What is the minimum auto insurance coverage in oregon information

Home » Trend » What is the minimum auto insurance coverage in oregon informationYour What is the minimum auto insurance coverage in oregon images are available in this site. What is the minimum auto insurance coverage in oregon are a topic that is being searched for and liked by netizens now. You can Find and Download the What is the minimum auto insurance coverage in oregon files here. Download all royalty-free photos.

If you’re looking for what is the minimum auto insurance coverage in oregon images information linked to the what is the minimum auto insurance coverage in oregon keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

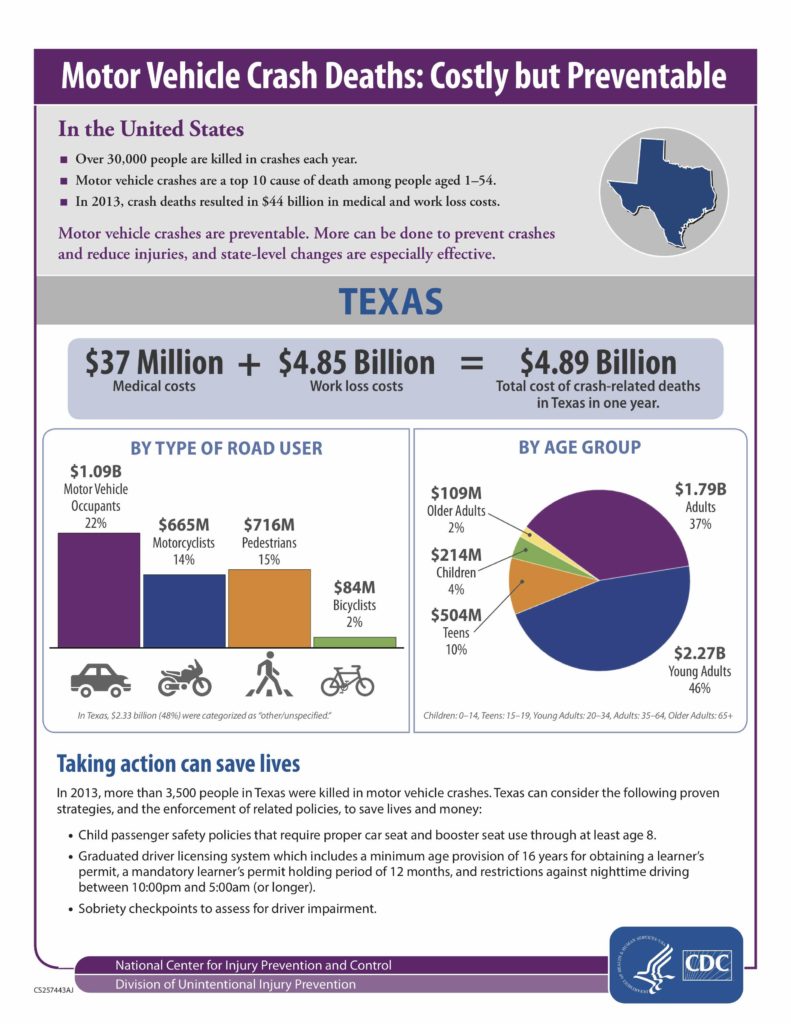

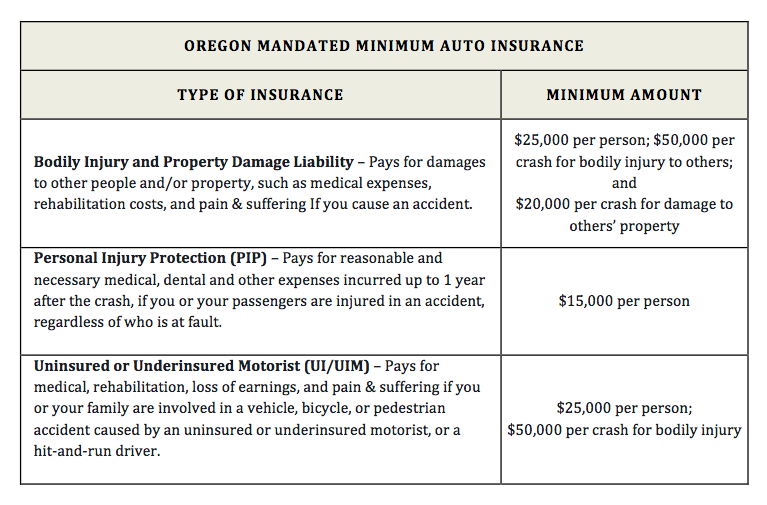

What Is The Minimum Auto Insurance Coverage In Oregon. The abbreviation would be 25/50/25. In the event of a covered accident, your limits for bodily injury are $25,000. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. Of oregon , 846 p.2d 1206 , 118 or.app.

What Is The Minimum Auto Insurance Coverage In Oregon at From revisi.net

What Is The Minimum Auto Insurance Coverage In Oregon at From revisi.net

There isn�t an insurance product called full coverage. $50,000 for total bodily injury to others, per accident. A minimum coverage policy includes state minimum liability. $25,000 for bodily injury, per person. If you cause an accident in oregon, this type of coverage pays the other. The minimum amount of oregon auto insurance coverage is $25,000/$50,000/$20,000.

If you cause an accident in oregon, this type of coverage pays the other.

In oregon, drivers must carry liability insurance, personal injury protection and uninsured motorist coverage. $25,000 per person and $50,000 per accident. $50,000 for total bodily injury to others, per accident. Personal injury protection your car insurance policy must include personal injury protection (pip) coverage. 4 rows you can fulfill your financial responsibility in oregon by purchasing a car insurance policy. Oregon�s liability auto insurance requirements are:

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

