What is suitability in insurance information

Home » Trend » What is suitability in insurance informationYour What is suitability in insurance images are available. What is suitability in insurance are a topic that is being searched for and liked by netizens now. You can Download the What is suitability in insurance files here. Download all free photos.

If you’re looking for what is suitability in insurance pictures information linked to the what is suitability in insurance topic, you have come to the ideal site. Our website always provides you with hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

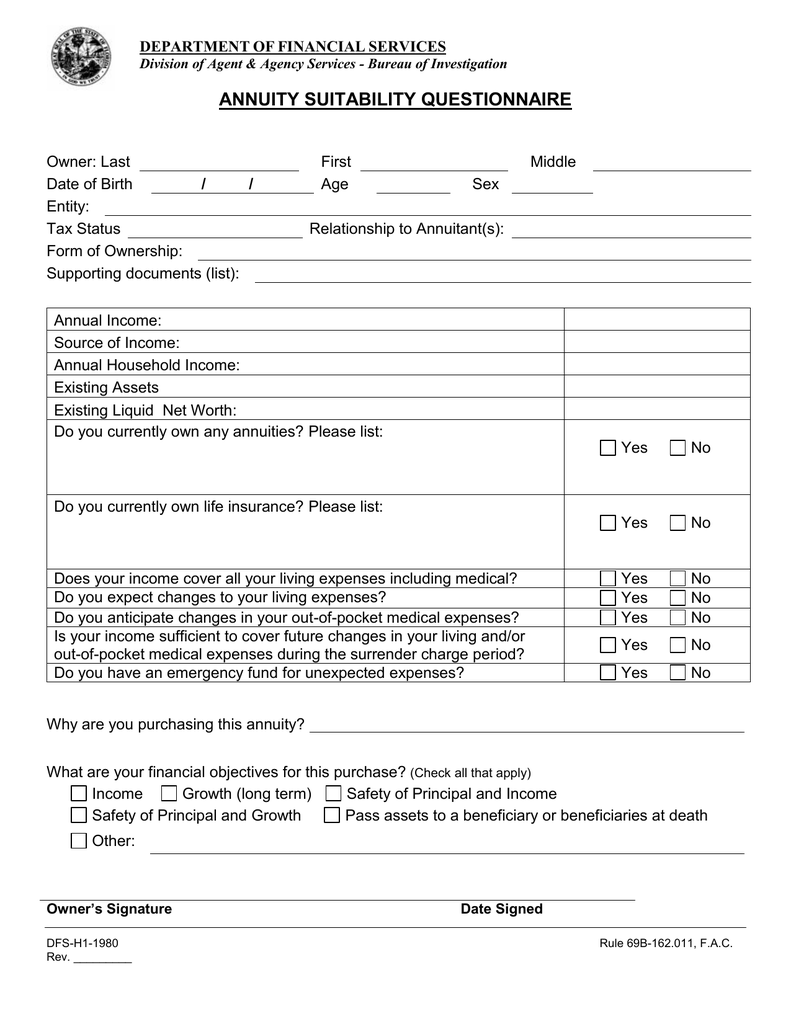

What Is Suitability In Insurance. An insurance certificate is suitable for your investment goals and financial situation. Insurance company or the insurer, agrees to compensate the loss or damage sustained to another party, i.e. As an agent, it is your job to analyze these needs and be an advocate or problem solver to make sure the requested risk has been transferred. Suitability, by definition, is the requirement to determine if a life insurance product is appropriate for a given client, based on the client�s goals and financial situation.

The coverage you opt for does impact your quotes. Moreover From pinterest.com

The coverage you opt for does impact your quotes. Moreover From pinterest.com

This doesn’t happen automatically or easily. Your agent must ask you certain questions about your financial situation, objectives, and goals. Suitability conduct in the world of insurance, client�s must decide when to insure, what to insure and how much to cover and pay. The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020. Finra rule 2111 states the customer’s investment profile “includes, but is not limited to,. It helps to cover the costs for personal injuries, loss or damage to property, and death.

I/we understand that the product(s) and fund(s) recommended to me are based on the information provided by me/us and which is considered suitable in the view and understanding of licensed intermediary and/or icici prudential.

Suitable (suitability) understanding suitable (suitability). The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020. Suitable (suitability) understanding suitable (suitability). I/we understand that the product(s) and fund(s) recommended to me are based on the information provided by me/us and which is considered suitable in the view and understanding of licensed intermediary and/or icici prudential. These are frequently the most expensive claims for businesses to defend. An insurance certificate is suitable for your investment goals and financial situation.

