What is the replacement rule in life insurance information

Home » Trending » What is the replacement rule in life insurance informationYour What is the replacement rule in life insurance images are available. What is the replacement rule in life insurance are a topic that is being searched for and liked by netizens today. You can Get the What is the replacement rule in life insurance files here. Get all free images.

If you’re searching for what is the replacement rule in life insurance pictures information connected with to the what is the replacement rule in life insurance keyword, you have pay a visit to the right site. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

What Is The Replacement Rule In Life Insurance. The replacement of life insurance and annuities regulation is designed to protect the interest of the. The department�s current rules apply to the replacement of life insurance policies. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Beside above, what is the replacement rule in life insurance?

What is voluntary life insurance vs. basic life insurance From quickquote.com

What is voluntary life insurance vs. basic life insurance From quickquote.com

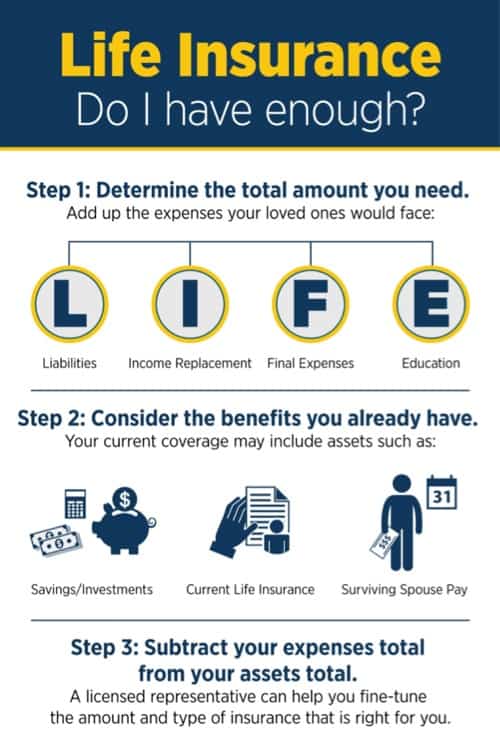

New rules for life insurance march 2016. If you’re married or have children, it’s important that you know what these rules are. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. There is no one replacement rule in life insurance, but there are some replacement guidelines and explanations. Life insurance replacement regulation protects the interests of the policyowner which of the following documents must an agent submit to the replacing insurance company during the replacement of an existing life insurance policy? If you are considering the purchase of life insurance as part of your estate plan thatmeans you should act

Life insurance replacement regulation protects the interests of the policyowner which of the following documents must an agent submit to the replacing insurance company during the replacement of an existing life insurance policy?

A term conversion is a contractual right where a term insurance (policy or benefit) is being converted to a permanent insurance. However, the rules are very strict around who can do this and when. A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. Shall leave with the applicant the original or a copy of such materials used. Major issues with replacing a life policy include contestability, surrender fees, and churning.

![Life Insurance Replacement [Top 5 Dos and Don�ts] Life Insurance Replacement [Top 5 Dos and Don�ts]](https://www.lifeinsuranceblog.net/wp-content/uploads/2018/11/Life-Insurance-Replacement.jpg) Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Get all life insurance news on news18.com A term conversion is a contractual right where a term insurance (policy or benefit) is being converted to a permanent insurance. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. New tax rules for life insurance policies will become effective on january 1, 2017. (1) a life insurance agent shall obtain, with, or as a part of, each application for life insurance, a statement signed by the applicant as to whether the insurance for which application is made will replace existing life insurance.

Source: pinterest.jp

Source: pinterest.jp

A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. Department of insurance replacement of life insurance and annuities. Replacement of life insurance and annuities [prior to 10/22/86, insurance department[510]] 191—16.1(507b) purpose and authority. 2) whether or not you make the replacement is up to you to do. However, life insurance could potentially act as income replacement insurance in the event of the loss of a primary earner.

Source: youtube.com

Source: youtube.com

If you’re married or have children, it’s important that you know what these rules are. It is, however, a practice that can lead to ethical lapses. The national association of insurance commissioners lays. So, why buy life insurance for income replacement? Also, the amendment changes the references to “agent” in the

Source: farmers.com

Source: farmers.com

However, the rules are very strict around who can do this and when. So, why buy life insurance for income replacement? These policies can help compensate family members when an income earner dies and serve as income replacement insurance for the lost wages. Get all life insurance news on news18.com Beside above, what is the replacement rule in life insurance?

Source: quickquote.com

Source: quickquote.com

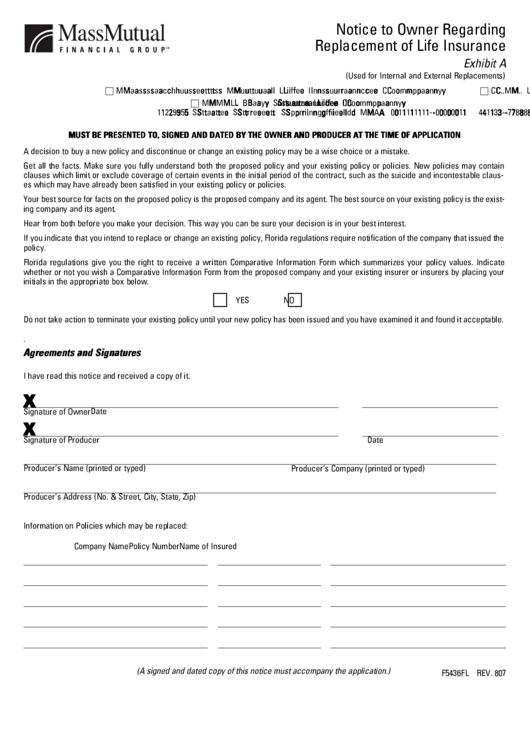

What is the definition of a life insurance replacement? (2) a life insurance agent shall submit to the insurer, in connection with each It is, however, a practice that can lead to ethical lapses. If you are considering the purchase of life insurance as part of your estate plan thatmeans you should act The florida replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy.

