What is private placement life insurance information

Home » Trend » What is private placement life insurance informationYour What is private placement life insurance images are available. What is private placement life insurance are a topic that is being searched for and liked by netizens today. You can Download the What is private placement life insurance files here. Get all royalty-free photos.

If you’re searching for what is private placement life insurance images information connected with to the what is private placement life insurance topic, you have visit the right site. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

What Is Private Placement Life Insurance. Through private placement life insurance (“ppli”) or private placement annuities (“ppva”). Unlike traditional life insurance, an investor would buy a ppli policy principally as an income tax free investment vehicle. Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit.

Private Placement Life Insurance Colva From colvaservices.com

Private Placement Life Insurance Colva From colvaservices.com

In addition to wanting to have exposure to these types of asset classes is generally going to be someone with a very high net worth. The real value of private placement life insurance is the flexibility it provides in terms of the asset classes a person can own within their policy. The administrative costs associated with life insurance contracts are almost always more than worth the tax savings that you get with a properly structured ppli. 2) lower costs — typically, ppli offers lower fees. Benefits of private placement life insurance. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public.

The product is often also known as “private banking insurance” or “insurance wrappers”.

As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. “private placement life insurance—often referred to by its initials: What is a private placement? It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital.

![]() Source: aicpaconferences.com

Source: aicpaconferences.com

Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred. Private placement life insurance uses the tax advantages of life insurance while getting the monetary gains of hedge funds. Private placement life insurance creates that structure that eliminates the tax consideration for the most part and allows investors to choose what they want to invest in in a more robust fashion. The real value of private placement life insurance is the flexibility it provides in terms of the asset classes a person can own within their policy. Private placement life insurance (ppli) is a life insurance policy wrapped around an investment.

Source: expandedworldwideplanning.com

Source: expandedworldwideplanning.com

Insurance dedicated funds enable hedge funds to manage a separate fund that follows the same strategy as the flagship fund. Insurance dedicated funds enable hedge funds to manage a separate fund that follows the same strategy as the flagship fund. Also, the death benefit itself more than makes up for any. The product is often also known as “private banking insurance” or “insurance wrappers”. Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes:

Source: slideshare.net

Source: slideshare.net

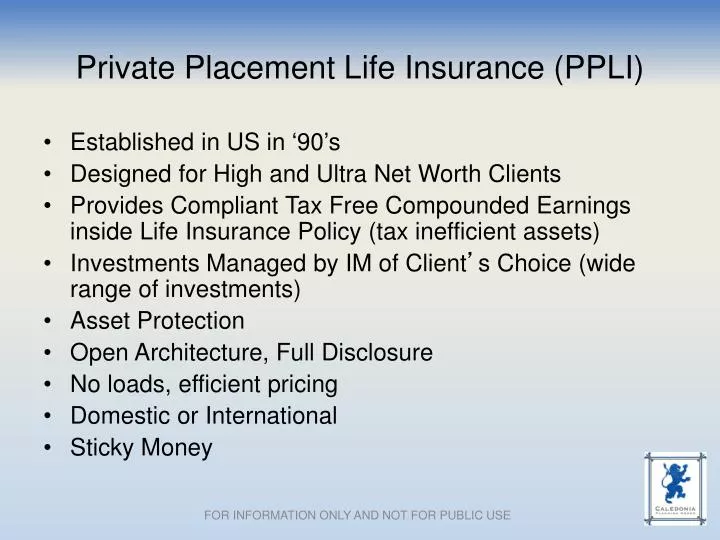

Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. Benefits of private placement life insurance. Ppli—is a version of variable universal life insurance that has been designed for. Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public.

