What is stop loss insurance information

Home » Trend » What is stop loss insurance informationYour What is stop loss insurance images are ready. What is stop loss insurance are a topic that is being searched for and liked by netizens now. You can Get the What is stop loss insurance files here. Download all free photos.

If you’re searching for what is stop loss insurance images information connected with to the what is stop loss insurance keyword, you have come to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

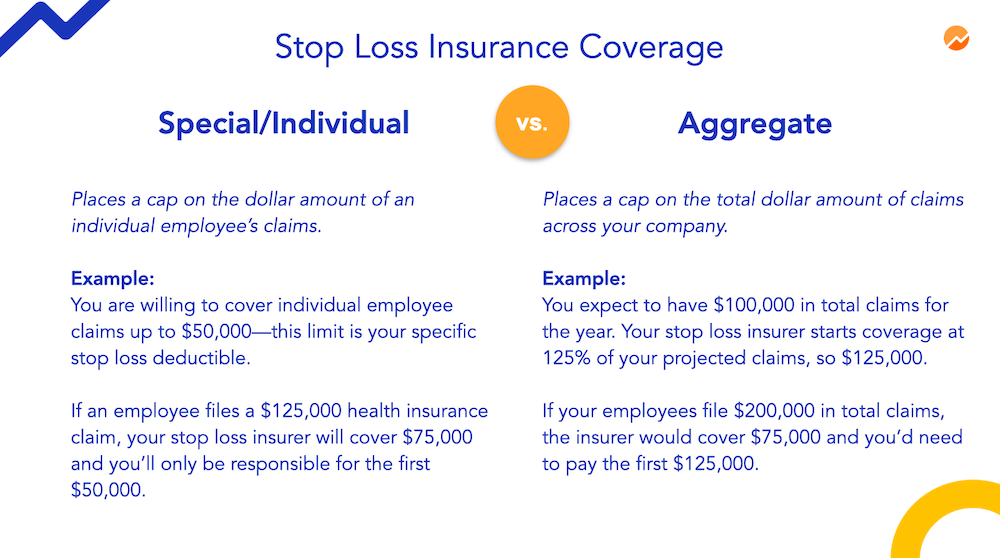

