What is risk retention in insurance information

Home » Trending » What is risk retention in insurance informationYour What is risk retention in insurance images are ready in this website. What is risk retention in insurance are a topic that is being searched for and liked by netizens now. You can Download the What is risk retention in insurance files here. Get all free vectors.

If you’re looking for what is risk retention in insurance pictures information linked to the what is risk retention in insurance keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

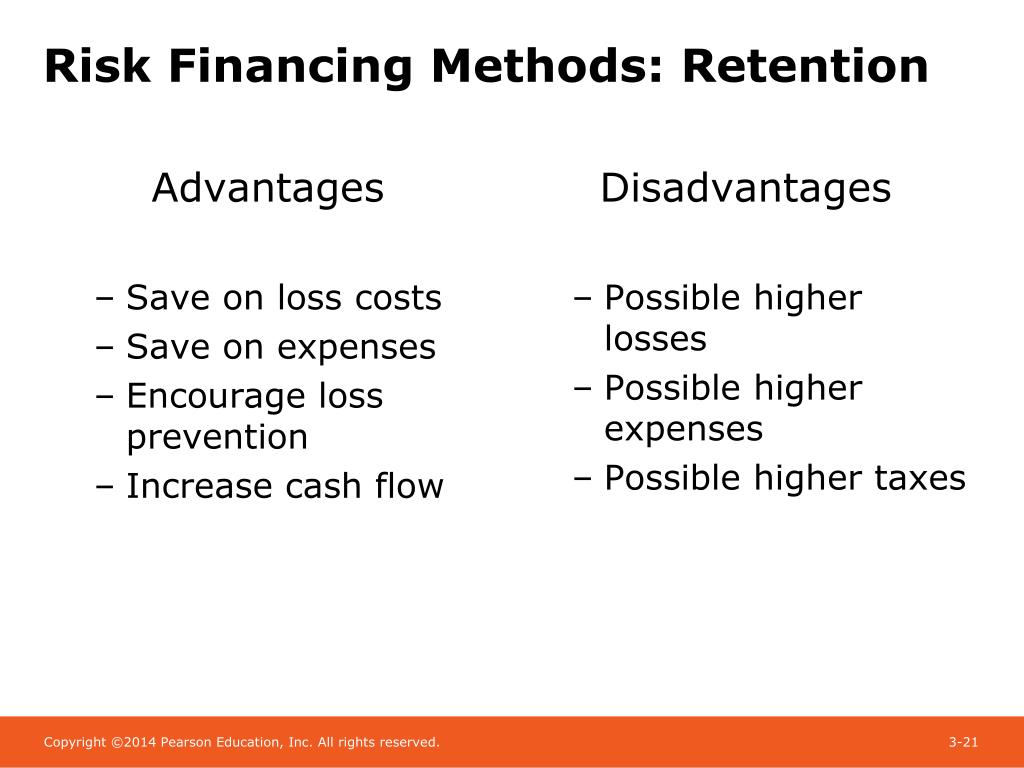

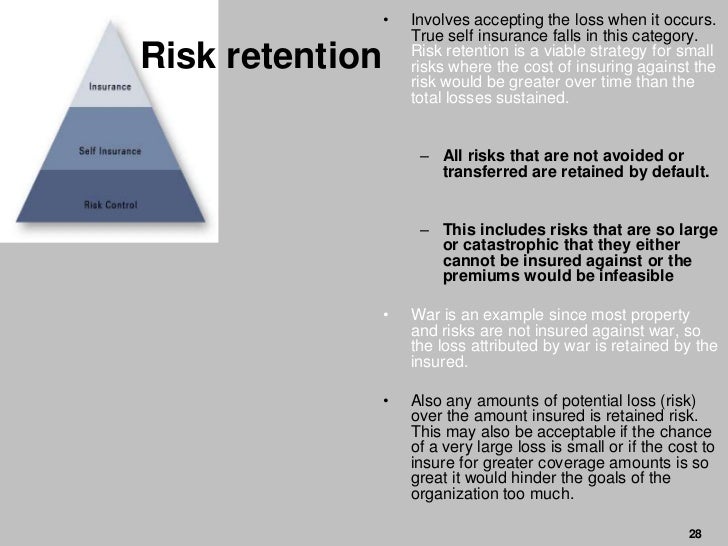

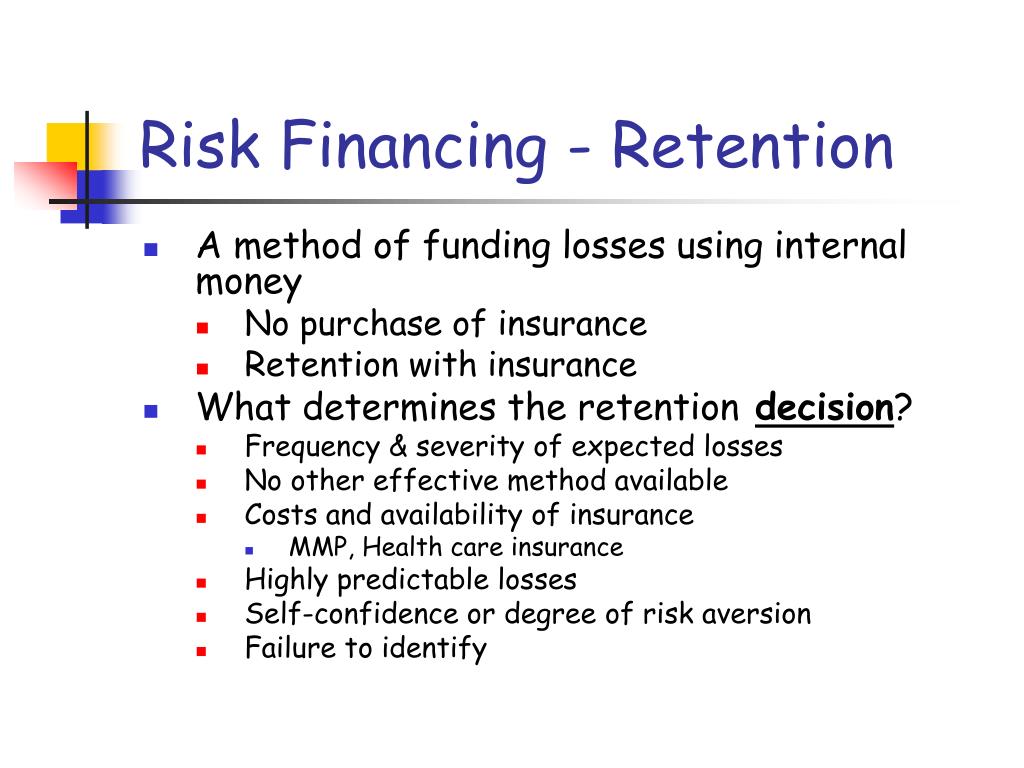

What Is Risk Retention In Insurance. According to the dictionary of business terms, risk retention means the following: This is schemed by insurance companies to promote personal responsibility. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company.

PPT Chapter 3 Introduction to Risk Management PowerPoint From slideserve.com

PPT Chapter 3 Introduction to Risk Management PowerPoint From slideserve.com

