What is the difference between bonded and insured information

Home » Trend » What is the difference between bonded and insured informationYour What is the difference between bonded and insured images are ready. What is the difference between bonded and insured are a topic that is being searched for and liked by netizens now. You can Download the What is the difference between bonded and insured files here. Find and Download all royalty-free images.

If you’re searching for what is the difference between bonded and insured pictures information related to the what is the difference between bonded and insured topic, you have come to the ideal site. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

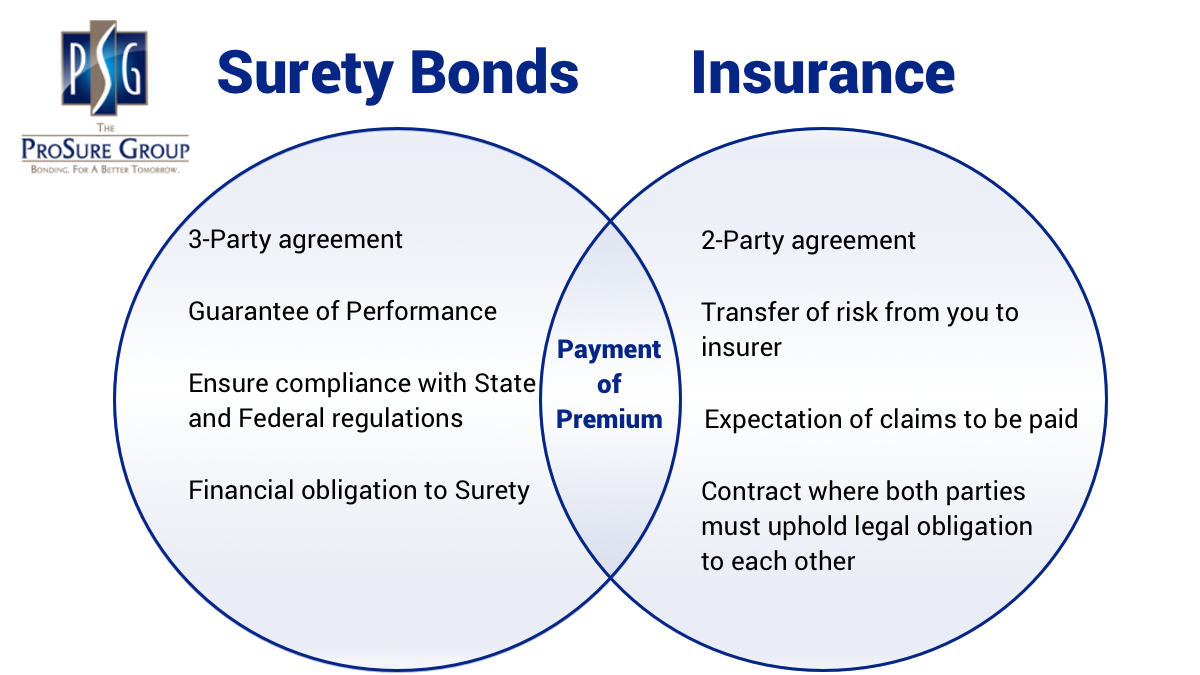

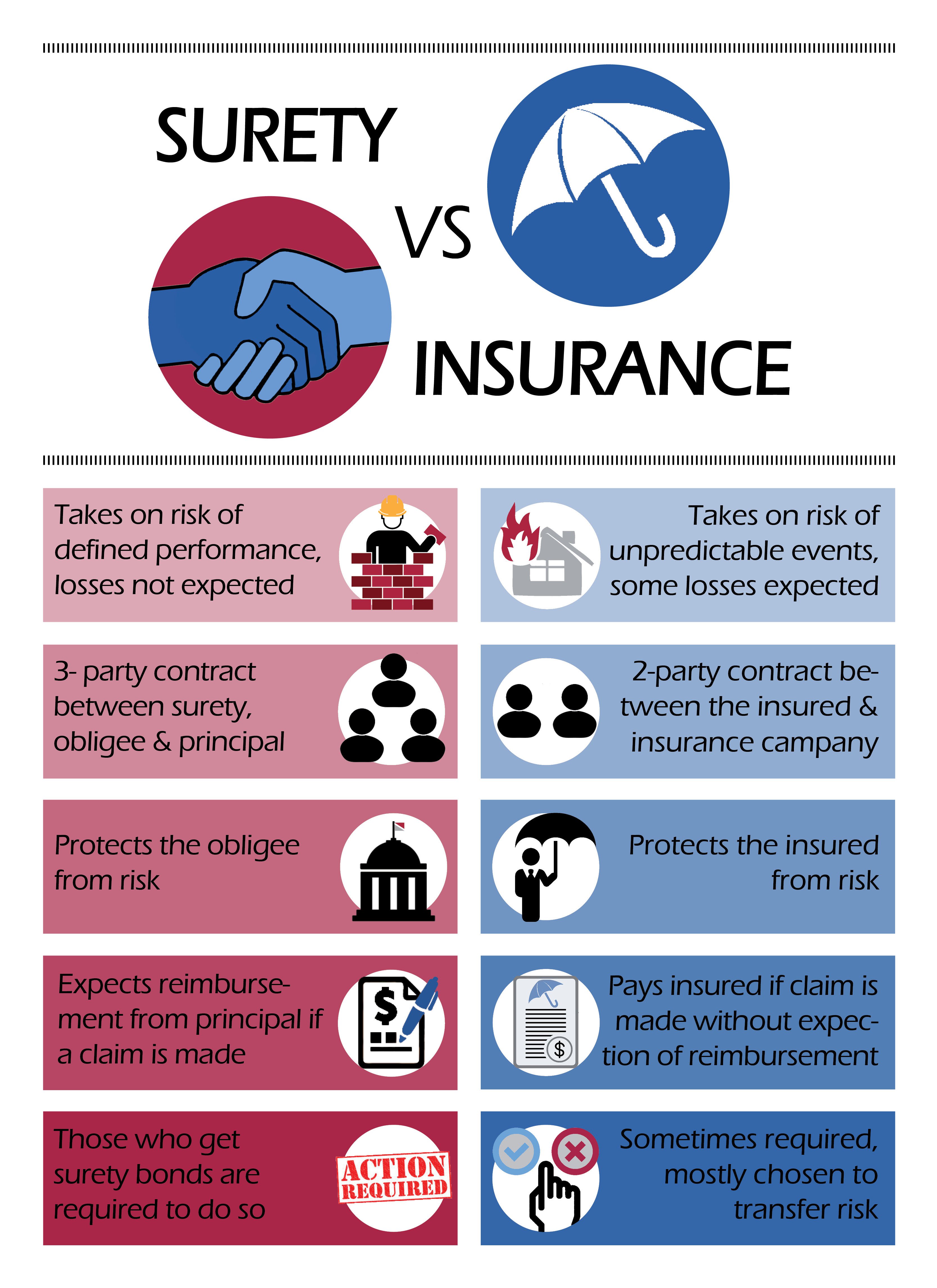

What Is The Difference Between Bonded And Insured. Getting a contractor surety bond. Insurance offers coverage to the business as a policyholder, while a bond covers the customer against a breach of contract by the business. Insured contractors carry liability and worker�s comp insurance. Difference between bonded and insured.

Difference between surety and insurance Alpha Surety Bonds From alphasurety.com

Difference between surety and insurance Alpha Surety Bonds From alphasurety.com

While dealing with a bonded company is important, making sure they are insured is absolutely essential. When you say that you are licensed, bonded and insured, you have the required licensing for your business, proper insurance and you have made payments for additional coverage with a bond. Bonded contractors must pay back the surety. A bond would not cover this, because the incident would not be related to the completion of the electrician�s job. Difference between surety and insurance alpha surety bonds from alphasurety.com. Why your business should become licensed, bonded, and insured

Without this type of insurance, an accident occurring on.

Insured contractors have more protection than bonded contractors. The principal is the business or individual purchasing the bond from the second party, called the surety. For the tree service company, being insured protects against financial damages in case of an incident, accident, or property damage that arises during the course of business. Licensed means that a contractor has a valid contractor’s license from a state. Bonded means that a contractor has purchased a surety bond to guarantee. Bonded contractors have a surety bond in case of contract default.

Source: suretybonds.org

Source: suretybonds.org

Difference between surety and insurance alpha surety bonds from alphasurety.com. Bonded contractors have a surety bond in case of contract default. Being bonded is not insurance. It can be a little confusing when the terms bond insurance, surety bond insurance are being used, but being bonded is still not the same as being insured. Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

Insured contractors pay premiums and don�t have to pay back a claim. Insured contractors have more protection than bonded contractors. While there is a definite difference regarding bonded vs insured individuals, bonds and insurance policies are still sometimes made available by the same financial organization, because the two serve similar purposes and must be backed by a company with the resources to pay out any claims made against them. However, being insured and being bonded are not the same thing. Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company.