$25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs. $25,000 for bodily injury, per person. Before you can legally register your car in the state of oregon, you’ll need to prove to the state that your vehicle is insured. Bodily injury and property damage liability. $25,000 per person and $50,000 per accident.

Source: ktnv.com

Source: ktnv.com

The cost for coverage varies so it is important to shop when choosing an insurance company. Oregon car insurance minimum coverage. It differs by state, but it usually falls around the $15,000/$30,000 mark. Oregon law requires every car to be covered by automobile insurance. $25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs.

Source: carinsurancelist.com

Source: carinsurancelist.com

Bodily injury and property damage liability. What�s the difference between comprehensive and collision coverage? It differs by state, but it usually falls around the $15,000/$30,000 mark. Yes what are the minimum limits for oregon? For example, drivers in ohio are required to carry $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

Liability insurance covers (up to your policy’s limits) the other driver’s medical expenses and property damage following an accident that you were at fault for. For example, drivers in ohio are required to carry $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage. Your driving record and premiums. In the example above, these numbers mean that your state minimum responsibility is: $25,000 in bodily injury liability per person $50,000 in bodily injury liability per accident $20,000 in property damage liability per accident $15,000 in personal injury protection (pip) per person

Source: noyeshallallen.com

Source: noyeshallallen.com

The minimum liability coverage required for drivers is 25/50/25, which costs $25,000 per person, $50,000 in personal injury liability, and $25,000 in property damage liability. In the event of a covered accident, your limits for bodily injury are $25,000. In oregon, drivers must carry liability insurance, personal injury protection and uninsured motorist coverage. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. Insurance companies order driving records from the oregon dmv and from other states.