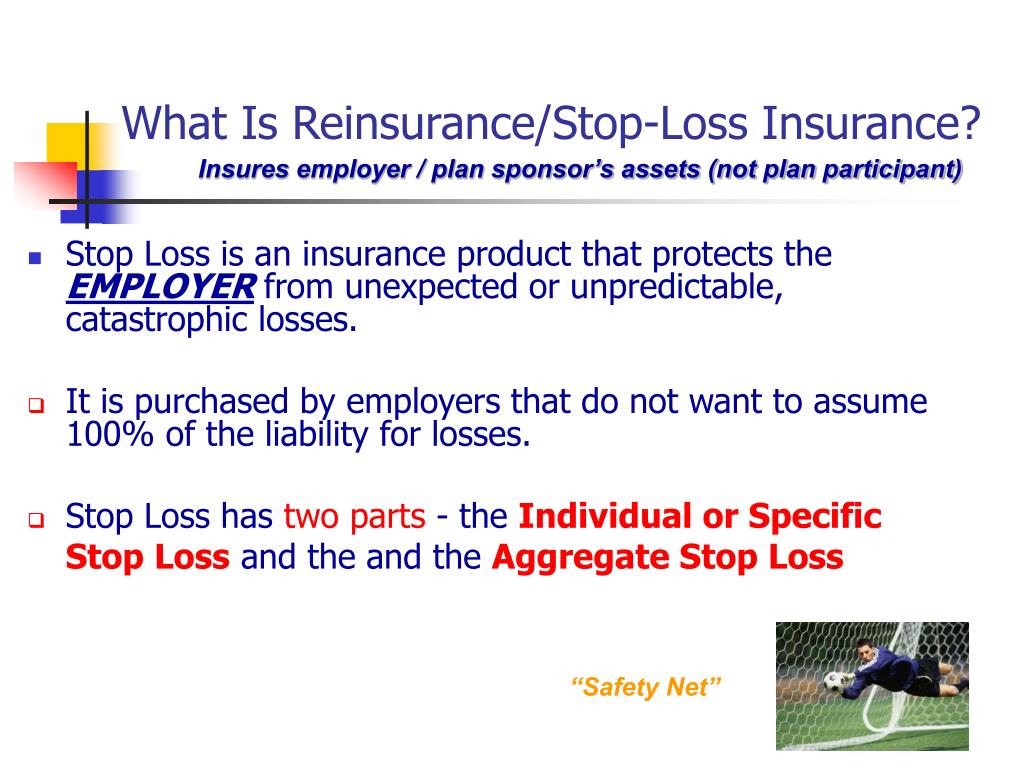

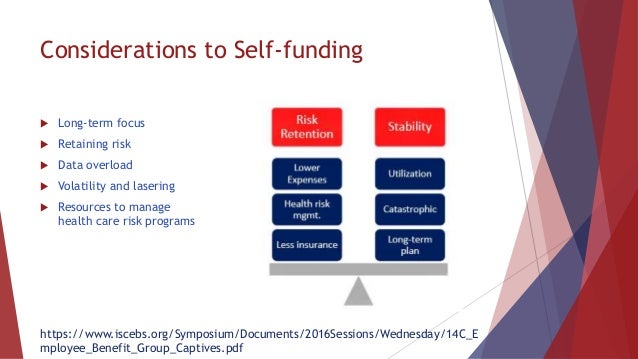

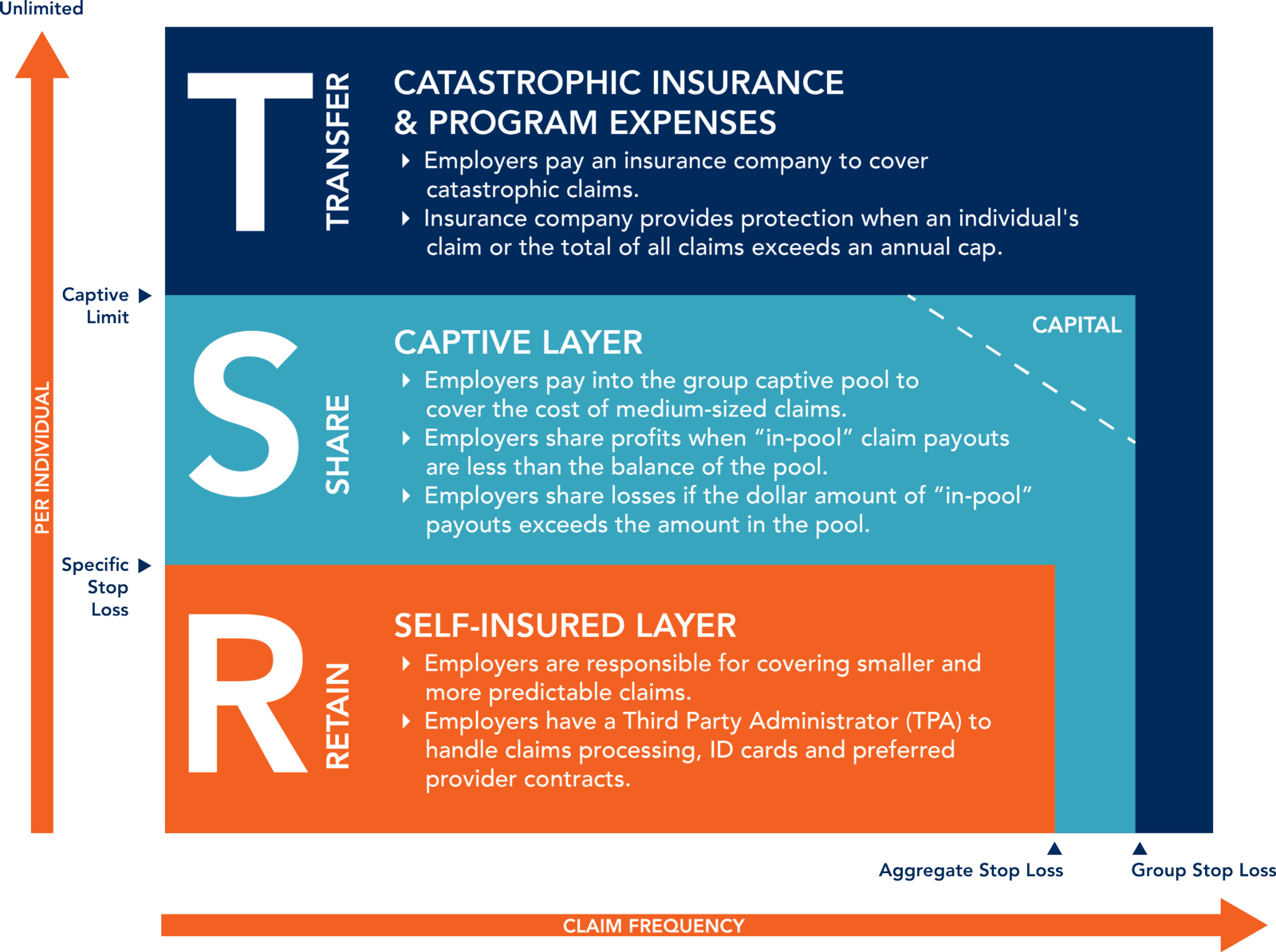

What Is Stop Loss Insurance. See also excess of loss reinsurance, which slr resembles. Check to make sure your policy has a stop loss provision so that you know exactly what you will potentially be responsible for financially in regard your medical expenses. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). It is used primarily in the healthcare and employee benefits space, by employers who have.

