What is third party fire and theft insurance cover information

Home » Trend » What is third party fire and theft insurance cover informationYour What is third party fire and theft insurance cover images are ready. What is third party fire and theft insurance cover are a topic that is being searched for and liked by netizens today. You can Find and Download the What is third party fire and theft insurance cover files here. Download all royalty-free images.

If you’re looking for what is third party fire and theft insurance cover images information connected with to the what is third party fire and theft insurance cover interest, you have visit the right site. Our site frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

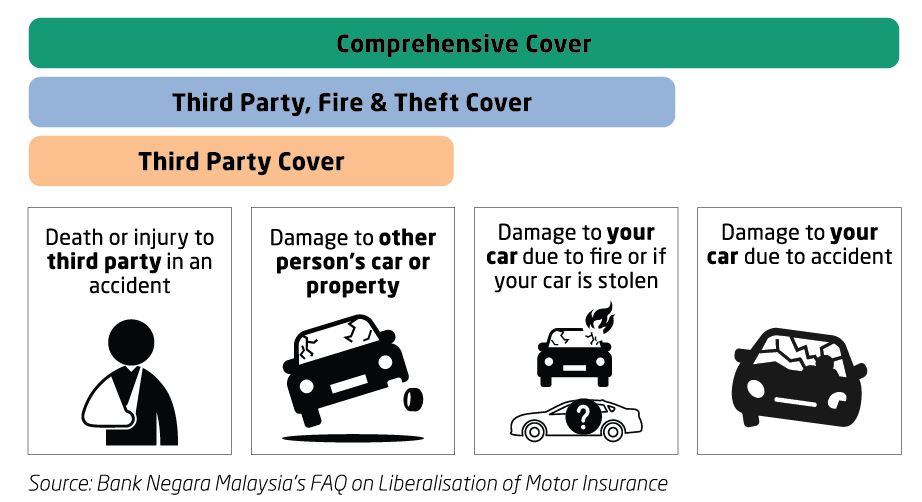

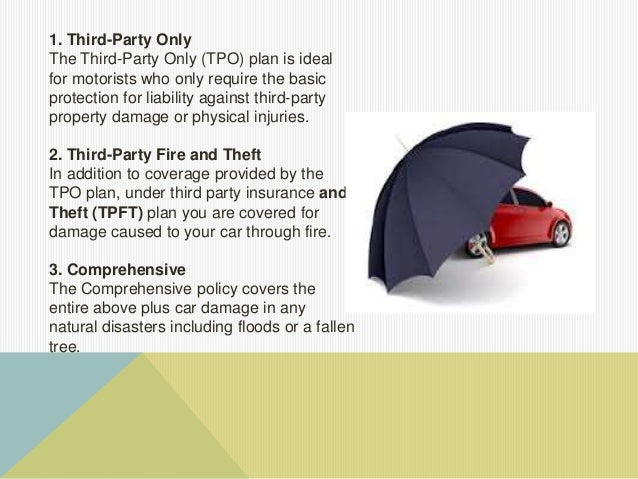

What Is Third Party Fire And Theft Insurance Cover. This is the minimum legal requirement and covers you for damage to someone else�s vehicle or property or injury to someone else in an accident. It doesn’t cover your own vehicle if it’s damaged in an accident. What does third party, fire and theft car insurance cover? Meanwhile, a comprehensive insurance policy will cover all of the above and also cover the costs of any damage to your own vehicle if you’re involved in an incident.

Third Party Car Insurance Kenya Cover, Cost & Claim From nextinsurance.co.ke

Third Party Car Insurance Kenya Cover, Cost & Claim From nextinsurance.co.ke

This type of insurance does not extend cover for accidental damage to your own vehicle. If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property. While it doesn’t cover everything, it can provide peace of mind when you’re on the road. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. Third party fire & theft car insurance. If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property.

Third party fire and theft insurance means that if your car is damaged due to a fire or as a result of theft, you’ll be covered.

There are three main types of policy. Up to $5,000 for loss or damage to your car in an incident where the third party driver at fault is uninsured choice of repairer and lifetime repair guarantee on work completed by an racq insurance selected repairer show more inclusions save with racq fire, theft and third party liability car insurance roadside assistance loyalty discount Most insurers will also cover you for vandalism or damage from an attempted theft too. Sometimes it’s a cheaper option and it does what it says on the tin. It also covers any damage or injury to third parties due to an accident where you are at fault. What does third party, fire and theft car insurance cover?

