What is the benefit of a credit disability insurance plan Idea

Home » Trend » What is the benefit of a credit disability insurance plan IdeaYour What is the benefit of a credit disability insurance plan images are ready. What is the benefit of a credit disability insurance plan are a topic that is being searched for and liked by netizens now. You can Find and Download the What is the benefit of a credit disability insurance plan files here. Get all free photos and vectors.

If you’re looking for what is the benefit of a credit disability insurance plan pictures information linked to the what is the benefit of a credit disability insurance plan keyword, you have visit the right blog. Our site always gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

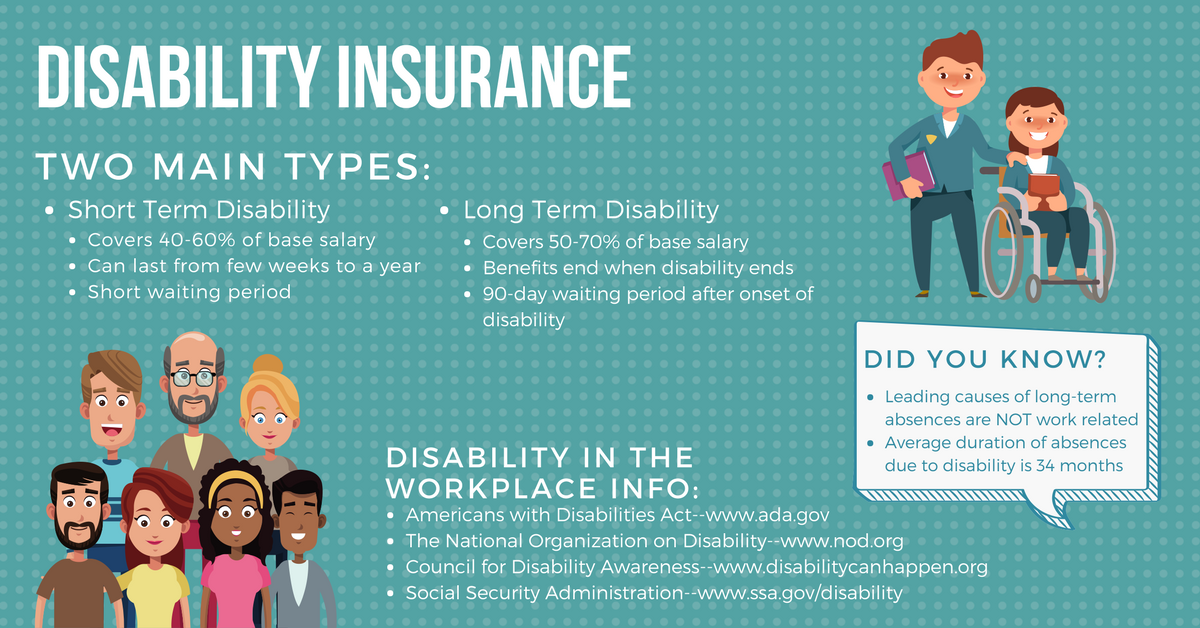

What Is The Benefit Of A Credit Disability Insurance Plan. This amount includes the premiums you made through the years as well as a bonus. Credit disability insurance pays your loan payments when you can’t work after a disability. Benefit plan consultants are also often hired to support the plan sponsor with vendor selection and various other responsibilities. Typically, a group insurance provider is hired to insure the plan members and run the various aspects of the program, which includes paying claims.

Protect your paycheck UCLA From newsroom.ucla.edu

Protect your paycheck UCLA From newsroom.ucla.edu

There are tax advantages of life insurance, because death benefit payouts are generally tax free; A an insured is involved in a car accident. Its purpose is to replace a percentage of your income. A disabling illness or injury can strike at any time. Typically, this insurance is offered by your lender when you’re approved for a loan and can apply to different kinds of loans, such as auto loans, personal loans, credit cards, home equity lines of credit and even some mortgages. Credit life insurance pays off a debt if you pass away.