Source: pinterest.com

Source: pinterest.com

As an agent, it is your job to analyze these needs and be an advocate or problem solver to make sure the requested risk has been transferred. It’s the process of assuring that clients buy a life insurance or annuity product for the appropriate reasons. The tenure of these policies can range between 10 and 50 years. The financial information you share will be used by your agent to determine if the product he/s he is recommending is suitable. It helps to cover the costs for personal injuries, loss or damage to property, and death.

Source: instituteonline.com

Source: instituteonline.com

The amount you recover will Most business owners don’t feel comfortable leaving things like this to chance. The questions pertain to your personal situation at the time of this application, and to your understanding of the features of the product for which you These are frequently the most expensive claims for businesses to defend. For these people, a sale is suitable when a prospect has a certain amount of assets and income.

Source: testway.in

Source: testway.in

If someone files a product liability lawsuit against your business, product liability insurance helps cover legal, medical, and other financial costs resulting from the claim. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. This doesn’t happen automatically or easily. Insurance refers to a contractual arrangement in which one party, i.e. The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020.

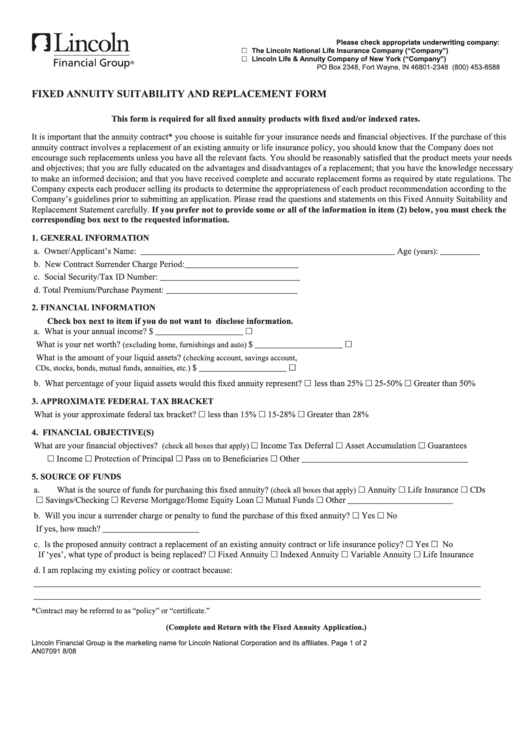

Source: formsbank.com

Source: formsbank.com

That means they fully understand its features, benefits, conditions, and limitations. The tenure of these policies can range between 10 and 50 years. The questions pertain to your personal situation at the time of this application, and to your understanding of the features of the product for which you Your agent must ask you certain questions about your financial situation, objectives, and goals. The financial information you share will be used by your agent to determine if the product he/s he is recommending is suitable.

Source: templateroller.com

Source: templateroller.com

Public liability insurance covers the cost of claims made by the public that happen in connection with your business. Your agent must ask you certain questions about your financial situation, objectives, and goals. Suitability or suitableness, noun suitably, adverb. The consumer must be the final arbiter of what is suitable and what is not. Product after understanding the suitability of the product(s) as per my/our needs.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

If the insurer that issued your life, annuity or health insurance policy becomes impaired or insolvent, you are entitled to compensation for your policy from the assets of that insurer. An insurance certificate is suitable for your investment goals and financial situation. Concurrently with the execution of this agreement, subscriber has completed and executed the suitability letter, the terms of. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. As an agent, it is your job to analyze these needs and be an advocate or problem solver to make sure the requested risk has been transferred.

Source: financialexpress.com

Source: financialexpress.com

Businesses typically choose general liability insurance rather than public liability insurance since it�s more comprehensive. We need checklists of things that can cause decisions to change. Important investor client disclosure information. The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence.

Source: pinterest.com

Source: pinterest.com

Important investor client disclosure information. The insured, by paying a definite amount, in exchange for. Your agent must ask you certain questions about your financial situation, objectives, and goals. Finra rule 2111 governs general suitability obligations, while certain securities are covered under other rules that may contain additional requirements. Read atul gawande’s the checklist manifesto.

Source: pinterest.com

Source: pinterest.com

A client views policies in terms of obtainingreduced uncertainty. Businesses typically choose general liability insurance rather than public liability insurance since it�s more comprehensive. The insured, by paying a definite amount, in exchange for. Finra rule 2111 governs general suitability obligations, while certain securities are covered under other rules that may contain additional requirements. Covers the cost of medical care.

