What is reduced paid up insurance information

Home » Trend » What is reduced paid up insurance informationYour What is reduced paid up insurance images are available. What is reduced paid up insurance are a topic that is being searched for and liked by netizens now. You can Download the What is reduced paid up insurance files here. Find and Download all free images.

If you’re searching for what is reduced paid up insurance pictures information related to the what is reduced paid up insurance interest, you have come to the right site. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

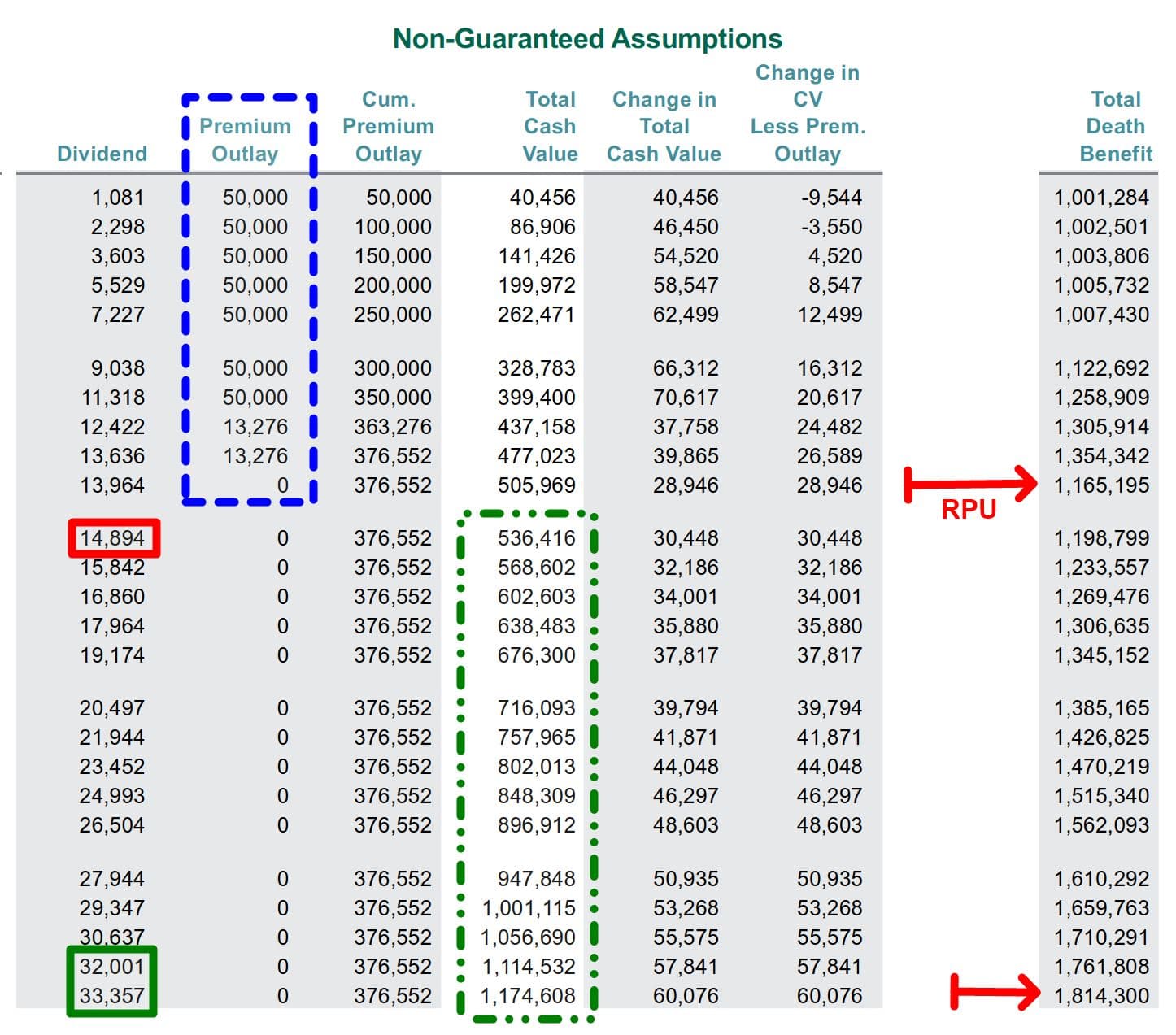

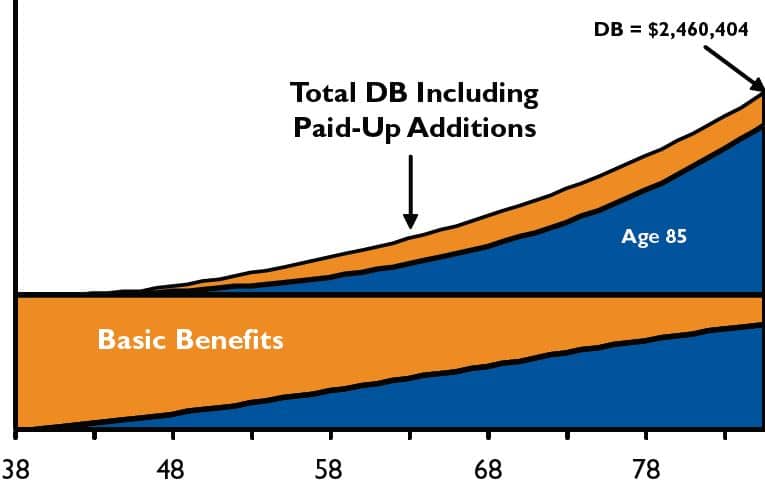

What Is Reduced Paid Up Insurance. What you need to provide. A value has been assigned to your policy, which would be available either at the time of maturity or at the time of death before maturity. Does sum assured gets changed (from what i see on lic site, sum assured is not reduced yet, but will it remain same till maturity of policy?) Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened.

Reduced Paid Up Insurance Chapter4. Life Insurance From epahepaee.blogspot.com

Reduced Paid Up Insurance Chapter4. Life Insurance From epahepaee.blogspot.com

The face amount of your policy will be reduced and the life insured will be covered for the reduced face amount. Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit. Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. I know concept of paid up policy. A value has been assigned to your policy, which would be available either at the time of maturity or at the time of death before maturity.

Also i understand that bonuses would not be applicable.

Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. What you need to provide. I know concept of paid up policy. Once this option is triggered, you’re no longer required to make monthly premium payments. It has a lower death benefit than the. The face amount of your policy will be reduced and the life insured will be covered for the reduced face amount.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

