What is rti gap insurance information

Home » Trend » What is rti gap insurance informationYour What is rti gap insurance images are ready. What is rti gap insurance are a topic that is being searched for and liked by netizens now. You can Download the What is rti gap insurance files here. Download all free vectors.

If you’re searching for what is rti gap insurance images information linked to the what is rti gap insurance interest, you have visit the ideal blog. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

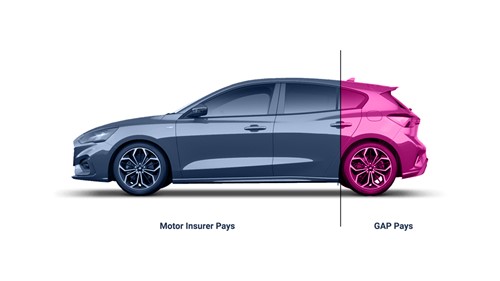

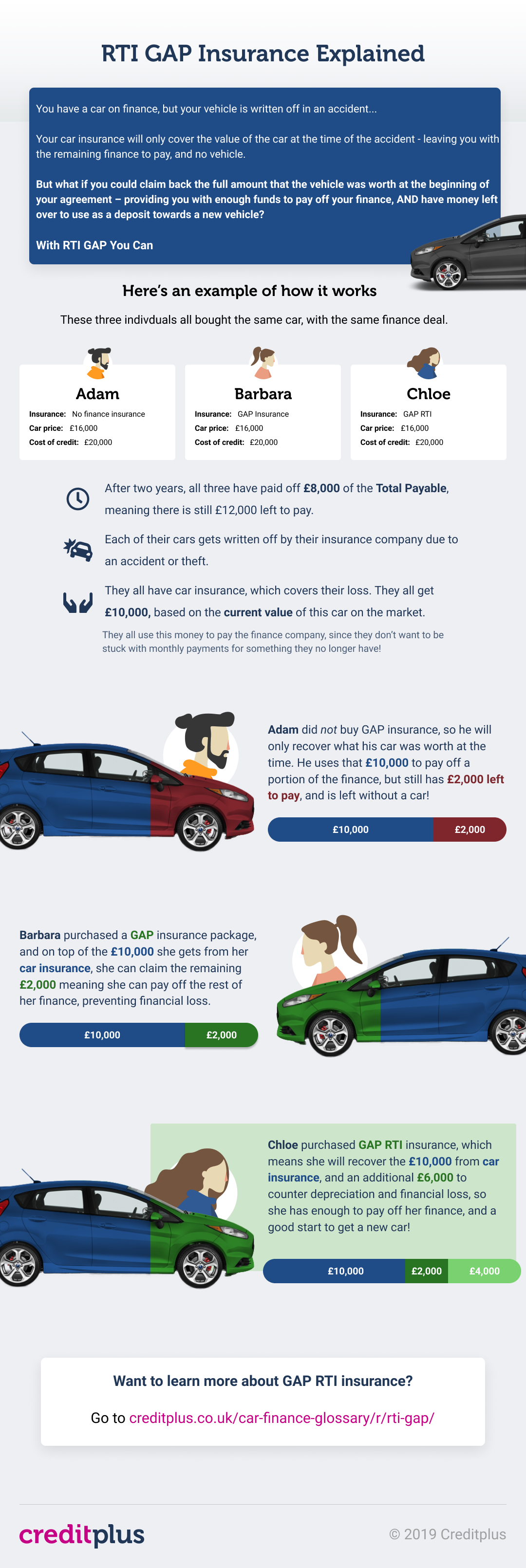

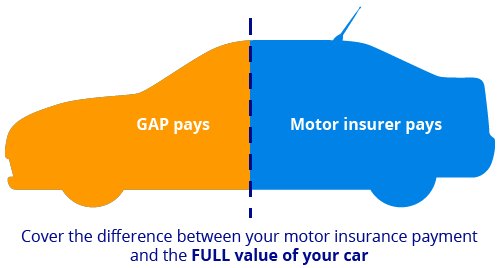

What Is Rti Gap Insurance. Rti gap insurance pays the depreciation, the difference in the loss value, which is the value of your car at time of accident or theft; There are many websites that give much information about the gap rti insurance that you should know about. For context, the idv is lesser than the invoice value of your car because of depreciation that happens over years. Incorporates return to invoice cover (rti) and guaranteed asset protection (or gap).

What is GAP Insurance? Gap Insurance Explained and the From gapinsurancetoday.co.uk

What is GAP Insurance? Gap Insurance Explained and the From gapinsurancetoday.co.uk

Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years Example of return to invoice gap insurance The return to invoice gap insurance policy is designed to get you back to the point you started by closing the gap between your motor insurance settlement and the amount you originally paid for the vehicle. Gap is suited to customers taking out a finance agreement and may pay the difference between the road risk insurance settlement and the amount your customer still owes. Another way of knowing about the rti gap insurance uk is to check out some information online. Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover?

Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover?

If your vehicle is stolen or written off in an accident, return to invoice (rti) gap insurance covers the shortfall between the vehicle’s total loss value and the original purchase price of the vehicle. Incorporates return to invoice cover (rti) and guaranteed asset protection (or gap). Example of return to invoice gap insurance Rti gap insurance pays the depreciation, the difference in the loss value, which is the value of your car at time of accident or theft; Value at the time of loss. There are many websites that give much information about the gap rti insurance that you should know about.

Source: gapinsurance.co.uk

Source: gapinsurance.co.uk

Guaranteed asset protection (gap insurance), or shortfall insurance, protects you against financial loss if your vehicle has been declared a total loss or write off by your insurer. Rti/finance gap insurance covers you for 3 years and gives you back the difference between your motor insurer�s payout and the net purchase invoice price or the outstanding finance amount (whichever is greater) so you can buy another car for the original value. Most of the time, these websites are owned by a gap insurance company in which are giving details on what their rti gap. Rti insurance (return to invoice) cover the difference between your insurance pay out and the price you paid for your vehicle. It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car.

Source: newvehiclesolutions.co.uk

Source: newvehiclesolutions.co.uk

Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover? Subject to the claims limit as shown on your policy schedule , if your vehicle is declared a total loss by a vehicle insurer as a result of a fire, theft, or the vehicle sustaining damage (following an accident, or due to malicious damage or a flood), It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car. Invoice price (purchase price) £6500. Rti insurance (return to invoice) cover the difference between your insurance pay out and the price you paid for your vehicle.

Source: bemoto.uk

Source: bemoto.uk

Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years If you opt for rti This is not available for used cars or any on contract hire or finance lease. Gap insurance (guaranteed asset protection) cover the difference between your insurance pay out and the remaining cost of your finance agreement. Gap is suited to customers taking out a finance agreement and may pay the difference between the road risk insurance settlement and the amount your customer still owes.

Source: chrisknott.co.uk

Source: chrisknott.co.uk

Rti gap insurance pays the depreciation, the difference in the loss value, which is the value of your car at time of accident or theft; Cover the difference between the remainder of your finance agreement and what your insurers pay out after a write off. In the event of a write off vehicle replacement insurance will cover the difference between your motor insurance payout and the cost of replacing your vehicle to the exact specification, even if the price of the new replacement car has increased. However it can only be bought within 3 months of buying the car. So by doing this, you can get all your purchase price back, if you paid cash, or pay off the finance and whatever is left is your deposit for your new vehicle.

Source: travelvos.blogspot.com

If you opt for rti For context, the idv is lesser than the invoice value of your car because of depreciation that happens over years. Gap insurance is not a replacement for existing motor insurance policy, but a valuable supplement that protects you against serious financial loss if. This is not available for used cars or any on contract hire or finance lease. Rvi insurance (replacement vehicle insurance)

Source: mbgdirect.com

Source: mbgdirect.com

Value at the time of loss. Example of return to invoice gap insurance Once again, take a look: About your insurance welcome to your ultimate protection combined rti/gap insurance policy. Gap insurance is not a replacement for existing motor insurance policy, but a valuable supplement that protects you against serious financial loss if.

Source: creditplus.co.uk

Source: creditplus.co.uk

Return to invoice gap insurance covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle y. Rti gap insurance is a vehicle protection insurance plan that fills the financial deficit often left when insurance company settlements are lower than expected upon a total loss insurance claim. Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years Example of return to invoice gap insurance Return to invoice gap insurance covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle y.

Source: youtube.com

Source: youtube.com

Gap insurance (guaranteed asset protection) cover the difference between your insurance pay out and the remaining cost of your finance agreement. Guaranteed asset protection (gap insurance), or shortfall insurance, protects you against financial loss if your vehicle has been declared a total loss or write off by your insurer. Rti insurance means you’d get back what you paid for your car. However it can only be bought within 3 months of buying the car. It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car.

Source: closemotorfinance.co.uk

However it can only be bought within 3 months of buying the car. Gap insurance (guaranteed asset protection) cover the difference between your insurance pay out and the remaining cost of your finance agreement. Example of return to invoice gap insurance Rti gap insurance is a vehicle protection insurance plan that fills the financial deficit often left when insurance company settlements are lower than expected upon a total loss insurance claim. There are five main types of gap insurance.

