What is pure risk in insurance information

Home » Trending » What is pure risk in insurance informationYour What is pure risk in insurance images are ready in this website. What is pure risk in insurance are a topic that is being searched for and liked by netizens now. You can Download the What is pure risk in insurance files here. Get all royalty-free photos.

If you’re looking for what is pure risk in insurance images information connected with to the what is pure risk in insurance topic, you have come to the ideal site. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

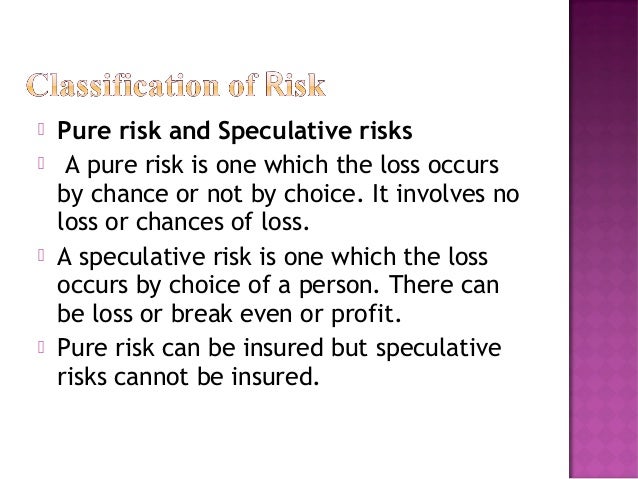

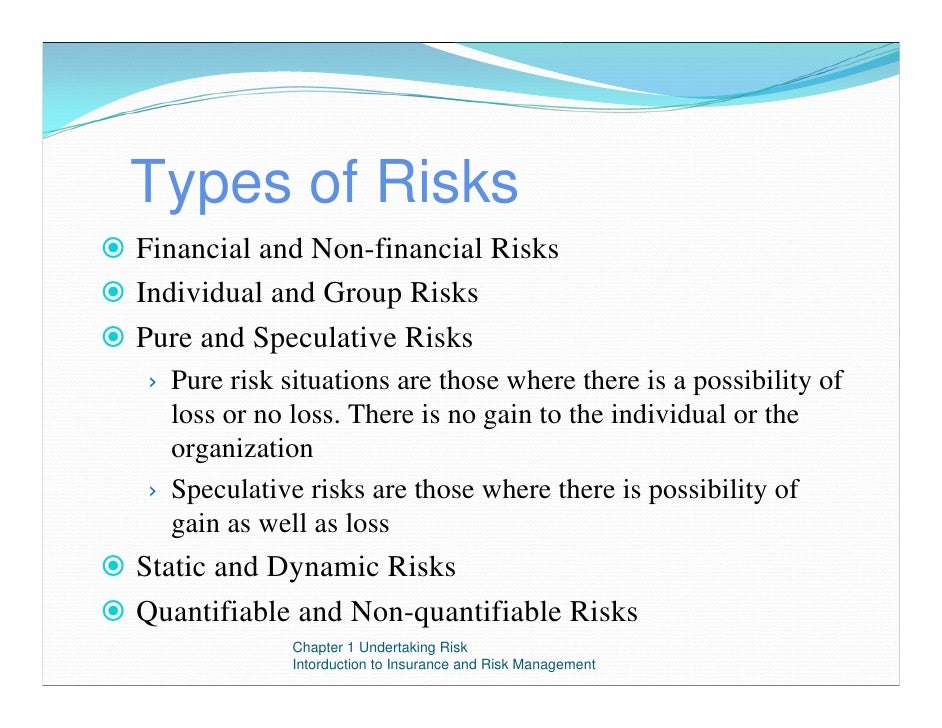

What Is Pure Risk In Insurance. We�re now going to unravel the complexity of speculative risks and pure risks. Term insurance covers the finances of the family against the untimely demise of the life assured. The house will enjoy a year with nothing bad occurring or there will be damage caused by a covered cause of loss (fire, wind, etc.). The person whose risk is insured is called ______________.

What Is Pure Risk In Insurance / Pure Risk Keeps Insurance From freshnewattitude.blogspot.com

What Is Pure Risk In Insurance / Pure Risk Keeps Insurance From freshnewattitude.blogspot.com

Pure risks are an independent insurance intermediary specialising in placing professional indemnity insurance for professionals. They are pure in the sense that they do not mix both profits and losses.insurance is concerned with the economic problems created by pure risks.speculative risks are not insurable. The risk is a concept which relates to human expectations. Types of pure risks are; Typically, events that are considered to carry this level of risk are out of the control of the individual who is assuming the risk, making it impossible to actually make a conscious decision to take on the risk. Make sure to watch our videos;cargo misappropriation :