Source: adthirdpartycarinsuranceas.blogspot.com

What does third party, fire and theft car insurance cover? This type of insurance does not extend cover for accidental damage to your own vehicle. Third party fire & theft car insurance that covers your car if it�s stolen or catches fire, and covers other people�s cars and property if you cause an accident get a quote what’s included for you and everyone who drives your car 1 theft we cover your car if it’s stolen or damaged by someone trying to steal it (up to $10,000) 2. If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property. Our third party, fire and theft car insurance covers you if your car is damaged by fire or stolen, and if other people claim against you for injury or damage to their car or property.

Source: insurance.woolworths.com.au

Source: insurance.woolworths.com.au

Up to $5,000 for loss or damage to your car in an incident where the third party driver at fault is uninsured choice of repairer and lifetime repair guarantee on work completed by an racq insurance selected repairer show more inclusions save with racq fire, theft and third party liability car insurance roadside assistance loyalty discount Injuries to a person in another car While it doesn’t cover everything, it can provide peace of mind when you’re on the road. Tpft adds to this, also paying out to remedy fire damage to your vehicle, to replace it if it�s stolen, or to fix any damage caused during an attempted theft. Third party, fire and theft motor insurance is usually bought where insurance for loss or damage to the insured vehicle is not a priority and the insured believes that at only serious loss or damage is worthy of a claim, or the low priced insurance is required or.

Source: bewiser.co.uk

This includes accidents caused by your passenger. Injuries to a person in another car Third party, fire & theft car insurance covers your vehicle for accidental damage caused to a third party and against theft and fire damage caused to your vehicle, however any damage caused to your vehicle will not be covered. What is third party, fire and theft car insurance? What does third party, fire and theft insurance cover?

Source: kosmetyczna-rewolucja.blogspot.com

Source: kosmetyczna-rewolucja.blogspot.com

What does third party, fire and theft car insurance cover? This is the minimum legal requirement and covers you for damage to someone else�s vehicle or property or injury to someone else in an accident. With third party fire and theft car insurance, you’ll be covered for any damage you cause to someone else’s property, as well as fire and theft damage to your car. This may also cover any parts of your car stolen during the theft. What does third party fire and theft cover?

Source: nextinsurance.co.ke

Source: nextinsurance.co.ke

Most insurers will also cover you for vandalism or damage from an attempted theft too. If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property. Third party, fire and theft car insurance is a basic form of car insurance that provides cover for accidental damage caused to another person’s vehicle. Third party, fire and theft Up to $5,000 for loss or damage to your car in an incident where the third party driver at fault is uninsured choice of repairer and lifetime repair guarantee on work completed by an racq insurance selected repairer show more inclusions save with racq fire, theft and third party liability car insurance roadside assistance loyalty discount

Source: moneysupermarket.com

Source: moneysupermarket.com

Benefits of third party property, fire and theft cover accidental loss or damage to your car from theft, or attempted theft and fire lock and key replacement if your car keys are stolen help with repair cost to your trailer or caravan if attached to your car in an accident What does third party, fire and theft insurance cover? Additionally, it also covers your vehicle for damages sustained due to a fire or theft. Third party, fire and theft Our third party, fire and theft car insurance covers you if your car is damaged by fire or stolen, and if other people claim against you for injury or damage to their car or property.

Source: kernpioneer.org

Source: kernpioneer.org

Our third party, fire and theft car insurance covers you if your car is damaged by fire or stolen, and if other people claim against you for injury or damage to their car or property. With third party fire and theft car insurance, you’ll be covered for any damage you cause to someone else’s property, as well as fire and theft damage to your car. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. Injuries to a person in another car There are three main types of policy.

Source: us.dujuz.com

Source: us.dujuz.com

What does third party, fire and theft insurance cover? Third party, fire and theft car insurance is a basic form of car insurance that provides cover for accidental damage caused to another person’s vehicle. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. Third party, fire & theft car insurance covers your vehicle for accidental damage caused to a third party and against theft and fire damage caused to your vehicle, however any damage caused to your vehicle will not be covered. This may also cover any parts of your car stolen during the theft.

What does third party, fire and theft car insurance cover? What does third party, fire and theft car insurance cover? Most insurers will also cover you for vandalism or damage from an attempted theft too. This type of insurance does not extend cover for accidental damage to your own vehicle. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft.

Source: slideshare.net

Source: slideshare.net

Third party, fire and theft motor insurance is usually bought where insurance for loss or damage to the insured vehicle is not a priority and the insured believes that at only serious loss or damage is worthy of a claim, or the low priced insurance is required or. Benefits of third party property, fire and theft cover accidental loss or damage to your car from theft, or attempted theft and fire lock and key replacement if your car keys are stolen help with repair cost to your trailer or caravan if attached to your car in an accident You have to cover the cost of replacing or repairing your car due to accidental damage out of your own pocket. Sometimes it’s a cheaper option and it does what it says on the tin. It doesn�t cover repairs to your own vehicle.