Source: wealthhow.com

Source: wealthhow.com

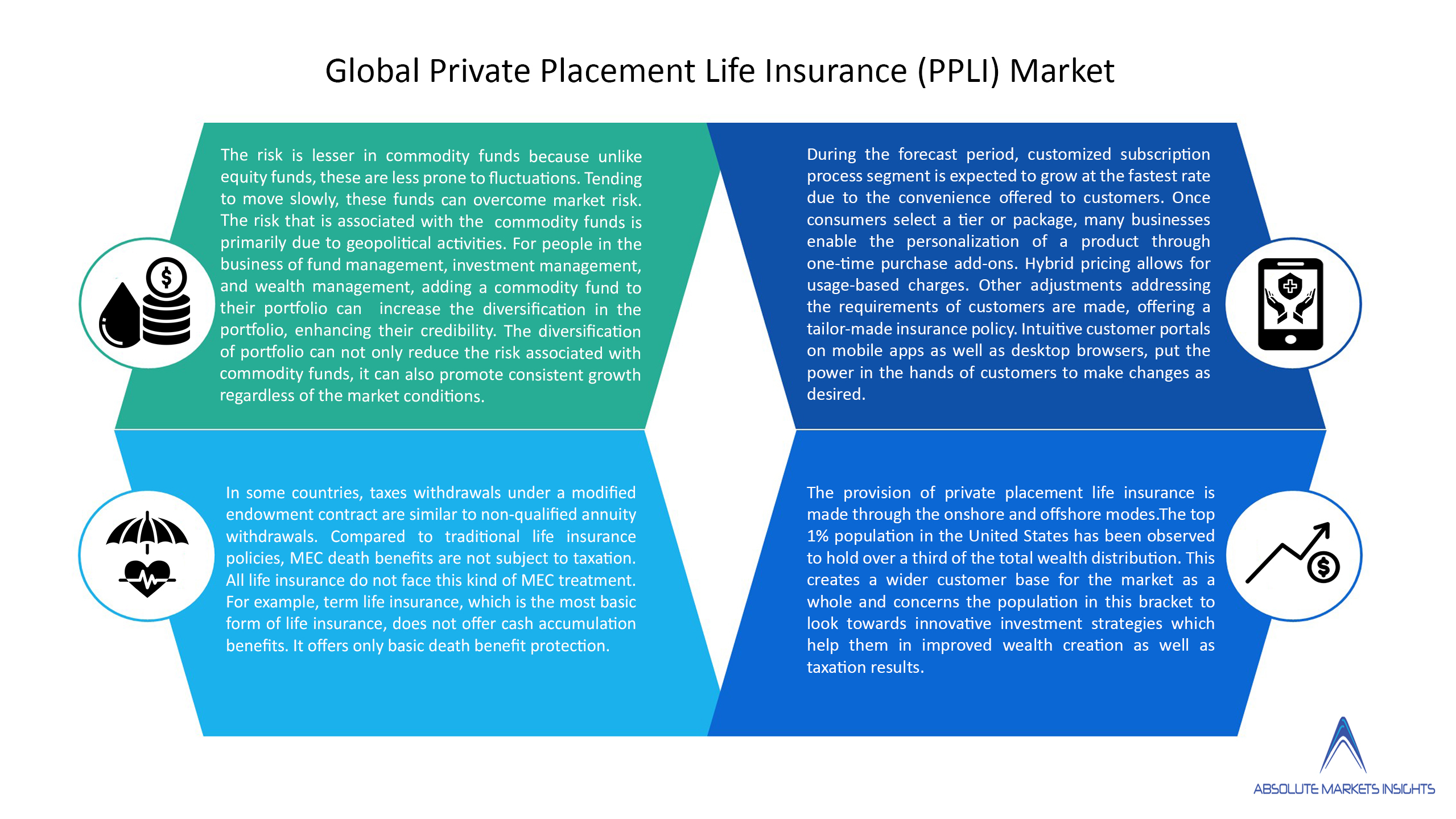

Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. In addition to wanting to have exposure to these types of asset classes is generally going to be someone with a very high net worth. Through private placement life insurance (“ppli”) or private placement annuities (“ppva”). In other words, ppli presents a planning. Insurance dedicated funds enable hedge funds to manage a separate fund that follows the same strategy as the flagship fund.

