What is simplified term life insurance information

Home » Trending » What is simplified term life insurance informationYour What is simplified term life insurance images are ready. What is simplified term life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What is simplified term life insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for what is simplified term life insurance images information related to the what is simplified term life insurance interest, you have pay a visit to the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

What Is Simplified Term Life Insurance. You qualify for coverage, regardless of your health. “simplified issue” means you answer a few questions about your medical history for the life insurance application, rather than undergoing a medical exam. Applicants must answer some questions about their health and lifestyle but do not have to take a medical exam. If you need coverage right away, you can get.

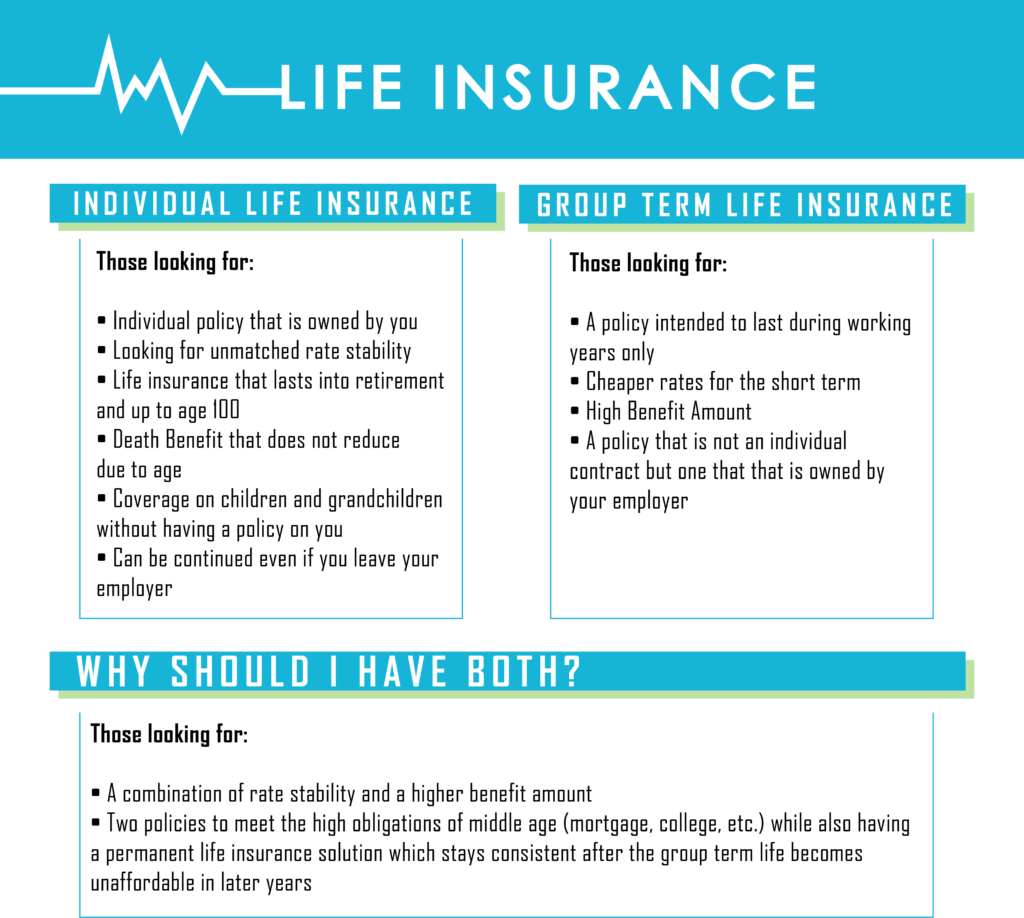

Personal Life Insurance Explained From insurechance.com

Personal Life Insurance Explained From insurechance.com

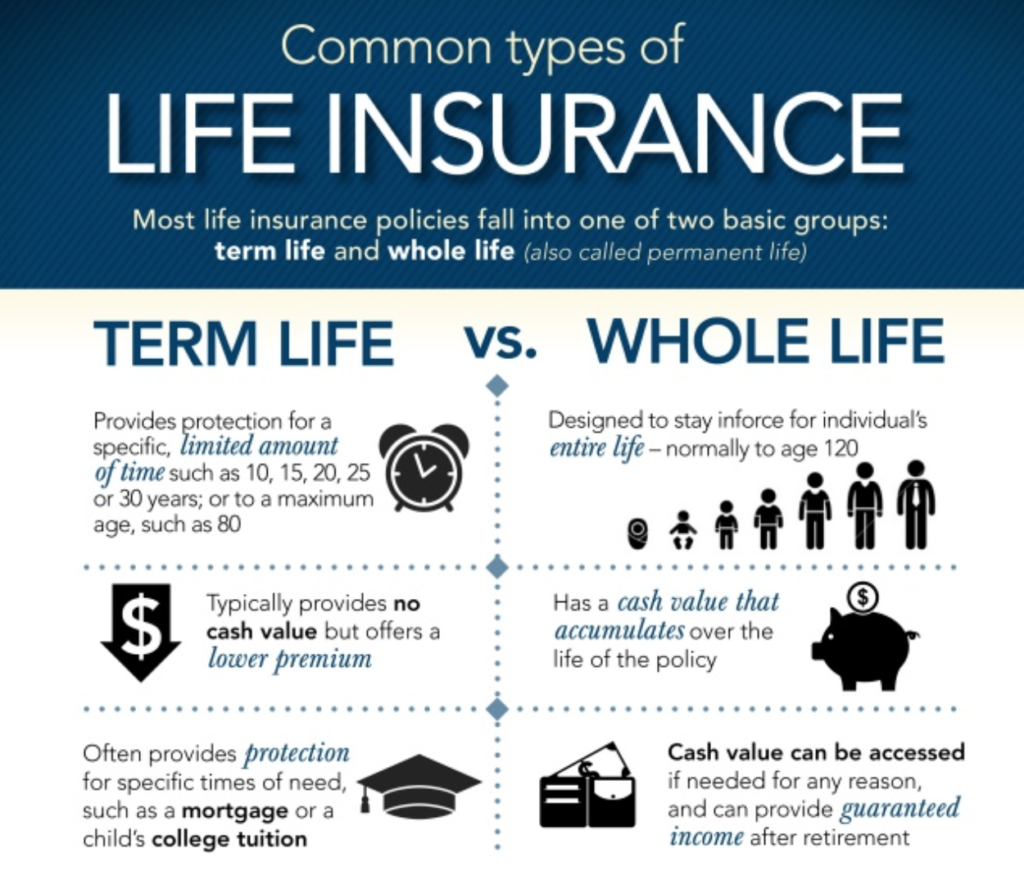

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. However, premiums are high and the coverage availability is low. Simplified issue term life insurance may be a smart alternative if you’re searching for the following: What is simplified issue life insurance, and how does it work? If you need coverage right away, you can get. 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants.

Simplified issue is a type of life insurance where the underwriting process is more streamlined and straightforward.

If you die during this time, your beneficiary receives a death benefit from the life insurance company. Simplified issue is a type of life insurance that doesn�t require a medical exam, so coverage amounts are limited. As the name suggests, simplified issue is the simplest form of underwriting. However, that isn’t always the truth. Insurance amounts of up to $10 million, with more terms, critical illness and disability riders, and competitive premiums make this a great choice for your clients who need more coverage. Simple issue term life insurance life insurance doesn’t have to be complicated.

Source: pinterest.com

Source: pinterest.com

Applicants must answer some questions about their health and lifestyle but do not have to take a medical exam. 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. Get a quote what makes it great? Simplified issue term life insurance, also referred to as no medical exam life insurance, may sound great. That’s why we offer a simple issue term life insurance policy to provide easy access to the affordable protection you need without the hassle you don’t.