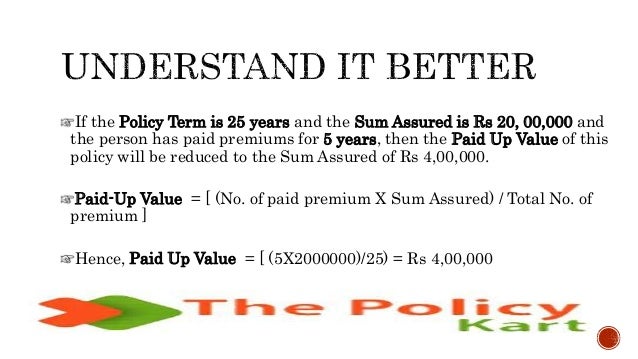

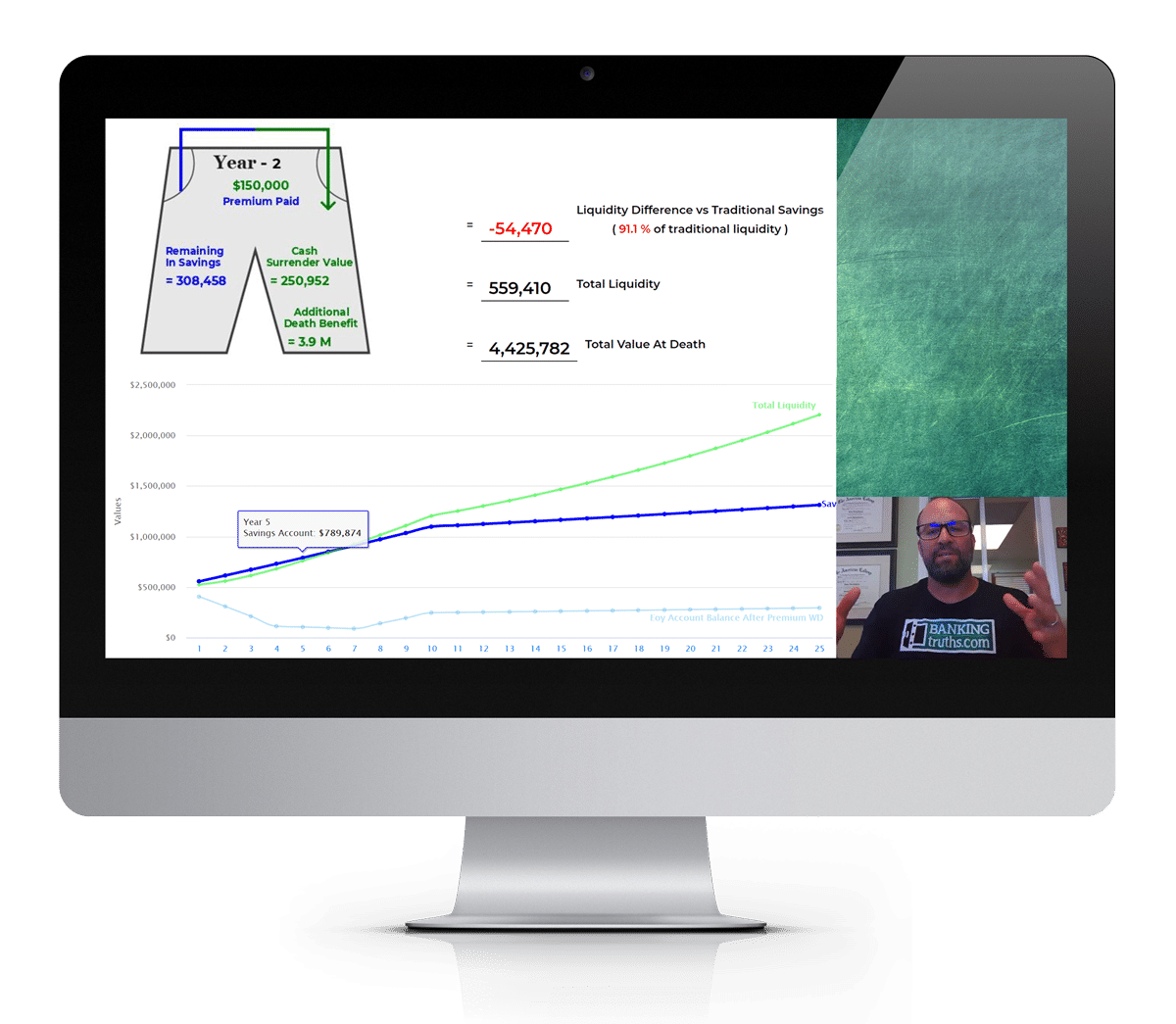

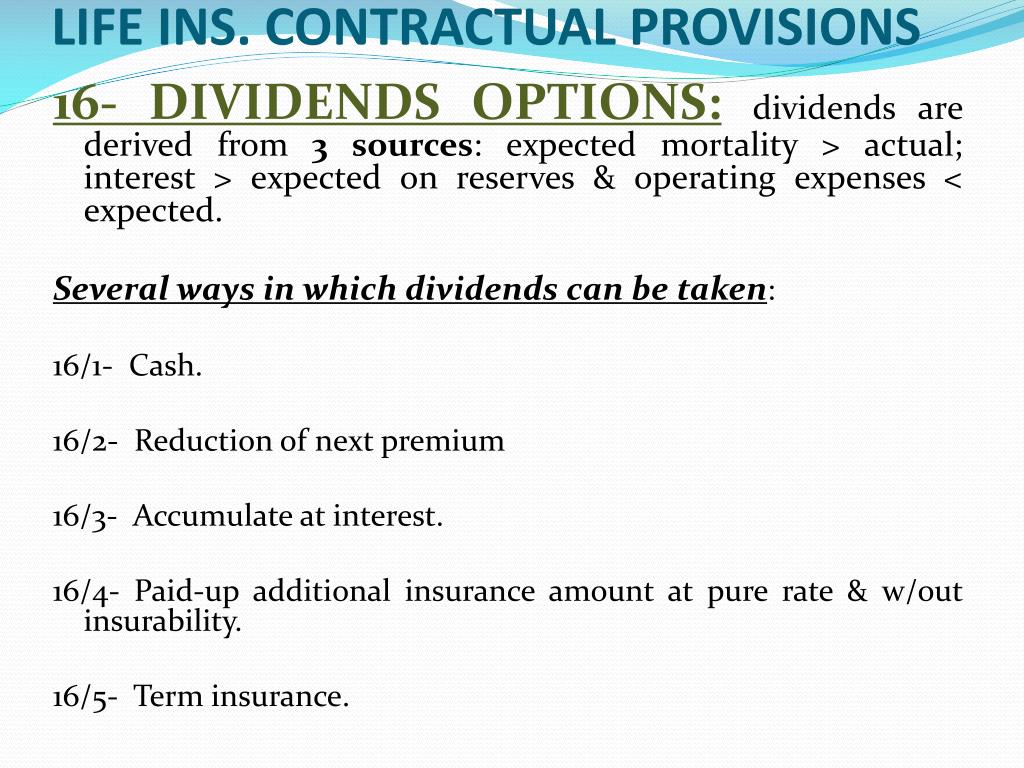

Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. The new policy coverage amount is based on the insured�s age and the policy cash surrender value. But what about insurance cover? Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

A value has been assigned to your policy, which would be available either at the time of maturity or at the time of death before maturity. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. The value is the paid up value at the time you stopped paying premium. Featuring black’s law dictionary free online legal dictionary 2nd ed.

Source: scottzlateff.com

Source: scottzlateff.com

There are circumstances where exercising this choice may be a good financial move and other. Featuring black’s law dictionary free online legal dictionary 2nd ed. It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit.

Source: bankingtruths.com

Source: bankingtruths.com

Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit. Does sum assured gets changed (from what i see on lic site, sum assured is not reduced yet, but will it remain same till maturity of policy?) The new policy coverage amount is based on the insured�s age and the policy cash surrender value. Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. I know concept of paid up policy.

Source: bestinsurancecenter.com

Source: bestinsurancecenter.com

Rather than surrender the policy, or take the cash value, the policy owner decided to turn the policy into a reduced paid up whole life insurance policy. What you need to provide. I know concept of paid up policy. Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. Also i understand that bonuses would not be applicable.

Source: youtube.com

Source: youtube.com

The value is the paid up value at the time you stopped paying premium. I know concept of paid up policy. The value is the paid up value at the time you stopped paying premium. Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier.

