What is supplemental ad d insurance information

Home » Trend » What is supplemental ad d insurance informationYour What is supplemental ad d insurance images are available. What is supplemental ad d insurance are a topic that is being searched for and liked by netizens today. You can Download the What is supplemental ad d insurance files here. Download all royalty-free images.

If you’re searching for what is supplemental ad d insurance pictures information connected with to the what is supplemental ad d insurance interest, you have visit the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video content and images that match your interests.

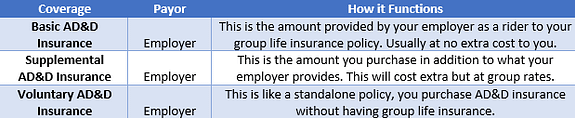

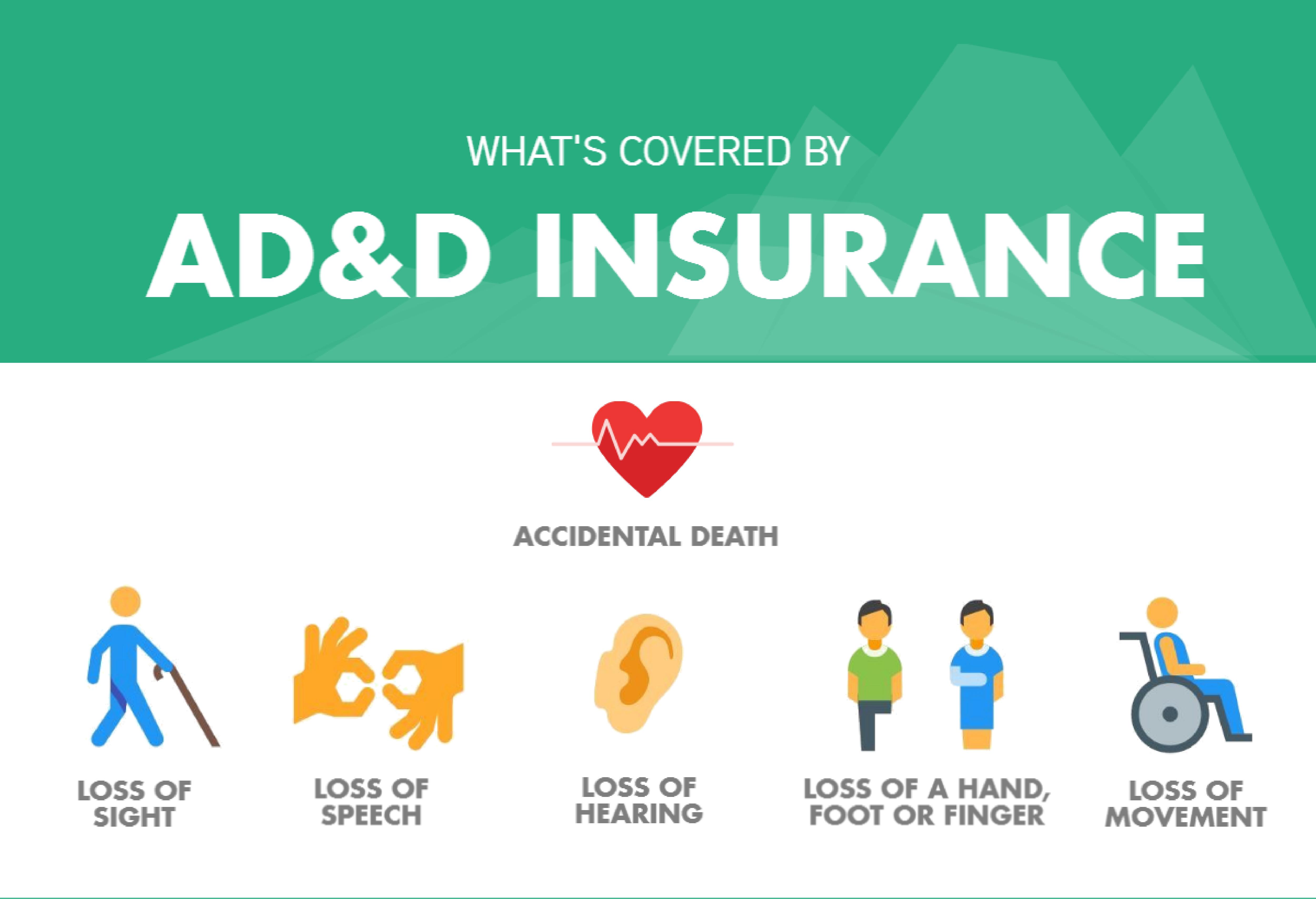

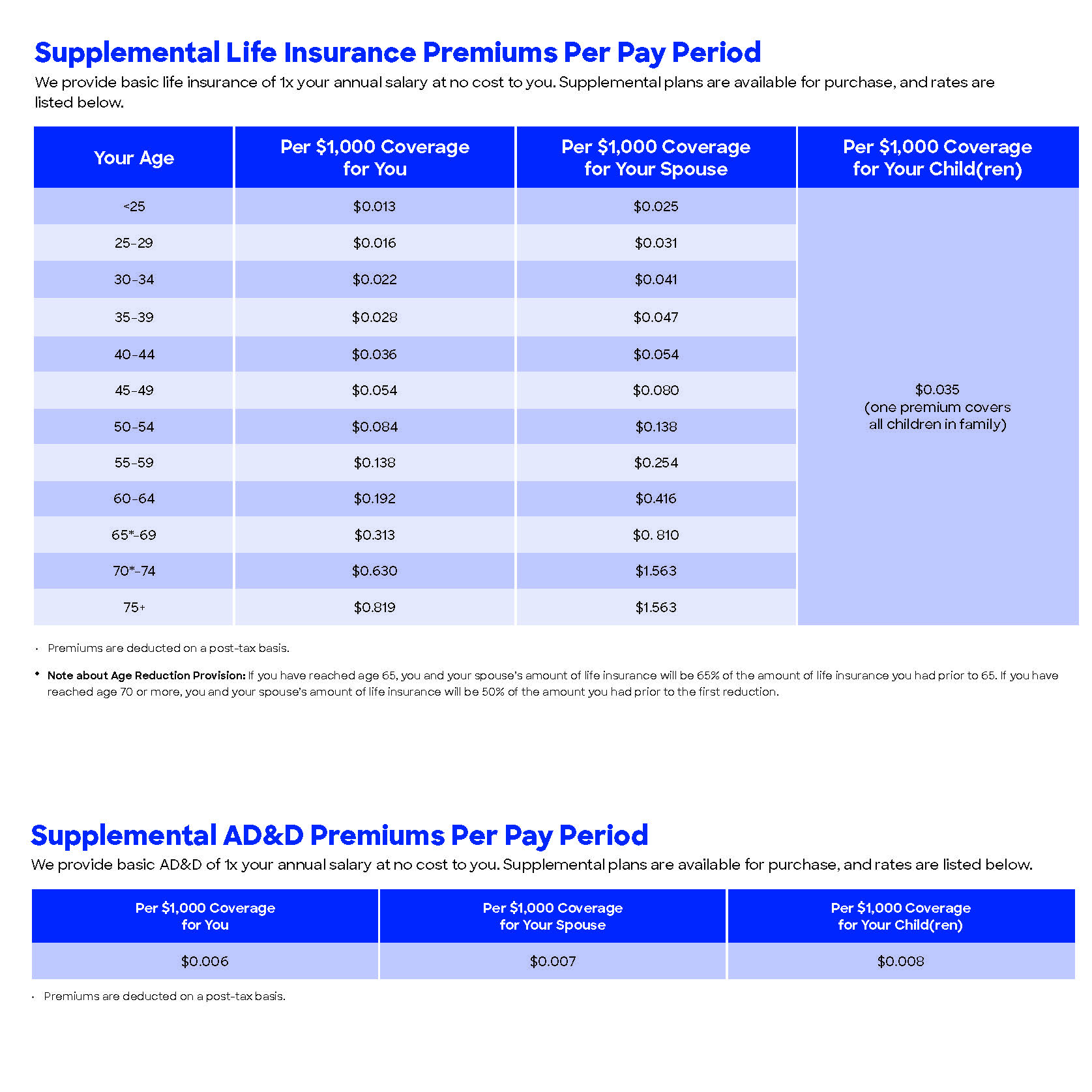

What Is Supplemental Ad D Insurance. What would happen if your loved one died? But you can also add an ad&d rider to your life policy. Some supplemental policies are specifically for accidental death and dismemberment (ad&d). Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of.

What Is Supplemental Ad&D Insurance / South From enriquecimientodelosmasjovenes.blogspot.com

What Is Supplemental Ad&D Insurance / South From enriquecimientodelosmasjovenes.blogspot.com

Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss (4). Most people know about supplemental life and ad&d (accident, death, and dismemberment insurance) but forget about supplement life insurance for a spouse or child. Supplemental child life insurance that covers eligible dependents. Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer. Supplemental spouse life insurance that covers the life of your spouse or domestic partner.

The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss

The employee is automatically the beneficiary of any benefits that become payable. Pros and cons of accidental death and dismemberment insurance Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. You might and not even realize it. Supplemental child life insurance that covers eligible dependents. Some supplemental policies are specifically for accidental death and dismemberment (ad&d).

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Supplemental insurance pays benefits above and beyond the coverage you carry either through a group or individual policy. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of. The employee is automatically the beneficiary of any benefits that become payable. Supplemental policies for the others in your life may be just as important. Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss The employee is automatically the beneficiary of any benefits that become payable. People without any type of insurance also purchase supplemental insurance as their primary source of financial protection (although it�s certainly not ideal). Supplemental child life insurance that covers eligible dependents. Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss (4).

