What is special event insurance Idea

Home » Trending » What is special event insurance IdeaYour What is special event insurance images are ready in this website. What is special event insurance are a topic that is being searched for and liked by netizens today. You can Get the What is special event insurance files here. Download all royalty-free images.

If you’re looking for what is special event insurance pictures information connected with to the what is special event insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

What Is Special Event Insurance. Special event insurance is designed to provide financial protection if you have to cancel or postpone a gathering due to natural disasters that are outside of your control. Get an instant quote and pay online using our secure application (all major credit cards accepted). It helps safeguard your investment so you don’t lose deposits, incur additional expenses or suffer liabilities. This type of coverage must be purchased before an event takes place and is relatively inexpensive.

Why You Should Have Special Event Insurance and What Does From xinsurance.com

Why You Should Have Special Event Insurance and What Does From xinsurance.com

What does event insurance cost? However, special event coverage only covers certain types of events like weddings and banquets. Helps protect you if someone causes property damage to the venue or someone is injured at your event. Event insurance is insurance coverage for a wedding or other special event. Email proof of insurance to your venue in minutes. Special event insurance (also called event liability) provides liability coverage for third party property damage and bodily injury that could occur at your event.

It can be very affordable for a small business.

Multiple days the liability limits you choose for the policy We are the #1 preferred event insurance of venues. Moreover, claims or suits by injured attendees can be costly, particularly for a small business. Several factors affect policy costs, including: Our insurance is a+ rated. The exact cost of special event insurance varies depending on:

Source: thinkhealth.priorityhealth.com

Source: thinkhealth.priorityhealth.com

We can also include liquor liability if alcohol is being served at your event. The thing is that when you rent a venue for such events, you may have to sign a contract with the facility that owns or operates the premises. Special event insurance (also called event liability) provides liability coverage for third party property damage and bodily injury that could occur at your event. Up to $2 million in coverage can be purchased. Event weather insurance protects against adverse weather conditions that can reduce revenue from sources such as ticket sales, concessions, food and parking.

Source: coverwallet.com

Source: coverwallet.com

Email proof of insurance to your venue in minutes. Special event liability insurance (also referred to as cgl, commercial general liability or spectator liability) is an insurance policy designed to provide broad protection for situations in which an event holder or concessionaire must defend itself against lawsuits or pay damages for bodily injury or property damage to third parties. What does event insurance cost? Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows. Policies often cost less than you.

Source: alignedinsurance.com

Source: alignedinsurance.com

What does event insurance cost? Up to $2 million in coverage can be purchased. Lost or damaged photography or videography. It helps safeguard your investment so you don’t lose deposits, incur additional expenses or suffer liabilities. Helps protect you if someone causes property damage to the venue or someone is injured at your event.

Source: agencyheight.com

Source: agencyheight.com

It can be very affordable for a small business. The photographer doesn�t show up, extreme weather occurs, or the event needs to be postponed or cancelled. The exact cost of special event insurance varies depending on: Special event insurance is a must if your business plans to sponsor an event and has not already purchased a general liability policy. What does event insurance cost?

Source: healthmarkets.com

Source: healthmarkets.com

What is special event insurance? Employers’ special enrollment periods are often between 30 and 60 days. Event insurance helps protect you from liability in case someone injures themselves or damages the venue�s property. Special event insurance (also called event liability) provides liability coverage for third party property damage and bodily injury that could occur at your event. Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

It can be very affordable for a small business. The number of attendees at the event whether or not it is one day vs. Anniversary parties banquets car shows festivals prom/school dances sweet sixteen parties award presentations bar/bat mitzvahs conventions graduation parties quinceañeras tradeshows Helps protect you if someone causes property damage to the venue or someone is injured at your event. Specifically, special event insurance is a type of liability coverage that applies to claims made by third parties for bodily injury or property damage that occurs during an event.

Source: youtube.com

Source: youtube.com

Lost or damaged photography or videography. Policies often cost less than you. You can get two types of event insurance through event helper: However, special event coverage only covers certain types of events like weddings and banquets. Email proof of insurance to your venue in minutes.

![Do I Qualify for a Special Enrollment Period? [INFOGRAPHIC] Do I Qualify for a Special Enrollment Period? [INFOGRAPHIC]](https://www.healthmarkets.com/wp-content/uploads/2014/04/MiniIG-Under-65-V4-UPDATE-01.png) Source: healthmarkets.com

Source: healthmarkets.com

At events where alcohol is served, the policy should. The exact cost of special event insurance varies depending on: Just enter your event information and select coverages. Moreover, claims or suits by injured attendees can be costly, particularly for a small business. Instead, open enrollment is the standard time of year when you can make changes to your health coverage.

Source: portieragency.com

Source: portieragency.com

Policies often cost less than you. It helps safeguard your investment so you don’t lose deposits, incur additional expenses or suffer liabilities. The photographer doesn�t show up, extreme weather occurs, or the event needs to be postponed or cancelled. Up to $2 million in coverage can be purchased. What is special event insurance?

Source: worldinsurance.com

Source: worldinsurance.com

No, open enrollment isn’t a qualifying event for a special enrollment period. Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows. We can also include liquor liability if alcohol is being served at your event. Specifically, special event insurance is a type of liability coverage that applies to claims made by third parties for bodily injury or property damage that occurs during an event. Get a quote and purchase coverage online today!

Source: friendsforeverplus.blogspot.com

Source: friendsforeverplus.blogspot.com

Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows. We can also include liquor liability if alcohol is being served at your event. Our insurance is a+ rated. Get an instant quote and pay online using our secure application (all major credit cards accepted). Policies often cost less than you.