Source: everquote.com

Source: everquote.com

(minimum limits if driver purchases car insurance, which is optional.) $25,000 bodily injury liability per person $50,000 bodily injury liability per accident $25,000 property damage liability per. In the event of a covered accident, your limits for bodily injury are $25,000. If you cause an accident in oregon, this type of coverage pays the other. $45,000 for bodily injury per accident. $25,000 in bodily injury liability per person $50,000 in bodily injury liability per accident $20,000 in property damage liability per accident $15,000 in personal injury protection (pip) per person

Source: illinoisinjurylawcenter.com

Source: illinoisinjurylawcenter.com

In oregon, drivers must carry liability insurance, personal injury protection and uninsured motorist coverage. Here are some of the parameters of our. $45,000 for bodily injury per accident. Premiums reflect your driving record for the past three years. $50,000 per crash for bodily injury to others;

Source: revisi.net

Source: revisi.net

This is an abbreviated way to show the limits of a minimum coverage car insurance policy. This is more expensive than the nationwide average by 13%. The minimum insurance a driver must have is: The abbreviation would be 25/50/25. In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident.

Source: floridalatamworldofbusiness.com

Source: floridalatamworldofbusiness.com

$20,000 for property damage, per accident. Coverage limits are displayed like 15/45/25 or $15,000/$45,000/$25,000. Yes what are the minimum limits for oregon? In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. For example, drivers in ohio are required to carry $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

Before you can legally register your car in the state of oregon, you’ll need to prove to the state that your vehicle is insured. $25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs. The minimum liability coverage required for drivers is 25/50/25, which costs $25,000 per person, $50,000 in personal injury liability, and $25,000 in property damage liability. The types and levels of coverage, however, vary from state to state. Oregon car insurance minimum coverage.

Source: autoinsurance.org

Source: autoinsurance.org

It differs by state, but it usually falls around the $15,000/$30,000 mark. Here are some of the parameters of our. In oregon, you�ll need to have at least the following minimums of liability insuranc e: The minimum fine is $110. Oregon law requires every car to be covered by automobile insurance.

Source: dipsegovia.info

Source: dipsegovia.info

The minimum liability coverage required for drivers is 25/50/25, which costs $25,000 per person, $50,000 in personal injury liability, and $25,000 in property damage liability. This is more expensive than the nationwide average by 13%. In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident. Oregon car insurance laws & state minimum coverage limits oregon car insurance laws require minimum liability rates of 25/50/20 for bodily injury and property damage coverage. The minimum fine is $110.

Source: mayorlaw.com

Source: mayorlaw.com

It differs by state, but it usually falls around the $15,000/$30,000 mark. $50,000 per crash for bodily injury to others; A minimum coverage policy includes state minimum liability. For example, drivers in ohio are required to carry $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage. Premiums reflect your driving record for the past three years.

