What is pip insurance in florida information

Home » Trending » What is pip insurance in florida informationYour What is pip insurance in florida images are available in this site. What is pip insurance in florida are a topic that is being searched for and liked by netizens now. You can Download the What is pip insurance in florida files here. Download all free photos and vectors.

If you’re looking for what is pip insurance in florida pictures information connected with to the what is pip insurance in florida interest, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

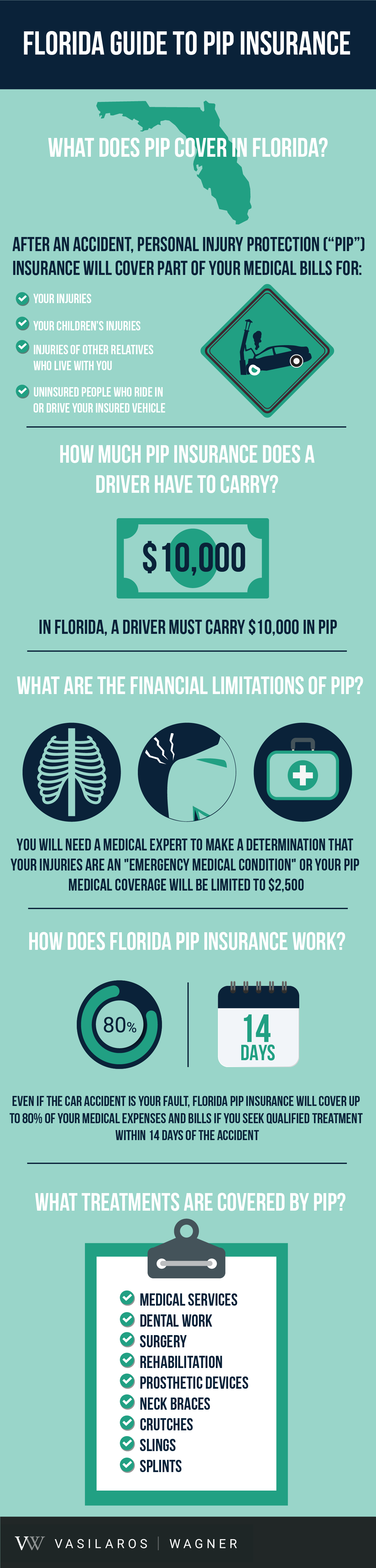

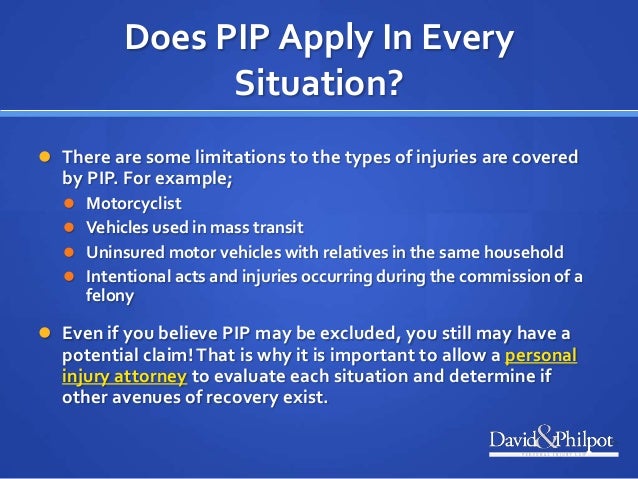

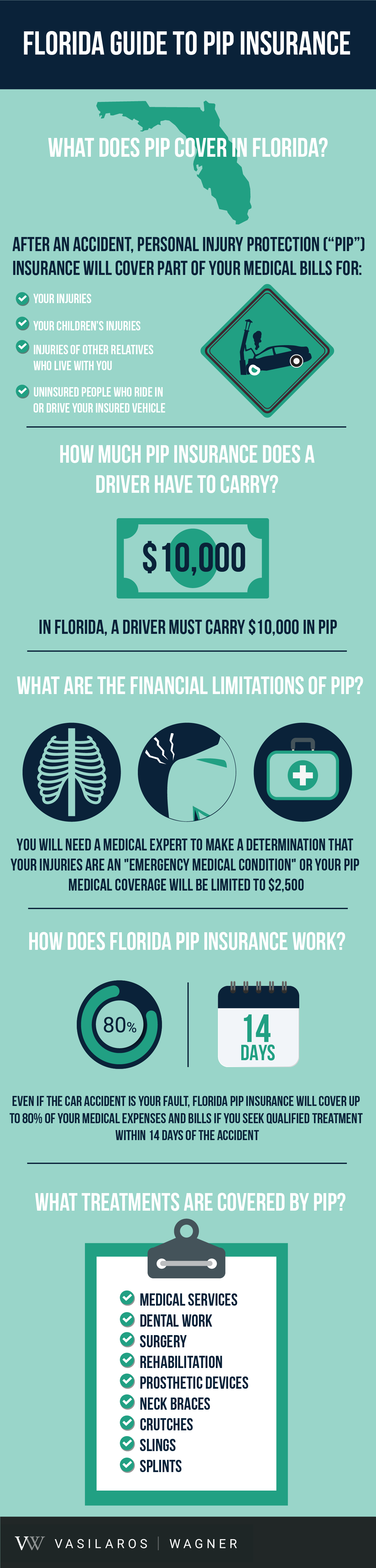

What Is Pip Insurance In Florida. Car accidents in orlando are unfortunately common. In new jersey, for example, any medical treatment or care given during the first 10 days after an accident must be approved and certified by your insurance company. Pip is designed to act as an extension of your auto insurance policy, and it covers some of your medical expenses incurred after an auto accident. Pip insurance is personal injury insurance and it is required in “no fault” insurance states such as florida.

StepbyStep Guide to PIP Vasilaros Wagner From accidentfirm.com

StepbyStep Guide to PIP Vasilaros Wagner From accidentfirm.com

