What is the purpose of key person insurance information

Home » Trend » What is the purpose of key person insurance informationYour What is the purpose of key person insurance images are available. What is the purpose of key person insurance are a topic that is being searched for and liked by netizens now. You can Get the What is the purpose of key person insurance files here. Get all royalty-free vectors.

If you’re looking for what is the purpose of key person insurance pictures information connected with to the what is the purpose of key person insurance interest, you have pay a visit to the right site. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

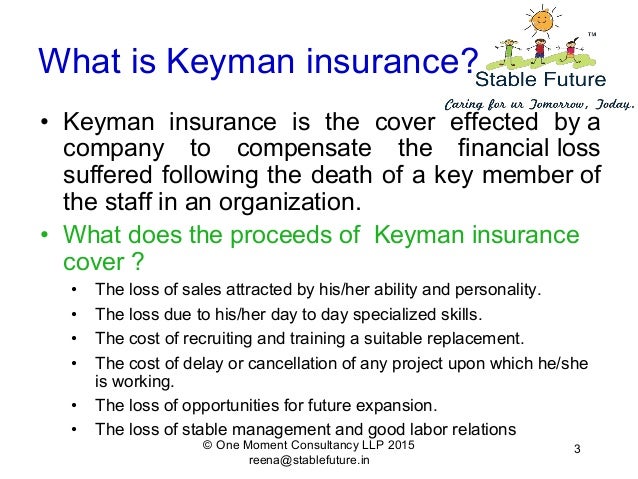

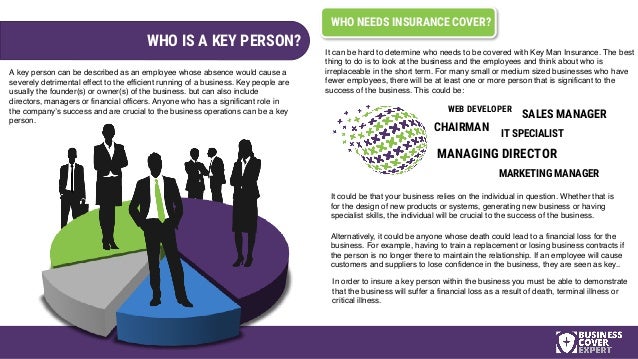

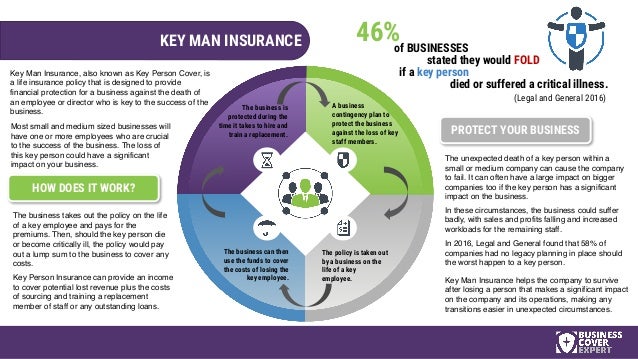

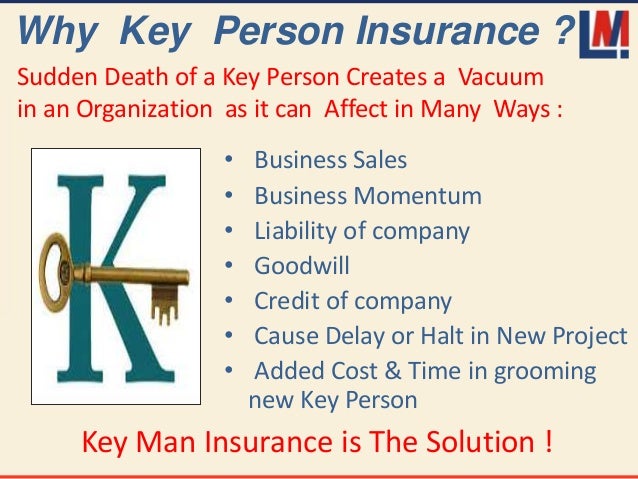

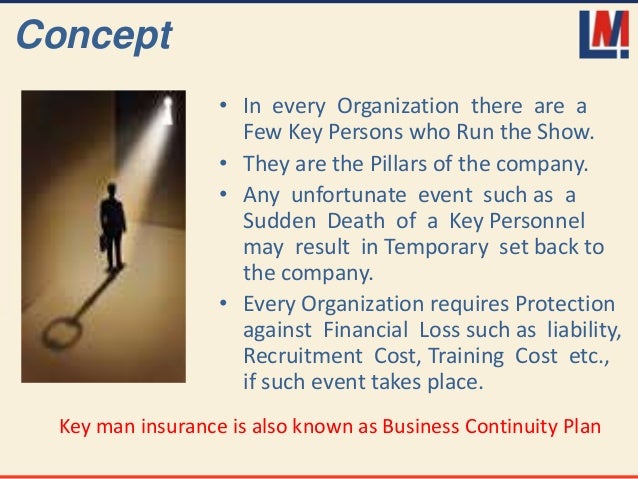

What Is The Purpose Of Key Person Insurance. To maintain an account that insures the owner of a company remains solvent d. The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company. To provide health insurance to the families of key employees b. Key person insurance, also called keyman insurance, is an important form of business insurance.there is no legal definition of key person insurance.

