What is self funded insurance Idea

Home » Trending » What is self funded insurance IdeaYour What is self funded insurance images are ready in this website. What is self funded insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is self funded insurance files here. Download all free photos.

If you’re searching for what is self funded insurance images information connected with to the what is self funded insurance topic, you have come to the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

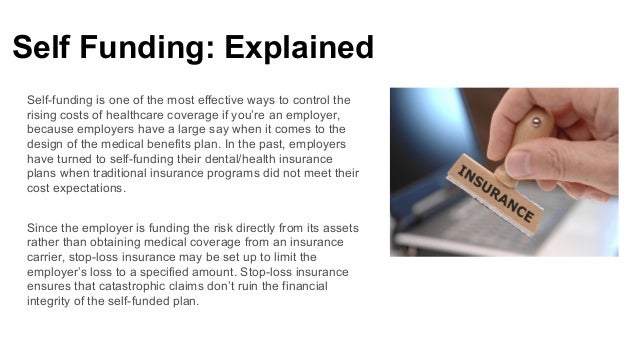

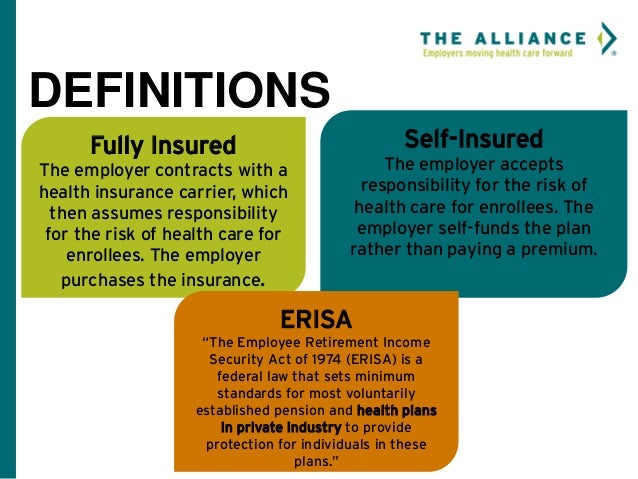

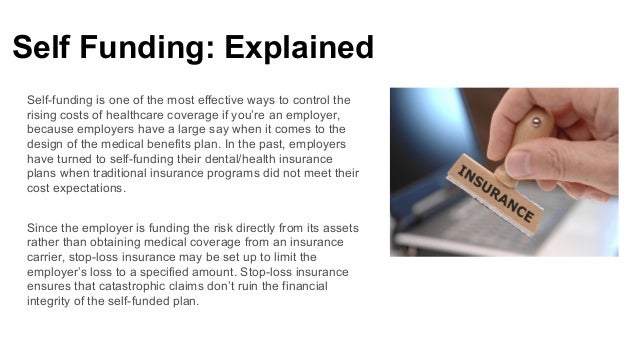

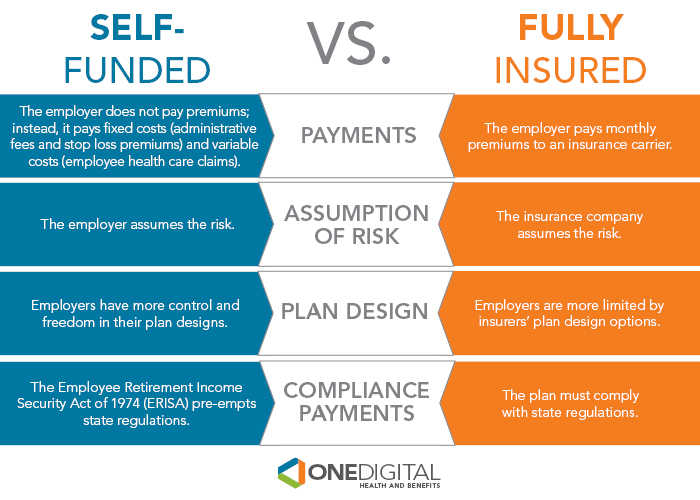

What Is Self Funded Insurance. That means the employer pays health claims based on the healthcare that’s used. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. This is a popular choice among large companies.

The Benefits of SelfFunded Health Insurance From slideshare.net

The Benefits of SelfFunded Health Insurance From slideshare.net

Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. Employers can reduce health costs by educating and giving incentives for. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. That means the employer pays health claims based on the healthcare that’s used. This is a popular choice among large companies.

This is a popular choice among large companies.