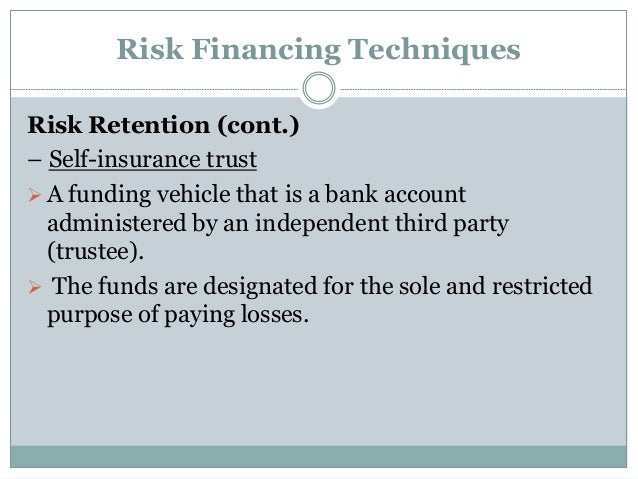

Retention can be intentional or, when exposures are not identified, unintentional. In insurance, the word retention is always related to how a company handles its business risk. In this guide, we will explore the concept of risk retention and introduce a viable captive insurance solution called the risk retention group (rrg). Risk retention groups were created by the. An insurance deductible is a common example of risk retention to save money, since a deductible is a limited risk that can save money on insurance premiums for larger risks. Companies often retain risks when they believe that the cost of doing so is less.

In case you are making a mistake, you will be partially liable for it.

This is schemed by insurance companies to promote personal responsibility. What is risk retention in insurance. In case you are making a mistake, you will be partially liable for it. Handling risk by bearing the results of risk, rather than employing other methods of handling it, su Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles.

