What is redlining in insurance information

Home » Trending » What is redlining in insurance informationYour What is redlining in insurance images are ready. What is redlining in insurance are a topic that is being searched for and liked by netizens today. You can Download the What is redlining in insurance files here. Download all royalty-free vectors.

If you’re looking for what is redlining in insurance pictures information related to the what is redlining in insurance topic, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

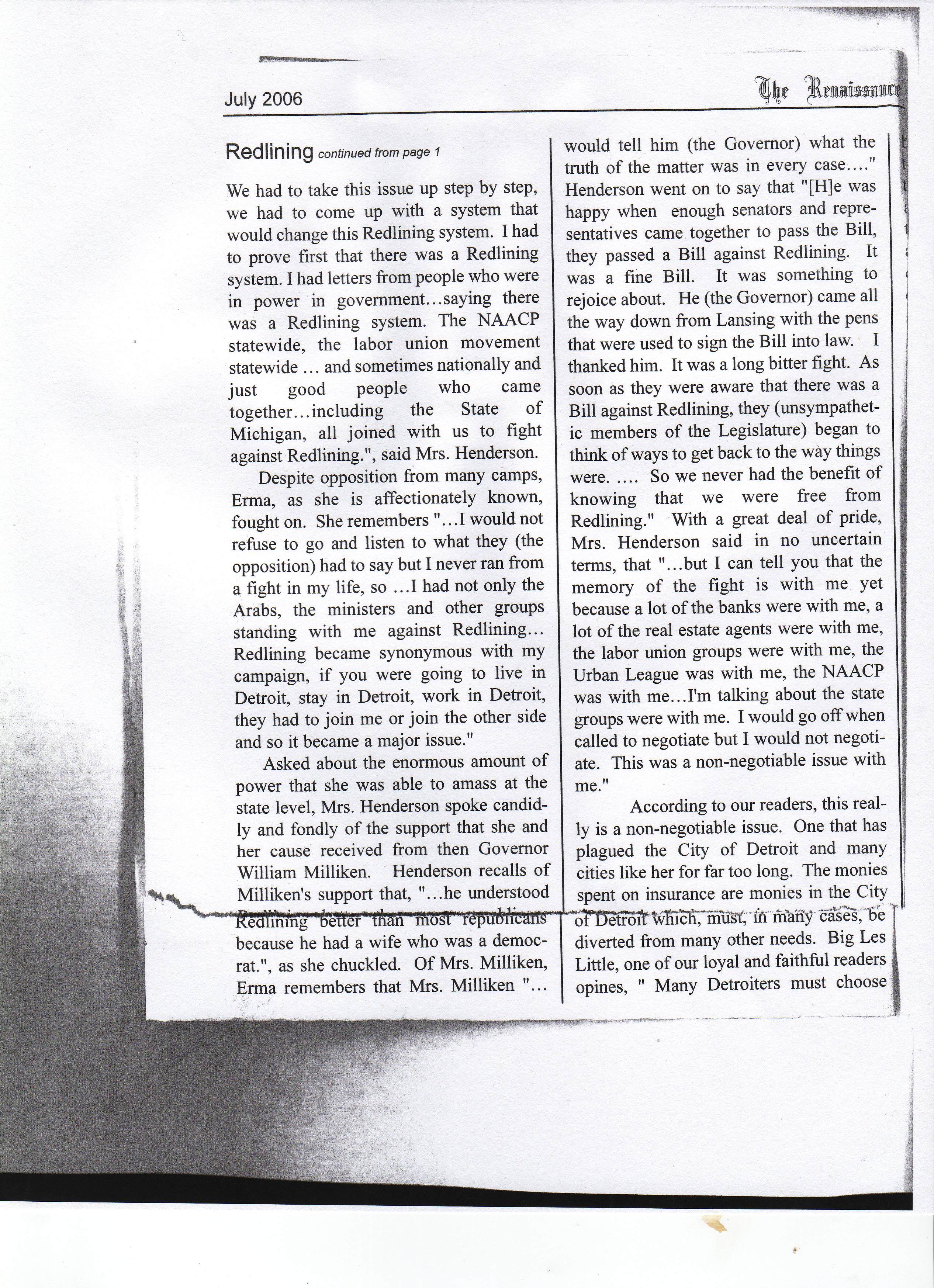

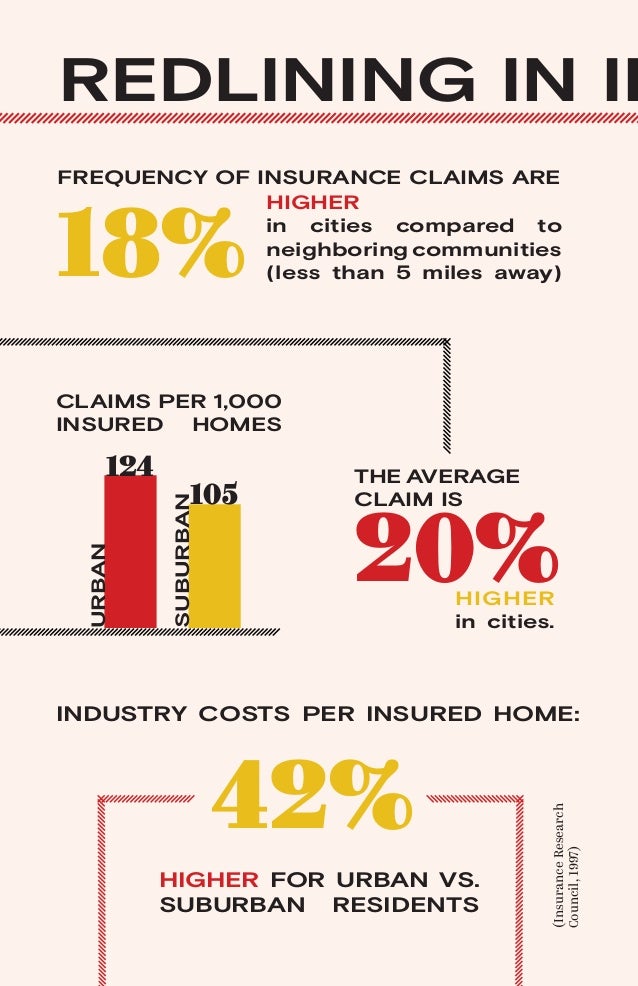

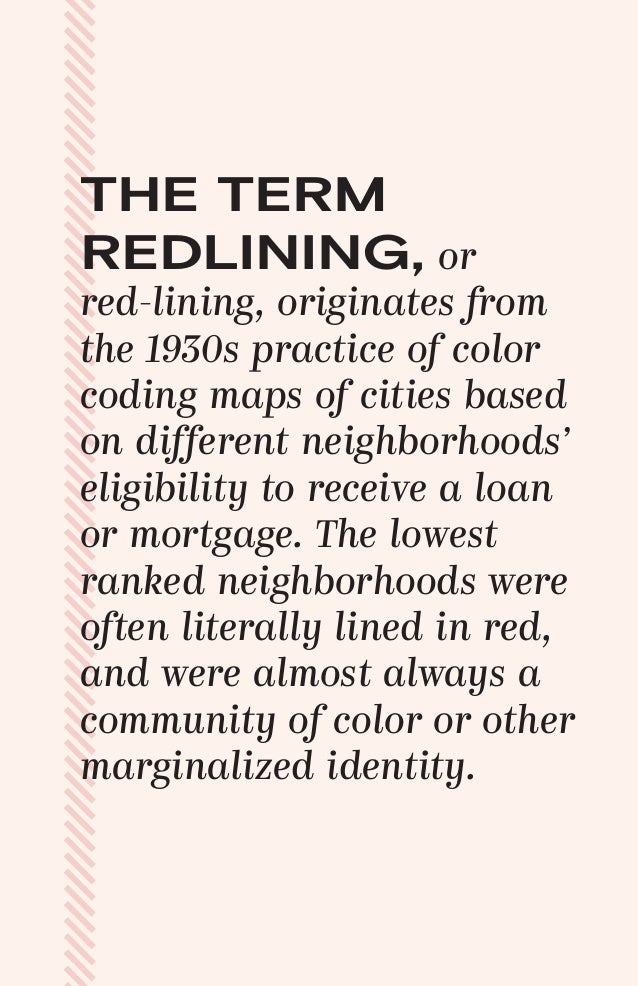

What Is Redlining In Insurance. The term redlining refers to a practice of insurance companies marking out areas in which they refused to offer insurance coverage on maps with red lines. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. It is most common for redlining to be used as a term in canada and the united states. What is redlining in simple terms?