D the benefit can be up to 66 and 2/3% of one�s monthly income.

Credit disability insurance covers loan payments if you become disabled and you�re unable to work. In addition to general, less serious injuries, he permanently loses the use of his leg and is rendered completely blind. And some policies have features that can help transfer money to heirs with fewer tax liabilities. However, you only get this if you have paid all your premiums and completed the term. Credit card debt protection insurance helps protect your credit standing by providing protection in case you are not able to make your monthly card payment. The employer sponsors the plan.

Source: lifecentra.com

Source: lifecentra.com

The above disability plans focus on how your medical condition affects your ability to work. In addition to general, less serious injuries, he permanently loses the use of his leg and is rendered completely blind. For purposes of calculating your ltd benefit, benefits eligible pay is limited to a maximum of $500,000. Benefit plan consultants are also often hired to support the plan sponsor with vendor selection and various other responsibilities. D the benefit can be up to 66 and 2/3% of one�s monthly income.

Source: bankrate.com

Source: bankrate.com

Authorities 2.1 legislative and regulatory financial administration act (faa); Credit disability insurance will make the originally scheduled monthly payments on your loan if you are disabled due to a covered illness or injury. If eligible for the dtc, you can receive upwards of an $8000 in federal credit. In addition, a maturity benefit policy also provides death risk cover. What is the rehabilitation program.

Source: huffingtonpost.com

Source: huffingtonpost.com

Generally, it helps cover your minimum card payment for a specified period of time. May be limited to a certain number of payments or total amount paid. However, you only get this if you have paid all your premiums and completed the term. Credit unemployment insurance covers loan payments if you are laid off from your job. In addition, a maturity benefit policy also provides death risk cover.

Source: wiseradvisor.com

Source: wiseradvisor.com

Authorities 2.1 legislative and regulatory financial administration act (faa); Credit life insurance pays off a debt if you pass away. Disability insurance has earned the moniker “disability income insurance” because that’s what it is. It aims to provide greater tax equity for those living with a disability. This amount includes the premiums you made through the years as well as a bonus.

Source: prweb.com

Source: prweb.com

The above disability plans focus on how your medical condition affects your ability to work. The is not focused on your ability to work. In addition, a maturity benefit policy also provides death risk cover. Generally, it helps cover your minimum card payment for a specified period of time. Disability benefits received from any state disability plan, social security and the ltd portion of the plan, combined, won’t exceed 60% of your benefits eligible pay.

Source: jrwassoc.com

Source: jrwassoc.com

Rather, it focuses on impairment with your daily activities. The blindness improves a month later. What medical conditions qualify for the disability tax credit? Credit card debt protection insurance helps protect your credit standing by providing protection in case you are not able to make your monthly card payment. To what extent will he receive presumptive disability benefits?

Source: heffins.com

Source: heffins.com

Credit life insurance pays off a debt if you pass away. Typically, this insurance is offered by your lender when you’re approved for a loan and can apply to different kinds of loans, such as auto loans, personal loans, credit cards, home equity lines of credit and even some mortgages. Rather, it focuses on impairment with your daily activities. Generally, it helps cover your minimum card payment for a specified period of time. D the benefit can be up to 66 and 2/3% of one�s monthly income.

Source: slideshare.net

Source: slideshare.net

In addition, a maturity benefit policy also provides death risk cover. A an insured is involved in a car accident. This is a program designed to assist disabled plan members to regain an acceptable level of employment. If eligible for the dtc, you can receive upwards of an $8000 in federal credit. The employer sponsors the plan.

Source: schlawpc.com

Source: schlawpc.com

Credit disability insurance credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work. This amount includes the premiums you made through the years as well as a bonus. You typically cant qualify for more than 80 percent of your salary, but since the benefit of an individual policy isnt usually taxed… Disability insurance has earned the moniker “disability income insurance” because that’s what it is. This is a program designed to assist disabled plan members to regain an acceptable level of employment.