Source: click4gap.co.uk

Source: click4gap.co.uk

Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover? The return to invoice gap insurance policy is designed to get you back to the point you started by closing the gap between your motor insurance settlement and the amount you originally paid for the vehicle. Rti gap insurance the financial shortfall between the amount received from the motor insurance policy in the event of the vehicle being a total loss following damage, fire or theft and the amount originally paid for the vehicle up to the maximum stated in the policy schedule. Rti gap insurance is a vehicle protection insurance plan that fills the financial deficit often left when insurance company settlements are lower than expected upon a total loss insurance claim. Gap insurance is not a replacement for existing motor insurance policy, but a valuable supplement that protects you against serious financial loss if.

Source: creditplus.co.uk

Source: creditplus.co.uk

Another way of knowing about the rti gap insurance uk is to check out some information online. Cover the difference between the value you bought your car for, and what your insurers pay out after a write off. Return to invoice gap insurance covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle y. So by doing this, you can get all your purchase price back, if you paid cash, or pay off the finance and whatever is left is your deposit for your new vehicle. Rti/finance gap insurance covers you for 3 years and gives you back the difference between your motor insurer�s payout and the net purchase invoice price or the outstanding finance amount (whichever is greater) so you can buy another car for the original value.

Source: creditplus.co.uk

Source: creditplus.co.uk

Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years Once again, take a look: Gap insurance is not a replacement for existing motor insurance policy, but a valuable supplement that protects you against serious financial loss if. Rti gap insurance the financial shortfall between the amount received from the motor insurance policy in the event of the vehicle being a total loss following damage, fire or theft and the amount originally paid for the vehicle up to the maximum stated in the policy schedule. Return to invoice gap insurance covers the difference between your insurer’s payout and either the price you originally paid or the amount needed to settle y.

Source: gapinsurancetoday.co.uk

Source: gapinsurancetoday.co.uk

There are five main types of gap insurance. Invoice price (purchase price) £6500. There are many websites that give much information about the gap rti insurance that you should know about. Once again, take a look: Most of the time, these websites are owned by a gap insurance company in which are giving details on what their rti gap.

Source: youtube.com

Source: youtube.com

Example of return to invoice gap insurance Most of the time, these websites are owned by a gap insurance company in which are giving details on what their rti gap. Cover the difference between the remainder of your finance agreement and what your insurers pay out after a write off. Cover the difference between the value you bought your car for, and what your insurers pay out after a write off. Invoice price (purchase price) £6500.

Source: closemotorfinance.co.uk

Return to invoice cover (rti) if your car is written off or a total loss, an rti policy will pay the difference between the original purchase price and the payout received from your insurer. Rti cover could reimburse any difference between the road risk insurance settlement and original vehicle price. So by doing this, you can get all your purchase price back, if you paid cash, or pay off the finance and whatever is left is your deposit for your new vehicle. Rvi insurance (replacement vehicle insurance) Gap insurance is not a replacement for existing motor insurance policy, but a valuable supplement that protects you against serious financial loss if.

Source: platinummotorgroup.co.uk

Source: platinummotorgroup.co.uk

Guaranteed asset protection (gap insurance), or shortfall insurance, protects you against financial loss if your vehicle has been declared a total loss or write off by your insurer. Rti insurance means you’d get back what you paid for your car. Rvi insurance (replacement vehicle insurance) Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover?

Source: confused.com

Source: confused.com

Rti gap covers you for a maximum of 36 months includes £250 towards your motor insurance policy excess we’ll negotiate with your insurer on your behalf to get the best settlement price for your vehicle to start your cover, please call us on 0333 321 6059 eligibility and exclusions are you eligible for return to invoice gap cover? In the event of a write off vehicle replacement insurance will cover the difference between your motor insurance payout and the cost of replacing your vehicle to the exact specification, even if the price of the new replacement car has increased. It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car. Rti gap insurance pays the depreciation, the difference in the loss value, which is the value of your car at time of accident or theft; Get an instant gap insurance quote car van bike £ provides return to invoice gap protection for up to 4 years

Source: confused.com

Source: confused.com

Subject to the claims limit as shown on your policy schedule , if your vehicle is declared a total loss by a vehicle insurer as a result of a fire, theft, or the vehicle sustaining damage (following an accident, or due to malicious damage or a flood), It pays the difference between your car insurance claim settlement amount and the amount you paid for the car, the invoice amount for the car. So by doing this, you can get all your purchase price back, if you paid cash, or pay off the finance and whatever is left is your deposit for your new vehicle. Rti insurance (return to invoice) cover the difference between your insurance pay out and the price you paid for your vehicle. Cover the difference between the value you bought your car for, and what your insurers pay out after a write off.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is rti gap insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information