Source: youtube.com

Source: youtube.com

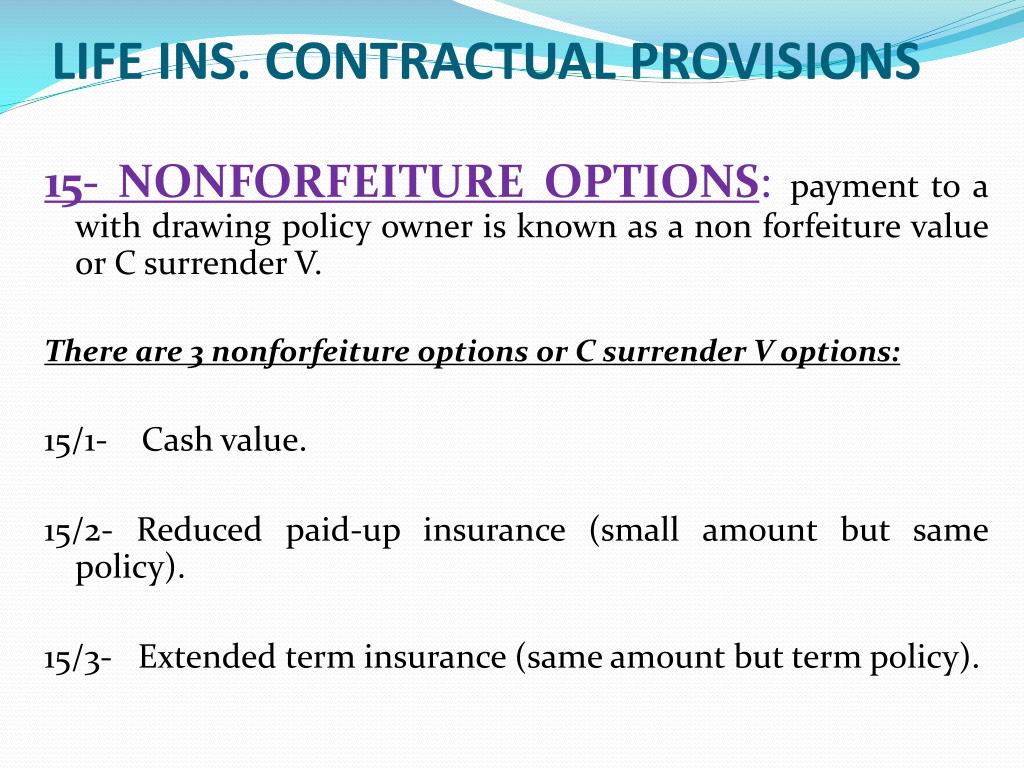

If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. It is a standard non forfeiture option It has a lower death benefit than the. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums.

Source: bankingtruths.com

Source: bankingtruths.com

If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier. Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. A value has been assigned to your policy, which would be available either at the time of maturity or at the time of death before maturity. Also i understand that bonuses would not be applicable.

Source: homeworklib.com

Source: homeworklib.com

Featuring black’s law dictionary free online legal dictionary 2nd ed. It is a standard non forfeiture option Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit. A value has been assigned to your policy, which would be available either at the time of maturity or at the time of death before maturity. Once this option is triggered, you’re no longer required to make monthly premium payments.

Source: bizfluent.com

Source: bizfluent.com

The face amount of your policy will be reduced and the life insured will be covered for the reduced face amount. Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. Also i understand that bonuses would not be applicable. It is a standard non forfeiture option

Source: bankingtruths.com

Source: bankingtruths.com

What you need to provide. Also i understand that bonuses would not be applicable. It has a lower death benefit than the. What you need to provide. I know concept of paid up policy.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Does sum assured gets changed (from what i see on lic site, sum assured is not reduced yet, but will it remain same till maturity of policy?) If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier. It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. The face amount of your policy will be reduced and the life insured will be covered for the reduced face amount. You will not need to pay any future premiums.

Source: kamuslengkap.com

Source: kamuslengkap.com

It is a standard non forfeiture option Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit. There are circumstances where exercising this choice may be a good financial move and other. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. The new policy coverage amount is based on the insured�s age and the policy cash surrender value.

Source: npa1.org

Source: npa1.org

Rather than surrender the policy, or take the cash value, the policy owner decided to turn the policy into a reduced paid up whole life insurance policy. Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. Featuring black’s law dictionary free online legal dictionary 2nd ed. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. But what about insurance cover?

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Rather than surrender the policy, or take the cash value, the policy owner decided to turn the policy into a reduced paid up whole life insurance policy. If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier. Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. Rather than surrender the policy, or take the cash value, the policy owner decided to turn the policy into a reduced paid up whole life insurance policy. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. Also i understand that bonuses would not be applicable. You will not need to pay any future premiums. If premiums have been paid for a period of three years and thereafter due to unforeseen circumstances, payments cannot be made, policy will automatically be converted into a paid up policy for a reduced sum assured, payable on the date of maturity or in event of the policyholder’s death, if earlier. Featuring black’s law dictionary free online legal dictionary 2nd ed.

Source: npa1.org

Source: npa1.org

Your policy is made paid up due to non payment of premium & fresh bonus addition has been stopped. What you need to provide. Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. The value is the paid up value at the time you stopped paying premium. Rather than surrender the policy, or take the cash value, the policy owner decided to turn the policy into a reduced paid up whole life insurance policy.

Source: homeworklib.com

Source: homeworklib.com

Though the option is required in many states, the precise terms and requirements vary among insurance companies and between policies. Once this option is triggered, you’re no longer required to make monthly premium payments. Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums, but did not want to lose the death benefit. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. It is a standard non forfeiture option

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is reduced paid up insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information