What is term insurance plan in lic information

Home » Trending » What is term insurance plan in lic informationYour What is term insurance plan in lic images are ready. What is term insurance plan in lic are a topic that is being searched for and liked by netizens today. You can Find and Download the What is term insurance plan in lic files here. Download all free photos.

If you’re looking for what is term insurance plan in lic pictures information connected with to the what is term insurance plan in lic keyword, you have visit the right site. Our website frequently provides you with hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

What Is Term Insurance Plan In Lic. As the name suggests, a critical illness rider provides additional benefits when attached with your term insurance policy i.e., if you get diagnosed with an illness covered under the rider, a lump sum amount is paid to you to avoid any financial setback that your family might have to face for getting the treatment. Hi, policy term is the duration for which the policy provides you cover. Term insurance is a life insurance plan that provides coverage to the nominee of the life insured in the event of his/her death while the policy is active. It enables his/her family to cope with the emotional turmoil due to the sudden loss of a loved one and serves as a stable source of income in their absence.

LIC Term Insurance Plan New Anmol Jeevan And New Amulya From licinsurance.online

LIC Term Insurance Plan New Anmol Jeevan And New Amulya From licinsurance.online

Whats more, this comes at a very affordable price. Each individual�s insurance needs and requirements are different from that of the others. This plan will be available through online application process only and no intermediaries will be involved. A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured. Term insurance is a life insurance plan that provides coverage to the nominee of the life insured in the event of his/her death while the policy is active. Hi, policy term is the duration for which the policy provides you cover.

As a pure protection plan, the term insurance policy offers insurance coverage only in the form of a death benefit to the beneficiary of the policy.

As they say a life insurance plans cannot stop any unfortunate event from happening but will be your support if it happens. As individuals it is inherent to differ. Means there is no maturity benefit or surrender benefit. Lic term insurance or term assurance policies are one of the most basic types of insurance plans. If he policyholder remains all well even after the policy term expires he or his family gets nothing. Life insurance plans from lic check more about lic pages informative term insurance pages disclaimer gst of 18% is applicable on life insurance effective from the 1st of july, 2017 disclaimer

Source: moneymanch.com

Source: moneymanch.com

Each individual�s insurance needs and requirements are different from that of the others. Term insurance is a life insurance plan that provides coverage to the nominee of the life insured in the event of his/her death while the policy is active. A term insurance plan is a pure protection plan, which helps the dependents of the policyholder as a source of funds when an emergency strikes. Lic�s insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured.

Source: insuranceguideinfo.com

Source: insuranceguideinfo.com

A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured. Term insurance is a life insurance plan that provides coverage to the nominee of the life insured in the event of his/her death while the policy is active. What is a term insurance plan? Lic policy is the will that you create before you earn that amount. This lic term plan is non linked and without profit plan.

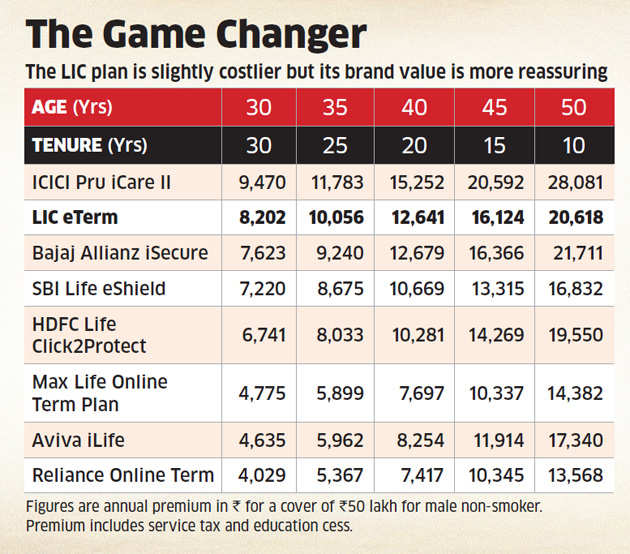

Source: financialexpress.com

Source: financialexpress.com

A term insurance plan is a pure protection plan, which helps the dependents of the policyholder as a source of funds when an emergency strikes. The policyholders can choose from single, regular or limited premium payment based on their financial situation and other requirements. A term insurance plan is a pure protection plan, which helps the dependents of the policyholder as a source of funds when an emergency strikes. Lic�s insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. What is a term insurance plan?

Source: slideshare.net

Source: slideshare.net

In simple terms term insurance plan is the assurance that you buy on your life for a fixed number of years. Lic policy is the will that you create before you earn that amount. Life insurance plans from lic check more about lic pages informative term insurance pages disclaimer gst of 18% is applicable on life insurance effective from the 1st of july, 2017 disclaimer These policies provide the policy buyer a risk cover against death for a period of time, as defined in the policy tenure. Lic policy is a life insurance plan that ensures your family’s financial freedom in the case something happens to the earning member of the family.