Source: colvaservices.com

Source: colvaservices.com

It combines the financial advantages of hedge funds with the tax benefits of life insurance. The real value of private placement life insurance is the flexibility it provides in terms of the asset classes a person can own within their policy. Only by working with a. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. Private placement life insurance avails policyholders of the following 8 benefits:

Source: industryglobalnews24.com

Source: industryglobalnews24.com

“private placement life insurance—often referred to by its initials: Private placement life insurance is at the core of our superior, customised and portable wealth solutions that address the needs of high net worth individuals, their families and institutions to help them ensure their assets are protected, portable and can be passed on. Through private placement life insurance (“ppli”) or private placement annuities (“ppva”). Ppli—is a version of variable universal life insurance that has been designed for. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

Source: blog.michaelmalloy.solutions

Source: blog.michaelmalloy.solutions

Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified investment strategies. 2) lower costs — typically, ppli offers lower fees. In addition to wanting to have exposure to these types of asset classes is generally going to be someone with a very high net worth. Ppli—is a version of variable universal life insurance that has been designed for.

Source: slideserve.com

Source: slideserve.com

Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred. Private placement life insurance is at the core of our superior, customised and portable wealth solutions that address the needs of high net worth individuals, their families and institutions to help them ensure their assets are protected, portable and can be passed on. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Private placement life insurance uses the tax advantages of life insurance while getting the monetary gains of hedge funds.

Source: expandedworldwideplanning.com

Source: expandedworldwideplanning.com

Ppli—is a version of variable universal life insurance that has been designed for. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. It has many advantages, but it also has limitations. Private placement life insurance (ppli) is a life insurance policy wrapped around an investment. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

Source: casaruraldavina.com

Source: casaruraldavina.com

It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. In addition to wanting to have exposure to these types of asset classes is generally going to be someone with a very high net worth. Also, the death benefit itself more than makes up for any. It has many advantages, but it also has limitations. If the wealthy individual invests in them in their personal.

Source: npa1.org

Source: npa1.org

Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. The real value of private placement life insurance is the flexibility it provides in terms of the asset classes a person can own within their policy. It has many advantages, but it also has limitations. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. “private placement life insurance—often referred to by its initials:

Source: schechterwealth.com

Source: schechterwealth.com

Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public. “private placement life insurance—often referred to by its initials: It has many advantages, but it also has limitations. In other words, ppli presents a planning.

Source: asia.lombardinternational.com

Source: asia.lombardinternational.com

Private placement life insurance avails policyholders of the following 8 benefits: Insurance dedicated funds enable hedge funds to manage a separate fund that follows the same strategy as the flagship fund. It is similar to a variable universal life insurance policy, but the investments owned by the policy are privately offered and meet very specific tax code requirements. Also, the death benefit itself more than makes up for any. Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public.

Source: premieroffshore.com

Source: premieroffshore.com

“private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. Private placement life insurance is at the core of our superior, customised and portable wealth solutions that address the needs of high net worth individuals, their families and institutions to help them ensure their assets are protected, portable and can be passed on. Private placement life insurance is a type of variable universal life (vul) insurance1 that allows investments contained within the policy to grow with income and capital gains taxes deferred. Also, the death benefit itself more than makes up for any. Tailored to each client, therefore, it is known as private placement.

Source: colvaservices.com

Source: colvaservices.com

What is a private placement? The administrative costs associated with life insurance contracts are almost always more than worth the tax savings that you get with a properly structured ppli. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. 2) lower costs — typically, ppli offers lower fees. Private placement life insurance is a variable universal life insurance policy that provides cash value by investing in a broader range of investments, some of which are not available to the general public.

Source: premierrisk.com

Source: premierrisk.com

Private placement life insurance creates that structure that eliminates the tax consideration for the most part and allows investors to choose what they want to invest in in a more robust fashion. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. At present, ppli policies are more often offered by banks, hedge. The product is often also known as “private banking insurance” or “insurance wrappers”. Private placement life insurance is at the core of our superior, customised and portable wealth solutions that address the needs of high net worth individuals, their families and institutions to help them ensure their assets are protected, portable and can be passed on.

Source: excelsiorgp.com

Source: excelsiorgp.com

Unlike traditional life insurance, an investor would buy a ppli policy principally as an income tax free investment vehicle. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. Benefits of private placement life insurance. Tailored to each client, therefore, it is known as private placement. It has many advantages, but it also has limitations.

Source: youtube.com

Source: youtube.com

Also, the death benefit itself more than makes up for any. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit. Private placement life insurance creates that structure that eliminates the tax consideration for the most part and allows investors to choose what they want to invest in in a more robust fashion. “private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. The product is often also known as “private banking insurance” or “insurance wrappers”.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is private placement life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information