What is the price of insurance for each exposure unit Idea

Home » Trend » What is the price of insurance for each exposure unit IdeaYour What is the price of insurance for each exposure unit images are ready in this website. What is the price of insurance for each exposure unit are a topic that is being searched for and liked by netizens today. You can Find and Download the What is the price of insurance for each exposure unit files here. Get all royalty-free photos.

If you’re searching for what is the price of insurance for each exposure unit pictures information related to the what is the price of insurance for each exposure unit topic, you have visit the right site. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

What Is The Price Of Insurance For Each Exposure Unit. According to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. The exposure unit is used to establish insurance premiums by examining parallel groups. Price per unit = 18+3.6 = 21.6; At least theoretically, elected by policyowners.

Exposure Calculator — Total Ink Solutions From totalinksolutions.com

Exposure Calculator — Total Ink Solutions From totalinksolutions.com

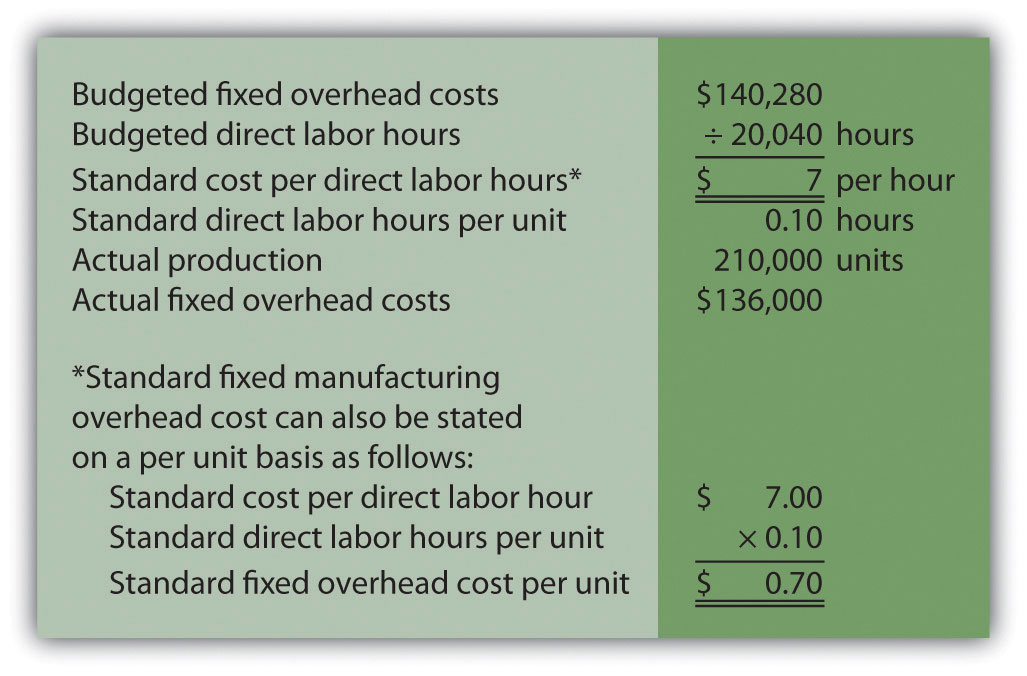

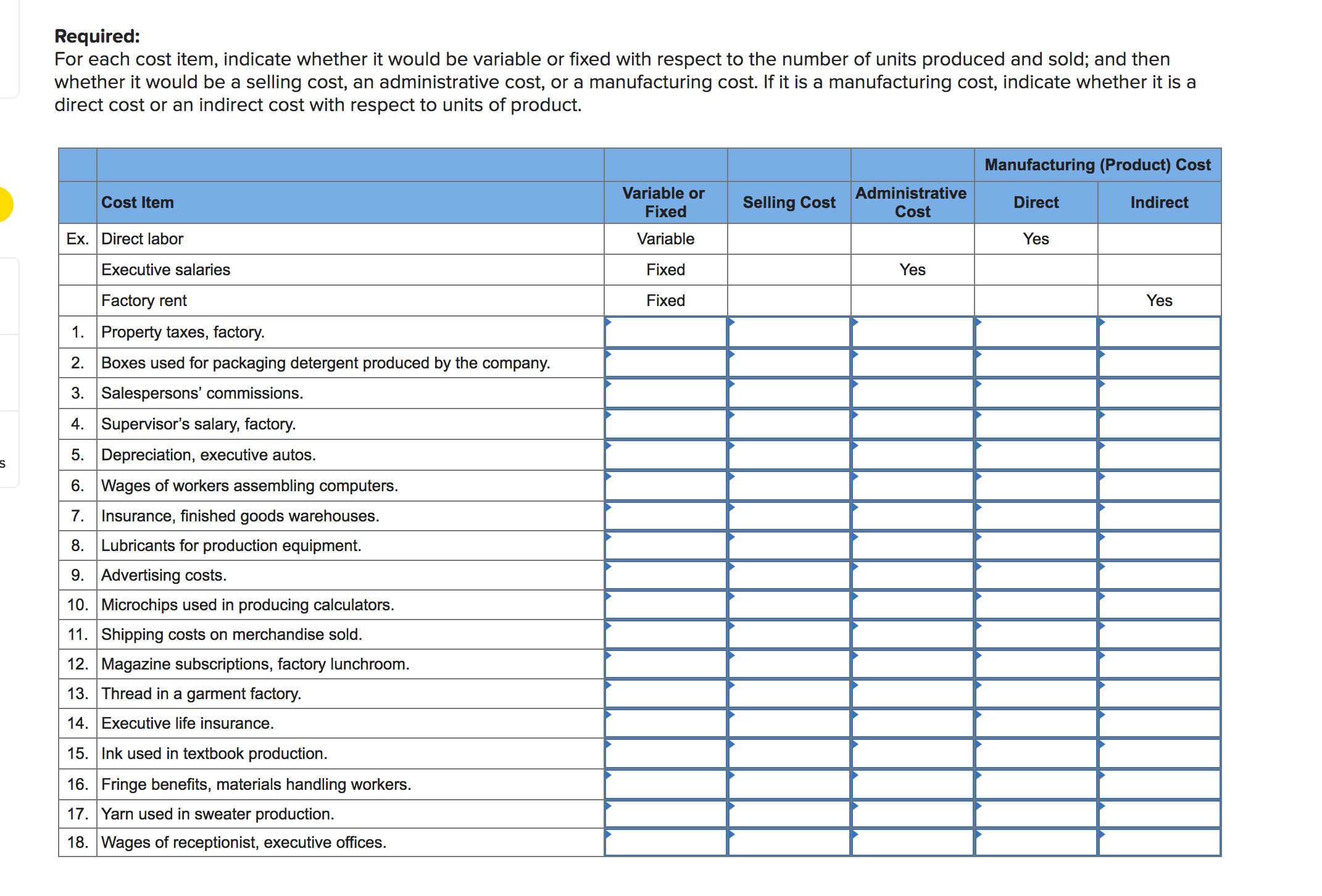

For an auto insurance policy, an exposure unit may equate to 100 miles driven, while for property insurance, one exposure unit could be $1,000 of property value. The basic unit that underlies an insurance premium. The losses that occur are accidental. If an insured has $1,000 of exposed property, the premium will thus be $10. Measurement of business operating cash flow is affected due to a change in the exchange rate, which results in a growth in profit. A rate is the price per unit of insurance for each exposure unit, which is the unit of measurement used in insurance pricing.

Since the current relative average rate level is 1.2375, the 1985 calendar year earned premium must be multiplied by (1.2375/1.1094) = 1.1155 to reflect current rate levels.

