What is rcv in insurance information

Home » Trend » What is rcv in insurance informationYour What is rcv in insurance images are ready. What is rcv in insurance are a topic that is being searched for and liked by netizens now. You can Get the What is rcv in insurance files here. Download all royalty-free images.

If you’re searching for what is rcv in insurance images information connected with to the what is rcv in insurance interest, you have pay a visit to the right site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

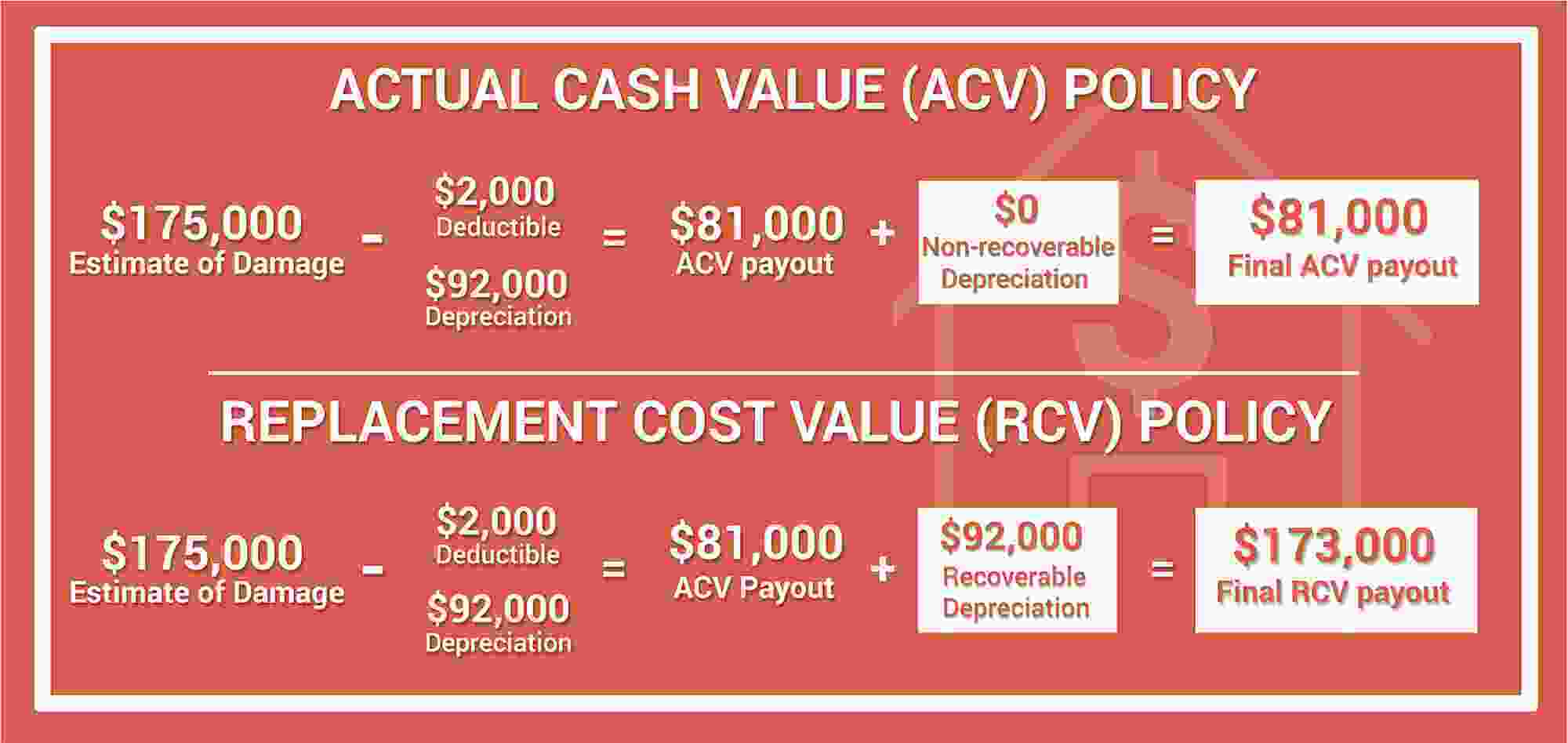