What is StopLoss Insurance? aka StopLoss Coverage From varipro.com

What is StopLoss Insurance? aka StopLoss Coverage From varipro.com

Reinsurance is insurance for insurance companies. It is used primarily in the healthcare and employee benefits space, by employers who have. If at the end of the year the claims experience is 95%, abc would retain 70% and recover 25% from the reinsurers. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. In a stop loss reinsurance arrangement, the reinsurer. Insurance is designed to maintain a person’s financial sense of security without having to worry about going bankrupt in the event that a major illness or injury strikes.

Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below).

The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. Reinsurance is insurance for insurance companies. The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. In a stop loss reinsurance arrangement, the reinsurer. Without this provision, the insured would.

Source: springgroup.com

Source: springgroup.com

In a stop loss reinsurance arrangement, the reinsurer. Check to make sure your policy has a stop loss provision so that you know exactly what you will potentially be responsible for financially in regard your medical expenses. If at the end of the year the claims experience is 95%, abc would retain 70% and recover 25% from the reinsurers. It is used primarily in the healthcare and employee benefits space, by employers who have. Insurance is designed to maintain a person’s financial sense of security without having to worry about going bankrupt in the event that a major illness or injury strikes.

Source: fundera.com

Source: fundera.com

Reinsurance is insurance for insurance companies. Abc insurance company has a stop loss cover of 30% xs 70% with a premium income of 100,000. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). The peak is in the second year, 1991, and goes from 1990 to 1991. Without this provision, the insured would.

Source: wincline.com

Source: wincline.com

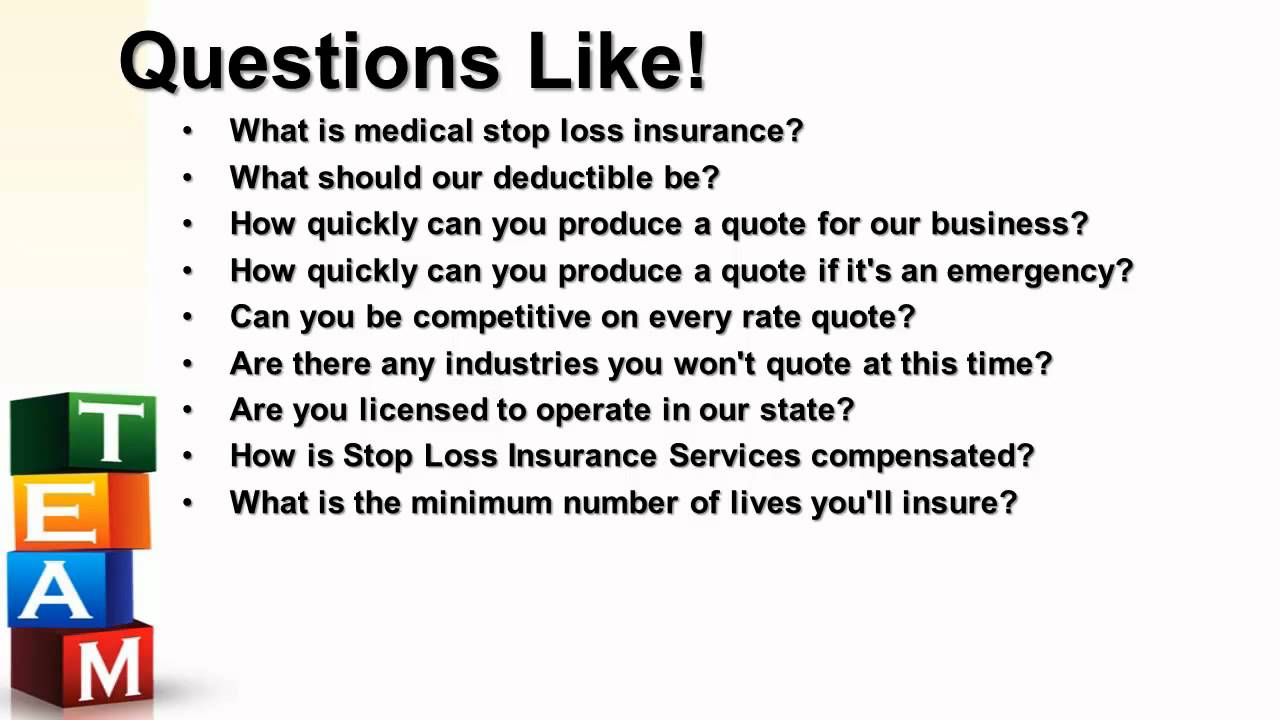

Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. See also excess of loss reinsurance, which slr resembles. What is stop loss insurance? Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses.

