What is tail insurance information

Home » Trend » What is tail insurance informationYour What is tail insurance images are available in this site. What is tail insurance are a topic that is being searched for and liked by netizens now. You can Download the What is tail insurance files here. Get all free photos.

If you’re looking for what is tail insurance images information connected with to the what is tail insurance interest, you have come to the ideal blog. Our site always gives you hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

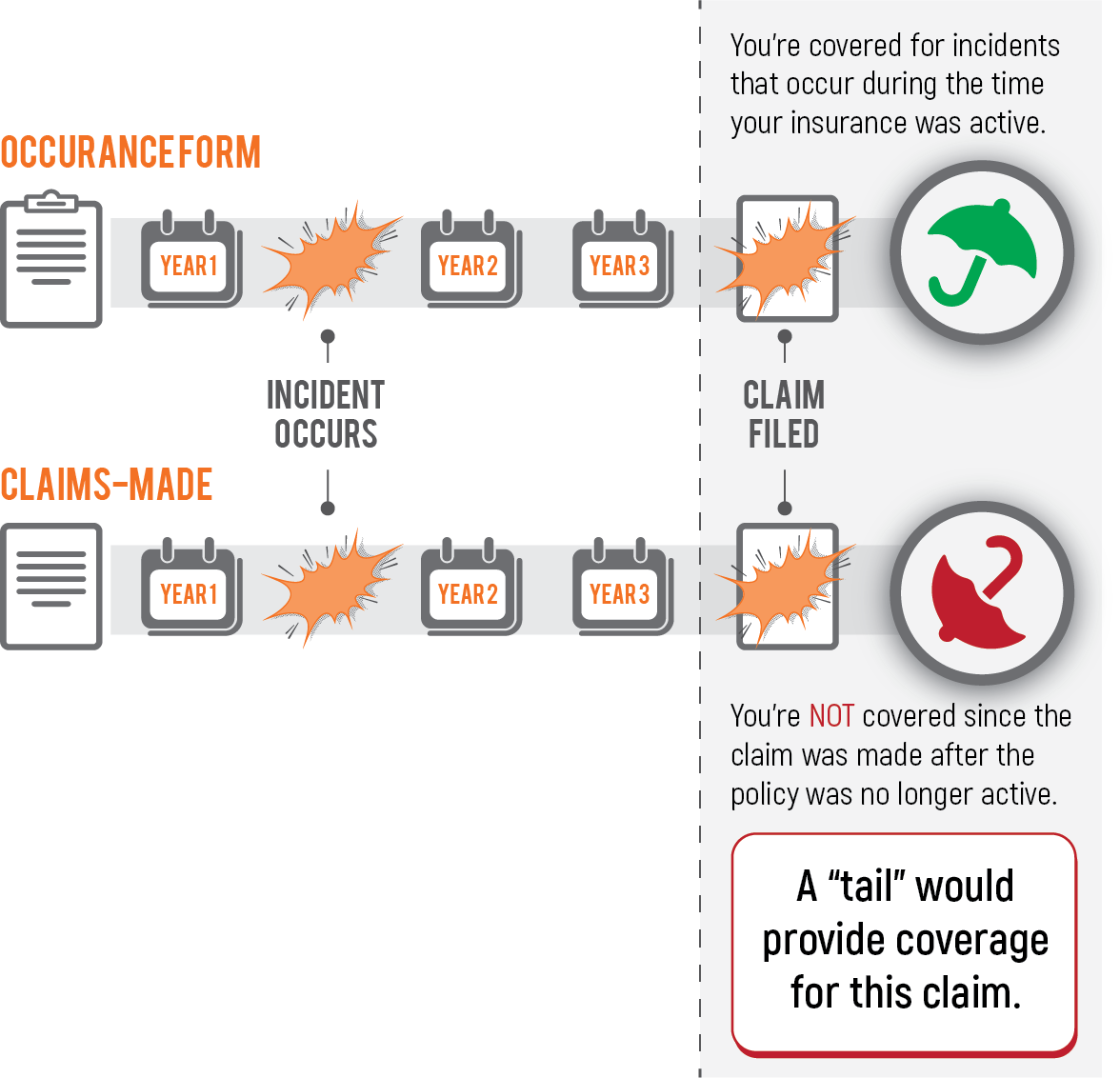

What Is Tail Insurance. Tail coverage insurance is a type of coverage that allows claims to be filed after the original insurance expires or is canceled, so long as you still had insurance when the incident/accident occurred. They are either looking to retire, or possibly, it could be written in their contract if they are an employee at a hospital or a practice. Here is an example of how tail coverage works: One of the least understood or appreciated provisions in the typical lawyer professional liability insurance policy is when and why you need tail insurance;