Source: slideshare.net

Source: slideshare.net

This means you can apply to get life insurance faster because you don’t have to wait for exam results or go through a lengthy questionnaire about your health. Simple issue term life insurance life insurance doesn’t have to be complicated. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. However, that isn’t always the truth. Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Source: quickquote.com

If you don’t want to go through a medical exam, simplified insurance might be a good choice for you. Get a quote what makes it great? “simplified issue” means you answer a few questions about your medical history for the life insurance application, rather than undergoing a medical exam. When you fit into one or more of these scenarios, it can be tricky to qualify for traditional term or whole life insurance, but that doesn’t mean all options are exhausted when it comes to protecting your loved ones. However, premiums are high and the coverage availability is low.

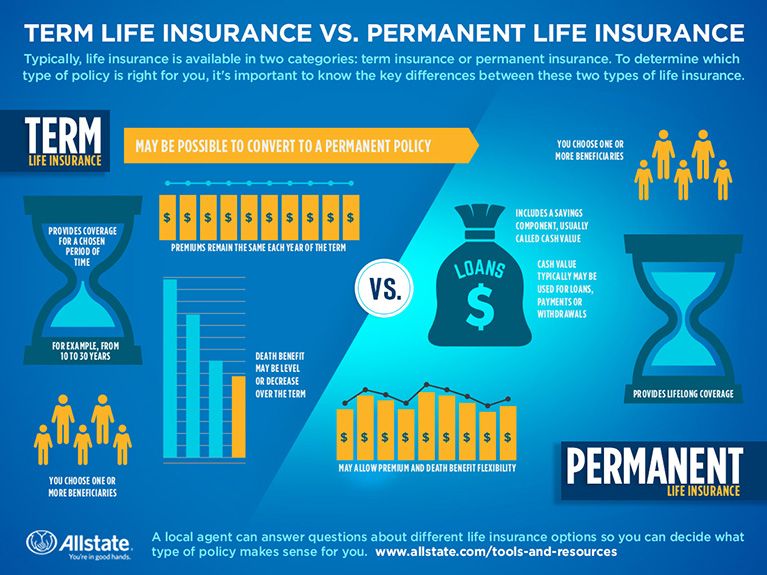

Source: allstate.com

Source: allstate.com

Term life insurance (also called pure life insurance) is a type of life insurance policy that lasts for a set number of years, or term. If you die before the term is over, the insurance company will pay the death benefit (also called payout ). Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. It�s targeted to younger, healthier people. If you don’t want to go through a medical exam, simplified insurance might be a good choice for you.

Source: noclutter.cloud

Source: noclutter.cloud

As the name suggests, simplified issue is the simplest form of underwriting. If you need coverage right away, you can get. It�s targeted to younger, healthier people. What is simplified issue life insurance, and how does it work? Simplified term life our simplified term life insurance plan provides you with all the benefits and affordability of a traditional term insurance policy with the ease and speed of simplified coverage.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

Simple issue term life insurance life insurance doesn’t have to be complicated. 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. Still, it is a significantly more expensive product that may not be worth the convenience. However, premiums are high and the coverage availability is low. No meeting with agents or filling out paperwork.

Source: pinterest.com

Source: pinterest.com

Simplified issue term life insurance, also referred to as no medical exam life insurance, may sound great. What is simplified issue life insurance, and how does it work? Simplified issue life insurance can be a good life insurance choice for both seniors and individuals with health problems. Providing protection for your family should relieve stress, not create it. However, that isn’t always the truth.

