What is straight life insurance Idea

Home » Trending » What is straight life insurance IdeaYour What is straight life insurance images are ready in this website. What is straight life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What is straight life insurance files here. Get all free vectors.

If you’re searching for what is straight life insurance pictures information related to the what is straight life insurance keyword, you have visit the right blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

What Is Straight Life Insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. What is group life insurance? With a straight life policy, a portion of your premium pays for the insurance and the rest. Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary.

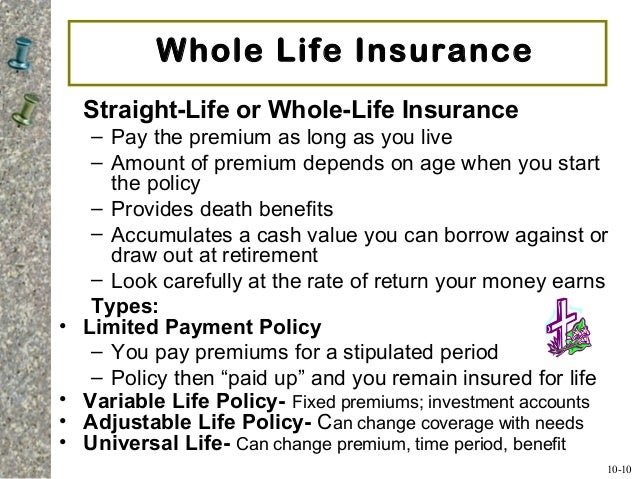

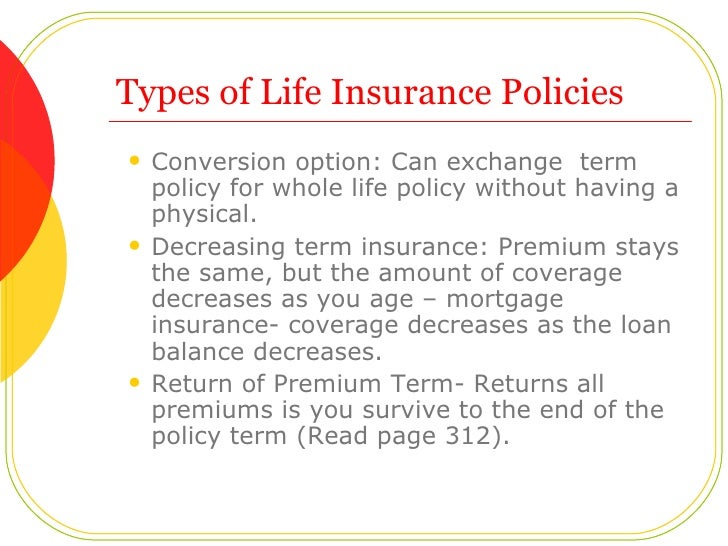

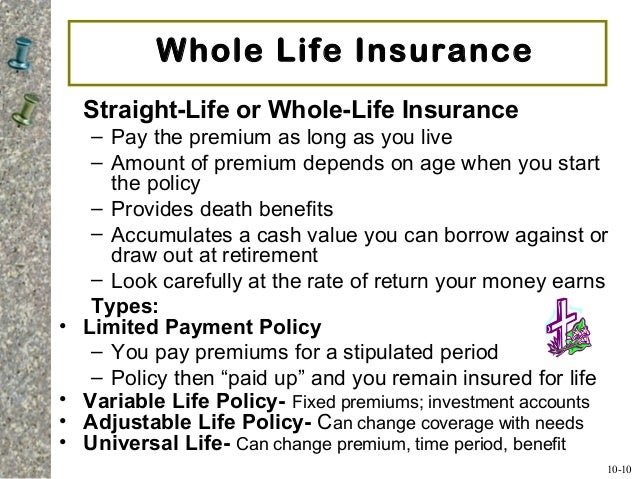

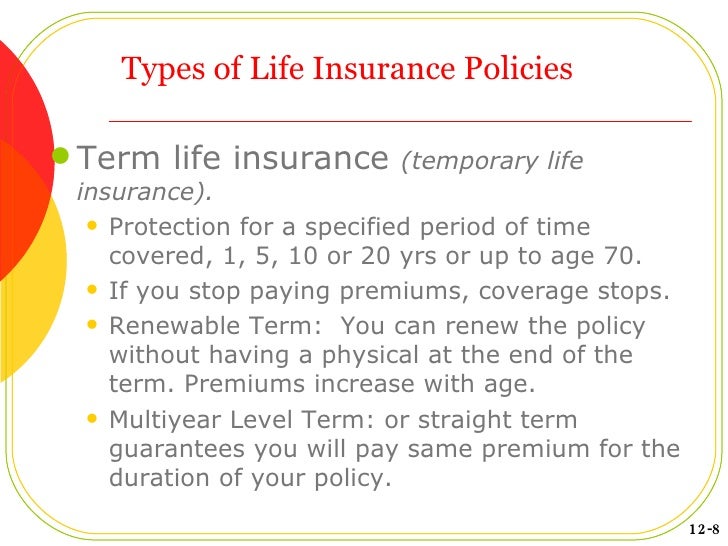

Chapter 10 From slideshare.net

Chapter 10 From slideshare.net

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured�s entire lifetime, provided required premiums are paid, or to the maturity date. What is pre existing, waiting periods and exclusions in a health insurance policy ? A decreasing annual premium for the life of the insured c. Premiums are traditionally paid annually and premiums are level for life. Straight life insurance has cash values and is sometimes used as another name for whole life. It contrasts with term life insurance, which only provides coverage for a set period, and does not include a savings component.

