What is sr22 insurance illinois information

Home » Trending » What is sr22 insurance illinois informationYour What is sr22 insurance illinois images are available in this site. What is sr22 insurance illinois are a topic that is being searched for and liked by netizens now. You can Find and Download the What is sr22 insurance illinois files here. Download all free images.

If you’re looking for what is sr22 insurance illinois images information connected with to the what is sr22 insurance illinois topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

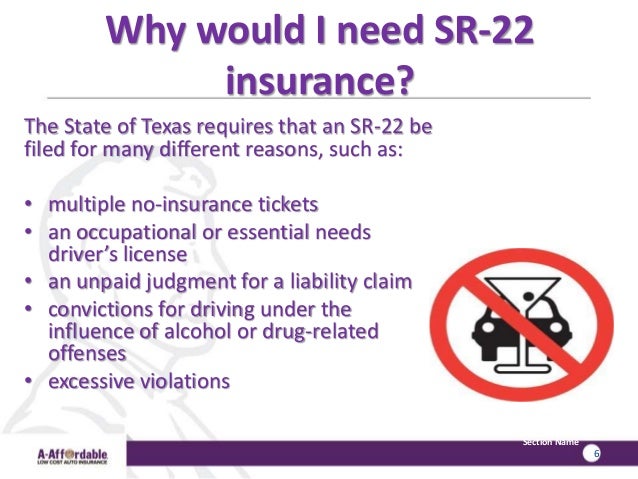

What Is Sr22 Insurance Illinois. An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. Other than the fee to file an sr22, no other additional costs are associated with having an sr22. Rs22 certificates are typically ordered by the courts. In the state of illinois, the mandatory minimum liability insurance coverage is as followed:

SR22 Insurance, What It Is and When You Need It 2017 From youtube.com

SR22 Insurance, What It Is and When You Need It 2017 From youtube.com

If you refuse to submitting a chemical test of your blood, breath, or urine the chemical test shows a bac.08% or higher any An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. Use a sr22 insurance illinois 2019 template to make your document workflow more streamlined. Your guide to sr22 insurance in illinois for 2020. The cost of sr22 insurance is determined by your state’s minimum liability requirements. Ultracar insurance works with top rated companies to find the best illinois sr22 insurance rate to suit your needs, and files your certificate quickly and accurately in as little as twenty minutes start to finish.

