What is tort insurance Idea

Home » Trending » What is tort insurance IdeaYour What is tort insurance images are ready in this website. What is tort insurance are a topic that is being searched for and liked by netizens today. You can Download the What is tort insurance files here. Get all free photos.

If you’re searching for what is tort insurance images information connected with to the what is tort insurance topic, you have pay a visit to the right site. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

What Is Tort Insurance. Pennsylvania offers you a choice when you�re preparing your car insurance policy. Tort insurance is when a state is operating under the tort system for insurance claims. Tort insurance is when a state is operating under the tort system for insurance claims. Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident.

What is a Tort Claim? l The Law Office Of Wolf & Pravato From wolfandpravato.com

What is a Tort Claim? l The Law Office Of Wolf & Pravato From wolfandpravato.com

A legal term denoting a wrongful act resulting in injury or damage on which a civil court action, or legal proceeding, may be based. Malpractice insurance is a specific type of liability insurance which is utilized by those that are employed in the medical field. As first named insured, your full or limited tort election applies to everyone in your household that is covered by the policy. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. In this context, it means that the person you were involved in an accident with can sue you for any damaged he or she incurred as a result of the accident, including pain and suffering. Bankrate can help explain the differences and how they affect your car insurance.

There are two types of tort insurance.

Full coverage is a combination of liability coverage that pays for damages to third parties and collision and comprehensive coverages that add. What is tort liability insurance?; Tort insurance is when a state is operating under the tort system for insurance claims. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Tort insurance explained tort is a legal term that refers to a wrongful act that infringes on another person�s rights and leads to civil legal liability. Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident.

Source: theworldlink.com

Source: theworldlink.com

It’s important because it allows drivers to be awarded claim settlements when they’re not at fault in the accident. Full coverage is a combination of liability coverage that pays for damages to third parties and collision and comprehensive coverages that add. Bankrate can help explain the differences and how they affect your car insurance. This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface. Tort insurance is not something you.

Source: silverandsilver.com

Source: silverandsilver.com

Bankrate can help explain the differences and how they affect your car insurance. Typically, limited tort offers you a small discount on your monthly premium. Tort and insurance law articles provide information concerning current tort law issues and insurance issues addressed by practitioners representing either plaintiffs or defendants in tort cases. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Tort insurance allows auto insurance companies to recover the damages from the party that caused an accident.

Source: kjerstinem.blogspot.com

What is tort liability insurance?; Tort insurance is when a state is operating under the tort system for insurance claims. Its aim is to take all relevant circumstances into account (briefly: Practical operation of the law of tort cannot be fully comprehended without closely looking at the fact and extent of insurance, whether it be liability insurance, loss insurance, or legal expenses insurance. This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface.

Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident. In some states, including pennsylvania, you have the option to choose full or. Tort insurance is when a state is operating under the tort system for insurance claims. In tort law cases, tort liability insurance is very important for the accused to protect their assets. It’s important because it allows drivers to be awarded claim settlements when they’re not at fault in the accident.

Source: testing.tpub.com

This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface. In this context, it means that the person you were involved in an accident with can sue you for any damaged he or she incurred as a result of the accident, including pain and suffering. Tort law is the area of the law that covers most civil suits. There are two types of tort insurance. In terms of insurance, liability insurance exists to protect parties being sued for committing a tort.

Source: signnow.com

Source: signnow.com

In terms of insurance, liability insurance exists to protect parties being sued for committing a tort. A tort system puts a greater emphasis on liability insurance to cover injuries a driver might cause but. Tort car insurance means that if you are injured in an auto accident, you have the right to sue for pain and suffering for that injury. As first named insured, your full or limited tort election applies to everyone in your household that is covered by the policy. “tort” is a legal term that refers to an unjust or unlawful action that infringes on someone else’s rights which could lead to liability.

The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Its aim is to take all relevant circumstances into account (briefly: Tort insurance is when a state is operating under the tort system for insurance claims. Tort insurance is not offered by all insurance companies and it depends on where you live. This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface.

Source: wolfandpravato.com

Source: wolfandpravato.com

Tort law is an area of law that involves civil as opposed to criminal wrongs. The tort clause only becomes relevant when you get involved in an accident and need to sue for compensation. Tort insurance is an auto insurance system in which drivers can seek compensation from the other party who caused the accident. There are two types of tort insurance. Fortunately for you, your business is able to shield itself from tort claims by purchasing a general liability insurance policy.