Source: iselect.com.au

Source: iselect.com.au

Businesses typically choose general liability insurance rather than public liability insurance since it�s more comprehensive. Businesses typically choose general liability insurance rather than public liability insurance since it�s more comprehensive. Suitability, by definition, is the requirement to determine if a life insurance product is appropriate for a given client, based on the client�s goals and financial situation. The questions pertain to your personal situation at the time of this application, and to your understanding of the features of the product for which you Important investor client disclosure information.

Source: wallstreetinstructors.com

Source: wallstreetinstructors.com

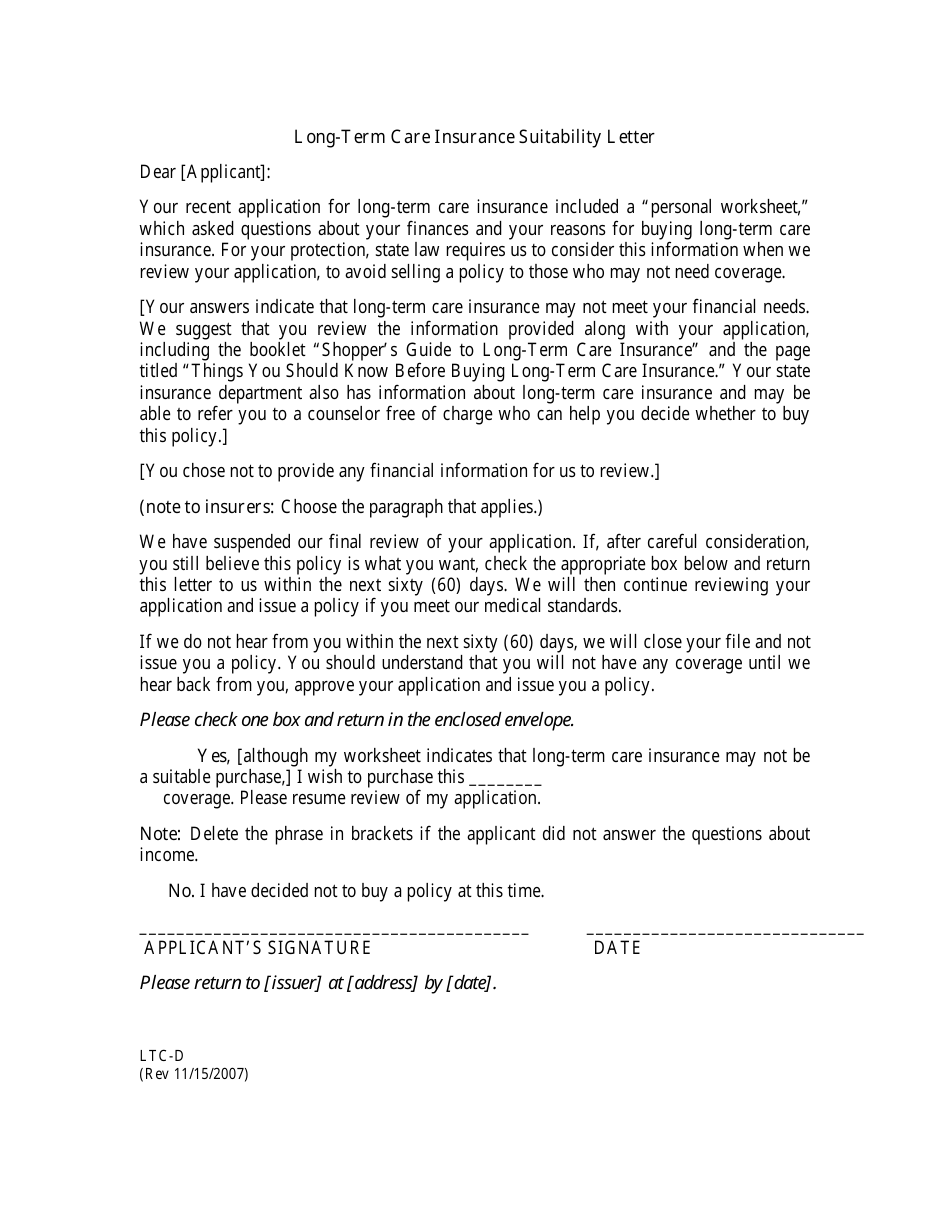

Finra rule 2111 states the customer’s investment profile “includes, but is not limited to,. That means they fully understand its features, benefits, conditions, and limitations. For your protection, state law requires us to consider this information when we The amount you recover will For these people, a sale is suitable when a prospect has a certain amount of assets and income.