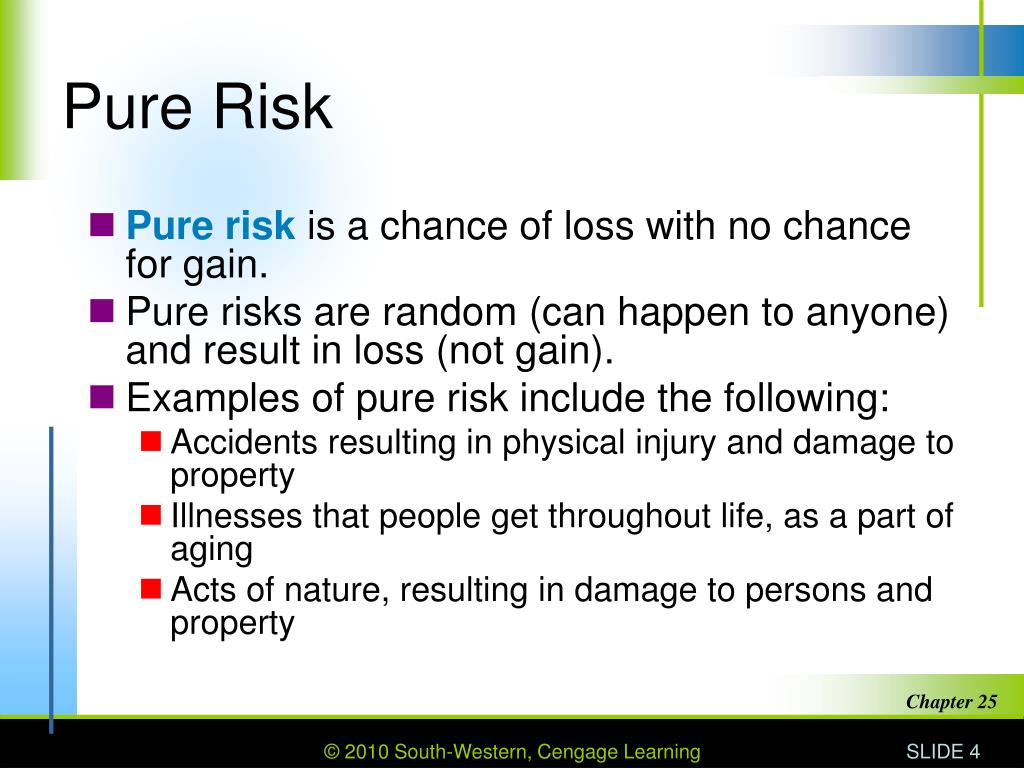

Pure risk is a risk that can only result in losses.