Premium should be economically feasible. If an insured has $1,000 of exposed property, the premium will thus be $10. In property insurance, approximately one. The rate is the price per unit of exposure. Price per unit = cost per unit + profit requirement. Similar to life insurance, a unit of insurance in liability equals $1,000 of standard liability coverage.

Source: arizonahealthagents.com

Source: arizonahealthagents.com

Of account to discover your actual insurance exposure, including premium basis, classifications and rates that apply, for a specific period of time coverage was provided. Of account to discover your actual insurance exposure, including premium basis, classifications and rates that apply, for a specific period of time coverage was provided. Large numbers of exposure units. At least theoretically, elected by policyowners. Manufacturing cost per month increased by ₹ 5,00,00,000 due to a change in the exchange rate.

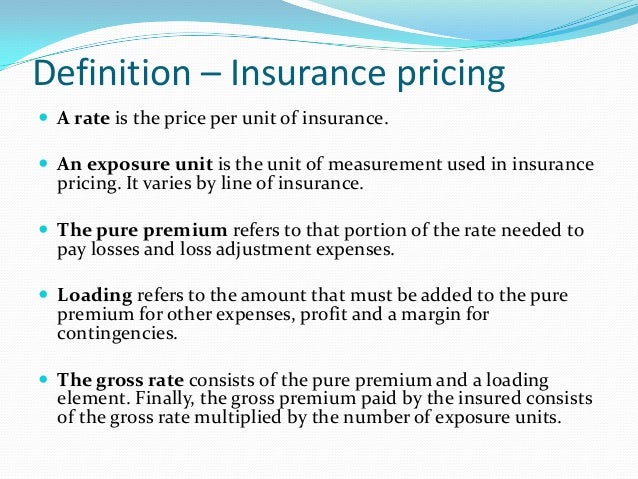

Source: slideserve.com

Source: slideserve.com

A couple of examples of an exposure unit include per $1,000 of property value or per $1 per square foot area of property. For an auto insurance policy, an exposure unit may equate to 100 miles driven, while for property insurance, one exposure unit could be $1,000 of property value. The loss cost per unit of exposure, the administrative expenses, or “loading,” and the profit. A rate is the price per unit of insurance for each exposure unit, which is the unit of measurement used in insurance pricing. The exposure units actually exposed to loss at a given point in time.

Source: financialsnet.com

Source: financialsnet.com

The average 1975 relative earned rate level is therefore [(.125)(1.000) + (.875)(1.1253] = 1.1094. Large numbers of exposure units. For an auto insurance policy, an exposure unit may equate to 100 miles driven, while for property insurance, one exposure unit could be $1,000 of property value. If an insured has $1,000 of exposed property, the premium will thus be $10. The theory of insurance is based on the law of large numbers.

Source: online-accounting.net

Source: online-accounting.net

Insurance defines properties or liabilities with similar characteristics as an exposure unit. The losses that occur are accidental. In fire insurance, for example, the rate may be expressed as $1 per $100 of exposed property; Large numbers of exposure units. In everyday usage, “risk” is often used synonymously with “probability” of a loss or threat.

Source: worksheeto.com

Source: worksheeto.com

Similar to life insurance, a unit of insurance in liability equals $1,000 of standard liability coverage. A couple of examples of an exposure unit include per $1,000 of property value or per $1 per square foot area of property. In fire insurance, for example, the rate may be expressed as $1 per $100 of exposed property; Actuarial rates are expressed as a price per unit of insurance for each exposure unit, which is a unit of liability or property with similar characteristics. Following are some critical advantages of pricing a product:

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Determine the fixed expenses per exposure unit. In everyday usage, “risk” is often used synonymously with “probability” of a loss or threat. The rate reflects three major elements: For liability, insurance companies set rates as the price per unit of insurance for each unit exposed to liability. So, the price per unit of the product is $21.6.