Source: referenceinsurance.blogspot.com

Ad&d insurance vs accident insurance accident insurance is another type of insurance that�s similar to accidental death and dismemberment insurance. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Supplemental accidental death and dismemberment (ad&d) insurance: Most people know about supplemental life and ad&d (accident, death, and dismemberment insurance) but forget about supplement life insurance for a spouse or child. Understanding its benefits and costs can help you decide whether buying supplemental ad&d insurance is.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Understanding its benefits and costs can help you decide whether buying supplemental ad&d insurance is. Some employer group plans also allow employees to. You might and not even realize it. Also called supplemental accident insurance or personal accident insurance, it pays out a lump sum if you are injured in any type of accident. Supplement dependent ad&d insurance coverage is designed to protect you against certain financial burdens in the event a coverage dependent dies of an accidental death.

Source: imprecisaoemelodia.blogspot.com

However, these policies often have some exclusions. Supplemental life and spouse life insurance. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one (9). If you can afford it, a separate ad&d policy can supplement your life insurance coverage. The employee is automatically the.

Source: pocketsense.com

Source: pocketsense.com

This provides a death benefit in addition to your basic policy if you die or are seriously injured as the result of an accident. If you can afford it, a separate ad&d policy can supplement your life insurance coverage. Your eligibility to buy supplemental life insurance for your spouse or children is often dependent on you first buying the base policy or a supplemental policy for. This provides a death benefit in addition to your basic policy if you die or are seriously injured as the result of an accident. Ad&d insurance vs accident insurance accident insurance is another type of insurance that�s similar to accidental death and dismemberment insurance.

Source: theinsurancenerd.com

Source: theinsurancenerd.com

Supplemental child life insurance that covers eligible dependents. If you can afford it, a separate ad&d policy can supplement your life insurance coverage. Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss of a. Ad&d insurance vs accident insurance accident insurance is another type of insurance that�s similar to accidental death and dismemberment insurance. This provides a death benefit in addition to your basic policy if you die or are seriously injured as the result of an accident.

Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of. Accidental death and dismemberment (ad&d) insurance. Ad&d insurance provides coverage only if you die or are dismembered in an accident. The employee is automatically the beneficiary of any benefits that become payable.

Source: enriquecimientodelosmasjovenes.blogspot.com

Supplemental child life insurance that covers eligible dependents. This means they will only cover you if your death is caused by an. Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer. The accidental death and dismemberment (ad&d) portion is automatically included with supplemental spouse life and provides the dependent with additional insurance coverage for the loss of life or loss

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Supplemental insurance pays benefits above and beyond the coverage you carry either through a group or individual policy. Natural causes, illness, suicide, and overdoses are not covered under ad&d insurance. Your eligibility to buy supplemental life insurance for your spouse or children is often dependent on you first buying the base policy or a supplemental policy for. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of. The employee is automatically the.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Some employer group plans also allow employees to. Videos you watch may be added to the tv�s watch history and. If playback doesn�t begin shortly, try restarting your device. Unlike with life insurance, you don’t have to die to get benefits paid under ad&d insurance. What would happen if your loved one died?

Source: hub.jhu.edu

Source: hub.jhu.edu

Ad&d insurance provides coverage only if you die or are dismembered in an accident. Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. Understanding its benefits and costs can help you decide whether buying supplemental ad&d insurance is. Pros and cons of accidental death and dismemberment insurance Supplemental spouse life/ad&d insurance allows the employee to buy more life insurance than the basic amount provided by the employer.

Source: epsilonbeg.blogspot.com

Source: epsilonbeg.blogspot.com

Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Your eligibility to buy supplemental life insurance for your spouse or children is often dependent on you first buying the base policy or a supplemental policy for. Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed. It pays an additional benefit if you die or are seriously injured in an.

Source: easyquotes4you.com

Source: easyquotes4you.com

Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss (4). Accidental death and dismemberment (ad&d) insurance. This means they will only cover you if your death is caused by an. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of.

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Accidental death and dismemberment insurance is supplemental insurance added as a rider that can elevate that peace of mind, protecting and providing for you and your loved one if a tragic event occurs. Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one (9). People without any type of insurance also purchase supplemental insurance as their primary source of financial protection (although it�s certainly not ideal). Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. Some employer group plans also allow employees to.

Source: michigan.gov

Source: michigan.gov

Some supplemental policies are specifically for accidental death and dismemberment (ad&d). Supplemental ad&d is a type of insurance that pays out clearly defined cash benefits if an accident causes death, blindness or the loss of one or more limbs. Your eligibility to buy supplemental life insurance for your spouse or children is often dependent on you first buying the base policy or a supplemental policy for. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for. If you can afford it, a separate ad&d policy can supplement your life insurance coverage.

Source: floridabar.memberbenefits.com

Source: floridabar.memberbenefits.com

Accidental death and dismemberment insurance is supplemental insurance added as a rider that can elevate that peace of mind, protecting and providing for you and your loved one if a tragic event occurs. The employee is automatically the beneficiary of any benefits that become payable. You might and not even realize it. Supplemental accidental death and dismemberment insurance (ad&d) that covers you in addition to your basic policy. In other words, most anyone can benefit from this type of coverage.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss (4). Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Supplemental ad&d can play a critical role, but it�s wise to think of it as added protection rather than solely relying on ad&d coverage. However, these policies often have some exclusions. This means they will only cover you if your death is caused by an.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is supplemental ad d insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information