The Purpose of Key Person Insurance darkinthedark From darkinthedark.com

The Purpose of Key Person Insurance darkinthedark From darkinthedark.com

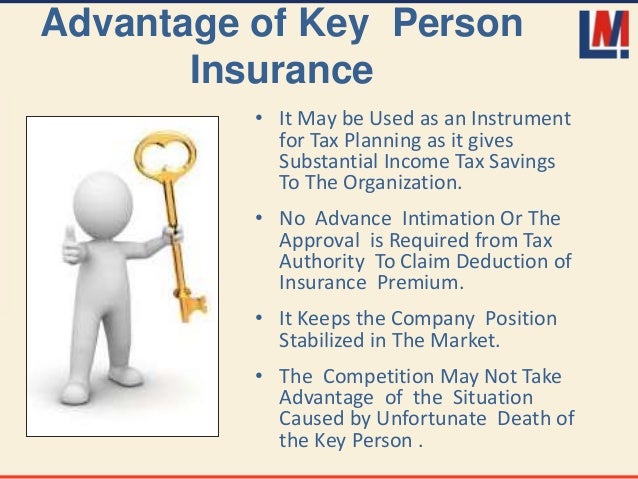

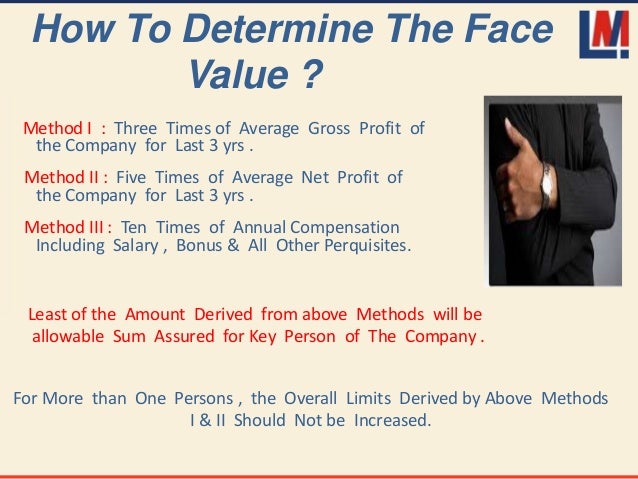

However, key person insurance differs from personal life insurance as its main purpose is to protect your business. Very often, a small business depends on one or two key people to keep the business afloat. The key person life insurance policy as compared to life insurance of the personal type mainly protects your business. The primary purpose of life insurance is to provide a financial benefit to dependants upon premature death of an insured person.the purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work.the purpose of the coverage is to allow the business to hire additional help while the. To provide health insurance to the families of key employees b. Key person insurance is the comprehensive policy from cig that caters for this.

To maintain an account that insures the owner of a company remains solvent d.

Revenue purpose insurance is key person insurance taken out to protect the business from a fall in revenue or increased costs and includes any protection against an adverse effect on the revenue or profit and loss account (“p&l”). To maintain an account that insures the owner of a company remains solvent d. To protect business in case of death of employee. Essentially, it�s a life insurance policy that is typically taken out on a business owner or other key individual. What is a key person life insurance? What is the purpose of key person insurance?