That means the employer pays health claims based on the healthcare that’s used. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Employers can reduce health costs by educating and giving incentives for. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most.

Source: slideshare.net

Source: slideshare.net

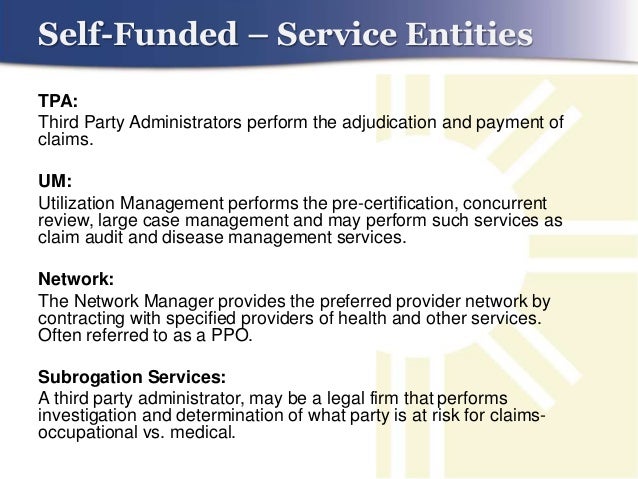

Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. You pay an employee’s claims directly from the money you have set aside for them on a monthly basis. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Employers can reduce health costs by educating and giving incentives for. This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Source: slideshare.net

Source: slideshare.net

This is a popular choice among large companies. This is a popular choice among large companies. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,.