Source: hubbis.com

Source: hubbis.com

If someone files a product liability lawsuit against your business, product liability insurance helps cover legal, medical, and other financial costs resulting from the claim. Read atul gawande’s the checklist manifesto. The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020. For these people, a sale is suitable when a prospect has a certain amount of assets and income. If the insurer that issued your life, annuity or health insurance policy becomes impaired or insolvent, you are entitled to compensation for your policy from the assets of that insurer.

Source: manningrushworth.co.uk

Source: manningrushworth.co.uk

The insurance company promises to pay the assured sum to cover the loss related to the vehicle, medical treatments, fire, theft, or even financial problems during travel. The tenure of these policies can range between 10 and 50 years. Insurance refers to a contractual arrangement in which one party, i.e. The insured, by paying a definite amount, in exchange for. Finra rule 2111 governs general suitability obligations, while certain securities are covered under other rules that may contain additional requirements.

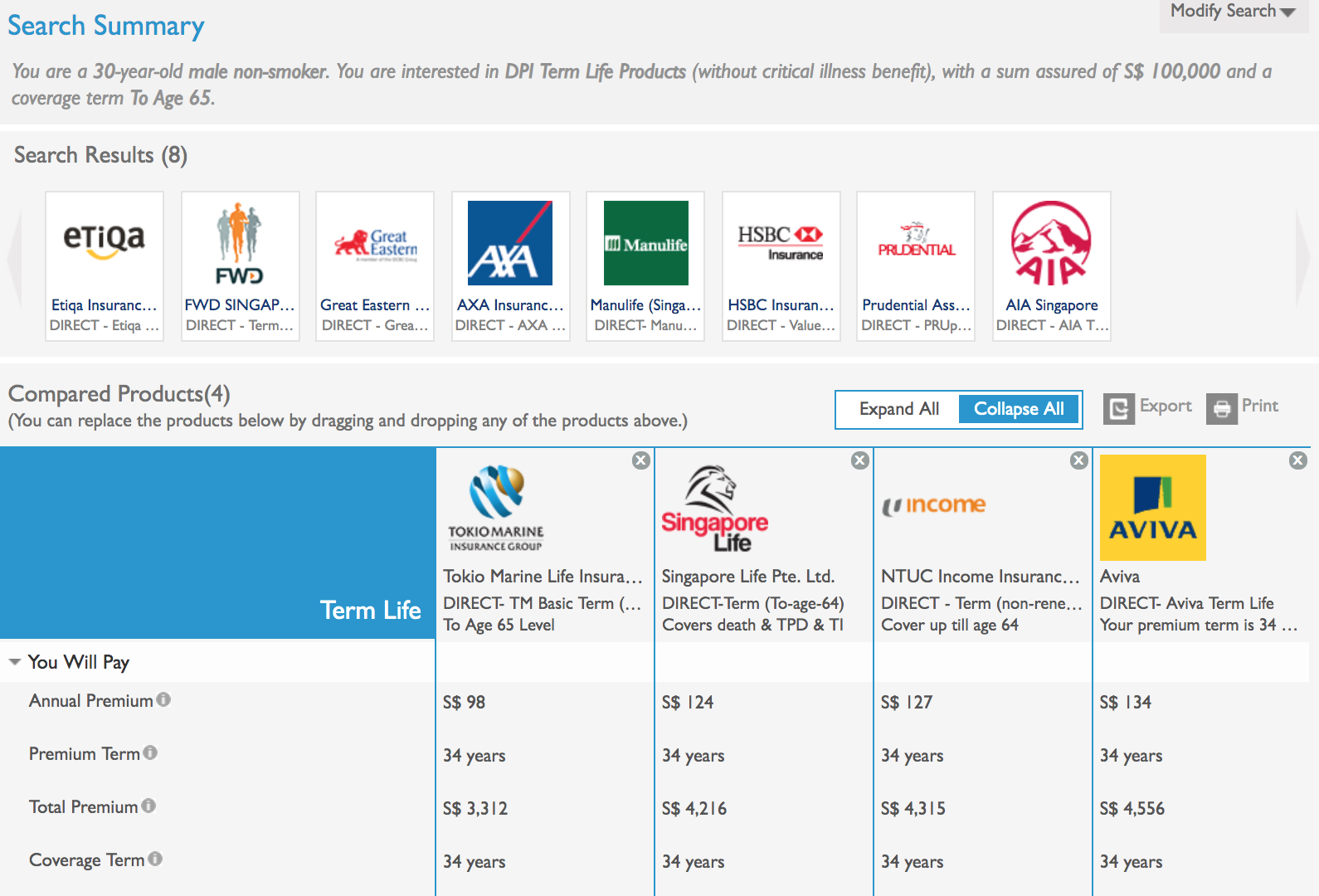

Source: asiaone.com

Source: asiaone.com

Public liability insurance covers the cost of claims made by the public that happen in connection with your business. Your agent must ask you certain questions about your financial situation, objectives, and goals. As an agent, it is your job to analyze these needs and be an advocate or problem solver to make sure the requested risk has been transferred. The questions pertain to your personal situation at the time of this application, and to your understanding of the features of the product for which you Suitability, by definition, is the requirement to determine if a life insurance product is appropriate for a given client, based on the client�s goals and financial situation.

Source: oltraining.com

Source: oltraining.com

Finra rule 2111 governs general suitability obligations, while certain securities are covered under other rules that may contain additional requirements. A client views policies in terms of obtainingreduced uncertainty. A pure term insurance plan is a traditional life insurance product that provides financial coverage to an insured’s family in the event of his death. If someone files a product liability lawsuit against your business, product liability insurance helps cover legal, medical, and other financial costs resulting from the claim. Public liability insurance covers the cost of claims made by the public that happen in connection with your business.