Source: walmart.com

Source: walmart.com

Tort law is the area of the law that covers most civil suits. In terms of insurance, liability insurance exists to protect parties being sued for committing a tort. Tort insurance is not something you. In tort law cases, tort liability insurance is very important for the accused to protect their assets. Those found guilty without liability insurance benefit often find it takes a lifetime to pay off any judgments made against them and may have wages garnished or money taken from bank accounts.

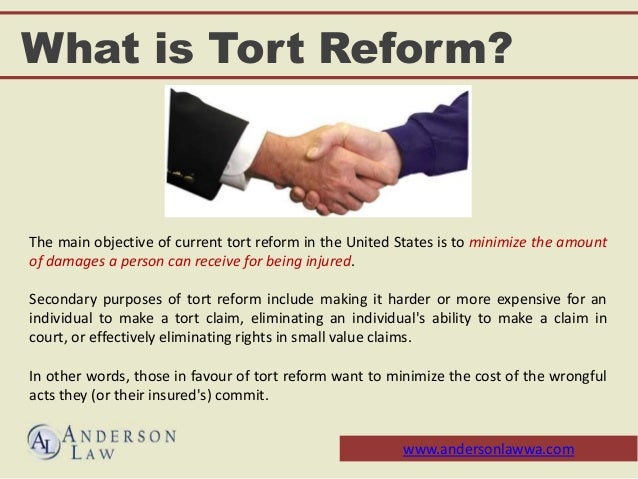

Source: slideshare.net

Source: slideshare.net

Tort car insurance means that if you are injured in an auto accident, you have the right to sue for pain and suffering for that injury. Tort insurance is not something you. Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident. Tort insurance allows auto insurance companies to recover the damages from the party that caused an accident. Its aim is to take all relevant circumstances into account (briefly:

