What is the insuring clause Idea

Home » Trending » What is the insuring clause IdeaYour What is the insuring clause images are ready. What is the insuring clause are a topic that is being searched for and liked by netizens today. You can Find and Download the What is the insuring clause files here. Get all free photos.

If you’re searching for what is the insuring clause images information connected with to the what is the insuring clause keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

What Is The Insuring Clause. A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage. — also termed insuring agreement. The insuringclause states the very purpose of the life policy; In this context, it would include the insurer�s name, the face value payable, and the insured�s name.

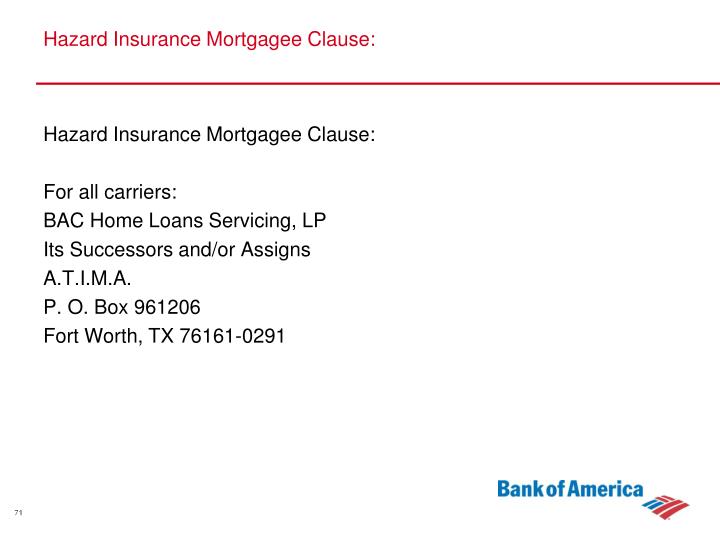

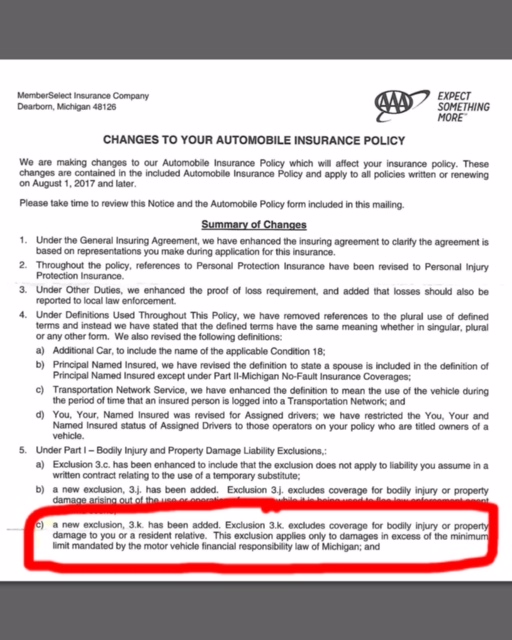

PPT Washington State Housing Finance Commission From slideserve.com

PPT Washington State Housing Finance Commission From slideserve.com

In respect to this, what does the insuring clause do? It contains the face value of the policy, the insured�s name, and the name of the insurer. The insuring agreement (or insuring clause) is the agreement in which the insurance company promises to pay for a loss resulting from any of the perils covered by the contract. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. Theft of funds held in escrow.

In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage.

Risk of direct physical loss, except for. However, the claim would be settled only if it is reported to the insurer in writing and within the time as stated in the policy. Risk of direct physical loss, except for. The insurer will pay the beneficiary should you or your spouse die of any cause not excluded under the agreement, up to the limits of indemnity set out in the table above. We agree to reimburse you for loss first discovered by your du…. In respect to this, what does the insuring clause do?

Source: doctoraamill.blogspot.com

Source: doctoraamill.blogspot.com

A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded. Theft of funds in personal f…. This could be described as the heart of the policy and, in modern pi policies, will very often be a description of broad and comprehensive cover. Basics of an insuring clause. A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage.