Source: asiaone.com

Source: asiaone.com

Public liability insurance covers the cost of claims made by the public that happen in connection with your business. If someone files a product liability lawsuit against your business, product liability insurance helps cover legal, medical, and other financial costs resulting from the claim. The financial information you share will be used by your agent to determine if the product he/s he is recommending is suitable. A pure term insurance plan is a traditional life insurance product that provides financial coverage to an insured’s family in the event of his death. The suitability in annuity transactions model regulation, commonly referred to as the naic model regulation, provided the framework when it was adopted in 2003, then was revised with enhanced standards in 2020.

Source: researchgate.net

Source: researchgate.net

For your protection, state law requires us to consider this information when we To date, 11 states have adopted the 2020 revisions to the naic model regulation, including the following: For these people, a sale is suitable when a prospect has a certain amount of assets and income. That means they fully understand its features, benefits, conditions, and limitations. Concurrently with the execution of this agreement, subscriber has completed and executed the suitability letter, the terms of.

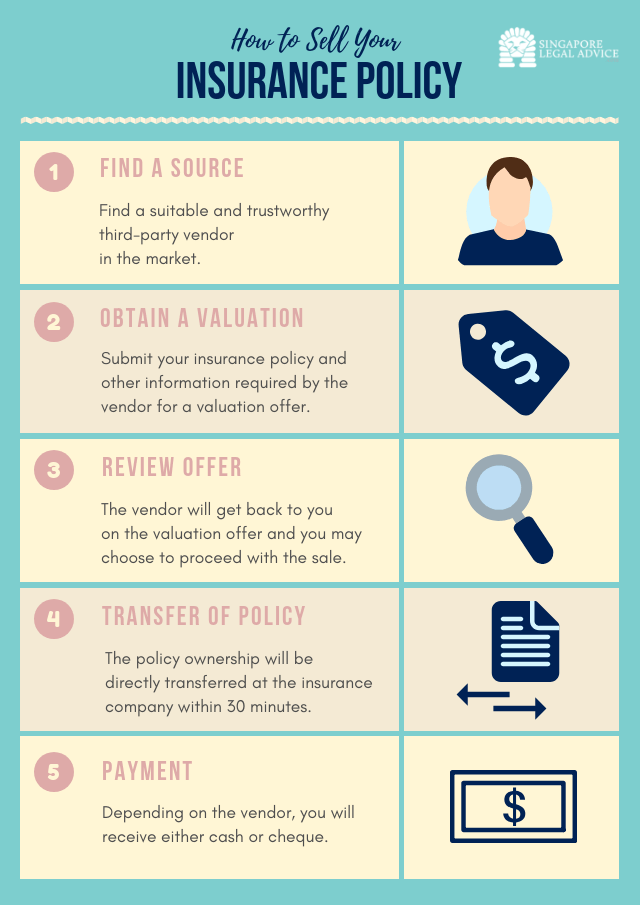

Source: pinterest.com

Source: pinterest.com

Suitability conduct in the world of insurance, client�s must decide when to insure, what to insure and how much to cover and pay. Important investor client disclosure information. An insurance certificate is suitable for your investment goals and financial situation. The financial information you share will be used by your agent to determine if the product he/s he is recommending is suitable. Suitability conduct in the world of insurance, client�s must decide when to insure, what to insure and how much to cover and pay.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is suitability in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information