Source: solidhealthinsurance.com

Source: solidhealthinsurance.com

Our insurance is a+ rated. Several factors affect policy costs, including: Special event insurance is designed to provide financial protection if you have to cancel or postpone a gathering due to natural disasters that are outside of your control. Get an instant quote and pay online using our secure application (all major credit cards accepted). Up to $2 million in coverage can be purchased.

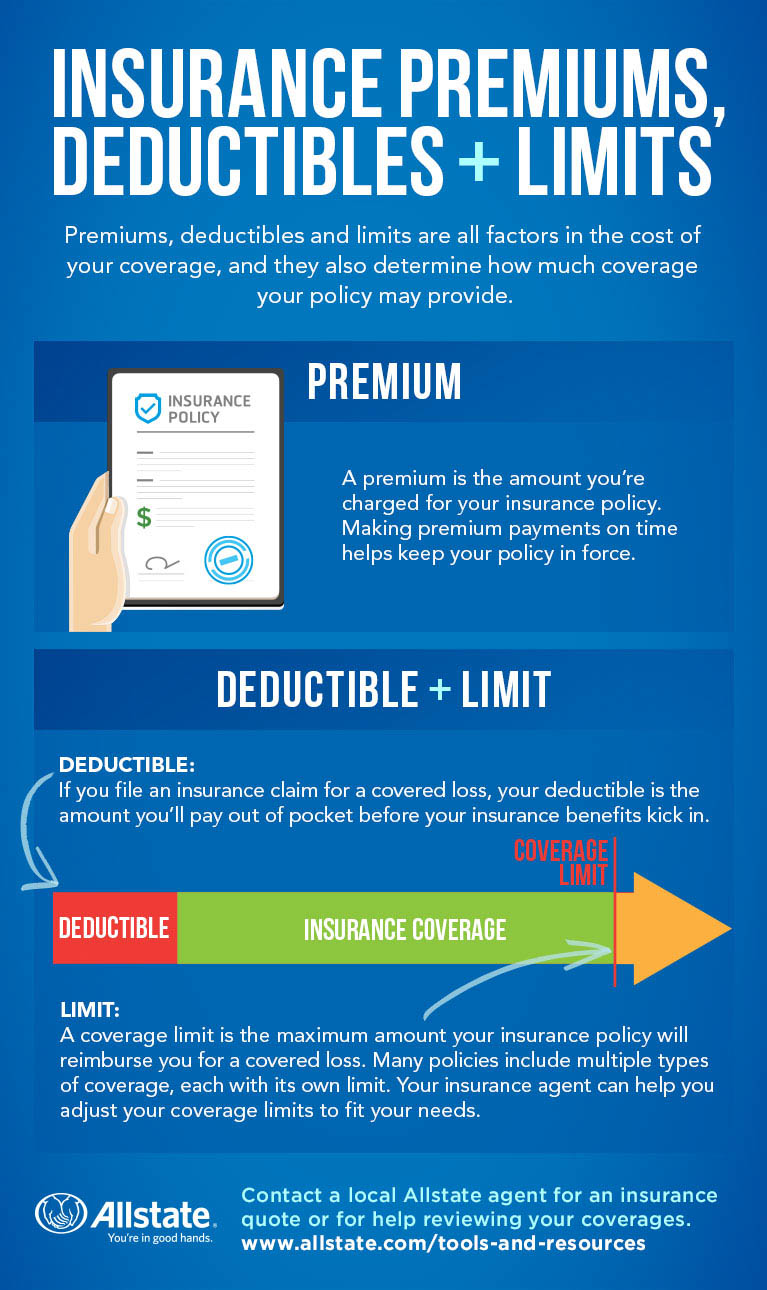

Source: allstate.com

Source: allstate.com

What is special event insurance? What is special event insurance? Moreover, claims or suits by injured attendees can be costly, particularly for a small business. Lost or damaged photography or videography. The photographer doesn�t show up, extreme weather occurs, or the event needs to be postponed or cancelled.

Source: allstate.com

Source: allstate.com

The photographer doesn�t show up, extreme weather occurs, or the event needs to be postponed or cancelled. Employers’ special enrollment periods are often between 30 and 60 days. Get a quote and purchase coverage online today! Coverage can be purchased anytime up to 14 days before your event, and policies can start as low as $130. Moreover, claims or suits by injured attendees can be costly, particularly for a small business.

Source: usamutualins.com

Source: usamutualins.com

Event insurance is insurance coverage for a wedding or other special event. Event insurance is insurance coverage for a wedding or other special event. What is special event insurance? Many venue owners will not rent their facility to you unless you provide proof of liability insurance. It helps safeguard your investment so you don’t lose deposits, incur additional expenses or suffer liabilities.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows. Though most often thought of in relation to weddings, special event insurance can be used to cover a 50 th anniversary party, a bar mitzvah, a graduation party or any occasion. Typical buyers of event weather insurance include fairs, festivals, concerts, parades and air shows. It helps safeguard your investment so you don’t lose deposits, incur additional expenses or suffer liabilities. What does event insurance cost?

Source: openpr.com

Source: openpr.com

Several factors affect policy costs, including: You can get two types of event insurance through event helper: Get an instant quote and pay online using our secure application (all major credit cards accepted). Many venue owners will not rent their facility to you unless you provide proof of liability insurance. Event insurance is insurance coverage for a wedding or other special event.

Source: pinterest.com

Source: pinterest.com

Special event insurance is a must if your business plans to sponsor an event and has not already purchased a general liability policy. Employers’ special enrollment periods are often between 30 and 60 days. Special event insurance is designed to provide financial protection if you have to cancel or postpone a gathering due to natural disasters that are outside of your control. The exact cost of special event insurance varies depending on: Special event insurance (also called event liability) provides liability coverage for third party property damage and bodily injury that could occur at your event.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is special event insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information