That coverage is known as personal injury protection insurance. This is what is meant by. Even a seemingly minor fender bender can cause serious harm while more major crashes can leave you facing hundreds of thousands of dollars in medical expenses and other costs. If you are a driver in the sunshine state it is. In florida, drivers with automobile insurance have personal injury protection (pip) insurance. In new jersey, for example, any medical treatment or care given during the first 10 days after an accident must be approved and certified by your insurance company.

Pip stands for personal injury protection and under florida law it is required that every vehicle owner and driver on the road have $10,000 worth of pip insurance coverage.

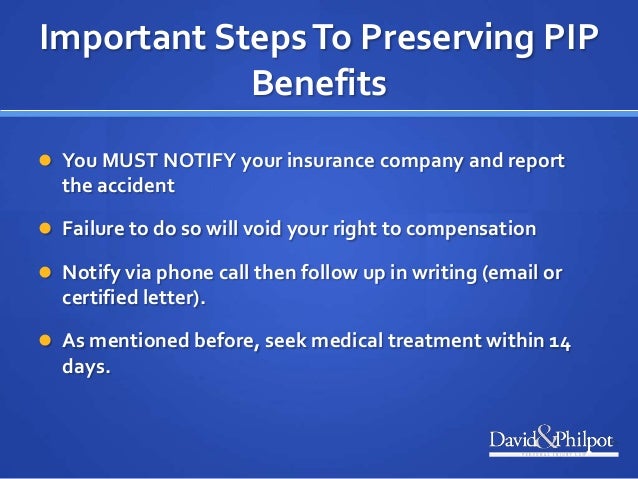

In florida, one of the requirements is personal injury protection (pip),. It’s vital that you stick to your auto insurance company’s procedures and timelines. The pip statute under florida law can be found in fla. Pip insurance is $10,000 of coverage that your auto insurance policy has available to you for medical treatment. If you are a driver in the sunshine state it is. It covers 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury no matter who caused a motor vehicle crash in florida.