tail insurance What you need to know about tail insurance From clickingfrogs.com

tail insurance What you need to know about tail insurance From clickingfrogs.com

The option to purchase an extended claims reporting period, commonly referred to as a “tail”. You’ll have to pay extra to add tail coverage to your business insurance. Your malpractice insurance still needs to be renewed at the end of every coverage period. And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended. Tail insurance covers the gap between when a physician leaves an employer and when the statute of limitations on filing a medical malpractice claims ends. Think of tail coverage as a liability insurance extension plan.

Tail coverage insurance is a type of coverage that allows claims to be filed after the original insurance expires or is canceled, so long as you still had insurance when the incident/accident occurred.

Doctor a�s insurance policy is in effect from january 1, 2010 through december 31, 2020. It’s sometimes known as tail insurance or an extended reporting period. It’s sometimes known as tail insurance or an extended reporting period. One of the least understood or appreciated provisions in the typical lawyer professional liability insurance policy is when and why you need tail insurance; This coverage is also known as an extended reporting period. Also referred to as an “extended reporting period,” tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse.

Source: landesblosch.com

Source: landesblosch.com

One of the least understood or appreciated provisions in the typical lawyer professional liability insurance policy is when and why you need tail insurance; Tail coverage insurance was designed for professionals like you. It gives your business protection for claims that are reported after your insurance policy ends. It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period. Tail coverage is a type of insurance that you add at the end of your policy.

Source: hcpnational.com

Source: hcpnational.com

If you�ve been a doctor for 30 years, you�ve had liability insurance during that time, in case a patient made a claim against you. Tail coverage insurance was designed for professionals like you. The formal term for this type of coverage is extended reporting period (erp). One of the least understood or appreciated provisions in the typical lawyer professional liability insurance policy is when and why you need tail insurance; You’ll be responsible for keeping your payments up to date to maintain coverage.

Source: joomla3template.com

Source: joomla3template.com

It gives your business protection for claims that are reported after your insurance policy ends. This coverage is also known as an extended reporting period. This coverage is also known as an extended reporting period. Tail coverage is a type of insurance that you add at the end of your policy. Tail coverage is a type of insurance that you add at the end of your policy.

Source: insurancebaby.org

Source: insurancebaby.org

In contrast to a standard policy, tail coverage provides protection for medical malpractice claims that are reported after the provider�s policy expired or was cancelled. You’ll have to pay extra to add tail coverage to your business insurance. Tail coverage insurance is a type of coverage that allows claims to be filed after the original insurance expires or is canceled, so long as you still had insurance when the incident/accident occurred. It allows the insured to report claims against a policy for a specified period after the policy has expired. Tail coverage requires that the insured pay.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

You’ll have to pay extra to add tail coverage to your business insurance. And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended. It is critical to understand that this provision is not found on every insurance policy. If you�ve been a doctor for 30 years, you�ve had liability insurance during that time, in case a patient made a claim against you. You’ll be responsible for keeping your payments up to date to maintain coverage.

Source: sopyla.com

Source: sopyla.com

For example, if a person has a car accident on monday, their insurance expires on wednesday, and they file a claim on friday, then having tail. Your malpractice insurance still needs to be renewed at the end of every coverage period. It allows the insured to report claims against a policy for a specified period after the policy has expired. Tail coverage is an “extended reporting endorsement” to us insurance folks. For example, if a person has a car accident on monday, their insurance expires on wednesday, and they file a claim on friday, then having tail.

Source: clickingfrogs.com

Source: clickingfrogs.com

You’ll have to pay extra to add tail coverage to your business insurance. And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended. It’s sometimes known as tail insurance or an extended reporting period. Think of tail coverage as a liability insurance extension plan. It is critical to understand that this provision is not found on every insurance policy.