Source: quotewizard.com

Source: quotewizard.com

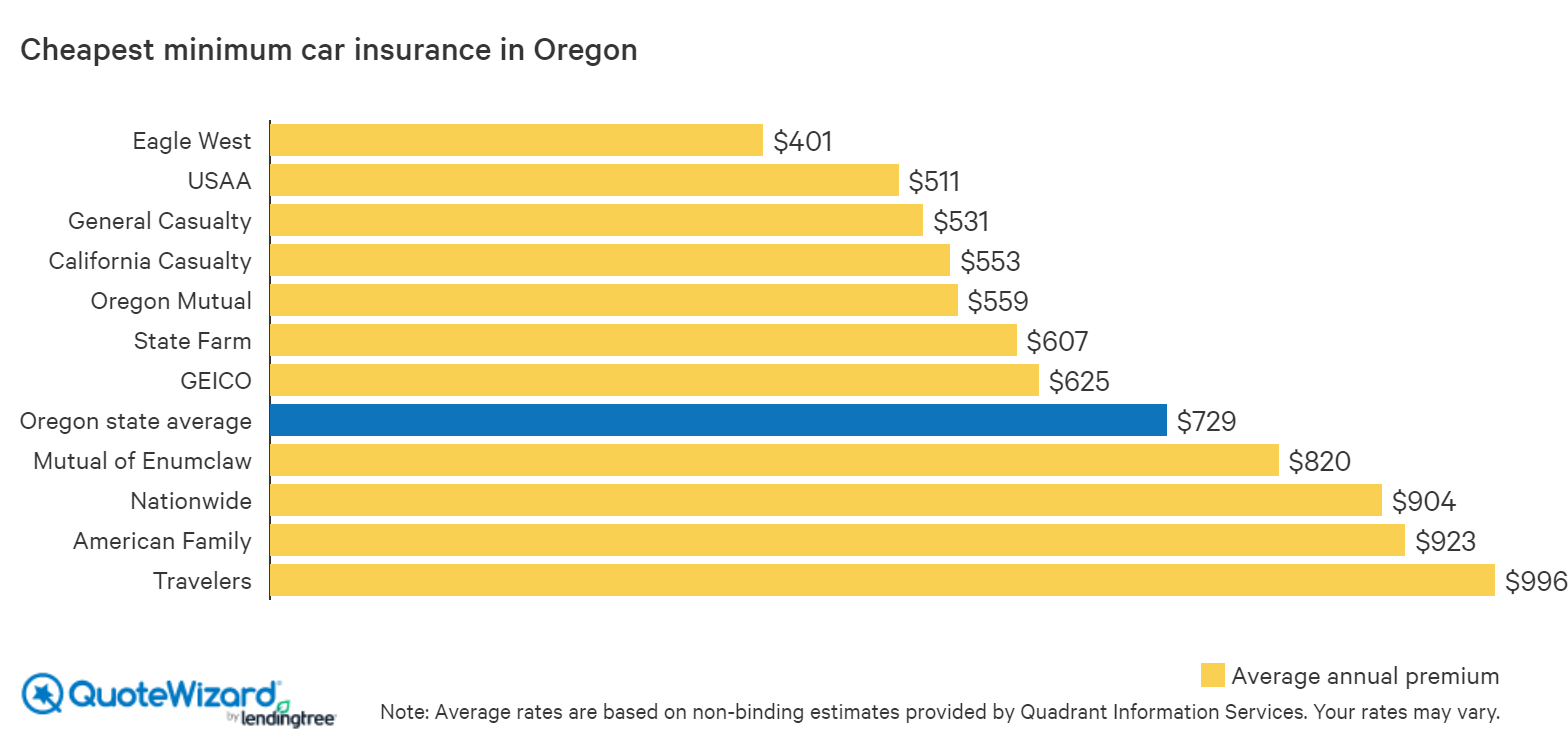

Bodily injury and property damage liability. Coverage limits are displayed like 15/45/25 or $15,000/$45,000/$25,000. The average car insurance rates in oregon are $610 per year for a minimum coverage policy and $1,346 per year for a full coverage policy. Liability insurance covers (up to your policy’s limits) the other driver’s medical expenses and property damage following an accident that you were at fault for. What�s the difference between comprehensive and collision coverage?

Source: revisi.net

Source: revisi.net

Oregon car insurance laws & state minimum coverage limits oregon car insurance laws require minimum liability rates of 25/50/20 for bodily injury and property damage coverage. The types and levels of coverage, however, vary from state to state. Oregon law requires every car to be covered by automobile insurance. In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident. The abbreviation would be 25/50/25.

Source: pinterest.com

Source: pinterest.com

$25,000 for bodily injury, per person. The abbreviation would be 25/50/25. In oregon, you must present proof of insurance in order to register a car and whenever asked to do so by a police officer during a traffic stop or accident. Oregon car insurance minimum coverage. If you cause an accident in oregon, this type of coverage pays the other.

Source: gajizmo.com

Source: gajizmo.com

It differs by state, but it usually falls around the $15,000/$30,000 mark. Oregon law requires every car to be covered by automobile insurance. $25,000 bodily injury per person $50,000 bodily injury per accident $20,000 property damage per accident —or— 25/50/20 dairyland® coverage in oregon at dairyland, we’re proud to be able to help drivers in oregon meet their insurance needs. Oregon car insurance minimum coverage. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information