What is premises liability insurance information

Home » Trending » What is premises liability insurance informationYour What is premises liability insurance images are ready. What is premises liability insurance are a topic that is being searched for and liked by netizens today. You can Get the What is premises liability insurance files here. Find and Download all royalty-free images.

If you’re searching for what is premises liability insurance images information linked to the what is premises liability insurance topic, you have visit the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

What Is Premises Liability Insurance. Premises liability is a legal concept that typically comes into play in personal injury cases where the injury was caused by some type of unsafe or defective condition on someone�s property. Premises liability insurance covers you in case of an accident in your home or business. What is premises liability insurance? What is premises liability insurance?

What is Commercial General Liability? ZIMMER INSURANCE From zimmerinsure.com

What is Commercial General Liability? ZIMMER INSURANCE From zimmerinsure.com

Premises liability coverage covers guests who are injured on your property. These workers are exposed to committing errors, omissions or suffering dishonest acts on the part of their employees, which may lead to claims or lawsuits by third parties. Insurance that covers individuals who are injured by an unsafe environment is called premises liability insurance. What is premises liability insurance? Premises liability is a legal concept that typically comes into play in personal injury cases where the injury was caused by some type of unsafe or defective condition on someone�s property. Premises liability coverage (also known as basic liability coverage) is a type of business insurance that financially protects business owners from accidents that take place on company property.

In order to have a basic understanding of premises liability,.

Types of premises liability insurance It could provide liability coverage in situations like the following: What is premises liability insurance? In this context, company property is any aspect of the area that you are responsible for. Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. In all states, the law requires that property owners make every effort to ensure that guests are safe.

Source: bergerandgreen.com

Source: bergerandgreen.com

In order to have a basic understanding of premises liability,. Most business owners don�t know that doesn’t always mean the physical location of your business—it can also include where you work. Liability insurance is designed for professionals or companies that employ lawyers, doctors, dentists, private detectives, judges, property administrators, tax advisors, etc. Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. What is premises liability insurance?

Source: insurancenoon.com

Source: insurancenoon.com

If someone slips and falls on your property—for example, your business—and sustains injuries, they could theoretically sue you for a wide range of issues, including lost wages, medical bills, future medical costs, physical therapy, prescription costs. However, it only refers to a specific type of negligence. Understanding what premises liability coverage entails is the first step to understanding why you might need it. For businesses, this duty includes ensuring the safety of customers, utility workers, delivery company staff and others who frequent their property. Premises liability insurance is a policy that covers property owners in case the owner’s negligence causes harm or injury.

Source: sardelisandbowles.com

Source: sardelisandbowles.com

Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. Common examples here include neighbours who slip and fall on your icy porch, or your dog biting the mailman. Most personal injury cases are based on negligence, and premises liability cases are no exception. Personal injury lawyers are familiar with the underhanded tactics insurers they employ. Insurance companies often attempt to undervalue or deny premises liability claims.

Source: businessinsurancequotes.com

Source: businessinsurancequotes.com

Premises liability insurance covers you in case of an accident in your home or business. What does a premises liability insurance cover? A client comes to your office. However, it only refers to a specific type of negligence. These policies provide peace of mind and ensure that innocent victims have compensation to cover their medical bills and lost wages.

Source: coolbuzz.org

Source: coolbuzz.org

Liability for bodily injury (such as an injury due to a fall in a parking lot) typically would be covered under the commercial general liability coverage subject to policy terms and conditions. While exact terms of this insurance vary by state, the liability is always based on the nature of the injured party. These workers are exposed to committing errors, omissions or suffering dishonest acts on the part of their employees, which may lead to claims or lawsuits by third parties. Premises liability insurance covers accidents that take place on your business premises. Premises liability insurance is an insurance policy that covers accidents that occur on your business premises.