Source: thevaninsurer.co.uk

Source: thevaninsurer.co.uk

If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property. What is third party fire and theft car insurance, and what does it cover? Third party fire & theft car insurance that covers your car if it�s stolen or catches fire, and covers other people�s cars and property if you cause an accident get a quote what’s included for you and everyone who drives your car 1 theft we cover your car if it’s stolen or damaged by someone trying to steal it (up to $10,000) 2. What does third party, fire and theft car insurance cover? What does third party, fire and theft insurance cover?

Source: aviva.co.uk

Source: aviva.co.uk

With third party fire and theft car insurance, you’ll be covered for any damage you cause to someone else’s property, as well as fire and theft damage to your car. Most insurers will also cover you for vandalism or damage from an attempted theft too. Third party, fire & theft car insurance covers your vehicle for accidental damage caused to a third party and against theft and fire damage caused to your vehicle, however any damage caused to your vehicle will not be covered. What is third party, fire and theft car insurance? Third party, fire and theft cover only covers accidental damage caused to third parties by your accident, plus your costs incurred by a fire, or the theft or hijacking of your vehicle.

Source: finder.com.au

Source: finder.com.au

You have to cover the cost of replacing or repairing your car due to accidental damage out of your own pocket. It doesn’t cover your own vehicle if it’s damaged in an accident. Our third party, fire and theft car insurance covers you if your car is damaged by fire or stolen, and if other people claim against you for injury or damage to their car or property. Injuries to a person in another car If you’re involved in a car accident and it’s found to be your fault, tpft insurance will cover any damage you caused to the other person and their property.

Source: carinsurances.co.za

Source: carinsurances.co.za

What does third party, fire and theft insurance cover? Damage to your own car is not covered by this type of insurance. Tpft adds to this, also paying out to remedy fire damage to your vehicle, to replace it if it�s stolen, or to fix any damage caused during an attempted theft. 5 rows what does third party fire and theft cover? Third party, fire & theft car insurance covers your vehicle for accidental damage caused to a third party and against theft and fire damage caused to your vehicle, however any damage caused to your vehicle will not be covered.

Source: i2designed.blogspot.com

Source: i2designed.blogspot.com

This includes accidents caused by your passenger. It also covers any damage or injury to third parties due to an accident where you are at fault. It doesn�t cover repairs to your own vehicle. A good third party, fire and theft insurance policy typically covers: Up to $5,000 for loss or damage to your car in an incident where the third party driver at fault is uninsured choice of repairer and lifetime repair guarantee on work completed by an racq insurance selected repairer show more inclusions save with racq fire, theft and third party liability car insurance roadside assistance loyalty discount

Source: picltt.com

Source: picltt.com

Third party, fire and theft car insurance is a basic form of car insurance that provides cover for accidental damage caused to another person’s vehicle. Third party fire & theft car insurance that covers your car if it�s stolen or catches fire, and covers other people�s cars and property if you cause an accident get a quote what’s included for you and everyone who drives your car 1 theft we cover your car if it’s stolen or damaged by someone trying to steal it (up to $10,000) 2. Most insurers will also cover you for vandalism or damage from an attempted theft too. Third party, fire and theft cover only covers accidental damage caused to third parties by your accident, plus your costs incurred by a fire, or the theft or hijacking of your vehicle. Tpft adds to this, also paying out to remedy fire damage to your vehicle, to replace it if it�s stolen, or to fix any damage caused during an attempted theft.

Source: iselect.com.au

Source: iselect.com.au

Sometimes it’s a cheaper option and it does what it says on the tin. This includes accidents caused by your passenger. This may also cover any parts of your car stolen during the theft. This type of insurance does not extend cover for accidental damage to your own vehicle. With third party fire and theft car insurance, you’ll be covered for any damage you cause to someone else’s property, as well as fire and theft damage to your car.

Source: kosmetyczna-rewolucja.blogspot.com

With third party fire and theft car insurance, you’ll be covered for any damage you cause to someone else’s property, as well as fire and theft damage to your car. Third party, fire and theft cover only covers accidental damage caused to third parties by your accident, plus your costs incurred by a fire, or the theft or hijacking of your vehicle. Additionally, it also covers your vehicle for damages sustained due to a fire or theft. Our third party, fire and theft car insurance covers you if your car is damaged by fire or stolen, and if other people claim against you for injury or damage to their car or property. This will also cover you for theft of the vehicle and fire damage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is third party fire and theft insurance cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information