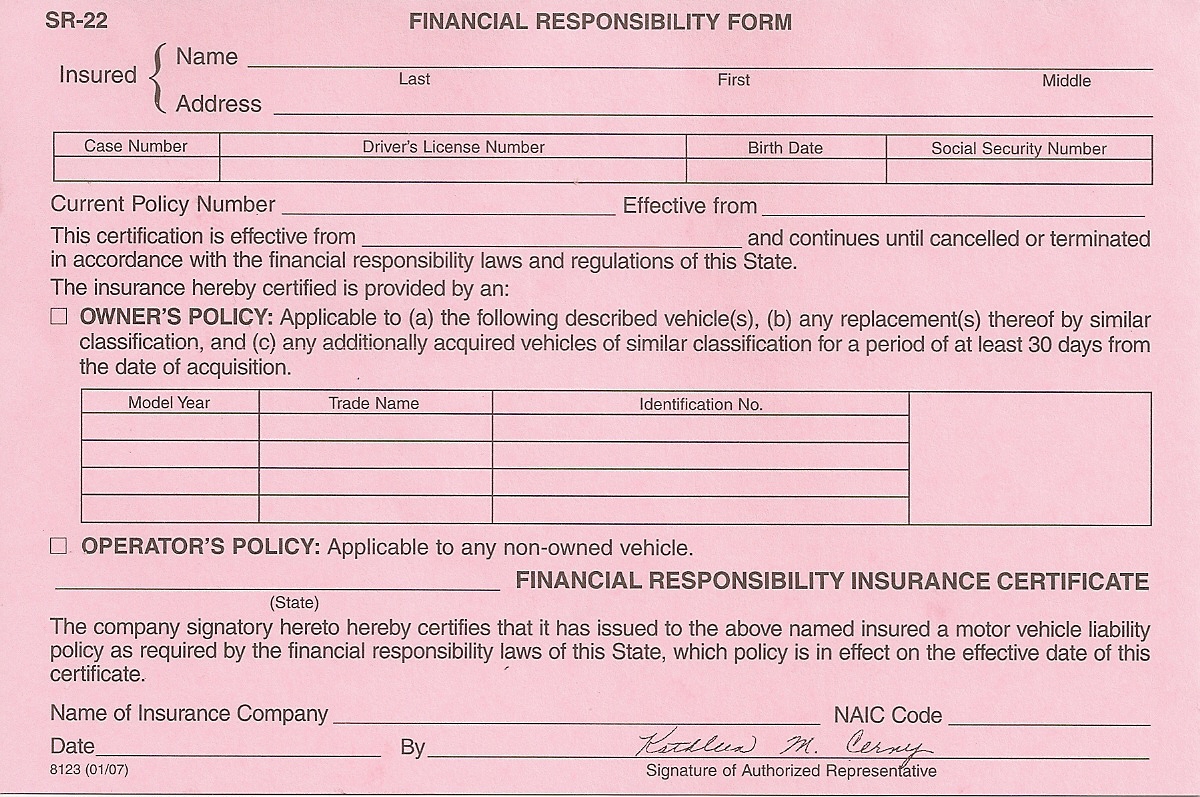

The sr22 is a form rather than an insurance policy itself.

The fee is charged separately for each individual on the policy. Sr22 insurance in illinois driving under the influence (dui) in illinois what is statutory summary suspension? Failure to do so will result in a driver’s license suspension. $50,000 for bodily injury per accident. Sr22 illinois is an automobile liability insurance policy required by the office of the department of motor vehicles of the state of illinois in the united states. The form is the insurance company’s voucher that proves that a driver has liability coverage.