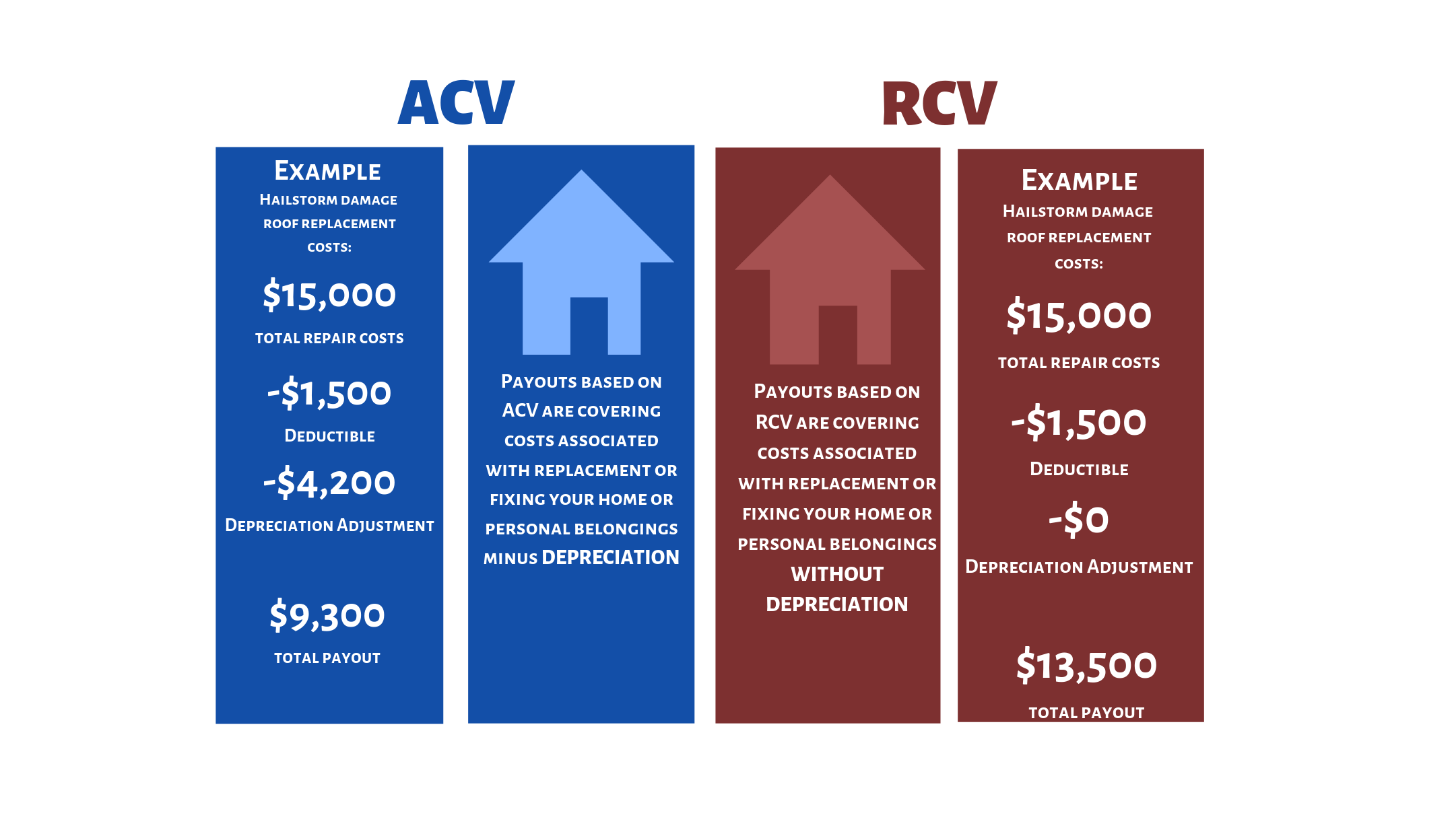

What Is Rcv In Insurance. Replacement cost value (rcv) is the actual total retail price of the item without any depreciation, no matter how much time has passed. Replacement cost value, or rcv, is the cost at which it would be to replace any damaged property with similar materials. Insurance agents, and any other professional service for that matter, have a bad habit of talking in industry jargon that leaves their clients with more questions than answers. Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage.