What is stop loss insurance? What is stop loss insurance? In a stop loss reinsurance arrangement, the reinsurer. It is used primarily in the healthcare and employee benefits space, by employers who have. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses.

Source: guardiananytime.com

Source: guardiananytime.com

In essence, this is a way for an. Check to make sure your policy has a stop loss provision so that you know exactly what you will potentially be responsible for financially in regard your medical expenses. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). Insurance is designed to maintain a person’s financial sense of security without having to worry about going bankrupt in the event that a major illness or injury strikes.

Source: guardiananytime.com

Source: guardiananytime.com

Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. In a stop loss reinsurance arrangement, the reinsurer. Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. In essence, this is a way for an.

Source: euphorahealth.com

Source: euphorahealth.com

The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. In essence, this is a way for an. Insurance is designed to maintain a person’s financial sense of security without having to worry about going bankrupt in the event that a major illness or injury strikes. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). It is used primarily in the healthcare and employee benefits space, by employers who have.

Source: youtube.com

Source: youtube.com

The peak is in the second year, 1991, and goes from 1990 to 1991. Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses. In essence, this is a way for an. Reinsurance is insurance for insurance companies.

Source: youtube.com

Source: youtube.com

The peak is in the second year, 1991, and goes from 1990 to 1991. See also excess of loss reinsurance, which slr resembles. Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. If at the end of the year the claims experience is 95%, abc would retain 70% and recover 25% from the reinsurers. In a stop loss reinsurance arrangement, the reinsurer.

Source: youtube.com

Source: youtube.com

Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. See also excess of loss reinsurance, which slr resembles. The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. It is used primarily in the healthcare and employee benefits space, by employers who have. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer.

Source: varipro.com

Source: varipro.com

Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. Without this provision, the insured would. The peak is in the second year, 1991, and goes from 1990 to 1991. It is used primarily in the healthcare and employee benefits space, by employers who have. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses.

Source: slideserve.com

Source: slideserve.com

In essence, this is a way for an. The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. Reinsurance is insurance for insurance companies. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). In essence, this is a way for an.

Source: slideshare.net

Source: slideshare.net

Without this provision, the insured would. In essence, this is a way for an. See also excess of loss reinsurance, which slr resembles. Reinsurance is insurance for insurance companies. Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses.

Source: myfindoc.com

Source: myfindoc.com

Stop loss helps to protect the employer from the financial loss associated with catastrophic claims or a multitude of unanticipated claims as well as high costs associated with unknown medical claim risks and the rising costs associated with can cer, preterm birth, transplants, etc. It is used primarily in the healthcare and employee benefits space, by employers who have. The peak is in the second year, 1991, and goes from 1990 to 1991. The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. Without this provision, the insured would.

Source: connerstrong.com

Source: connerstrong.com

The reinsurers will thus reimburse abc insurance company for 25% *100,000 = 25,000.00. Insurance is designed to maintain a person’s financial sense of security without having to worry about going bankrupt in the event that a major illness or injury strikes. Unlike conventional employee benefit insurance, stop loss insurance insures only the employer. Abc insurance company has a stop loss cover of 30% xs 70% with a premium income of 100,000. Check to make sure your policy has a stop loss provision so that you know exactly what you will potentially be responsible for financially in regard your medical expenses.

Source: yxebenefitsplan.ca

Source: yxebenefitsplan.ca

In a stop loss reinsurance arrangement, the reinsurer. If at the end of the year the claims experience is 95%, abc would retain 70% and recover 25% from the reinsurers. What is stop loss insurance? See also excess of loss reinsurance, which slr resembles. Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below).

Source: youtube.com

Source: youtube.com

Check to make sure your policy has a stop loss provision so that you know exactly what you will potentially be responsible for financially in regard your medical expenses. The peak is in the second year, 1991, and goes from 1990 to 1991. Without this provision, the insured would. What is stop loss insurance? Stop loss insurance, also known as excess insurance, is a product that provides companies protection against unpredictable or catastrophic losses.

Source: mercer.us

Source: mercer.us

Individual stop loss coverage is often combined with “aggregate” stop loss coverage (see the explanation of aggregate stop loss below). What is stop loss insurance? Abc insurance company has a stop loss cover of 30% xs 70% with a premium income of 100,000. Reinsurance is insurance for insurance companies. Without this provision, the insured would.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is stop loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information