Source: youtube.com

Source: youtube.com

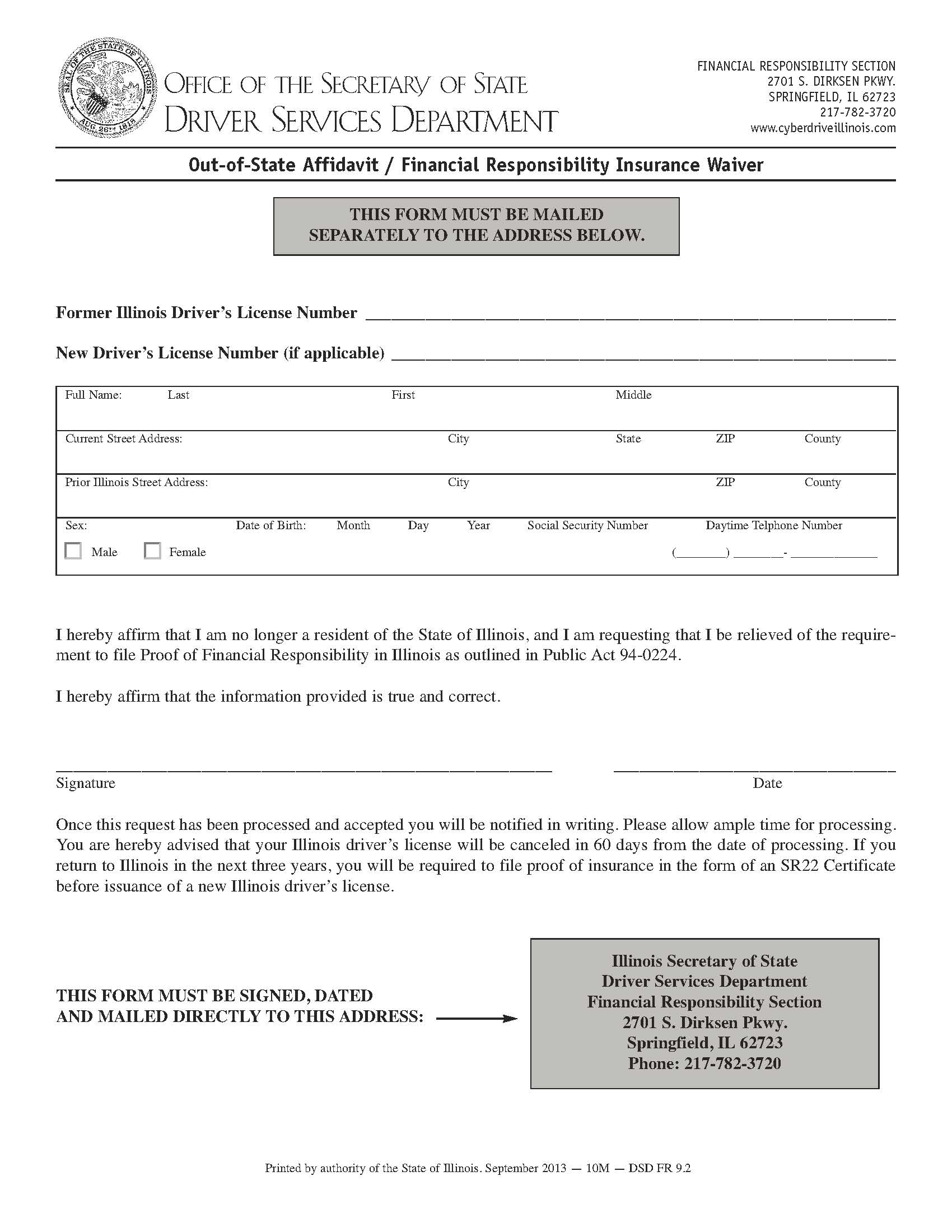

An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. Use a sr22 insurance illinois 2019 template to make your document workflow more streamlined. How much is sr22 insurance in illinois? The secretary of state’s office may have required you to obtain sr22 insurance in illinois if your driver’s license has been suspended or revoked. Sr22 illinois is an automobile liability insurance policy required by the office of the department of motor vehicles of the state of illinois in the united states.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Sr22 illinois is an automobile liability insurance policy required by the office of the department of motor vehicles of the state of illinois in the united states. The issuing agency also must have a power of attorney on file in illinois. The form is the insurance company’s voucher that proves that a driver has liability coverage. Illinois insurance center is an authorized company, and we serve chicago and the surrounding suburbs. Ultracar insurance works with top rated companies to find the best illinois sr22 insurance rate to suit your needs, and files your certificate quickly and accurately in as little as twenty minutes start to finish.

Source: everquote.com

Source: everquote.com

Ultracar insurance works with top rated companies to find the best illinois sr22 insurance rate to suit your needs, and files your certificate quickly and accurately in as little as twenty minutes start to finish. Sometimes this certificate is also mentioned as a record of monetary responsibility insurance. The secretary of state’s office may have required you to obtain sr22 insurance in illinois if your driver’s license has been suspended or revoked. An sr22 filing can be requested from an insurance company. $50,000 for bodily injury per accident.

Source: sr22insurancenow.com

Source: sr22insurancenow.com

Your guide to sr22 insurance in illinois for 2020. A driver’s license gets suspended under the following reasons: The sr22 is a form rather than an insurance policy itself. What is illinois sr22 insurance? If your policy lapsed or is canceled, your auto insurance company is required (4).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Sr22 illinois is an automobile liability insurance policy required by the office of the department of motor vehicles of the state of illinois in the united states. The certificate is intended for high risk insurance workers in the state. A driver’s license gets suspended under the following reasons: Because sr22 insurance is only available from authorized companies, you need to find one of these companies to write your sr22 policy. Sr22 is a relatively inexpensive certificate, costing anywhere from $17 to $45.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The fee is charged separately for each individual on the policy. An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. The form is the insurance company’s voucher that proves that a driver has liability coverage. Drunk driving, driving uninsured and exceeding beyond the minimum traffic violations over a specific period of time. Ultracar insurance works with top rated companies to find the best illinois sr22 insurance rate to suit your needs, and files your certificate quickly and accurately in as little as twenty minutes start to finish.

Source: sr22insurancenow.com

Source: sr22insurancenow.com

Rs22 certificates are typically ordered by the courts. If your policy lapsed or is canceled, your auto insurance company is required (4). Your license can be suspended for 6 or 36 months based on the following scenarios: Your guide to sr22 insurance in illinois for 2020. Sr22 insurance in illinois driving under the influence (dui) in illinois what is statutory summary suspension?