Source: itsaboutjustice.law

Source: itsaboutjustice.law

Being bonded is not insurance. However, being insured and being bonded are not the same thing. Getting a contractor surety bond. Bonded contractors must pay back the surety. A bond protects a client from a loss after hiring a third party to carry out a particular task.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

The first party is the company requesting the bond, referred to as the principal. On the other hand, insurance means that you won’t be on the hook if a contractor is injured while working on your property. Insurance protects the business itself from losses, whereas bonds protect the person the company is working for. Instead, each bond is written with the assumption that there will not be a claim on the underlying contract that is being bonded. Being insured means that you have an insurance policy that protects against accidents and liabilities, often with greater limits than bonds.

Source: thebalance.com

Source: thebalance.com

The first party is the company requesting the bond, referred to as the principal. Bonded and insured companies have higher chances of acquiring new business or winning public and government contracts. The first party is the company requesting the bond, referred to as the principal. Bonded contractors have a surety bond in case of contract default. A business that is bonded and insured provides a monetary guarantee about the quality of its services.

Source: prosuregroup.com

Source: prosuregroup.com

Insurance protects the business itself from losses, whereas bonds protect the person the company is working for. If your claim is determined to be valid and a judgment awarded but the company is unable to pay, the award would come from the bond. If a contractor is “bonded “, it means that you are financially protected if the contractor doesn’t complete a job for you, or the job is poorly executed. So the difference between bonded and insured is quite large. Bonded contractors must pay back the surety.

Source: prosuregroup.com

Source: prosuregroup.com

Insurance covers liability issues that may arise in the course of someone�s work, but unlike a bond, it will not necessarily cover a job which is not performed to satisfaction. When you say that you are licensed, bonded and insured, you have the required licensing for your business, proper insurance and you have made payments for additional coverage with a bond. Being bonded means you have purchased a surety bond that offers limited guarantees to clients. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two. On the other hand, insurance means that you won’t be on the hook if a contractor is injured while working on your property.

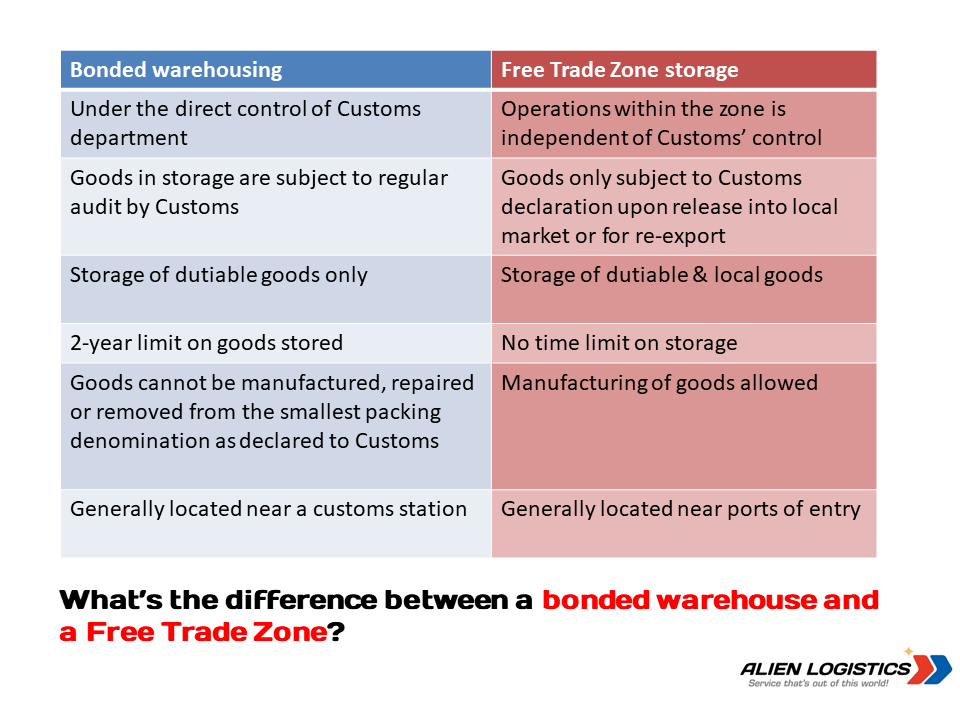

Source: alienlogistics.com

Source: alienlogistics.com

The first party is the company requesting the bond, referred to as the principal. A business that is bonded and insured provides a monetary guarantee about the quality of its services. It can be a little confusing when the terms bond insurance, surety bond insurance are being used, but being bonded is still not the same as being insured. Instead, it provides assurance against the risk of default of a single entity (such as a general contractor). Typically, insurers pay a percentage of losses after the insured pays a deductible amount.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