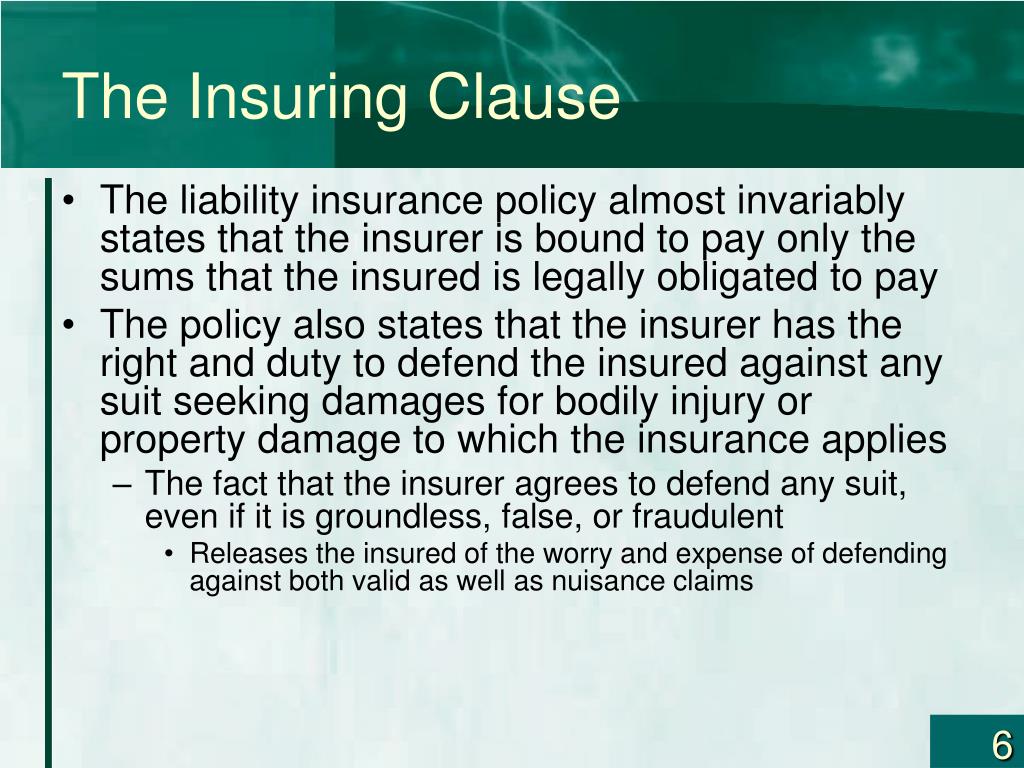

Source: slideserve.com

Source: slideserve.com

Other articles where insuring clause is discussed: Insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is. In respect to this, what does the insuring clause do? Insuring clauses 16th august 2010. A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded.

Source: albanord.com

Source: albanord.com

The insuringclause states the very purpose of the life policy; One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. Risk of direct physical loss, except for. The insuring agreement (or insuring clause) is the agreement in which the insurance company promises to pay for a loss resulting from any of the perils covered by the contract. In this context, it would include the insurer�s name, the face value payable, and the insured�s name.

Source: blog.cover360.in

Source: blog.cover360.in

Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage. It outlines the conditions under which the policy will pay. It contains the face value of the policy, the insured�s name, and the name of the insurer. Insuring agreement — that portion of the insurance.

Source: slideserve.com

Source: slideserve.com

The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. Other articles where insuring clause is discussed: The insuring agreement (or insuring clause) is the agreement in which the insurance company promises to pay for a loss resulting from any of the perils covered by the contract. The insuring clause describes what is covered by the policy. The insuring clause describes what is covered by the policy.