What is redlining? Definition and meaning Market From marketbusinessnews.com

What is redlining? Definition and meaning Market From marketbusinessnews.com

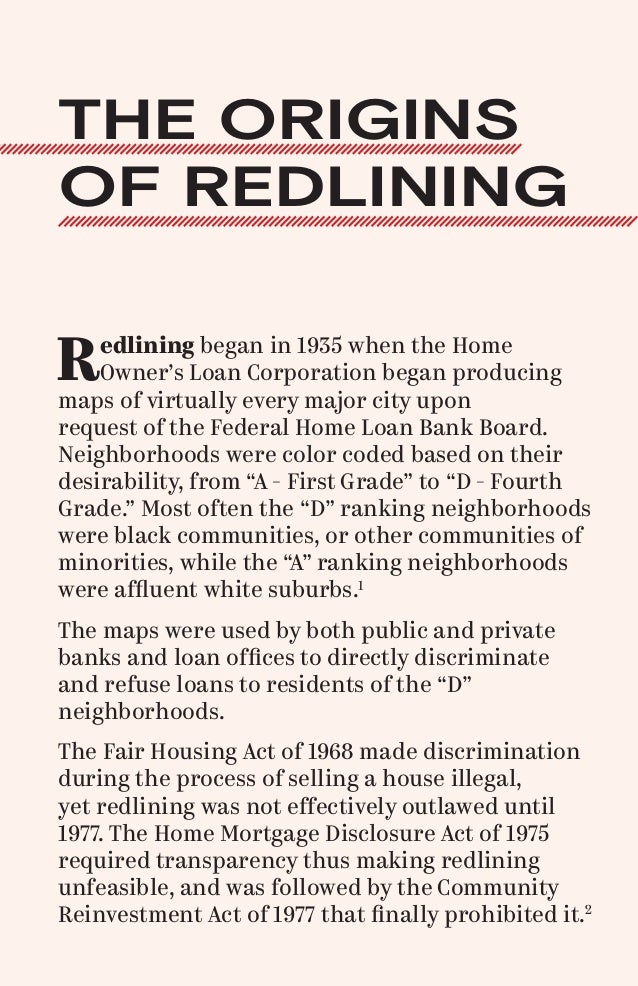

The practice is banned by both the fair housing act of 1968 and the fair housing amendments act of 1988. According to this law, the process is illegal. I quickly realized why my client was asking their question. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. The term redlining refers to a practice of insurance companies marking out areas in which they refused to offer insurance coverage on maps with red lines. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage.

Redlining is the practice of withholding financial services, such as loans and insurance, to inhabitants of a certain region who are.

It is most common for redlining to be used as a term in canada and the united states. It can be seen in the systematic denial of mortgages, insurance, loans and other financial services based on location (and that area�s default history) rather than an individual�s qualifications and creditworthiness. The term refers to the practice of charging higher prices for insurance to certain neighborhoods or communities. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage. What does redlining mean in legal? A mortgage lender or insurance provider denying an applicant a mortgage or charging a higher rate than their competitors are violating a 1992 law.

Source: detroitchurches.history.msu.edu

Source: detroitchurches.history.msu.edu

June 9, 2020 4:00 am pdt. The practice is banned by both the fair housing act of 1968 and the fair housing amendments act of 1988. Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage. In many cases, this has been done historically within a racial context.

Source: insurance.us

Source: insurance.us

Redlining could also make it difficult for people to get insurance, with insurance agencies refusing to undertake the risks of covering people in certain areas, and this practice persists to this day, although insurance companies vehemently deny it. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. Although the practice was formally outlawed in 1968 with the passage of the fair housing act,. The practice of showing changes to a draft of a document by marking with red lines. What is redlining in simple terms?

Source: ca.exprealty.com

In many cases, this has been done historically within a racial context. Redlining, a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition, is one of the clearest examples of institutionalized racism in the history of the united states. Redlining is the practice of withholding financial services, such as loans and insurance, to inhabitants of a certain region who are. According to this law, the process is illegal. The practice is banned by both the fair housing act of 1968 and the fair housing amendments act of 1988.

Source: aadl.org

Source: aadl.org

Redlining is an unethical practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity. Though the millions of protesters taking to the. It can be seen in the systematic denial of mortgages, insurance, loans and other financial services based on location (and that area�s default history) rather than an individual�s qualifications and creditworthiness. In many cases, this has been done historically within a racial context. Although the practice was formally outlawed in 1968 with the passage of the fair housing act,.