Source: tehcpa.net

Source: tehcpa.net

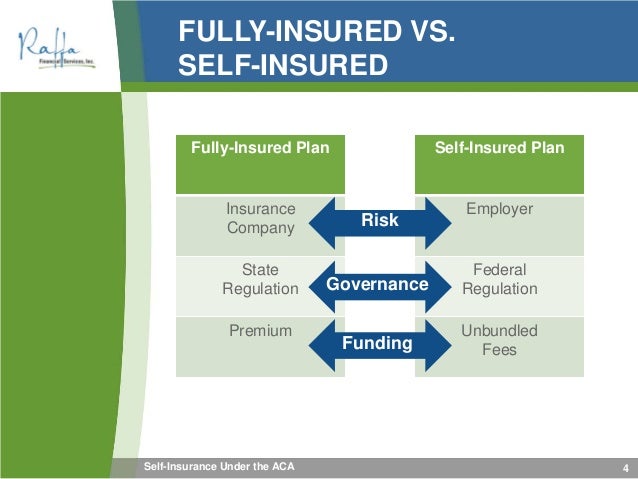

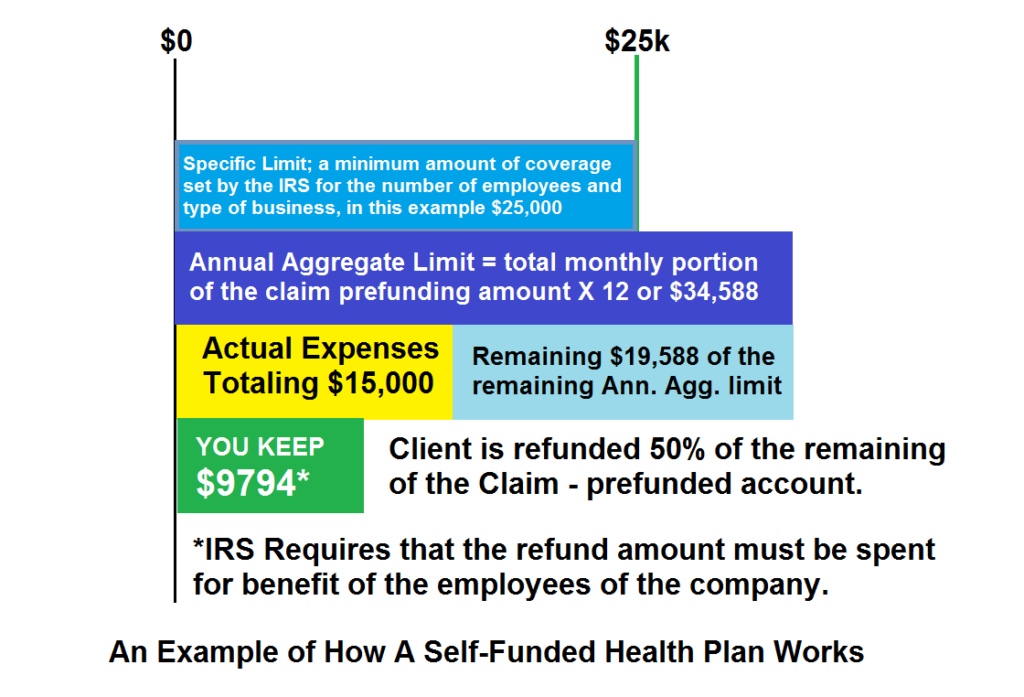

Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. This is a popular choice among large companies. The insurance company manages the payments, but the employer is the one who pays the claims. Specific coverage insures individual claims, while aggregate coverage insures group claims. You pay an employee’s claims directly from the money you have set aside for them on a monthly basis.

You pay an employee’s claims directly from the money you have set aside for them on a monthly basis. This is a popular choice among large companies. Employers can reduce health costs by educating and giving incentives for. You pay an employee’s claims directly from the money you have set aside for them on a monthly basis. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and.

Source: slideshare.net

Source: slideshare.net

Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Specific coverage insures individual claims, while aggregate coverage insures group claims. This is a popular choice among large companies. That means the employer pays health claims based on the healthcare that’s used. Employers can reduce health costs by educating and giving incentives for.

Source: bluelinemgt.com

Source: bluelinemgt.com

Specific coverage insures individual claims, while aggregate coverage insures group claims. Employers can reduce health costs by educating and giving incentives for. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. You pay an employee’s claims directly from the money you have set aside for them on a monthly basis. That means the employer pays health claims based on the healthcare that’s used.

Source: prodigystoploss.com

Source: prodigystoploss.com

Employers can reduce health costs by educating and giving incentives for. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. This is a popular choice among large companies. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. You pay an employee’s claims directly from the money you have set aside for them on a monthly basis.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Specific coverage insures individual claims, while aggregate coverage insures group claims. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The insurance company manages the payments, but the employer is the one who pays the claims. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

The insurance company manages the payments, but the employer is the one who pays the claims. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Specific coverage insures individual claims, while aggregate coverage insures group claims. The insurance company manages the payments, but the employer is the one who pays the claims. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most.

Source: olympiabenefits.com

Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Employers can reduce health costs by educating and giving incentives for. The insurance company manages the payments, but the employer is the one who pays the claims. Specific coverage insures individual claims, while aggregate coverage insures group claims. That means the employer pays health claims based on the healthcare that’s used.

Source: grantsmith.com

Source: grantsmith.com

The insurance company manages the payments, but the employer is the one who pays the claims. Employers can reduce health costs by educating and giving incentives for. The insurance company manages the payments, but the employer is the one who pays the claims. Specific coverage insures individual claims, while aggregate coverage insures group claims. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and.

Source: slideshare.net

Source: slideshare.net

Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. That means the employer pays health claims based on the healthcare that’s used. This is a popular choice among large companies. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Specific coverage insures individual claims, while aggregate coverage insures group claims.

Source: networkhealth.com

Source: networkhealth.com

You pay an employee’s claims directly from the money you have set aside for them on a monthly basis. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Employers can reduce health costs by educating and giving incentives for. Specific coverage insures individual claims, while aggregate coverage insures group claims.

Source: precisionwellness.io

Source: precisionwellness.io

Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. The insurance company manages the payments, but the employer is the one who pays the claims. Specific coverage insures individual claims, while aggregate coverage insures group claims. Instead, premiums are paid to the employer, which the company uses to pay for medical claims.

Source: slideshare.net

Source: slideshare.net

Specific coverage insures individual claims, while aggregate coverage insures group claims. Employers can reduce health costs by educating and giving incentives for. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. The insurance company manages the payments, but the employer is the one who pays the claims. That means the employer pays health claims based on the healthcare that’s used.

Source: slideshare.net

Source: slideshare.net

Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. Specific coverage insures individual claims, while aggregate coverage insures group claims. This is a popular choice among large companies. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,.

Source: jeffreybernard.com

Source: jeffreybernard.com

Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. Employers with this type of plan take responsibility to pay for employee medical claims as they are presented, using money contributed by employees and. The insurance company manages the payments, but the employer is the one who pays the claims.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims,. Instead, premiums are paid to the employer, which the company uses to pay for medical claims. The insurance company manages the payments, but the employer is the one who pays the claims. Nearly 156,199,800 people (which equals out to just under 50% of our nation’s population), receive health insurance through their employer, according to the kaiser family’s foundation (kff) most.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is self funded insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information