Source: pinterest.com.au

Source: pinterest.com.au

The secretary of state’s office may have required you to obtain sr22 insurance in illinois if your driver’s license has been suspended or revoked. Sr22 insurance in illinois driving under the influence (dui) in illinois what is statutory summary suspension? Since sr22 insurance is just a filing attached to your auto insurance, the cost of an sr22 policy is the same as the cost of an auto insurance policy plus about a $20, one time, filing fee. Finding the best rates is crucial. The sr22 is a form rather than an insurance policy itself.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The form is the insurance company’s voucher that proves that a driver has liability coverage. $25,000 coverage for bodily injury/death of one person. The cost of sr22 insurance is determined by your state’s minimum liability requirements. The sr22 is a form rather than an insurance policy itself. The cost of sr22 insurance is determined by your state’s minimum liability requirements.

Source: breatheeasyins.com

Source: breatheeasyins.com

Rs22 certificates are typically ordered by the courts. An sr22 filing can be requested from an insurance company. Your guide to sr22 insurance in illinois for 2020. Illinois sr22 insurance can be quite costly and time consuming to shop for on your own. If your policy lapsed or is canceled, your auto insurance company is required (4).

Source: insureonthespot.com

Source: insureonthespot.com

Failure to do so will result in a driver’s license suspension. Because sr22 insurance is only available from authorized companies, you need to find one of these companies to write your sr22 policy. In the state of illinois, the mandatory minimum liability insurance coverage is as followed: Sr22 illinois is an automobile liability insurance policy required by the office of the department of motor vehicles of the state of illinois in the united states. $25,000 coverage for bodily injury/death of one person.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

The form is the insurance company’s voucher that proves that a driver has liability coverage. $50,000 for bodily injury per accident. The secretary of state’s office may have required you to obtain sr22 insurance in illinois if your driver’s license has been suspended or revoked. Your license can be suspended for 6 or 36 months based on the following scenarios: Rs22 certificates are typically ordered by the courts.

Source: wallinside.com

Source: wallinside.com

The issuing agency also must have a power of attorney on file in illinois. Rs22 certificates are typically ordered by the courts. Drunk driving, driving uninsured and exceeding beyond the minimum traffic violations over a specific period of time. If you refuse to submitting a chemical test of your blood, breath, or urine the chemical test shows a bac.08% or higher any The cost of sr22 insurance is determined by your state’s minimum liability requirements.

Source: americanautoinsurance.com

Source: americanautoinsurance.com

The state of illinois requires a minimum of 3 years sr22 filing. The fee is charged separately for each individual on the policy. An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. An sr22 filing can be requested from an insurance company. The form is the insurance company’s voucher that proves that a driver has liability coverage.

Source: youtube.com

Source: youtube.com

Ultracar insurance works with top rated companies to find the best illinois sr22 insurance rate to suit your needs, and files your certificate quickly and accurately in as little as twenty minutes start to finish. $25,000 coverage for bodily injury/death of one person. Your license can be suspended for 6 or 36 months based on the following scenarios: In most states it is exactly $25. Drunk driving, driving uninsured and exceeding beyond the minimum traffic violations over a specific period of time.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Rs22 certificates are typically ordered by the courts. $25,000 coverage for bodily injury/death of one person. We help residents all throughout the state of illinois afford sr22 insurance. $25,000 for injury to one person, $50,000 for injury to two or more people, and $20,000 for property damage. The cost of sr22 insurance is determined by your state’s minimum liability requirements.

Source: referenceinsurance.blogspot.com

Sr22 is a relatively inexpensive certificate, costing anywhere from $17 to $45. We help residents all throughout the state of illinois afford sr22 insurance. The cost of sr22 insurance is determined by your state’s minimum liability requirements. You will have to pay more only if you let your coverage lapse. Other than the fee to file an sr22, no other additional costs are associated with having an sr22.

Source: youtube.com

Source: youtube.com

A driver’s license gets suspended under the following reasons: An illinois sr22 is a certificate that is required by an individual person when convicted of a variety of traffic violations. The secretary of state’s office may have required you to obtain sr22 insurance in illinois if your driver’s license has been suspended or revoked. An sr22 filing can be requested from an insurance company. Other than the fee to file an sr22, no other additional costs are associated with having an sr22.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is sr22 insurance illinois by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information