Source: pinterest.com

Source: pinterest.com

In many cases, this has been done historically within a racial context. June 9, 2020 4:00 am pdt. Traditionally, redlining is the practice of denying, or not insuring, loans for creditworthy borrowers on the basis of their race or the neighborhood that they live in. What does redlining mean in legal? In many cases, this has been done historically within a racial context.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Redlining could also make it difficult for people to get insurance, with insurance agencies refusing to undertake the risks of covering people in certain areas, and this practice persists to this day, although insurance companies vehemently deny it. Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. June 9, 2020 4:00 am pdt. The term refers to the practice of charging higher prices for insurance to certain neighborhoods or communities. What does redlining mean in legal?

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Insurance redlining is real—and it will hurt neighborhoods hit by looting. Redlining describes a practice that occurs when lenders refuse to make loans to people with lower incomes or of a certain demographic. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage. Redlining is an unethical practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity. These residents largely belong to racial and ethnic minorities.

Source: democratandchronicle.com

Source: democratandchronicle.com

Though the millions of protesters taking to the. Traditionally, redlining is the practice of denying, or not insuring, loans for creditworthy borrowers on the basis of their race or the neighborhood that they live in. The illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents) — compare reverse redlining. This practice is considered illegal in most states, and companies engaged in redlining can face punitive consequences. This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities.

Source: researchgate.net

Source: researchgate.net

Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. What does redlining mean in legal? Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities.