Source: homeworklib.com

Source: homeworklib.com

The unit price helps the company to adequately market its product. Admissions/unit size= # of exposure units 50,000 admissions/1,000 admissions=50 exposure units rate per unit x # of exposure units= premium $100 x 50 = $5,000 For liability, insurance companies set rates as the price per unit of insurance for each unit exposed to liability. So, the price per unit of the product is $21.6. In everyday usage, “risk” is often used synonymously with “probability” of a loss or threat.

Source: bartleby.com

Source: bartleby.com

The exposure units actually exposed to loss in a given period. Large numbers of exposure units. Exposure rating is one of two risk calculations used in the insurance industry — the other being the experience rating method. The exposure unit is used to establish insurance premiums by examining parallel groups. The number of similar exposure units is large.

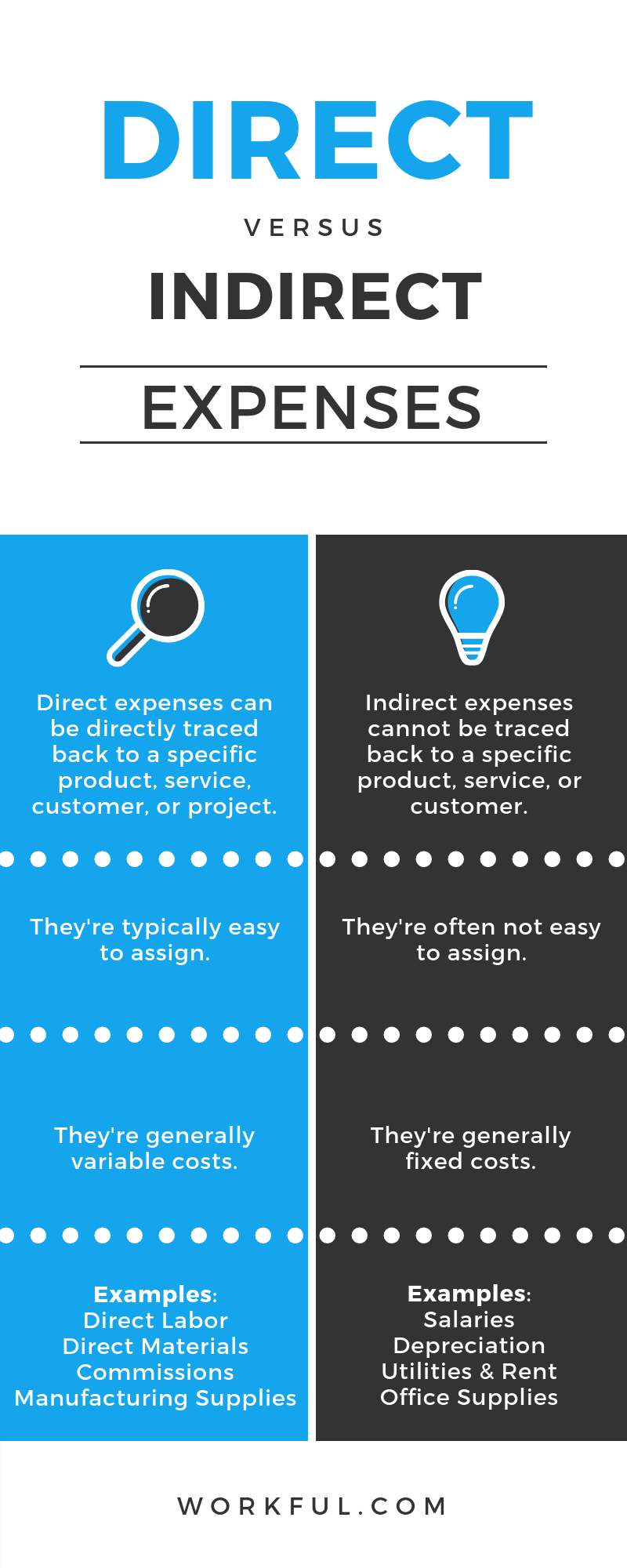

Source: workful.com

Source: workful.com

Competitive effect and conversion effect will take place in the case of multinationals compare to local businesses operating in. The number of similar exposure units is large. The price of insurance for each exposure unit is called the a. A rate is the price per unit of insurance for each exposure unit, which is the unit of measurement used in insurance pricing. “exposure” means your payroll, receipts or sales, units, number of employees or contract cost.

