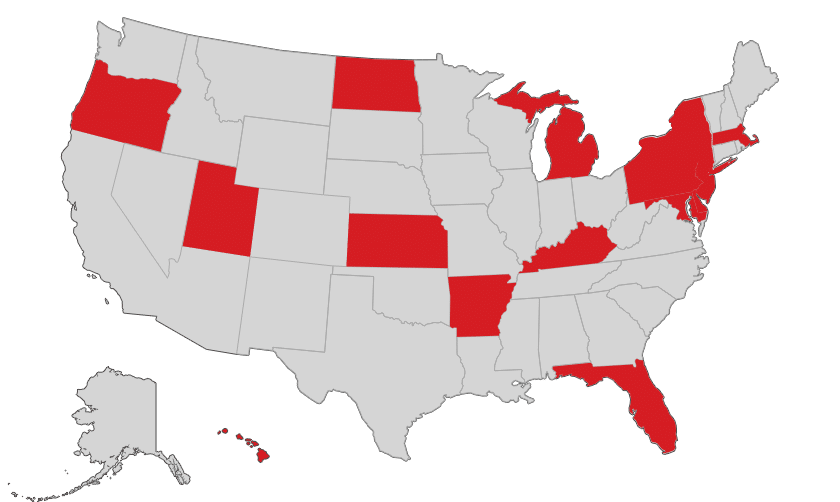

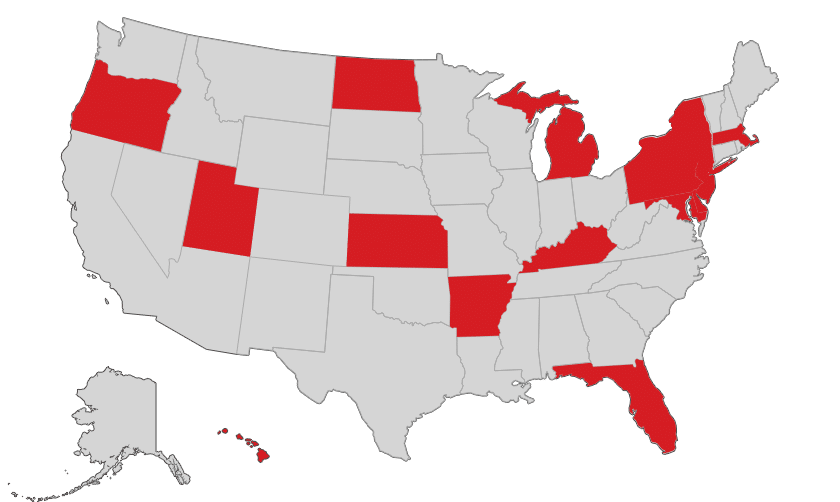

What is No Fault Insurance? PIP Insurance? and Costs From ratesforinsurance.com

What is No Fault Insurance? PIP Insurance? and Costs From ratesforinsurance.com

In texas, insurance companies must offer pip coverage, but you have the right to decline it. But it also pays for things like lost wages and other nonmedical costs. “all texas auto insurance policies include personal injury protection (pip) by default, so you must tell your carrier in writing if you wish to opt out. Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile accident. Insurers will pay reasonable accident related medical and funeral expenses within 3 years of the accident. Ad see new 2022 insurance to see if you could save in texas.

If you cause an accident, you will have to pay for damages.

The benefit limit in texas is typically $2,500 per person. The benefit limit in texas is typically $2,500 per person. If you cause an accident, you will have to pay for damages. Chandler ross injury attorneys is a dallas/fort worth personal injury law firm. 1952.152 in the texas insurance code. However, acquiring the coverage can help address the initial health care costs, lost income after the incident, and deductibles.

Source: sigmonlawpllc.com

Source: sigmonlawpllc.com

In texas, insurance companies must offer pip coverage, but you have the right to decline it. This type of insurance provides compensation for certain expenses you may incur if you are injured in a car accident. Coverage starting at midnight, care as soon as tomorrow. Although opting out can seem like an easy way to cut down your insurance bill, we can say from experience that doing so might cost you much more later — and at the worst possible time.” Even if you did not discuss the details of your car insurance plan with your insurance broker or provider, you.

Source: law.com

Source: law.com

Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile accident. Pip as your safety net In texas, insurance companies must offer pip coverage, but you have the right to decline it. If you don’t want it, you must tell the company in writing. Pip is not required in texas.

Source: carsurance.net

Source: carsurance.net

The nitty gritty details can be found in sec. Coverage starting at midnight, care as soon as tomorrow. But it also pays for things like lost wages and other nonmedical costs. While liability insurance is mandatory, texas does not require drivers to purchase pip coverage. Ad see new 2022 insurance to see if you could save in texas.

Source: pinterest.com

Source: pinterest.com

In addition to paying medical bills, pip will also cover 80 percent of lost income as well as the cost of hiring a. However, less than half of drivers in texas have pip insurance. The benefit limit in texas is typically $2,500 per person. But it also pays for things like lost wages and other nonmedical costs. Companies must provide $2,500 per person in coverage, unless it is rejected in writing.