Source: slideshare.net

Source: slideshare.net

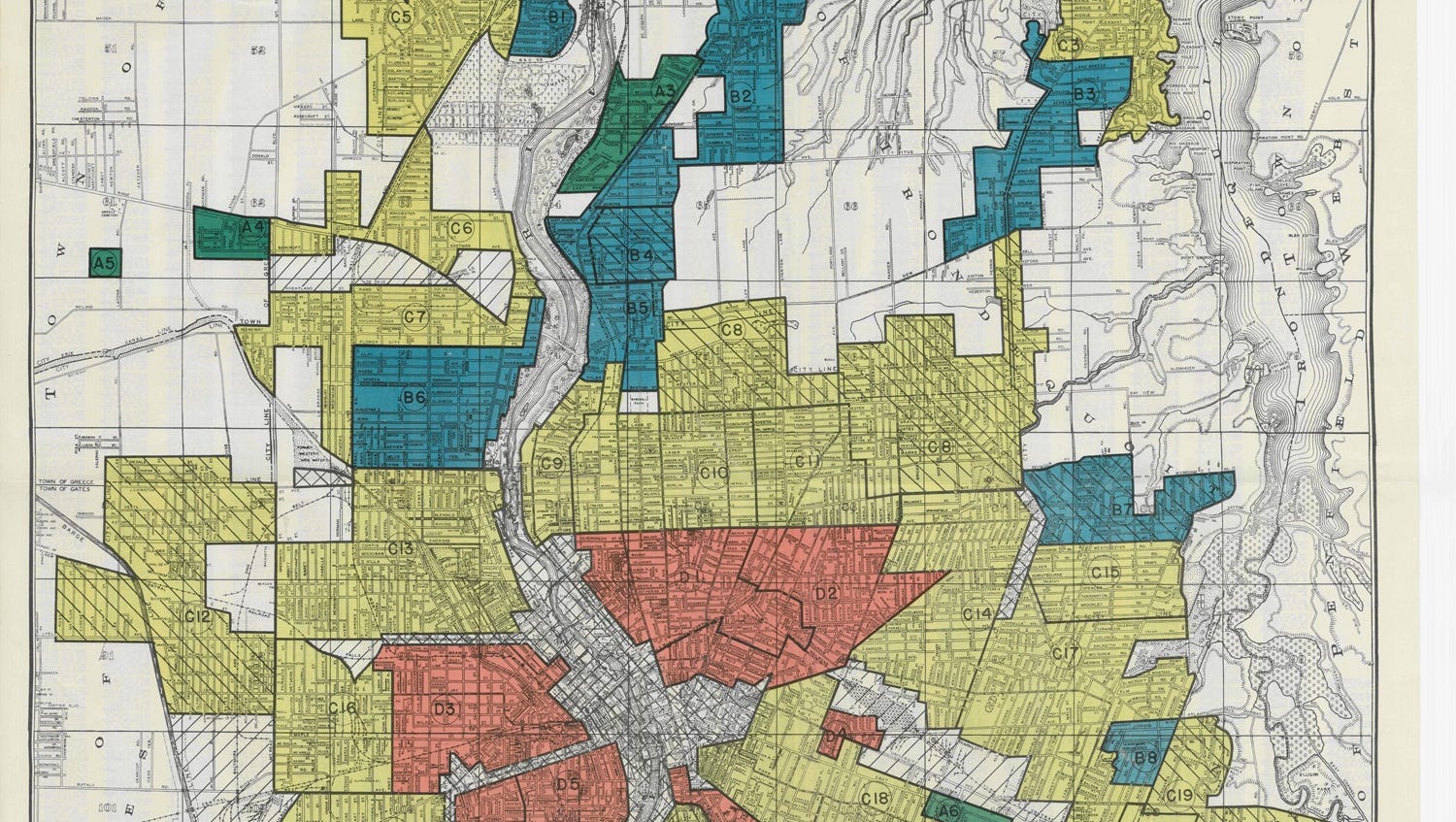

The term comes from the image of an owner of a service firm drawing a red line around a portion of a map and deciding not to provide any service within that area. Redlining is the practice of withholding financial services, such as loans and insurance, to inhabitants of a certain region who are. Redlining describes a practice that occurs when lenders refuse to make loans to people with lower incomes or of a certain demographic. What does redlining mean in legal? Insurance redlining is real—and it will hurt neighborhoods hit by looting.

Source: researchgate.net

Source: researchgate.net

Although the practice was formally outlawed in 1968 with the passage of the fair housing act,. Redlining is an unethical practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity. The practice is banned by both the fair housing act of 1968 and the fair housing amendments act of 1988. It can be seen in the systematic denial of mortgages, insurance, loans and other financial services based on location (and that area�s default history) rather than an individual�s qualifications and creditworthiness. Though the millions of protesters taking to the.

Source: moneystrive.com

Source: moneystrive.com

The practice of showing changes to a draft of a document by marking with red lines. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage. Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area. Traditionally, redlining is the practice of denying, or not insuring, loans for creditworthy borrowers on the basis of their race or the neighborhood that they live in. Redlining could also make it difficult for people to get insurance, with insurance agencies refusing to undertake the risks of covering people in certain areas, and this practice persists to this day, although insurance companies vehemently deny it.

Source: 4autoinsurancequote.com

Source: 4autoinsurancequote.com

The practice of redlining is a familiar, but distant, term in the industry. What does redlining mean in legal? In the united states, redlining is a discriminatory practice in which services ( financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; A mortgage lender or insurance provider denying an applicant a mortgage or charging a higher rate than their competitors are violating a 1992 law. Redlining is an unethical practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity.

Source: slideserve.com

Source: slideserve.com

I quickly realized why my client was asking their question. Although the practice was formally outlawed in 1968 with the passage of the fair housing act,. Redlining is an unethical practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity. The practice of redlining is a familiar, but distant, term in the industry. In the united states, redlining is a discriminatory practice in which services ( financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment;

Source: slideshare.net

Source: slideshare.net

The illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents) — compare reverse redlining. These areas are typically high crime neighborhoods, abandoned inner city properties, and coastal zones where frequent storms wreak large amounts of damage. Redlining could also make it difficult for people to get insurance, with insurance agencies refusing to undertake the risks of covering people in certain areas, and this practice persists to this day, although insurance companies vehemently deny it. The illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents) — compare reverse redlining. June 9, 2020 4:00 am pdt.

Source: slideshare.net

Source: slideshare.net

These residents largely belong to racial and ethnic minorities. It can be seen in the systematic denial of mortgages, insurance, loans and other financial services based on location (and that area�s default history) rather than an individual�s qualifications and creditworthiness. Insurance redlining is real—and it will hurt neighborhoods hit by looting. Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. The term redlining refers to a practice of insurance companies marking out areas in which they refused to offer insurance coverage on maps with red lines.

Source: slideshare.net

Source: slideshare.net

These residents largely belong to racial and ethnic minorities. The illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents) — compare reverse redlining. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. Redlining, a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition, is one of the clearest examples of institutionalized racism in the history of the united states. The term refers to the practice of charging higher prices for insurance to certain neighborhoods or communities.

Source: worldatlas.com

Source: worldatlas.com

Although the practice was formally outlawed in 1968 with the passage of the fair housing act,. A mortgage lender or insurance provider denying an applicant a mortgage or charging a higher rate than their competitors are violating a 1992 law. In many cases, this has been done historically within a racial context. Though the millions of protesters taking to the. The practice of showing changes to a draft of a document by marking with red lines.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is redlining in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information