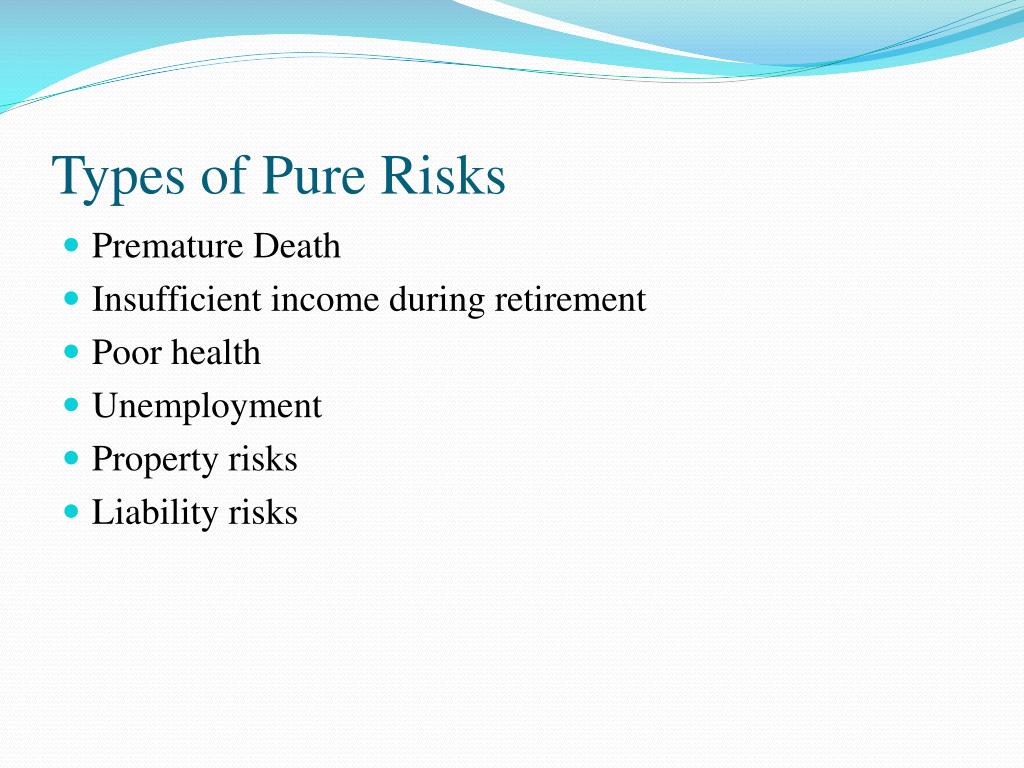

Term insurance plan is one such pure risk protection cover. In everyday usage, “risk” is often used synonymously with “probability” of a loss or threat. The following are the different types of risk in insurance: With pure risk, there is no opportunity to gain or profit from the event. There are no opportunities for gain or. The person whose risk is insured is called ______________.

Source: slideshare.net

Source: slideshare.net

What is a pure risk protection insurance plan? Types of pure risks are; The house will enjoy a year with nothing bad occurring or there will be damage caused by a covered cause of loss (fire, wind, etc.). The insurance company pays the sum assured to the beneficiary named in the policy. With pure risk, there is no opportunity to gain or profit from the event.

Source: freshnewattitude.blogspot.com

Source: freshnewattitude.blogspot.com

With pure risk, there is no opportunity to gain or profit from the event. What is pure risk in insurance? Insurance provides protection from the exposure to hazards and the probability of loss. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all. Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk.

Source: pt.slideshare.net

Source: pt.slideshare.net

Pure risk is a category of risk that cannot be controlled and has two outcomes: 2 two dimensions of pure risk killed in accident lose property in fire lose shirt death from Insurance provides protection from the exposure to hazards and the probability of loss. Risk is defined as the possibility of loss or injury, and insurance is concerned with the degree of probability of loss or injury. With pure risk, there is no opportunity to gain or profit from the event.

Source: slideshare.net

Source: slideshare.net

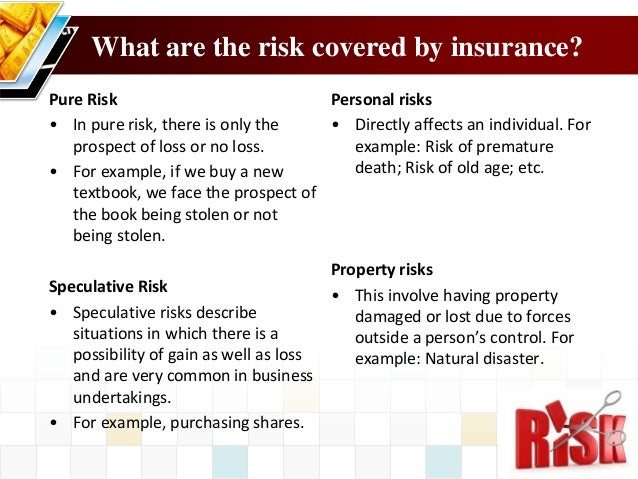

Personal risks these are the risks that directly affect the individual’s capability to earn income. It denotes a potential negative impact on an asset or some characteristic of value that may arise from some present process or some future event. Complete loss or no loss at all. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all. There are two types of life insurance policies, one which offers insurance and also an opportunity of building.

Source: slideserve.com

Source: slideserve.com

Complete loss or no loss at all. This term is used to differentiate between speculative risks that are taken for a chance of a gain and risks that are inherent in a situation but are never positive. There is no maturity benefit or an investment component. Property risks these are the risks to the persons in possession of the property being damaged or lost. Term insurance covers the finances of the family against the untimely demise of the life assured.

Source: slideserve.com

Source: slideserve.com

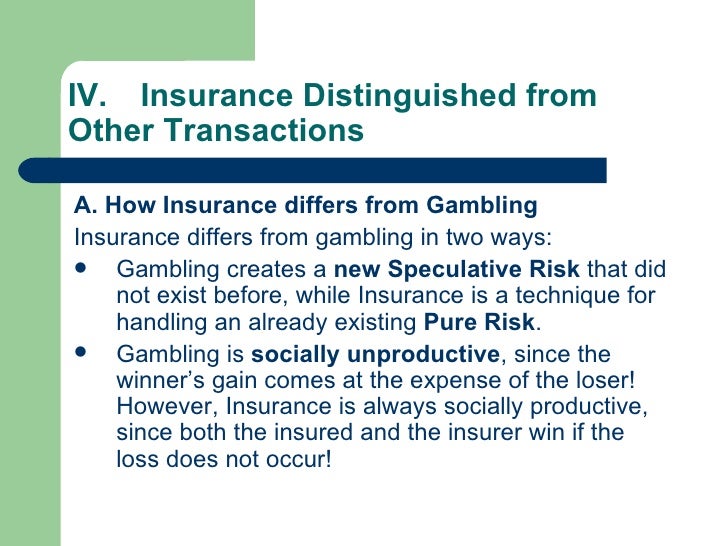

This term is used to differentiate between speculative risks that are taken for a chance of a gain and risks that are inherent in a situation but are never positive. Insured merchandiser marketer agents view answer 9. 1.4.1 speculative and pure risks. Make sure to watch our videos;cargo misappropriation : The house will enjoy a year with nothing bad occurring or there will be damage caused by a covered cause of loss (fire, wind, etc.).