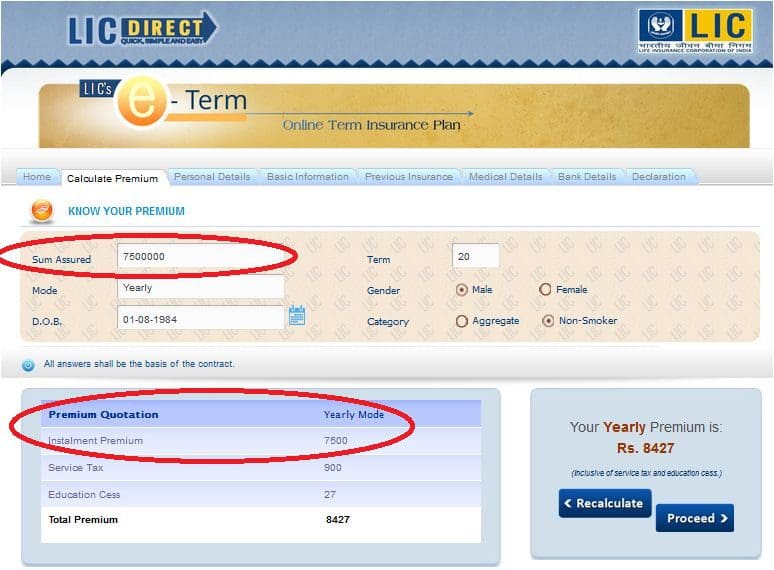

Source: moneyexcel.com

Source: moneyexcel.com

It enables his/her family to cope with the emotional turmoil due to the sudden loss of a loved one and serves as a stable source of income in their absence. If he policyholder remains all well even after the policy term expires he or his family gets nothing. If you are the sole earner of your family, it is wise to buy a lic 1 crore policy to offer financial security to your family members. A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured. If the life assured meets with an untimely death when covered under a term insurance plan, his/her nominee will be paid a benefit.

Source: relakhs.com

Source: relakhs.com

Term plan offers a sufficiently large amount to your family at the time of death of policyholder. That is if anything happens to you during that period your nominee will be pad a claim. This is a pure term insurance plan. As individuals it is inherent to differ. If the life assured meets with an untimely death when covered under a term insurance plan, his/her nominee will be paid a benefit.

Source: licinsurance.online

Source: licinsurance.online

Lic term plans have a minimum policy term of 5 years and a maximum term of 35 years, subject to the entry age and the maturity age of the life insured. This lic term plan is non linked and without profit plan. Term insurance plan term insurance calculator term insurance meaning term insurance tax benefit term insurance premium calculator term insurance benefits term insurance comes under which section term insurance plan lic. As individuals it is inherent to differ. If he policyholder remains all well even after the policy term expires he or his family gets nothing.

Source: quora.com

Term plan offers a sufficiently large amount to your family at the time of death of policyholder. Lic�s insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. Lic policy is the will that you create before you earn that amount. Means there is no maturity benefit or surrender benefit. This lic term plan is online plan only.

Source: fintotal.com

Source: fintotal.com

If the life assured meets with an untimely death when covered under a term insurance plan, his/her nominee will be paid a benefit. If the life assured meets with an untimely death when covered under a term insurance plan, his/her nominee will be paid a benefit. Some of the major features of lic tech term plan are: Lower premium for non smoking individuals. As individuals it is inherent to differ.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Read more details about this lic term. Lower premium for non smoking individuals. As a pure protection plan, the term insurance policy offers insurance coverage only in the form of a death benefit to the beneficiary of the policy. Term insurance is one of the simplest forms of life insurance. This is a pure term insurance plan.

Source: quora.com

Lic convertible term assurance policy lic’s convertible term insurance is a term plan with low and affordable premium which can be later converted to an endowment or a whole life plan. This lic term plan is non linked and without profit plan. Lic policy is the will that you create before you earn that amount. Term insurance is one of the simplest forms of life insurance. If you are the sole earner of your family, it is wise to buy a lic 1 crore policy to offer financial security to your family members.

Source: relakhs.com

Source: relakhs.com

Each individual�s insurance needs and requirements are different from that of the others. If he policyholder remains all well even after the policy term expires he or his family gets nothing. A term insurance plan is a pure protection plan, which helps the dependents of the policyholder as a source of funds when an emergency strikes. Lic�s insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. This is a pure term insurance plan.