Jeff McCormick (Goosehead Insurance) on RCV v ACV Roof From youtube.com

Jeff McCormick (Goosehead Insurance) on RCV v ACV Roof From youtube.com

There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Attorney bill voss explains the difference between acv and rcv, and explores how to get the best value for your property damage claim. An rcv policy stands for replacement cost value. The term rcv means that if an insured has suffered a covered loss, and the insured is entitled to rcv pursuant to the insurance contract, then the insurer (19). Current entry or replacement cost accounting:

It is the grand total.

For example, if your roof is damaged from a hail storm, you will (4). What is rcv(replacement cost value)? Replacement cost value (rcv) it is important to discuss replacement cost with your insurance agent when purchasing your policy. Rcv (replacement cost value) is full coverage, with no depreciation based on use or lifespan. Insurance companies have different ways of calculating your insurance payout. Cash out option homeowners insurance:

Source: pinterest.com

Source: pinterest.com

Meaning in the event of a loss, we’ll pay you enough to replace your damaged property with new property of the same type, kind and quality and you won’t have to worry about paying more than your deductible to cover the damage. Rcv is an abbreviation for “replacement cost value”. Cash out option homeowners insurance: Acv stands for actual cash value , and rcv means replacement cost value. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage. Under a replacement cost policy, the rcv is the total amount that the insurance company must pay after the repairs have been made (minus the acv payment it made at the beginning of the claim). There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was. Here’s a check for $600, which is the current value of. Most insurance providers base the reimbursement of your totaled vehicle on its actual cash value (acv), but there’s potential for a higher payout with replacement cost value (rcv) insurance, which is why it’s important to know.

Source: bankerscompliance.com

Source: bankerscompliance.com

Rcv (replacement cost value) is full coverage, with no depreciation based on use or lifespan. Keep in mind the amount your roof depreciated and the check you’ll receive is ultimately determined by your insurance company. There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was. “okay, it’s going to cost $1,000 to replace this couch. What does rcv stand for in insurance:

Source: restorationadvocate.com

Source: restorationadvocate.com

The coverage you have under your homeowners insurance policy will determine how much money you get from your insurer for your property damage claim. What does rcv mean in insurance: Replacement cost value (rcv) it is important to discuss replacement cost with your insurance agent when purchasing your policy. Depreciation here refers to the term found in statements of loss or estimates about your insurance payout. Like kind and quality property insurance:

Source: seguroapi.blogspot.com

What does rcv mean in insurance: There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was. Like kind and quality property insurance: What is rcv on insurance estimate: And not to brag, but goodcover provides rcv coverage as a standard for all renters insurance policies.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Current entry or replacement cost accounting: July 15, 2020 by carlos simpson. There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was. Rcv (replacement cost value) is full coverage, with no depreciation based on use or lifespan. What is replacement cost value (rcv)?

Source: slideshare.net

Source: slideshare.net

What is rcv(replacement cost value)? The acv is calculated by subtracting depreciation from. The term rcv means that if an insured has suffered a covered loss, and the insured is entitled to rcv pursuant to the insurance contract, then the insurer (19). Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation. The coverage you have under your homeowners insurance policy will determine how much money you get from your insurer for your property damage claim.

Source: opic.texas.gov

Source: opic.texas.gov

Acv and rcv coverage are a couple of examples of very important concepts that are essential to understand, so let’s take a moment to define and explain. Current replacement cost in national income: Current entry or replacement cost accounting: Attorney bill voss explains the difference between acv and rcv, and explores how to get the best value for your property damage claim. This couch has an estimated life expectancy of 10 years, and the receipt shows you bought it 4 years ago.