Source: unovest.co

Source: unovest.co

The life insurance and annuity replacement regulation defines replacement as. Beside above, what is the replacement rule in life insurance? New rules for life insurance march 2016. The department�s current rules apply to the replacement of life insurance policies. Instead a trustee should be named as the beneficiary.

Source: pinterest.com

Source: pinterest.com

Where the purchase of an individual life insurance contract is likely to result in termination, cancellation or reduction in benefits of another insurance contract. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. (2) a life insurance agent shall submit to the insurer, in connection with each Major issues with replacing a life policy include contestability, surrender fees, and churning. Shall leave with the applicant the original or a copy of such materials used.

Source: foglegroup.com

Source: foglegroup.com

A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another. Your life insurance is needed because if you were to pass away tomorrow unexpectedly your spouse might not have the income to sufficiently look after him or herself or your shared children. So, why buy life insurance for income replacement? New tax rules for life insurance policies will become effective on january 1, 2017. The replacement of life insurance and annuities regulation is designed to protect the interest of the.

Source: slideserve.com

Source: slideserve.com

- if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. The replacement of life insurance and annuities regulation is designed to protect the interest of the. What is the definition of a life insurance replacement? The florida replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary.

Source: themilitarywallet.com

Source: themilitarywallet.com

Major issues with replacing a life policy include contestability, surrender fees, and churning. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. Department of insurance replacement of life insurance and annuities. The department�s current rules apply to the replacement of life insurance policies. (1) a life insurance agent shall obtain, with, or as a part of, each application for life insurance, a statement signed by the applicant as to whether the insurance for which application is made will replace existing life insurance.

Source: elementummoney.com

Source: elementummoney.com

If you’re married or have children, it’s important that you know what these rules are. A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a. 1) if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. The replacement of life insurance and annuities regulation is designed to protect the interest of the. So, why buy life insurance for income replacement?

Source: blog.investyadnya.in

Source: blog.investyadnya.in

Get all life insurance news on news18.com The department�s current rules apply to the replacement of life insurance policies. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. Get all life insurance news on news18.com Major issues with replacing a life policy include contestability, surrender fees, and churning.

Source: military.com

Source: military.com

Beside above, what is the replacement rule in life insurance? New tax rules for life insurance policies will become effective on january 1, 2017. If you are considering the purchase of life insurance as part of your estate plan thatmeans you should act A term conversion is a contractual right where a term insurance (policy or benefit) is being converted to a permanent insurance. Inform its field representatives or other personnel responsible

Source: firstheartland.com

Source: firstheartland.com

Get all life insurance news on news18.com The florida replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. According to florida’s life insurance replacement laws, a policyowner must be provided with a written comparison and summary statement when it’s requested by the policyowner all of the following are eligibility requirements for an association group except A life insurance replacement is when you discontinue your current in force life insurance policy in order to buy another.

![Are You Insuring Your Biggest Asset? [Infographic] Are You Insuring Your Biggest Asset? [Infographic]](https://blog.nationwide.com/wp-content/uploads/2013/09/LifeInsurance_850w-infographic-approved-2.png) Source: blog.nationwide.com

Source: blog.nationwide.com

Exchanging an existing policy for a new policy. There is no one replacement rule in life insurance, but there are some replacement guidelines and explanations. However, the rules are very strict around who can do this and when. Inform its field representatives or other personnel responsible A term conversion is a contractual right where a term insurance (policy or benefit) is being converted to a permanent insurance.

Source: imoney.my

Source: imoney.my

The life insurance and annuity replacement regulation defines replacement as. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. If you are considering the purchase of life insurance as part of your estate plan thatmeans you should act However, life insurance could potentially act as income replacement insurance in the event of the loss of a primary earner. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another.

Source: formsbank.com

Source: formsbank.com

Inform its field representatives or other personnel responsible Instead a trustee should be named as the beneficiary. What’s a life insurance beneficiary rule? 2) whether or not you make the replacement is up to you to do. If you’re married or have children, it’s important that you know what these rules are.

![Are You Insuring Your Biggest Asset? [Infographic] Are You Insuring Your Biggest Asset? [Infographic]](https://blog.nationwide.com/wp-content/uploads/2014/07/life-insurance-infographic.jpg) Source: blog.nationwide.com

Source: blog.nationwide.com

Can one use a power of attorney to change a life insurance beneficiary designation dale streiman law llp However, the rules are very strict around who can do this and when. 1) if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. Your life insurance is needed because if you were to pass away tomorrow unexpectedly your spouse might not have the income to sufficiently look after him or herself or your shared children. Department of insurance replacement of life insurance and annuities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the replacement rule in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information