Source: caitlin-morgan.com

Source: caitlin-morgan.com

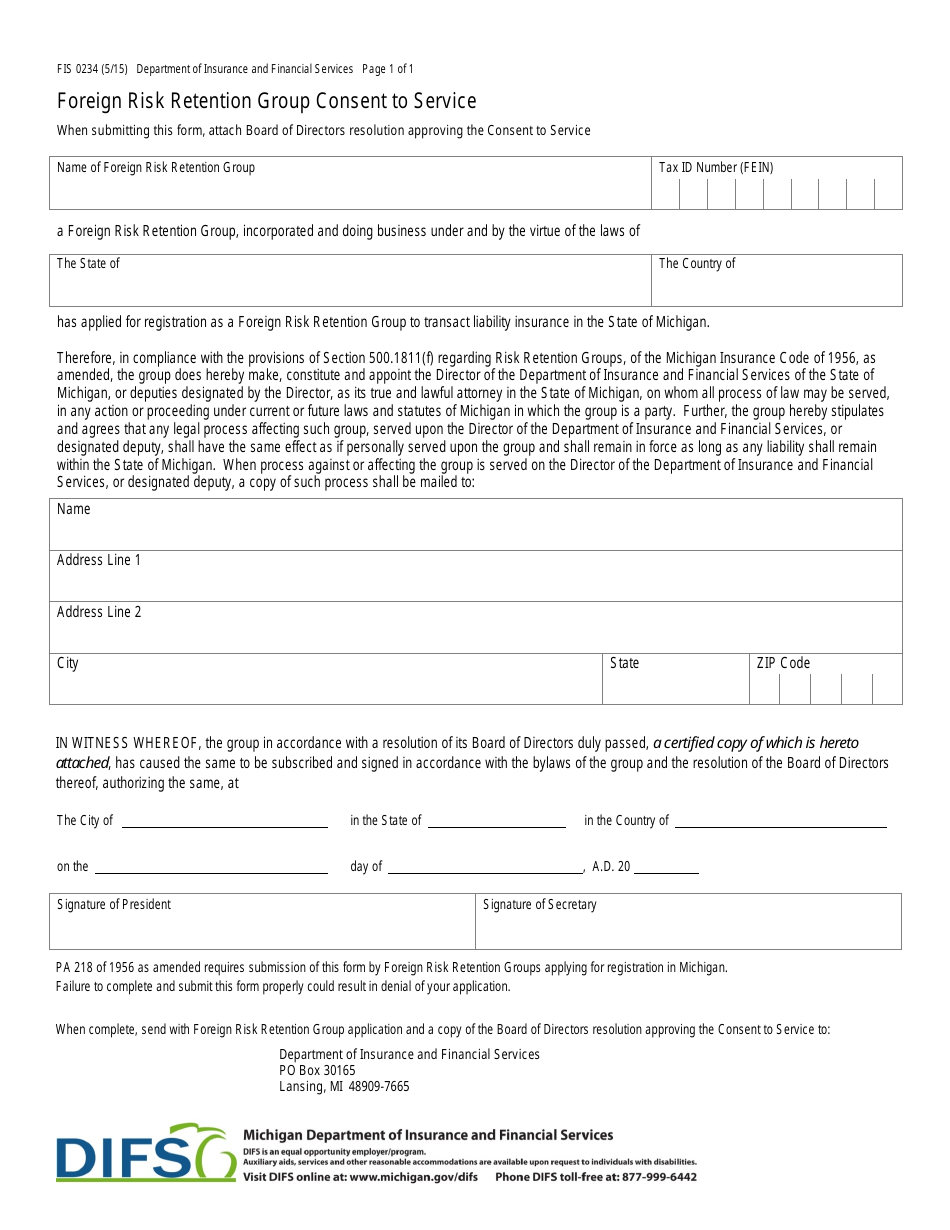

When you ‘retain’ risk, it usually means you’re not insuring it. Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. This is known as risk retention. In this guide, we will explore the concept of risk retention and introduce a viable captive insurance solution called the risk retention group (rrg). Risk retention groups (rrgs) got their start in 1981 after the passage of the federal product liability risk retention act.

Source: khurak.net

Source: khurak.net

Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company. May be it is done to keep the cost of insurance premium at the minimum level. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. The act was passed in response to soaring premium costs imposed by insurers, leading many. Some other risks are so big that taking any action on them is impossible due to the costs.

Source: slideshare.net

Source: slideshare.net

With risk retention programs, you have the luxury of more control over customizing insurance products to meet your needs. Insurance retention means you are involved in the game. Companies often retain risks when they believe that the cost of doing so is less. Risk retention groups were created by the. What is risk retention in insurance.