Source: travelers.com

Source: travelers.com

With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. One group is comprised of 1,000 units and the other is comprised of 4,000 units. Exposure base — the basis to which rates are applied to determine premium. At least theoretically, elected by policyowners. Since the current relative average rate level is 1.2375, the 1985 calendar year earned premium must be multiplied by (1.2375/1.1094) = 1.1155 to reflect current rate levels.

Source: digitsmith.com

Source: digitsmith.com

The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small apartment buildings ranges from $67 to $89 per month based on location, number of units, payroll, sales and experience. Measurement of business operating cash flow is affected due to a change in the exchange rate, which results in a growth in profit. Admissions/unit size= # of exposure units 50,000 admissions/1,000 admissions=50 exposure units rate per unit x # of exposure units= premium $100 x 50 = $5,000 Manufacturing cost per month increased by ₹ 5,00,00,000 due to a change in the exchange rate. The basic unit that underlies an insurance premium.

Source: managecasa.com

Source: managecasa.com

For an auto insurance policy, an exposure unit may equate to 100 miles driven, while for property insurance, one exposure unit could be $1,000 of property value. A $1 million property represents a larger risk to the insurance company than a. The rate reflects three major elements: The exposure units actually exposed to loss in a given period. If an insured has $1,000 of exposed property, the premium will thus be $10.

Source: totalinksolutions.com

Source: totalinksolutions.com

The price of insurance for each exposure unit is called the a. In fire insurance, for example, the rate may be expressed as $1 per $100 of exposed property; Of account to discover your actual insurance exposure, including premium basis, classifications and rates that apply, for a specific period of time coverage was provided. For an auto insurance policy, an exposure unit may equate to 100 miles driven, while for property insurance, one exposure unit could be $1,000 of property value. Price per unit = 18+3.6 = 21.6;

Source: slideshare.net

Source: slideshare.net

The basic unit that underlies an insurance premium. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small apartment buildings ranges from $67 to $89 per month based on location, number of units, payroll, sales and experience. The audit is done to obtain insurance rating information only. Large numbers of exposure units. In fire insurance, for example, the rate may be expressed as $1 per $100 of exposed property;