Source: slideshare.net

Source: slideshare.net

Pure risks are those risks where only a loss can occur if the event happens. An instrument by which a pure risk is transferred by a party other than insurer is insurance retention. Pure risks are an independent insurance intermediary specialising in placing professional indemnity insurance for professionals. Complete loss or no loss at all. Pure risk — the risk involved in situations that present the opportunity for loss but no opportunity for gain.

Source: youtube.com

Source: youtube.com

Insurable types of risk there are generally 3 types of risk that can be. Examples include natural disasters, theft, property damage or death. We�re now going to unravel the complexity of speculative risks and pure risks. Pure risk is a risk that can only result in losses. What are the three main types of insurable risks?

Source: financegab.com

Source: financegab.com

Term insurance covers the finances of the family against the untimely demise of the life assured. 1.4.1 speculative and pure risks. Pure risks are those risks where only a loss can occur if the event happens. Complete loss or no loss at all. What is pure risk in insurance?

Source: slideserve.com

Source: slideserve.com

What are the three main types of insurable risks? Why term insurance is pure risk protection? Only pure risks are insurable because they involve only the chance of loss. In the case of the life assured�s premature death, pure risk insurance provides a financial safety net. Types of pure risks are;

Source: slideserve.com

Source: slideserve.com

It denotes a potential negative impact on an asset or some characteristic of value that may arise from some present process or some future event. Types of pure risks are; An instrument by which a pure risk is transferred by a party other than insurer is insurance retention. Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. They are pure in the sense that they do not mix both profits and losses.insurance is concerned with the economic problems created by pure risks.speculative risks are not insurable.

Source: brainly.in

Source: brainly.in

What is pure risk in insurance? The following are the different types of risk in insurance: Predicting the outcomes of a pure risk is accomplished (sometimes) using the law of large numbers, a priori data or empirical data. In the case of the life assured�s premature death, pure risk insurance provides a financial safety net. Make sure to watch our videos;cargo misappropriation :

Source: slideshare.net

Source: slideshare.net

In the case of the life assured�s premature death, pure risk insurance provides a financial safety net. Pure risk — the risk involved in situations that present the opportunity for loss but no opportunity for gain. Pure risk is a category of risk that cannot be controlled and has two outcomes: Pure risk, also known as absolute risk, is insurable. Pure risk is a term that is applied to any situation where there is no potential for any benefit to be realized if a specific outcome should result.

Source: slideserve.com

Source: slideserve.com

1.4.1 speculative and pure risks. Term insurance covers the finances of the family against the untimely demise of the life assured. There are two types of life insurance policies, one which offers insurance and also an opportunity of building. What is pure risk in insurance? Examples include natural disasters, theft, property damage or death.

Property risks these are the risks to the persons in possession of the property being damaged or lost. The risk is a concept which relates to human expectations. What are the three main types of insurable risks? Insurance provides protection from the exposure to hazards and the probability of loss. Only pure risks are insurable because they involve only the chance of loss.

Source: slideshare.net

Source: slideshare.net

Predicting the outcomes of a pure risk is accomplished (sometimes) using the law of large numbers, a priori data or empirical data. The risk is a concept which relates to human expectations. 2 two dimensions of pure risk killed in accident lose property in fire lose shirt death from Insured merchandiser marketer agents view answer 9. Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered.

Source: slideshare.net

Source: slideshare.net

Most insurance providers only cover pure risks, or those risks that embody most or all of the main elements of insurable risk. Pure risks are generally insurable, whereas speculative risks (which also present the opportunity for gain) generally are not. They are pure in the sense that they do not mix both profits and losses.insurance is concerned with the economic problems created by pure risks.speculative risks are not insurable. The person whose risk is insured is called ______________. Damage or loss brought about by pure risk events can be covered by an insurance policy.

Source: slideshare.net

Source: slideshare.net

Insurance provides protection from the exposure to hazards and the probability of loss. We�re now going to unravel the complexity of speculative risks and pure risks. Damage or loss brought about by pure risk events can be covered by an insurance policy. Types of pure risks are; There are two types of life insurance policies, one which offers insurance and also an opportunity of building.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is pure risk in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information