Source: meaninb.blogspot.com

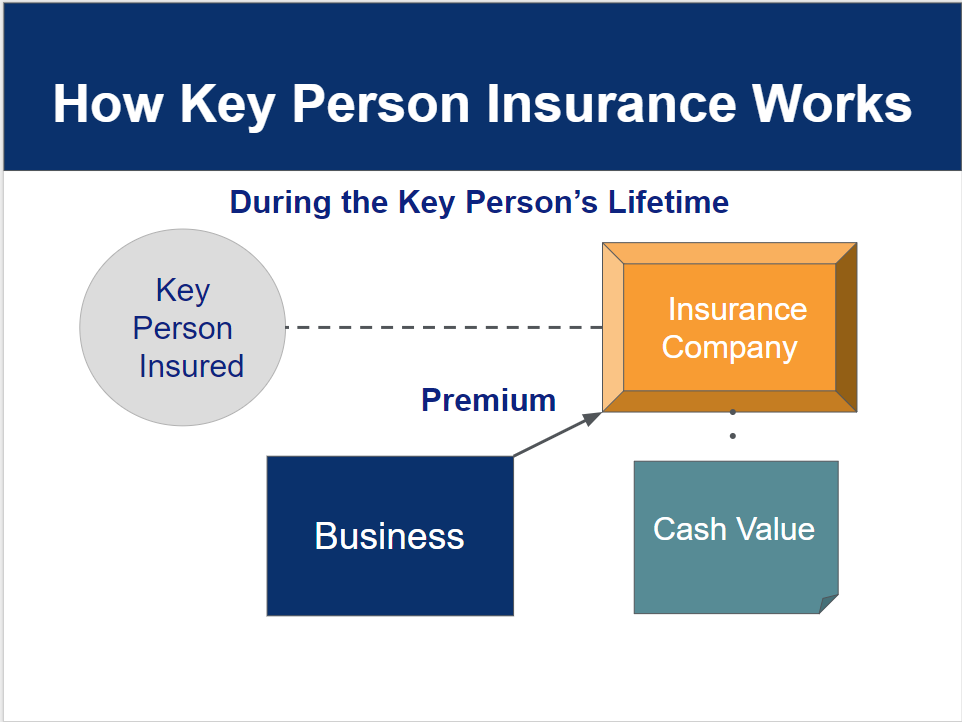

For example, a small business owner may choose to take out a policy on himself and make the business the beneficiary. You can take out a key person policy on any member of your team—even yourself. The business organizations will be unaffected by these things. Also known as key man insurance or business life insurance, the purpose of the policy is to help the company offset some of the financial losses brought about by the untimely death of a ‘key’ employee. Key person insurance is a type of business insurance policy taken out on an invaluable company executive or employee.

Source: rkhenshall.com

Source: rkhenshall.com

There are several facts about key person insurance. However, key person insurance differs from personal life insurance as its main purpose is to protect your business. There are several facts about key person insurance. To insure retirement benefits are available to all key employees c. Key person insurance is a type of life insurance that helps compensate a business if the owner or main employee dies.

Source: slideshare.net

Source: slideshare.net

Essentially, it�s a life insurance policy that is typically taken out on a business owner or other key individual. The company is the beneficiary of the plan and. The key person life insurance policy as compared to life insurance of the personal type mainly protects your business. So what is the purpose of key person insurance? Life insurance on a key employee, partner or proprietor on whom the continued successful operation of a business depends.

Source: moneymanagement.com.au

From the owners of a business to directors, project managers, ceo’s and sales heads, key person insurance covers the loss of those whose absence may threaten the future of the company. What is the purpose of a key person insurance? The key person life insurance policy as compared to life insurance of the personal type mainly protects your business. Key person insurance, also known as key employee insurance, helps protect your small business in case the owner or other key employee dies. The purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work.

Source: slideshare.net

Source: slideshare.net

It is one of the best ways to do these things. Click to see full answer. Any one of the five uses of key man life insurance can give you peace of mind that your business is protected in the event of the loss of a key person. In general, it can be described as an insurance policy taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. There are several facts about key person insurance.

Source: nextinsurance.com

Source: nextinsurance.com

To provide health insurance to the families of key employees b. From the owners of a business to directors, project managers, ceo’s and sales heads, key person insurance covers the loss of those whose absence may threaten the future of the company. To maintain an account that insures the owner of a company remains solvent d. The primary purpose of life insurance is to provide a financial benefit to dependants upon premature death of an insured person.the purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work.the purpose of the coverage is to allow the business to hire additional help while the. The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company.

Source: allinsgrp.com

Source: allinsgrp.com

The purpose of key person insurance is to mitigate the loss to the business due to the death of a key employee. The purpose of key person insurance. Key person insurance is the comprehensive policy from cig that caters for this. The company is the beneficiary of the plan and. What can be better than this?

Source: moneymanagement.com.au

Source: moneymanagement.com.au

The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company. So what is the purpose of key person insurance? Key person insurance is a type of business insurance policy taken out on an invaluable company executive or employee. To protect business in case of death of employee. To maintain an account that insures the owner of a company remains solvent d.

Source: footage.presseportal.de

Source: footage.presseportal.de

Key person insurance is the comprehensive policy from cig that caters for this. The purpose of key person insurance is to mitigate the loss to the business due to the death of a key employee. To maintain an account that insures the owner of a company remains solvent d. It is one of the best ways to do these. Key person insurance is a life insurance policy a company buys on the life of a top executive or another critical individual.

Source: darkinthedark.com

Source: darkinthedark.com

The purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work. Key person insurance is a type of life insurance that helps compensate a business if the owner or main employee dies. Key person insurance is a life insurance policy a company buys on the life of a top executive or another critical individual. That�s why key person insurance can be a vital planning tool. The purpose of key person insurance is to help the company survive the blow of losing the person who makes the business work.