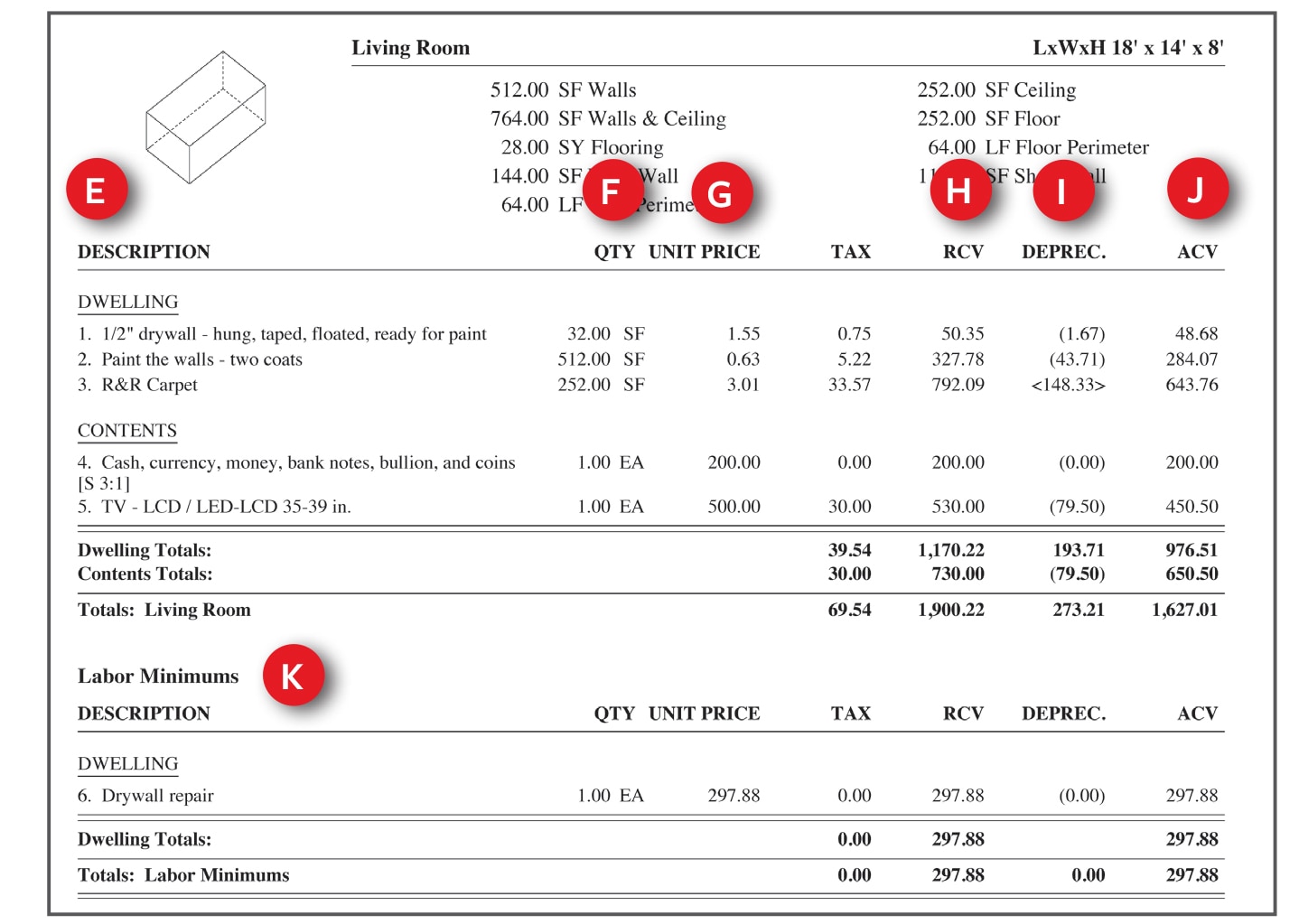

Source: adjustersinternational.com

Source: adjustersinternational.com

Actuarial rates are expressed as a price per unit of insurance for each exposure unit, which is a unit of liability or property with similar characteristics. Determine the fixed expenses per exposure unit. A $1 million property represents a larger risk to the insurance company than a. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. The exposure units actually exposed to loss at a given point in time.

Source: digitsmith.com

Source: digitsmith.com

A couple of examples of an exposure unit include per $1,000 of property value or per $1 per square foot area of property. Admissions/unit size= # of exposure units 50,000 admissions/1,000 admissions=50 exposure units rate per unit x # of exposure units= premium $100 x 50 = $5,000 Measurement of business operating cash flow is affected due to a change in the exchange rate, which results in a growth in profit. Following are some critical advantages of pricing a product: In everyday usage, “risk” is often used synonymously with “probability” of a loss or threat.

Source: digitsmith.com

Source: digitsmith.com

The number of similar exposure units is large. Price per unit = 18+3.6 = 21.6; A couple of examples of an exposure unit include per $1,000 of property value or per $1 per square foot area of property. According to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. The basic unit that underlies an insurance premium.

Source: insurancereload.com

Source: insurancereload.com

The price of insurance for each exposure unit is called the a. The price of insurance for each exposure unit is called the a. A couple of examples of an exposure unit include per $1,000 of property value or per $1 per square foot area of property. The basic unit that underlies an insurance premium. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the price of insurance for each exposure unit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information