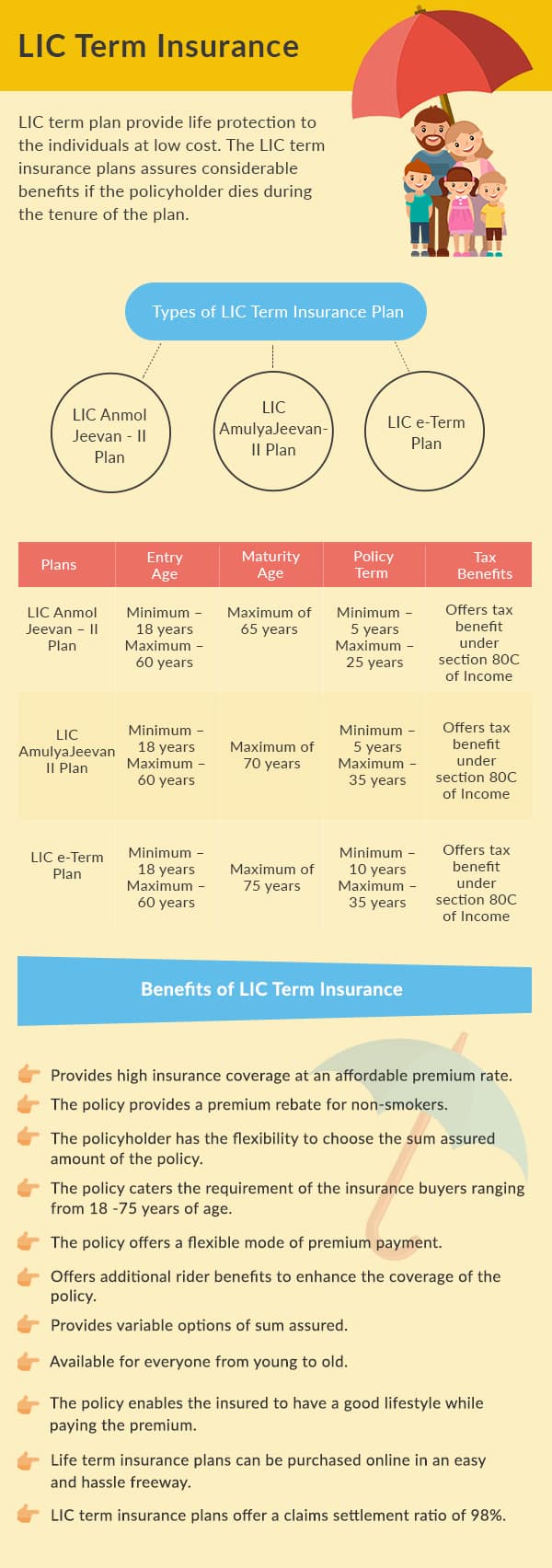

Source: policybazaar.com

Source: policybazaar.com

Term plan offers a sufficiently large amount to your family at the time of death of policyholder. Read more details about this lic term. A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured. Term plan offers a sufficiently large amount to your family at the time of death of policyholder. This lic term plan is non linked and without profit plan.

Source: wishpolicy.com

Source: wishpolicy.com

This lic term plan is online plan only. These policies provide the policy buyer a risk cover against death for a period of time, as defined in the policy tenure. Lower premium for non smoking individuals. This lic term plan is non linked and without profit plan. As the name suggests, a critical illness rider provides additional benefits when attached with your term insurance policy i.e., if you get diagnosed with an illness covered under the rider, a lump sum amount is paid to you to avoid any financial setback that your family might have to face for getting the treatment.

![[Review] ICICI Pru iProtect Smart Online Term Insurance Plan [Review] ICICI Pru iProtect Smart Online Term Insurance Plan](http://3.bp.blogspot.com/-vKNXujQCBEo/Vm_wRHvDdfI/AAAAAAAAL-g/JTgATUTXb68/s1600/Best-Online-Term-Insurance-Plans.png) Source: 15august.in

Source: 15august.in

Some of the major features of lic tech term plan are: Lic policy is the will that you create before you earn that amount. Policy paying term is the duration for which you have to pay the premium. Lic convertible term assurance policy lic’s convertible term insurance is a term plan with low and affordable premium which can be later converted to an endowment or a whole life plan. A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured.

Source: businesscolleague.com

Source: businesscolleague.com

You cannot buy it offline. Lic term plans have a minimum policy term of 5 years and a maximum term of 35 years, subject to the entry age and the maturity age of the life insured. Some of the major features of lic tech term plan are: This is a pure term insurance plan. Means there is no maturity benefit or surrender benefit.

Source: licindiaadvisor.com

Source: licindiaadvisor.com

Term insurance is one of the simplest forms of life insurance. The policyholders can choose from single, regular or limited premium payment based on their financial situation and other requirements. This lic term plan is online plan only. Policy paying term is the duration for which you have to pay the premium. In simple terms term insurance plan is the assurance that you buy on your life for a fixed number of years.

Source: basunivesh.com

Source: basunivesh.com

Lic�s insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. A term insurance plan is a pure protection plan, which helps the dependents of the policyholder as a source of funds when an emergency strikes. Some of the major features of lic tech term plan are: A term insurance plan, also known as a pure protection plan, is the simplest form of life insurance product that offers financial security to the family of the insured. These policies provide the policy buyer a risk cover against death for a period of time, as defined in the policy tenure.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is term insurance plan in lic by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information