Source: pinterest.com

Source: pinterest.com

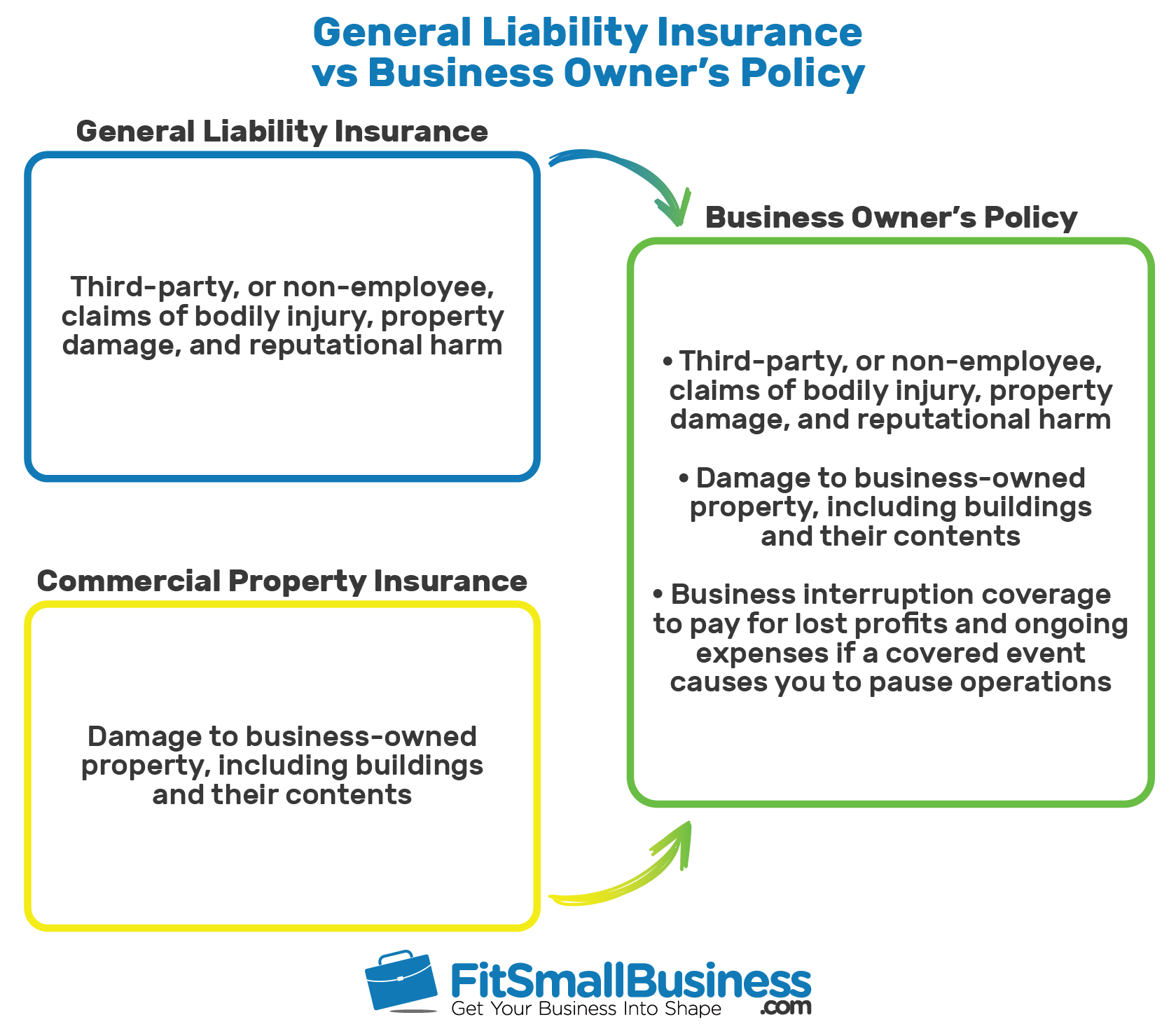

The primary premises liability coverage can be found under these coverage parts in your general liability policy: Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. General liability insurance includes the same protections as premise liability insurance, but also includes damages that you or your employees may cause to a customer’s property, as well as. Premises liability insurance is coverage provided to pay for the for costs that may. In all states, the law requires that property owners make every effort to ensure that guests are safe.

Source: lfphillylawyer.com

Source: lfphillylawyer.com

Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. What is premises liability insurance? Your attorney will fight to help you recover maximum compensation so you can focus on healing. Premises liability is the legal principle that property owners have a level of accountability for accidents and injuries on their property, or premises and can make businesses liable for safety. Personal injury lawyers are familiar with the underhanded tactics insurers they employ.