Source: slideshare.net

Source: slideshare.net

In florida, personal injury protection (pip) insurance is required. It’s vital that you stick to your auto insurance company’s procedures and timelines. The benefits are paid by your insurer once you are involved in an accident regardless of who is on the wrong. Pip benefits are paid by your own insurance company if you are in an accident. Every owner of a vehicle in the sunshine state is individually responsible for their own injuries if they are involved in an automobile accident.

Source: grossandschuster.com

Source: grossandschuster.com

Pip stands for personal injury protection and under florida law it is required that every vehicle owner and driver on the road have $10,000 worth of pip insurance coverage. The pip statute under florida law can be found in fla. In the state of florida, the law requires that all motorists have pip insurance to drive. What is personal injury protection? Pip insurance is $10,000 of coverage that your auto insurance policy has available to you for medical treatment.

Source: youtube.com

Source: youtube.com

The florida law requires each car owner to have at least $10,000 worth of pip insurance cover at all times. Vehicle owners carry it, and it provides access to up to $10,000 in compensation for medical bills in the event of an accident. In florida, personal injury protection (pip) is automobile insurance coverage that allows people to recover from an auto insurance company to which they are an insured for the economic loss (e.g. Every vehicle and every vehicle owner must have a minimum of $10,000 coverage on their policy. Personal injury protection insurance, or pip insurance, is required under florida law.

Source: youtube.com

Source: youtube.com

If you are planning to get your own car in florida, be aware that the state requires you to have personal injury protection (pip) and property damage liability (pdl) insurance. That coverage is known as personal injury protection insurance. Every owner of a vehicle in the sunshine state is individually responsible for their own injuries if they are involved in an automobile accident. In florida, drivers with automobile insurance have personal injury protection (pip) insurance. Pip insurance is $10,000 of coverage that your auto insurance policy has available to you for medical treatment.

Source: lowmanlawfirm.com

Source: lowmanlawfirm.com

Specifically, it pays for up to 80% of medical bills and 60% of lost wages, up to a maximum amount of $10,000. That coverage is known as personal injury protection insurance. When you have pip insurance, it pays you for your injuries even if you are proven to be at fault for the accident. Compensation for lost wages and death benefits are also available. Understanding a personal injury protection claim and pip law in florida are key, since this is the main form of insurance coverage for drivers of motor vehicles.

Source: rickkolodinsky.com

Source: rickkolodinsky.com

Pip is a type of insurance that helps pay a portion of medical expenses—up to. It’s an insurance policy in the state of florida that allows you to be treated regardless of who was at fault. The minimum required coverage is $10,000 of pip insurance. In florida, one of the requirements is personal injury protection (pip),. If you are planning to get your own car in florida, be aware that the state requires you to have personal injury protection (pip) and property damage liability (pdl) insurance.

Source: eastcoastinjury.com

Source: eastcoastinjury.com

That coverage is known as personal injury protection insurance. If you are planning to get your own car in florida, be aware that the state requires you to have personal injury protection (pip) and property damage liability (pdl) insurance. In florida, personal injury protection (pip) insurance is required. Like every state, florida has requirements for auto insurance that drivers have to abide by, and insurance companies will typically sell only policies that meet the requirements. It pays policyholders for their own medical expenses after an accident, regardless of fault.

Source: careyandleisure.com

Source: careyandleisure.com

When you have pip insurance, it pays you for your injuries even if you are proven to be at fault for the accident. Pip benefits are paid by your own insurance company if you are in an accident. That coverage is known as personal injury protection insurance. It’s vital that you stick to your auto insurance company’s procedures and timelines. Every vehicle and every vehicle owner must have a minimum of $10,000 coverage on their policy.