Source: amapubs-activation.org

Source: amapubs-activation.org

Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. It’s sometimes known as tail insurance or an extended reporting period. You’ll be responsible for keeping your payments up to date to maintain coverage. If you�ve been a doctor for 30 years, you�ve had liability insurance during that time, in case a patient made a claim against you. Tail coverage insurance is a type of coverage that allows claims to be filed after the original insurance expires or is canceled, so long as you still had insurance when the incident/accident occurred.

Source: presidioinsurance.com

Source: presidioinsurance.com

Also referred to as an “extended reporting period,” tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse. Tail coverage requires that the insured pay. Also referred to as an “extended reporting period,” tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse. You’ll have to pay extra to add tail coverage to your business insurance. And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended.

Source: presidioinsurance.com

Source: presidioinsurance.com

With tail coverage, you’re still insured if a claim is filed against you after the policy ends. It’s sometimes known as tail insurance or an extended reporting period. It allows the insured to report claims against a policy for a specified period after the policy has expired. Also referred to as an “extended reporting period,” tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse. For example, if a person has a car accident on monday, their insurance expires on wednesday, and they file a claim on friday, then having tail.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended. For example, if a person has a car accident on monday, their insurance expires on wednesday, and they file a claim on friday, then having tail. It gives your business protection for claims that are reported after your insurance policy ends. Having this coverage protects your business from claims made after your business insurance policy expires. Tail coverage requires that the insured pay.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

It�s sometimes known as tail insurance or. Think of tail coverage as a liability insurance extension plan. Tail coverage is an “extended reporting endorsement” to us insurance folks. They are either looking to retire, or possibly, it could be written in their contract if they are an employee at a hospital or a practice. It’s sometimes known as tail insurance or an extended reporting period.

Source: medpli.com

Source: medpli.com

Tail coverage is usually offered by the insurance company your current policy is with. They are either looking to retire, or possibly, it could be written in their contract if they are an employee at a hospital or a practice. If you�ve been a doctor for 30 years, you�ve had liability insurance during that time, in case a patient made a claim against you. Tail coverage is a type of insurance that you add at the end of your policy. With tail coverage, you’re still insured if a claim is filed against you after the policy ends.

Source: vintageins.com

Source: vintageins.com

Tail coverage insurance is a type of coverage that allows claims to be filed after the original insurance expires or is canceled, so long as you still had insurance when the incident/accident occurred. Tail coverage is an “extended reporting endorsement” to us insurance folks. And, when they leave that hospital or practice, it could be required that they tail out, which means that they have to purchase an extended. This coverage is also known as an extended reporting period. It gives your business protection for claims that are reported after your insurance policy ends.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. Tail coverage is a type of insurance that you add at the end of your policy. It�s sometimes known as tail insurance or. The formal term for this type of coverage is extended reporting period (erp). This coverage is also known as an extended reporting period.

Source: medpli.com

Source: medpli.com

This coverage is also known as an extended reporting period. They can add this coverage after canceling their insurance or when an insurer doesn’t renew the policy. It gives your business protection for claims that are reported after your insurance policy ends. With tail coverage, you’re still insured if a claim is filed against you after the policy ends. Your malpractice insurance still needs to be renewed at the end of every coverage period.

Source: vaned.com

Source: vaned.com

Tail coverage is a type of insurance that you add at the end of your policy. Tail coverage is an endorsement (or an addition) to your insurance that allows you to file a claim against your policy after it expired or was canceled. It gives your business protection for claims that are reported after your insurance policy ends. Tail coverage is a type of insurance that you add at the end of your policy. Tail coverage is an “extended reporting endorsement” to us insurance folks.

Source: demontinsurance.com

Source: demontinsurance.com

You’ll have to pay extra to add tail coverage to your business insurance. You’ll have to pay extra to add tail coverage to your business insurance. Tail coverage is usually offered by the insurance company your current policy is with. It protects physicians when a former patient claims malpractice that took place during the physician�s previous plan�s coverage period. They are either looking to retire, or possibly, it could be written in their contract if they are an employee at a hospital or a practice.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is tail insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information