Source: crunchbase.com

Source: crunchbase.com

Some other risks are so big that taking any action on them is impossible due to the costs. The members often belong to the same industry and have similar insurance needs. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer begins to cover the claim. The act was passed in response to soaring premium costs imposed by insurers, leading many. Handling risk by bearing the results of risk, rather than employing other methods of handling it, su

Source: staeti.blogspot.com

Source: staeti.blogspot.com

In insurance, the word retention is always related to how a company handles its business risk. What is risk retention in insurance hello dear friends !greetings of the day.i am sahil roy and i welcome you to my youtube channel aucommerce scholar.in thi. Insurance retention means you are involved in the game. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. This is schemed by insurance companies to promote personal responsibility.

Source: slideshare.net

Source: slideshare.net

Retention can be intentional or, when exposures are not identified, unintentional. What is risk retention in insurance hello dear friends !greetings of the day.i am sahil roy and i welcome you to my youtube channel aucommerce scholar.in thi. May be it is done to keep the cost of insurance premium at the minimum level. Risk retention groups must be made up of businesses only, and the group is owned by each member. Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company.

Source: slideserve.com

Source: slideserve.com

Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. Risk retention groups (rrgs) are liability insurance companies owned by its members. What is risk retention in insurance. With risk retention programs, you have the luxury of more control over customizing insurance products to meet your needs.

Source: templateroller.com

Source: templateroller.com

Risk retention is the process where an individual or a company accepts the financial risks and does not act on them before they actually occur. Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. Retention can be intentional or, when exposures are not identified, unintentional. Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company. These risks may be too small for which paying attention before could be too early.

Source: slideserve.com

Source: slideserve.com

Handling risk by bearing the results of risk, rather than employing other methods of handling it, su In insurance, the word retention is always related to how a company handles its business risk. Companies often retain risks when they believe that the cost of doing so is less. The members often belong to the same industry and have similar insurance needs. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer begins to cover the claim.

Source: dechert.com

According to the dictionary of business terms, risk retention means the following: There are many factors that influence risk retention; With this, insurance companies can take more risks from more entities. Risk retention groups must be made up of businesses only, and the group is owned by each member. A risk retention group (rrg) is an insurance company that provides liability protection to commercial businesses and some government entities.

Source: slideserve.com

Source: slideserve.com

May be it is done to keep the cost of insurance premium at the minimum level. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. Risk retention groups must be made up of businesses only, and the group is owned by each member. In insurance, the word retention is always related to how a company handles its business risk. The common alternative would be to pay an insurance company an annual premium to.

Source: slideshare.net

Source: slideshare.net

Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. What is risk retention in insurance. Risk retention is a company�s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. With risk retention programs, you have the luxury of more control over customizing insurance products to meet your needs.

Source: es.slideshare.net

Source: es.slideshare.net

This is schemed by insurance companies to promote personal responsibility. When you ‘retain’ risk, it usually means you’re not insuring it. An insurance deductible is a common example of risk retention to save money, since a deductible is a limited risk that can save money on insurance premiums for larger risks. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. The members often belong to the same industry and have similar insurance needs.

Source: medium.com

Source: medium.com

What is risk retention in insurance hello dear friends !greetings of the day.i am sahil roy and i welcome you to my youtube channel aucommerce scholar.in thi. The members often belong to the same industry and have similar insurance needs. What is risk retention in insurance hello dear friends !greetings of the day.i am sahil roy and i welcome you to my youtube channel aucommerce scholar.in thi. Risk retention is the process where an individual or a company accepts the financial risks and does not act on them before they actually occur. Risk retention groups (rrgs) are liability insurance companies owned by its members.

Source: slideserve.com

Source: slideserve.com

This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. Retention can be intentional or, when exposures are not identified, unintentional. In case you are making a mistake, you will be partially liable for it. This is known as risk retention.

Source: chi-dentist.com

Source: chi-dentist.com

These risks may be too small for which paying attention before could be too early. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. The act was passed in response to soaring premium costs imposed by insurers, leading many. Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained.

Source: khurak.net

Source: khurak.net

Some other risks are so big that taking any action on them is impossible due to the costs. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer begins to cover the claim. This solves the problem of no access to liability insurance for your industry due to rising costs or elimination within the market. According to the dictionary of business terms, risk retention means the following: Some other risks are so big that taking any action on them is impossible due to the costs.

Source: slideshare.net

Source: slideshare.net

An insurance deductible is a common example of risk retention to save money, since a deductible is a limited risk that can save money on insurance premiums for larger risks. Risk retention groups must be made up of businesses only, and the group is owned by each member. Insurance retention means you are involved in the game. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. The members often belong to the same industry and have similar insurance needs.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is risk retention in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information