Source: puhlemployeebenefits.com

Source: puhlemployeebenefits.com

1 some policies have a cash value that accumulates over time 2 and can be used to pay premiums later, or even tapped into to help live on in retirement. The benefits you receive can be used for anything you want or need, including: Credit disability insurance covers loan payments if you become disabled and you�re unable to work. The cpp disability benefit and qpp disability benefit are available to people who have contributed to those plans and aren’t able to work regularly at any job because of a disability. Disability insurance (di) policies typically offer a range of benefit periods, from as short as two years to a length that extends until the insured reaches age 67.

Source: argifinancialgroup.com

Source: argifinancialgroup.com

May be limited to a certain number of payments or total amount paid. The cpp disability benefit and qpp disability benefit are available to people who have contributed to those plans and aren’t able to work regularly at any job because of a disability. Its purpose is to replace a percentage of your income. This amount includes the premiums you made through the years as well as a bonus. Credit disability insurance also called accident and health insurance, this type of credit insurance pays a monthly benefit directly to a lender equal to the loan’s minimum monthly payment if you.

Source: louisvillelatest.blogspot.com

Source: louisvillelatest.blogspot.com

Mortgage utilities credit card payments auto loans personal loans retirement contributions student loans college or childcare Credit life insurance pays off a debt if you pass away. A an insured is involved in a car accident. To what extent will he receive presumptive disability benefits? Credit disability insurance covers loan payments if you become disabled and you�re unable to work.

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

Disability insurance has earned the moniker “disability income insurance” because that’s what it is. In addition, a maturity benefit policy also provides death risk cover. Mortgage utilities credit card payments auto loans personal loans retirement contributions student loans college or childcare In most cases when disability strikes, the family quickly feels the effects of the lost income. There are tax advantages of life insurance, because death benefit payouts are generally tax free;

Source: consumeraffairs.com

Source: consumeraffairs.com

The disability tax credit is different from other disability benefits plans. The above disability plans focus on how your medical condition affects your ability to work. However, you only get this if you have paid all your premiums and completed the term. Credit disability insurance credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work. Credit disability insurance also called accident and health insurance, this type of credit insurance pays a monthly benefit directly to a lender equal to the loan’s minimum monthly payment if you.

Source: newsroom.ucla.edu

Source: newsroom.ucla.edu

Disability insurance has earned the moniker “disability income insurance” because that’s what it is. Credit unemployment insurance covers loan payments if you are laid off from your job. The benefits you receive can be used for anything you want or need, including: Disability insurance has earned the moniker “disability income insurance” because that’s what it is. The disability insurance (di) plan provides employees in the public service who are included in collective bargaining, and who are members of the plan, with benefits to replace a substantial portion of earnings lost as a result of extended periods of disability.

Source: cartefinancial.com

Source: cartefinancial.com

Credit disability insurance credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work. 1 some policies have a cash value that accumulates over time 2 and can be used to pay premiums later, or even tapped into to help live on in retirement. In addition to general, less serious injuries, he permanently loses the use of his leg and is rendered completely blind. The cpp disability benefit and qpp disability benefit are available to people who have contributed to those plans and aren’t able to work regularly at any job because of a disability. Credit disability insurance pays your loan payments when you can’t work after a disability.

Source: jerusalemhouse.org

Source: jerusalemhouse.org

The above disability plans focus on how your medical condition affects your ability to work. Rather, it focuses on impairment with your daily activities. Disability insurance (di) policies typically offer a range of benefit periods, from as short as two years to a length that extends until the insured reaches age 67. D the benefit can be up to 66 and 2/3% of one�s monthly income. When you can’t work because of a serious illness or injury, disability insurance helps cover living expenses, like bills and groceries.

Source: pinterest.com

Source: pinterest.com

When you can’t work because of a serious illness or injury, disability insurance helps cover living expenses, like bills and groceries. Credit card debt protection insurance helps protect your credit standing by providing protection in case you are not able to make your monthly card payment. Credit disability insurance credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work. The disability tax credit is different from other disability benefits plans. What medical conditions qualify for the disability tax credit?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the benefit of a credit disability insurance plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information