Source: slideshare.net

Source: slideshare.net

The purpose is not to provide funding for the business owners to buy and sell each other�s shares in the business (that need is covered by buy/sell insurance arrangements). The purpose of key person insurance. The key employee is the covered individual under the policy, also called the “insured.”. In general, it can be described as an insurance policy taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. What is a key person life insurance?

Source: slideshare.net

Source: slideshare.net

The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company. These are the people who manage the books, know all the customers, and make sure there’s always coffee in the jar. The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company. You can take out a key person policy on any member of your team—even yourself. To protect business in case of death of employee.

Source: slideshare.net

Source: slideshare.net

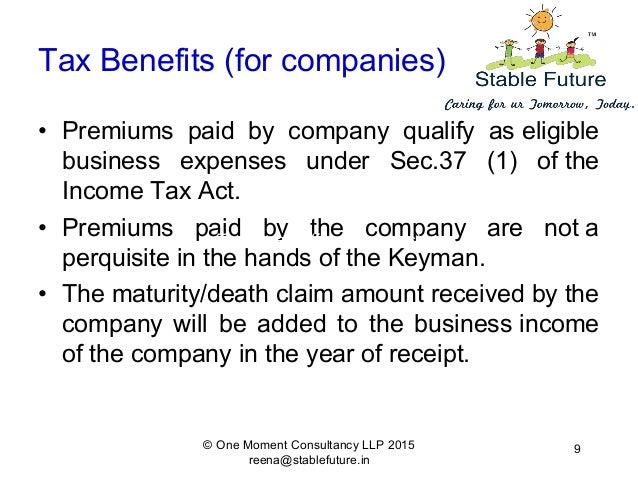

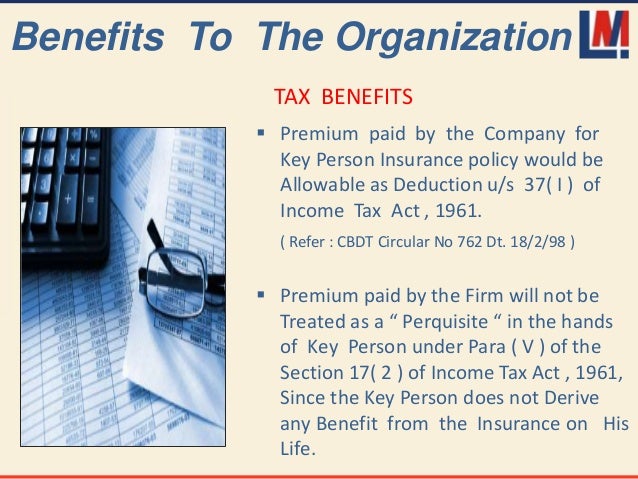

Read up on on how key person insurance might benefit your business and learn whether it�s tax deductible. To insure retirement benefits are available to all key employees c. Key person insurance is the comprehensive policy from cig that caters for this. Life insurance on a key employee, partner or proprietor on whom the continued successful operation of a business depends. This is made for the leader of the company.

Source: slideshare.net

Source: slideshare.net

In general, it can be described as an insurance policy taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. What is the purpose of key person insurance? This is made for the leader of the company. It is one of the best ways to do these things. What can be better than this?

Source: slideshare.net

Source: slideshare.net

The purpose of key person insurance. This is made for the leader of the company. Key person insurance is a type of business insurance policy taken out on an invaluable company executive or employee. A life insurance policy that a company purchases on a key executive�s life. The reason this coverage is important is because the death of a key person in a small company can cause the immediate death of that company.

Source: slideshare.net

Source: slideshare.net

Essentially, it�s a life insurance policy that is typically taken out on a business owner or other key individual. The purpose of key person insurance. The policy functions like life insurance by financially protecting your family and loved ones in the event that you pass away. To protect business in case of death of employee. The purpose of key person insurance is to protect a business against the loss of the services of a key person due to death, illness or injury.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

As the title suggests, in this article, we are going to dive into the topic of keyman insurance. There are several facts about key person insurance. The purpose of key person insurance. You can take out a key person policy on any member of your team—even yourself. Very often, a small business depends on one or two key people to keep the business afloat.

Source: slideshare.net

Source: slideshare.net

Essentially, you take out a life insurance policy (or, in some cases, disability insurance) on essential members of your. Key person insurance protects a business against the death or disability of an individual who is essential to the company’s survival.1 it is also called key (30). Key person insurance, also called keyman insurance, is an important form of business insurance.there is no legal definition of key person insurance. To provide health insurance to the families of key employees b. Key person insurance is the comprehensive policy from cig that caters for this.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the purpose of key person insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information