Source: youtube.com

Source: youtube.com

If you die during this time, your beneficiary receives a death benefit from the life insurance company. However, that isn’t always the truth. But if you qualify, you can get coverage similar to standard term policies without the wait and paperwork. 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Source: noclutter.cloud

Source: noclutter.cloud

Simplified issue term life insurance may be a smart alternative if you’re searching for the following: Get a quote what makes it great? Simplified term life insurance is an uncomplicated type of life insurance because it doesn’t require a medical exam or as many health questions as other types of life insurance. Simplified whole life insurance, also called simplified issue life insurance, is a type of final expense insurance. “simplified issue” means you answer a few questions about your medical history for the life insurance application, rather than undergoing a medical exam.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Term protection with up to $1,000,000 in coverage. “guaranteed issue” means you don’t have to answer any medical questions or go through a medical exam. Simple issue term life insurance life insurance doesn’t have to be complicated. This means you can apply to get life insurance faster because you don’t have to wait for exam results or go through a lengthy questionnaire about your health. These policies may be more costly than others, and a medical exam to get a life insurance policy usually takes less than an hour.

Source: pinterest.com

Source: pinterest.com

This means you can apply to get life insurance faster because you don’t have to wait for exam results or go through a lengthy questionnaire about your health. When you fit into one or more of these scenarios, it can be tricky to qualify for traditional term or whole life insurance, but that doesn’t mean all options are exhausted when it comes to protecting your loved ones. What is simplified issue life insurance, and how does it work? However, premiums are high and the coverage availability is low. Term protection with up to $1,000,000 in coverage.

Source: insurance-companies.co

Source: insurance-companies.co

5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. If you are in your 40s and have delayed getting life insurance, simplified issue. However, premiums are high and the coverage availability is low. 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. This means you can apply to get life insurance faster because you don’t have to wait for exam results or go through a lengthy questionnaire about your health.

Source: pinterest.com

Source: pinterest.com

Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. But if you qualify, you can get coverage similar to standard term policies without the wait and paperwork. Get a quote what makes it great? Providing protection for your family should relieve stress, not create it.

Source: pinterest.com

Source: pinterest.com

Simplified term life insurance is an uncomplicated type of life insurance because it doesn’t require a medical exam or as many health questions as other types of life insurance. If you need coverage right away, you can get. Most people confuse it as being the same as a no exam life insurance policy; 5 rows simplified issue term life insurance is a no medical examination policy that requires applicants. What is simplified issue life insurance, and how does it work?

Source: pinterest.com

Source: pinterest.com

Simplified issue life insurance can be a good life insurance choice for both seniors and individuals with health problems. Term plus life insurance term plus offers maximum options and flexibility to perfectly adjust to your clients’ circumstances and stage of life. Simplified whole life insurance, also called simplified issue life insurance, is a type of final expense insurance. Simplified term life our simplified term life insurance plan provides you with all the benefits and affordability of a traditional term insurance policy with the ease and speed of simplified coverage. Get a quote what makes it great?

Source: noclutter.cloud

Source: noclutter.cloud

Simplified issue life insurance can be a good life insurance choice for both seniors and individuals with health problems. These policies may be more costly than others, and a medical exam to get a life insurance policy usually takes less than an hour. You qualify for coverage, regardless of your health. If you need coverage right away, you can get. Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years.

Source: insurechance.com

Source: insurechance.com

Increasing term is a type of term life insurance, which means it lasts for a specific period, such as 10, 20 or 30 years. Term protection with up to $1,000,000 in coverage. It�s targeted to younger, healthier people. That’s why we offer a simple issue term life insurance policy to provide easy access to the affordable protection you need without the hassle you don’t. Term plus life insurance term plus offers maximum options and flexibility to perfectly adjust to your clients’ circumstances and stage of life.

Source: policybazaar.com

Source: policybazaar.com

If you die during this time, your beneficiary receives a death benefit from the life insurance company. This means you can apply to get life insurance faster because you don’t have to wait for exam results or go through a lengthy questionnaire about your health. Simplified issue term life insurance, also referred to as no medical exam life insurance, may sound great. Still, it is a significantly more expensive product that may not be worth the convenience. No meeting with agents or filling out paperwork.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is simplified term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information