Source: injuryattorneyofdallas.com

Source: injuryattorneyofdallas.com

Coverage starting at midnight, care as soon as tomorrow. Pip stands for personal injury protection and it’s a pretty important benefit, especially if you get into a car accident in texas. However, purchasing this coverage can protect your interests in the event of a car accident. It pays your and your passengers’ medical bills. What pip covers in texas pip insurance pays for your medical expenses, lost wages, and other expenses if you are injured in an automobile accident.

Source: jonesfamilyins.com

Source: jonesfamilyins.com

Texas law on pip insurance coverage under texas law, personal injury protection coverage must be offered in all auto insurance policies. This type of insurance gives policyholders the option to file a claim with their own insurance company after an accident. This type of insurance provides compensation for certain expenses you may incur if you are injured in a car accident. Insurers will pay reasonable accident related medical and funeral expenses within 3 years of the accident. However, you can get $5,000 or $10,000 in coverage for an additional cost.

Source: 1800lionlaw.com

Source: 1800lionlaw.com

Pip insurance coverage in texas in the state of texas, insurance companies must offer their drivers personal injury protection, which is also known as pip. What does pip coverage really do? But it also pays for things like lost wages and other nonmedical costs. While liability insurance is mandatory, texas does not require drivers to purchase pip coverage. Pip is a type of insurance that pays for your medical expenses, lost wages and other costs if you’re hurt in an auto accident.

Source: youtube.com

Source: youtube.com

The nitty gritty details can be found in sec. However, purchasing this coverage can protect your interests in the event of a car accident. Chandler ross injury attorneys is a dallas/fort worth personal injury law firm. Pip is similar to your medical payments coverage and will help pay any medical bills you incur after an auto accident. Insurance companies in texas are required to offer personal injury protection insurance.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

When looking for what is pip insurance coverage in texas chandler ross. Pip stands for personal injury protection and it’s a pretty important benefit, especially if you get into a car accident in texas. The nitty gritty details can be found in sec. This type of insurance provides compensation for certain expenses you may incur if you are injured in a car accident. The benefit limit in texas is typically $2,500 per person.

Source: tedlyon.com

Source: tedlyon.com

Insurance companies in texas are required to offer personal injury protection insurance. If you cause an accident, you will have to pay for damages. However, you can get $5,000 or $10,000 in coverage for an additional cost. Companies must provide $2,500 per person in coverage, unless it is rejected in writing. This type of insurance gives policyholders the option to file a claim with their own insurance company after an accident.

Source: tophoustoninjurylawyer.com

Source: tophoustoninjurylawyer.com

Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile. Www.montgomeryfirm.com if the policyholder does not reject this coverage, the carrier must provide $2,500.00 of pip benefits to all covered persons. In the state of texas, it is required to have personal injury protection coverage with your insurance plan. Chandler ross injury attorneys is a dallas/fort worth personal injury law firm. Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile.

Source: whamandrogers.com

Source: whamandrogers.com

Reasons to get personal injury protection insurance. Ad see new 2022 insurance to see if you could save in texas. Companies must provide $2,500 per person in coverage, unless it is rejected in writing. Insurance companies in texas are required to offer personal injury protection insurance. Ad see new 2022 insurance to see if you could save in texas.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

Texas law on pip insurance coverage under texas law, personal injury protection coverage must be offered in all auto insurance policies. This type of insurance provides compensation for certain expenses you may incur if you are injured in a car accident. Chandler ross injury attorneys is a dallas/fort worth personal injury law firm. Ad see new 2022 insurance to see if you could save in texas. If you don’t want it, you must tell the company in writing.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

If you don’t want it, you must tell the company in writing. Pip stands for personal injury protection. In the state of texas, it is required to have personal injury protection coverage with your insurance plan. Even if you did not discuss the details of your car insurance plan with your insurance broker or provider, you. Crucially, pip also covers any passengers who were in your vehicle at the time of the wreck.

Source: tedsmithlawgroup.com

Source: tedsmithlawgroup.com

However, acquiring the coverage can help address the initial health care costs, lost income after the incident, and deductibles. Insurers will pay reasonable accident related medical and funeral expenses within 3 years of the accident. Pip as your safety net When looking for what is pip insurance coverage in texas chandler ross. But it also pays for things like lost wages and other nonmedical costs.

Source: insuranceonline.com

Texas personal injury coverage (pip), is a part of your auto policy that covers medical expenses for passengers and drivers who are injured in an automobile accident. Coverage starting at midnight, care as soon as tomorrow. Pip covers the policyholder, family members living in the household, any driver with permission to drive the covered vehicle, and passengers. What does pip coverage really do? 1952.152 in the texas insurance code.

Source: puschnguyen.com

Source: puschnguyen.com

What does pip coverage really do? In the state of texas, it is required to have personal injury protection coverage with your insurance plan. Ad see new 2022 insurance to see if you could save in texas. Even if you did not discuss the details of your car insurance plan with your insurance broker or provider, you. However, less than half of drivers in texas have pip insurance.

Source: harlingencarcrashattorney.com

Source: harlingencarcrashattorney.com

It pays your and your passengers’ medical bills. Chandler ross injury attorneys is a dallas/fort worth personal injury law firm. What does pip coverage really do? However, purchasing this coverage can protect your interests in the event of a car accident. Coverage starting at midnight, care as soon as tomorrow.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is pip insurance coverage in texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information