Instead, each bond is written with the assumption that there will not be a claim on the underlying contract that is being bonded. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two. If a contractor is “bonded “, it means that you are financially protected if the contractor doesn’t complete a job for you, or the job is poorly executed. If your claim is determined to be valid and a judgment awarded but the company is unable to pay, the award would come from the bond. Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company.

Source: pinterest.com

Source: pinterest.com

At the same time, an insurance policy protects your business from financial losses resulting from damage or theft. If your claim is determined to be valid and a judgment awarded but the company is unable to pay, the award would come from the bond. There are different insurance types that a contractor should carry, like liability and worker’s comp. With surety bonds, the bonded is expected to pay for any claims. Insured contractors pay premiums and don�t have to pay back a claim.

Source: pinterest.com

Source: pinterest.com

Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company. There are different insurance types that a contractor should carry, like liability and worker’s comp. Insured contractors pay premiums and don�t have to pay back a claim. Without this type of insurance, an accident occurring on. For the tree service company, being insured protects against financial damages in case of an incident, accident, or property damage that arises during the course of business.

Source: alphasurety.com

Source: alphasurety.com

A bond is like an added level of insurance on your coverage plan. At the same time, an insurance policy protects your business from financial losses resulting from damage or theft. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two. Bonds are not prices assuming that there will be losses. Being bonded is not insurance.

Source: swiftbonds.com

Source: swiftbonds.com

Why is it important for a contractor to be bonded? Insurance offers coverage to the business as a policyholder, while a bond covers the customer against a breach of contract by the business. Bonded contractors have a surety bond in case of contract default. Bonded means that a contractor has purchased a surety bond to guarantee. Insurance, on the other hand, covers any liability claims that may arise during a job.

Source: insurancenoon.com

Source: insurancenoon.com

The first party is the company requesting the bond, referred to as the principal. Licensed means that a contractor has a valid contractor’s license from a state. However, being insured and being bonded are not the same thing. Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company. Why is it important for a contractor to be bonded?

![Surety Bonds vs Insurance Policy The Difference [Infographic] Surety Bonds vs Insurance Policy The Difference [Infographic]](https://www.performancesuretybonds.com/blog/wp-content/uploads/2019/07/Surety-Bonds-vs.-Insurance-Policies-Infographic_v1.jpg) Source: performancesuretybonds.com

Source: performancesuretybonds.com

Difference between surety and insurance alpha surety bonds from alphasurety.com. Why your business should become licensed, bonded, and insured The difference between being bonded and being insured. On the other hand, insurance means that you won’t be on the hook if a contractor is injured while working on your property. Main difference between being bonded and insured although the two seem similar, there is a thin difference between the two.

Source: amco.net

Source: amco.net

Difference between surety and insurance alpha surety bonds from alphasurety.com. Getting a contractor surety bond. While dealing with a bonded company is important, making sure they are insured is absolutely essential. Why your business should become licensed, bonded, and insured Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company.

Source: youtube.com

Source: youtube.com

Why is it important for a contractor to be bonded? If your claim is determined to be valid and a judgment awarded but the company is unable to pay, the award would come from the bond. Getting a contractor surety bond. Bonded and insured companies have higher chances of acquiring new business or winning public and government contracts. Instead, it provides assurance against the risk of default of a single entity (such as a general contractor).

Source: alphasurety.com

Source: alphasurety.com

A bond would not cover this, because the incident would not be related to the completion of the electrician�s job. Why is it important for a contractor to be bonded? Is amazon actually giving you the best price? Being bonded is more like credit, where the risk with the bond lies with the principle, meaning the person buying the bond, not with the insurance company. Insurance offers coverage to the business as a policyholder, while a bond covers the customer against a breach of contract by the business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the difference between bonded and insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information