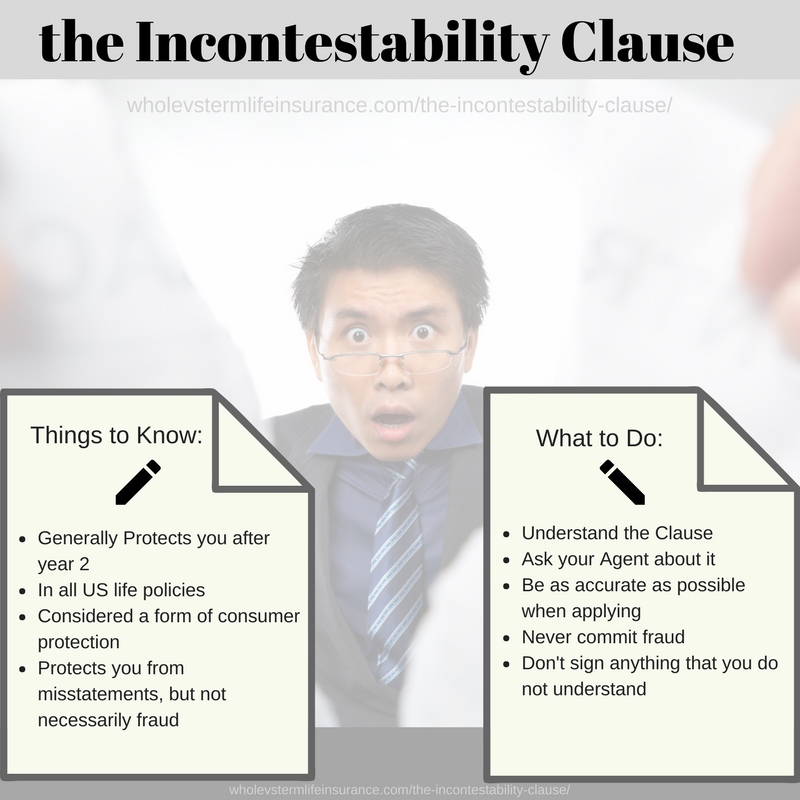

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage. A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded. Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. Insuring agreement — that portion of the insurance. •the type of property covered.

Source: basunivesh.com

Source: basunivesh.com

Insuring clauses 16th august 2010. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. In respect to this, what does the insuring clause do? The insuringclause states the very purpose of the life policy; A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded.

Source: slideserve.com

Source: slideserve.com

One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. — also termed insuring agreement. Insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. One is the insuring clause , in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person�s property.

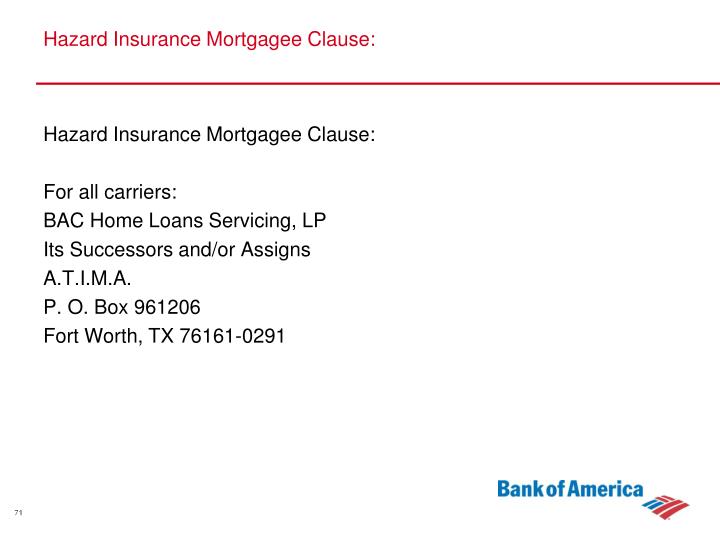

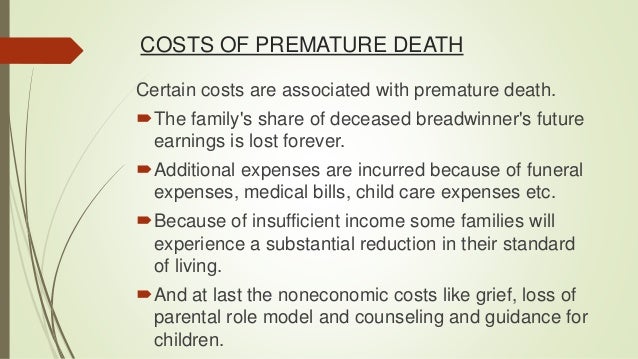

Source: slideshare.net

Source: slideshare.net

In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. An insuring clause is a part of insurance policies that defines how much risk will be taken on by the insurance company. In this context, it would include the insurer�s name, the face value payable, and the insured�s name. A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage.