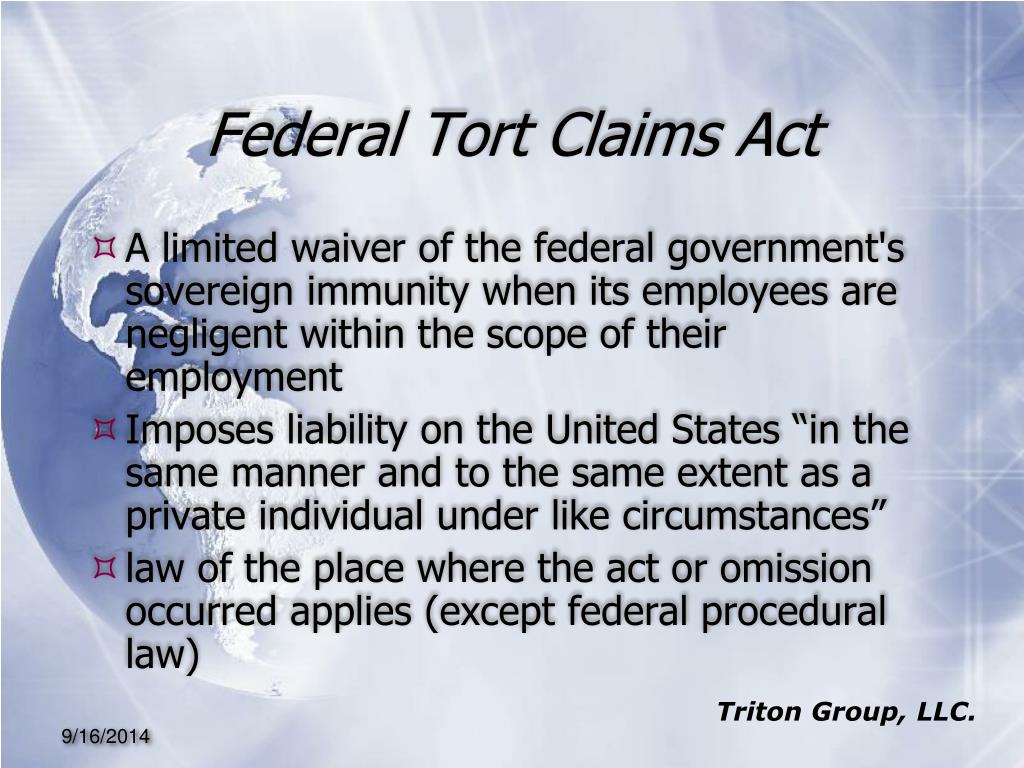

Source: slideserve.com

Source: slideserve.com

Full tort increases your pa auto insurance premium, and limited tort can save you up to 30% on the liability coverage premium you pay for your policy (the physical damage coverage is not affected by full or limited tort). One is the deterrence model in which tort law takes the leading role, whereas insurance is an auxiliary, and at times problematic, device. Tort insurance is an auto insurance system in which drivers can seek compensation from the other party who caused the accident. Tort insurance is an auto insurance system in which drivers can seek compensation. Full tort increases your pa auto insurance premium, and limited tort can save you up to 30% on the liability coverage premium you pay for your policy (the physical damage coverage is not affected by full or limited tort).

Source: nyfamily-digital.com

Source: nyfamily-digital.com

Full tort increases your pa auto insurance premium, and limited tort can save you up to 30% on the liability coverage premium you pay for your policy (the physical damage coverage is not affected by full or limited tort). As first named insured, your full or limited tort election applies to everyone in your household that is covered by the policy. Malpractice insurance is a specific type of liability insurance which is utilized by those that are employed in the medical field. This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface. In this context, it means that the person you were involved in an accident with can sue you for any damaged he or she incurred as a result of the accident, including pain and suffering.

Source: apdesignstudy.blogspot.com

Source: apdesignstudy.blogspot.com

In tort law cases, tort liability insurance is very important for the accused to protect their assets. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party. Full tort increases your pa auto insurance premium, and limited tort can save you up to 30% on the liability coverage premium you pay for your policy (the physical damage coverage is not affected by full or limited tort). Tort law is an area of law that involves civil as opposed to criminal wrongs. Fortunately for you, your business is able to shield itself from tort claims by purchasing a general liability insurance policy.

Source: slideshare.net

Source: slideshare.net

In insurance, tort insurance is an automobile insurance system that enables drivers to recover damages from the parties at fault in an accident. Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident. In tort law cases, tort liability insurance is very important for the accused to protect their assets. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Those found guilty without liability insurance benefit often find it takes a lifetime to pay off any judgments made against them and may have wages garnished or money taken from bank accounts.

Source: daviskelin.com

Source: daviskelin.com

Tort insurance allows auto insurance companies to recover the damages from the party that caused an accident. Pennsylvania offers you a choice when you�re preparing your car insurance policy. Bankrate can help explain the differences and how they affect your car insurance. Those found guilty without liability insurance benefit often find it takes a lifetime to pay off any judgments made against them and may have wages garnished or money taken from bank accounts. Tort insurance allows auto insurance companies to recover the damages from the party that caused an accident.

Source: noclutter.cloud

Source: noclutter.cloud

Those found guilty without liability insurance benefit often find it takes a lifetime to pay off any judgments made against them and may have wages garnished or money taken from bank accounts. Typically, limited tort offers you a small discount on your monthly premium. In terms of insurance, liability insurance exists to protect parties being sued for committing a tort. In general, any claim that arises in civil court, with the exception of contractual. Tort law is the area of the law that covers most civil suits.

Source: thefinelawfirm.com

Source: thefinelawfirm.com

Liability insurance is crucial for individuals and businesses alike to provide financial. This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface. In general, any claim that arises in civil court, with the exception of contractual. In this context, it means that the person you were involved in an accident with can sue you for any damaged he or she incurred as a result of the accident, including pain and suffering. In some states, including pennsylvania, you have the option to choose full or.

Source: noclutter.cloud

Source: noclutter.cloud

A legal term denoting a wrongful act resulting in injury or damage on which a civil court action, or legal proceeding, may be based. Tort insurance is when a state is operating under the tort system for insurance claims. Liability insurance is crucial for individuals and businesses alike to provide financial. In terms of insurance, liability insurance exists to protect parties being sued for committing a tort. In general and in several cases, it is only the fact that the defendant is insured against liability which makes it worthwhile to sue him.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is tort insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information