Source: seguroapi.blogspot.com

Source: seguroapi.blogspot.com

This number represents the total estimated cost to repair or replace the damaged property. Insurance agents, and any other professional service for that matter, have a bad habit of talking in industry jargon that leaves their clients with more questions than answers. If you have replacement cost value (rcv) coverage, your policy will pay the cost to repair or. The coverage you have under your homeowners insurance policy will determine how much money you get from your insurer for your property damage claim. Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage.

Source: youtube.com

Source: youtube.com

Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation. Under a replacement cost policy, the rcv is the total amount that the insurance company must pay after the repairs have been made (minus the acv payment it made at the beginning of the claim). Like kind and quality property insurance: Insurance agents, and any other professional service for that matter, have a bad habit of talking in industry jargon that leaves their clients with more questions than answers. Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation.

Source: blog.cfmimo.com

The purpose of homeowners insurance is to make a homeowner whole after he or she has suffered accidental damage to their property. Replacement cost value means the insurance has to pay to replace the item at the current day prices. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Under a replacement cost policy, the rcv is the total amount that the insurance company must pay after the repairs have been made (minus the acv payment it made at the beginning of the claim). Attorney bill voss explains the difference between acv and rcv, and explores how to get the best value for your property damage claim.

Source: insuranceagentofamerica.com

Source: insuranceagentofamerica.com

First, let’s talk the difference in payouts if your home has a replacement cost value of $245,000, but you decided to go with a less expensive policy and chose acv at $187,000 that is a significant difference in the amount the. Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage. Even if you purchased coverages that pay rcv, some types of property may only be paid at acv. Insurance companies have different ways of calculating your insurance payout. Current entry or replacement cost accounting:

Source: youtube.com

Source: youtube.com

And not to brag, but goodcover provides rcv coverage as a standard for all renters insurance policies. Keep in mind the amount your roof depreciated and the check you’ll receive is ultimately determined by your insurance company. The purpose of homeowners insurance is to make a homeowner whole after he or she has suffered accidental damage to their property. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Acv and rcv coverage are a couple of examples of very important concepts that are essential to understand, so let’s take a moment to define and explain.

Source: chateaupublicadjusters.com

Source: chateaupublicadjusters.com

Replacement cost value (rcv) is the actual total retail price of the item without any depreciation, no matter how much time has passed. That means this couch has depreciated 40% of it’s original $1,000 value. Like kind and quality property insurance: Most insurance providers base the reimbursement of your totaled vehicle on its actual cash value (acv), but there’s potential for a higher payout with replacement cost value (rcv) insurance, which is why it’s important to know. Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation.

Source: alpharoofga.com

Source: alpharoofga.com

Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation. Insurance agents, and any other professional service for that matter, have a bad habit of talking in industry jargon that leaves their clients with more questions than answers. Even if you purchased coverages that pay rcv, some types of property may only be paid at acv. There are a few ways to determine the value of an insured item, but in most cases, the insurance company determines how much the item was.

Source: restorationadvocate.com

Source: restorationadvocate.com

The difference between rcv and acv is the recoverable depreciation. Actual cash value (acv) and replacement cost value (rcv) are different types of insurance coverage. The purpose of homeowners insurance is to make a homeowner whole after he or she has suffered accidental damage to their property. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Damaged contents in rhode island

Source: tgsinsurance.com

Source: tgsinsurance.com

When a claim is paid, the insurance policy typically requires the initial payment be “at least actual cash value.” And there are a couple of things to consider before making a decision and understanding rcv and acv insurance. Cash out option homeowners insurance: Acv and rcv coverage are a couple of examples of very important concepts that are essential to understand, so let’s take a moment to define and explain. Replacement cost value (rcv) is the amount it costs to replace your property with new property, without deducting for depreciation.

Source: restoremastersllc.com

Source: restoremastersllc.com

Most insurance providers base the reimbursement of your totaled vehicle on its actual cash value (acv), but there’s potential for a higher payout with replacement cost value (rcv) insurance, which is why it’s important to know. Keep in mind the amount your roof depreciated and the check you’ll receive is ultimately determined by your insurance company. Replacement cost value (rcv) rcv is the amount to replace or fix your home and personal items. Current replacement cost in national income: With an rcv policy, your insurance company says:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is rcv in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information