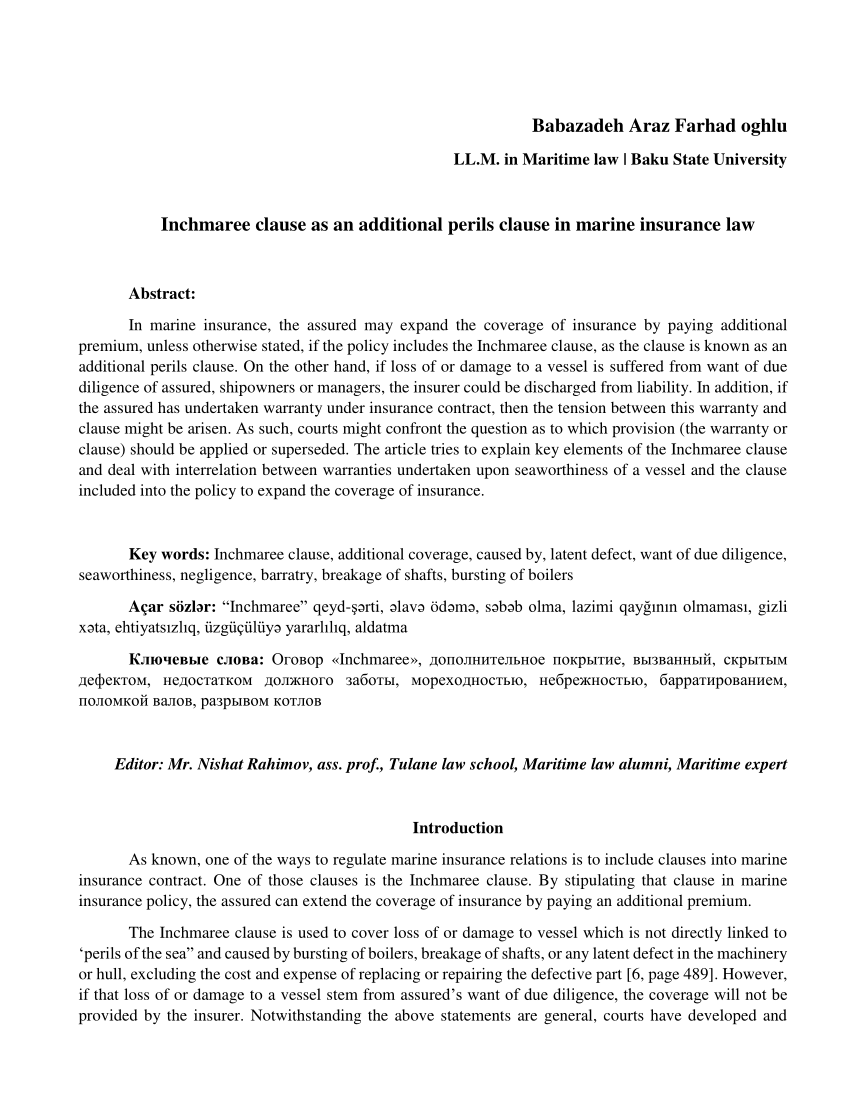

Source: researchgate.net

Source: researchgate.net

— also termed insuring agreement. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. In respect to this, what does the insuring clause do? A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded. Risk of direct physical loss, except for.