A straight life insurance is a type of policy that provides a lifetime’s worth of coverage for you and your loved ones.

Whole life insurance is also commonly known as ordinary life insurance or straight life insurance. It contrasts with term life insurance, which only provides coverage for a set period, and does not include a savings component. A term ticket is not a full eapp. Premiums are traditionally paid annually and premiums are level for life. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: wise-geek.com

Source: wise-geek.com

Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary. A straight life insurance policy, often known as whole life insurance, has a cash value account that increases in size as you pay premiums into the plan. However, once the individual is deceased there are no more payouts. A straight life policy has what type of premium? Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: brainly.com

Source: brainly.com

Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually. What is group life insurance? A level annual premium for the life of the insured A straight life insurance policy, often known as whole life insurance, has a cash value account that increases in size as you pay premiums into the plan. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

The premiums in this type of life insurance coverage are stable, meaning they do not change at all over time. A straight life insurance policy is one of the oldest types of insurance. A decreasing annual premium for the life of the insured c. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums. What is pre existing, waiting periods and exclusions in a health insurance policy ?

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Whole life insurance is also commonly known as ordinary life insurance or straight life insurance. Also known as whole life insurance, a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. A straight life insurance policy is one that provides lifelong coverage at a consistent premium rate. Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually. What is straight life insurance?

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Also known as whole or ordinary life insurance, the policy has a term length that lasts your entire life. A straight life policy has what type of premium? Premiums are traditionally paid annually and premiums are level for life. It’s been used for centuries to grow and protect policyholders’ money—and not just by the wealthy. Whole life insurance, sometimes called “straight life” or “ordinary life,” is a life insurance policy guaranteed to remain in force for the insured’s entire lifetime, provided required premiums are paid or to the maturity date.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually. Whole life insurance, sometimes called “straight life” or “ordinary life,” is a life insurance policy guaranteed to remain in force for the insured’s entire lifetime, provided required premiums are paid or to the maturity date. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. What is pre existing, waiting periods and exclusions in a health insurance policy ?

Source: npa1.org

Source: npa1.org

What does straight life annuity mean? A straight life insurance policy is one of the oldest types of insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. What is a straight life insurance policy and is it right for your financial goals?

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

The premium is paid for the entire lifetime of the insured. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. What is pre existing, waiting periods and exclusions in a health insurance policy ? Whole life insurance, sometimes called “straight life” or “ordinary life,” is a life insurance policy guaranteed to remain in force for the insured’s entire lifetime, provided required premiums are paid or to the maturity date.

Source: npa1.org

Source: npa1.org

Upon death, the payments stop, and you cannot designate a beneficiary with this type of insurance. A straight life insurance policy is one of the oldest types of insurance. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. The premium is paid for the entire lifetime of the insured. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured�s entire lifetime, provided required premiums are paid, or to the maturity date.

Source: atriplefullfatvent.blogspot.com

Source: atriplefullfatvent.blogspot.com

A decreasing annual premium for the life of the insured c. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. Also known as whole or ordinary life insurance, the policy has a term length that lasts your entire life. What is a straight life insurance policy and is it right for your financial goals? Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually.

Source: slideshare.net

Source: slideshare.net

A level annual premium for the life of the insured A straight life policy has what type of premium? This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Also known as whole life insurance, a straight life policy has a cash value account that grows in size as you contribute premiums to the plan.

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Source: whatisanirrevocablelifeinsurancetrust.blogspot.com

Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually. With a straight life policy, a portion of your premium pays for the insurance and the rest. Straight life insurance has cash values and is sometimes used as another name for whole life. Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary. A straight life insurance is a type of policy that provides a lifetime’s worth of coverage for you and your loved ones.

Whole life insurance is also commonly known as ordinary life insurance or straight life insurance. A straight life insurance policy is one that provides lifelong coverage at a consistent premium rate. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. A straight life insurance policy, often known as whole life insurance, has a cash value account that increases in size as you pay premiums into the plan. Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually.

Source: brainly.com

Source: brainly.com

This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. What is a straight life insurance policy and is it right for your financial goals? It contrasts with term life insurance, which only provides coverage for a set period, and does not include a savings component. An increasing annual premium for the life of the insured b. Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary.

Source: paradigmlife.net

Source: paradigmlife.net

A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A straight life insurance policy is one of the oldest types of insurance. Because the payouts will be shorter in duration, they offer the highest periodic payments. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: decisiontree.financial

Source: decisiontree.financial

A level annual premium for the life of the insured A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. A straight life insurance policy is one that provides lifelong coverage at a consistent premium rate. Straight life insurance is more commonly known as whole life insurance. What is pre existing, waiting periods and exclusions in a health insurance policy ?

Source: easyquotes4you.com

Source: easyquotes4you.com

What is pre existing, waiting periods and exclusions in a health insurance policy ? Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

Source: npa1.org

Source: npa1.org

A decreasing annual premium for the life of the insured c. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. However, once the individual is deceased there are no more payouts. A straight life policy has what type of premium? Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is straight life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information