Source: slideshare.net

Source: slideshare.net

In new jersey, for example, any medical treatment or care given during the first 10 days after an accident must be approved and certified by your insurance company. The pip statute under florida law can be found in fla. That means when there’s an auto accident, each party’s insurance covers their medical expenses. In florida, for example, pip coverage will only cover 80% of your medical expenses. Pip is applicable regardless of who causes the accident.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Fault does not have an effect on pip. Pip insurance was designed as an extension to your auto insurance policy to cover medical expenses that incurred as a result of an auto accident. This is what is meant by. In florida, one of the requirements is personal injury protection (pip),. The florida law requires each car owner to have at least $10,000 worth of pip insurance cover at all times.

Source: insurance.com

The benefits are paid by your insurer once you are involved in an accident regardless of who is on the wrong. In florida, personal injury protection (pip) insurance is required. Pip stands for personal injury protection. The pip statute under florida law can be found in fla. Like every state, florida has requirements for auto insurance that drivers have to abide by, and insurance companies will typically sell only policies that meet the requirements.

Pip benefits are paid by your own insurance company if you are in an accident. The benefits are paid by your insurer once you are involved in an accident regardless of who is on the wrong. Pip is a type of insurance that helps pay a portion of medical expenses—up to. Car sellers would ask for your pip and. The pip statute under florida law can be found in fla.

Source: accidentfirm.com

Source: accidentfirm.com

Car accidents in orlando are unfortunately common. In florida, every driver must have at least $10,000 in personal injury protection (pip) and $10,000 in property damage liability (pdl) coverage. Pip, which stands for “personal injury protection,” is insurance that pays you for personal injuries that you suffer in a car crash. It pays policyholders for their own medical expenses after an accident, regardless of fault. This is what is meant by.

Source: serviceandjustice.com

Source: serviceandjustice.com

Even a seemingly minor fender bender can cause serious harm while more major crashes can leave you facing hundreds of thousands of dollars in medical expenses and other costs. Car accidents in orlando are unfortunately common. Pip insurance was designed as an extension to your auto insurance policy to cover medical expenses that incurred as a result of an auto accident. Every owner of a vehicle in the sunshine state is individually responsible for their own injuries if they are involved in an automobile accident. Compensation for lost wages and death benefits are also available.

Source: news.onlineautoinsurance.com

Source: news.onlineautoinsurance.com

That means when there’s an auto accident, each party’s insurance covers their medical expenses. Pip benefits are paid by your own insurance company regardless of who was at fault for the accident. In florida, drivers with automobile insurance have personal injury protection (pip) insurance. If you are planning to get your own car in florida, be aware that the state requires you to have personal injury protection (pip) and property damage liability (pdl) insurance. Pip stands for personal injury protection and under florida law it is required that every vehicle owner and driver on the road have $10,000 worth of pip insurance coverage.

Source: joneslawjustice.com

Source: joneslawjustice.com

If you are a driver in the sunshine state it is. The florida law requires each car owner to have at least $10,000 worth of pip insurance cover at all times. In new jersey, for example, any medical treatment or care given during the first 10 days after an accident must be approved and certified by your insurance company. The pip statute under florida law can be found in fla. Fault does not have an effect on pip.

Source: fansstardollstardoll.blogspot.com

In florida, personal injury protection (pip) is automobile insurance coverage that allows people to recover from an auto insurance company to which they are an insured for the economic loss (e.g. Pip is designed to act as an extension of your auto insurance policy, and it covers some of your medical expenses incurred after an auto accident. Pip stands for personal injury protection and under florida law it is required that every vehicle owner and driver on the road have $10,000 worth of pip insurance coverage. Pip insurance is $10,000 of coverage that your auto insurance policy has available to you for medical treatment. Fault does not have an effect on pip.

Source: youtube.com

Source: youtube.com

Understanding a personal injury protection claim and pip law in florida are key, since this is the main form of insurance coverage for drivers of motor vehicles. This is what is meant by. In florida, drivers with automobile insurance have personal injury protection (pip) insurance. Pip benefits are paid by your own insurance company regardless of who was at fault for the accident. Pip stands for personal injury protection.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is pip insurance in florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information