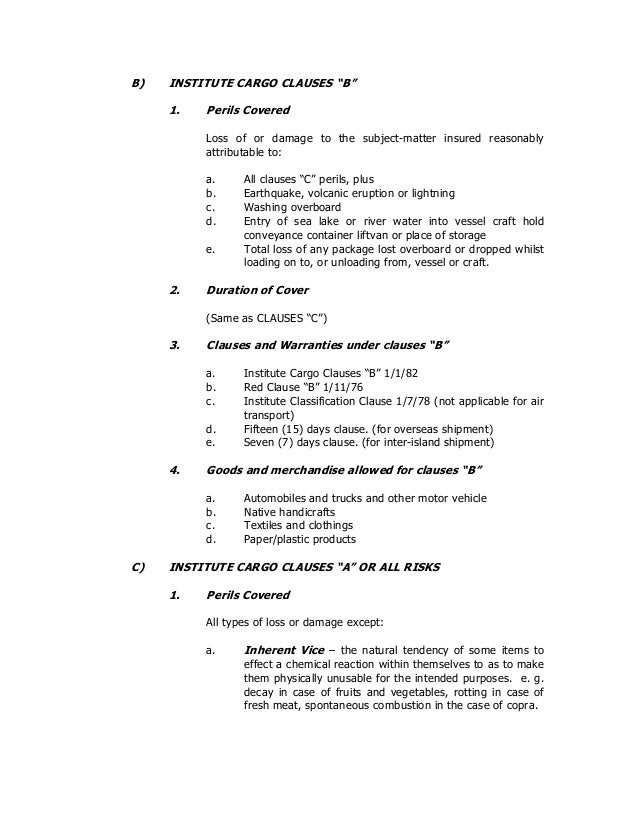

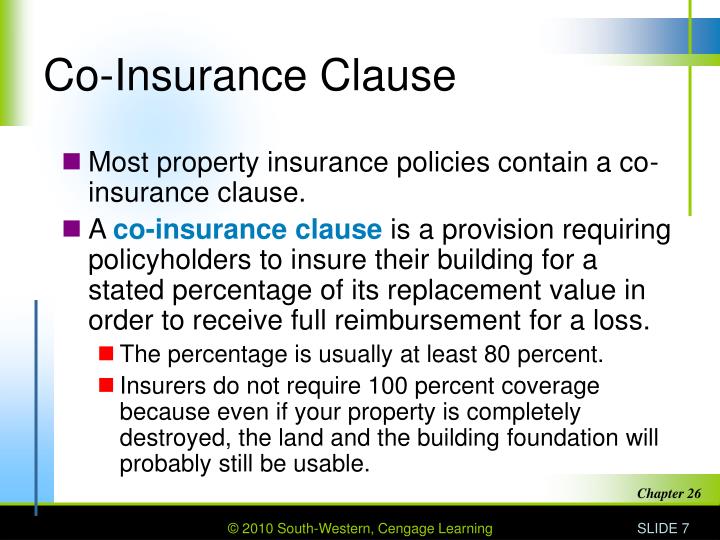

Source: slideserve.com

Source: slideserve.com

Legal definition of insuring clause. In this context, it would include the insurer�s name, the face value payable, and the insured�s name. In other words, it details the risks for which the insurer is liable and defines the scope of the coverage. An insuring clause is a part of insurance policies that defines how much risk will be taken on by the insurance company. Other articles where insuring clause is discussed:

Source: slideserve.com

Source: slideserve.com

Insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is. Insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is. Theft of funds held in escrow. Ransomware (extortion) we agree to reimburse you for loss first discovered by you dur…. •the type of property covered.

Source: dubaipostgraduate.com

Source: dubaipostgraduate.com

A provision in an insurance policy or bond reciting the risk assumed by the insurer or establishing the scope of the coverage. Insuring clauses 16th august 2010. An insuring clause is a provision in an insurance policy that stipulates the risks assumed by the insurer. Other articles where insuring clause is discussed: An insuring clause in a health or disability policy specifies exactly what the insurance company is liable for (or the risk that it assumes) and how much it will pay in benefits.

Source: sinasdramis.com

Source: sinasdramis.com

Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. The insuringclause states the very purpose of the life policy; For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured. •the type of property covered. An insuring clause is a part of insurance policies that defines how much risk will be taken on by the insurance company.

The insuringclause states the very purpose of the life policy; One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. Theft of funds held in escrow. In this context, it would include the insurer�s name, the face value payable, and the insured�s name. Insurers take on a certain amount of risk when providing an insurance policy, and the risk the company assumes is.

Source: basunivesh.com

Source: basunivesh.com

It outlines the conditions under which the policy will pay. This could be described as the heart of the policy and, in modern pi policies, will very often be a description of broad and comprehensive cover. Theft of funds in personal f…. Theft of funds held in escrow. Legal definition of insuring clause.

Source: slideserve.com

Source: slideserve.com

The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. Legal definition of insuring clause. Basics of an insuring clause. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage.

Source: issuu.com

Source: issuu.com

The insuring clause describes what is covered by the policy. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. The insuring agreement (or insuring clause) is the agreement in which the insurance company promises to pay for a loss resulting from any of the perils covered by the contract. However, the claim would be settled only if it is reported to the insurer in writing and within the time as stated in the policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the insuring clause by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information