Source: wlclaw.com

Source: wlclaw.com

What does a premises liability insurance cover? Liability for bodily injury (such as an injury due to a fall in a parking lot) typically would be covered under the commercial general liability coverage subject to policy terms and conditions. Premises liability insurance covers you in case of an accident in your home or business. Premises liability insurance is a type of insurance purchased by a homeowner to protect against accidents that might befall other people visiting their home. A client comes to your office.

Source: nreig.com

Source: nreig.com

Premises liability insurance covers accidents that take place on your business premises. This is where premises liability insurance comes in. Your attorney will fight to help you recover maximum compensation so you can focus on healing. What is premises liability insurance? Premises liability insurance is coverage provided to pay for the for costs that may arise from property destruction or personal injury (i.e.

Source: youtube.com

Source: youtube.com

Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. Premises liability insurance covers accidents that take place on your business premises. Premises liability insurance is a type of insurance purchased by a homeowner to protect against accidents that might befall other people visiting their home. Premises liability insurance covers damage caused by a property owner’s failure to maintain their property. This is where premises liability insurance comes in.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Premises liability insurance covers accidents that take place on your business premises. Types of premises liability insurance As a hairdresser, clients frequently come to your salon. If you get injured on someone’s property due to their negligence, you can file a claim against their insurer to receive compensation. Premises liability insurance is coverage provided to pay for the for costs that may.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

Most personal injury cases are based on negligence, and premises liability cases are no exception. Insurance that covers individuals who are injured by an unsafe environment is called premises liability insurance. Premises liability insurance covers you in case of an accident in your home or business. What does a premises liability insurance cover? Most personal injury cases are based on negligence, and premises liability cases are no exception.

Source: howmuch.net

Source: howmuch.net

Premises liability insurance covers damage caused by a property owner’s failure to maintain their property. Premises liability insurance is coverage provided to pay for the for costs that may arise from property destruction or personal injury (i.e. The law stipulates that a premises owners are expected to provide reasonable safety and precaution to guests and licensees. Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. Premises liability insurance is coverage provided to pay for the for costs that may.

Source: vtalkinsurance.com

Source: vtalkinsurance.com

Premises liability insurance is an insurance policy that covers accidents that occur on your business premises. If you get injured on someone’s property due to their negligence, you can file a claim against their insurer to receive compensation. The law stipulates that a premises owners are expected to provide reasonable safety and precaution to guests and licensees. Common examples here include neighbours who slip and fall on your icy porch, or your dog biting the mailman. Premises liability coverage covers guests who are injured on your property.

They slip on the polished floor and hurt their knee. A client comes to your office. For businesses, this duty includes ensuring the safety of customers, utility workers, delivery company staff and others who frequent their property. If someone slips and falls on your property—for example, your business—and sustains injuries, they could theoretically sue you for a wide range of issues, including lost wages, medical bills, future medical costs, physical therapy, prescription costs. In this context, company property is any aspect of the area that you are responsible for.

Source: visual.ly

Source: visual.ly

What does a premises liability insurance cover? What is premises liability insurance? Types of premises liability insurance Premises liability coverage (also known as basic liability coverage) is a type of business insurance that financially protects business owners from accidents that take place on company property. Premises liability insurance is an insurance policy that covers accidents that occur on your business premises.

Source: diamondcu.org

Source: diamondcu.org

Premises liability coverage (also known as basic liability coverage) is a type of business insurance that financially protects business owners from accidents that take place on company property. These insurance policies pay compensation to victims who are injured on your premises accidentally. What is premises liability insurance? General liability insurance includes the same protections as premise liability insurance, but also includes damages that you or your employees may cause to a customer’s property, as well as. Premises liability insurance covers damage caused by a property owner’s failure to maintain their property.

Source: youtube.com

Source: youtube.com

In all states, the law requires that property owners make every effort to ensure that guests are safe. As the name suggests, premises liability insurance protects you against lawsuits arising from injuries sustained by visitors to your home. Insurance that covers individuals who are injured by an unsafe environment is called premises liability insurance. Premises liability insurance is coverage provided to pay for the for costs that may arise from property destruction or personal injury (i.e. Premises liability is a legal concept that typically comes into play in personal injury cases where the injury was caused by some type of unsafe or defective condition on someone�s property.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is premises liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information