What is under insurance Idea

Home » Trending » What is under insurance IdeaYour What is under insurance images are available. What is under insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is under insurance files here. Find and Download all royalty-free vectors.

If you’re searching for what is under insurance pictures information linked to the what is under insurance interest, you have visit the ideal blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

What Is Under Insurance. The property insurance portion covers expenses related to damage to the structure of the home and its contents while the liability portion covers things like medical bills if someone sustains an injury on your property. It is the responsibility of all bike owners to purchase bike insurance. Insurance is the transfer of risk from an individual to a company. Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services.

What FDIC Insurance Means for Your Savings ADM From americandeposits.com

What FDIC Insurance Means for Your Savings ADM From americandeposits.com

Underwriter is an important role at institutions and companies that deal with financial risk. The main difference is that it typically only covers the interior of the. Under insurance is when your insurance cover is less than your replacement value. It may also be less than the replacement value of the insured items. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Insurance is a means of protection from financial loss.

It may also be less than the replacement value of the insured items.

It is the underwriter’s job to determine if its financially viable to take this risk on. For example if a property of the actual and market value for rs. An insurance company must have a way to decide just how much of a gamble it�s taking by providing coverage. Underwriter is an important role at institutions and companies that deal with financial risk. A policy or agreement between the policyholder and the insurer which is considered only after realization of the premium. Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services.

Source: ocmedicare.com

Source: ocmedicare.com

The principal of under insurance comes into play in the event of a partial loss to an asset. It may also be less than the replacement value of the insured items. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. Under insurance is when your insurance cover is less than your replacement value. In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer.

Source: buildsafe.com.au

Source: buildsafe.com.au

Condo insurance is similar to homeowners insurance. It is the person who is covered under the insurance policy. There are many types of insurance policies. The property insurance portion covers expenses related to damage to the structure of the home and its contents while the liability portion covers things like medical bills if someone sustains an injury on your property. The insured person is termed as first party, the insurer or the insurance provider is termed as second party, and the person who is injured is considered as third party.

Source: revisi.net

Source: revisi.net

Insurance underwriting is the way an insurance company assesses the risk and profitability of offering a policy to someone. In insurance, “peril” is an event that causes damage to your home or property and consequently, results in financial loss. It is the person who is covered under the insurance policy. Let us understand some commonly used terms in life insurance: Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services.

Source: noclutter.cloud

Source: noclutter.cloud

Under insurance is when the amount of insurance cover is less than the actual value of the insured items. Insurance underwriting is the way an insurance company assesses the risk and profitability of offering a policy to someone. In other words, the amount would not replace your damaged property, or your lost or stolen items. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. Because in the event of a total loss, the sum insured will not pay for the full value of the claim.

Source: thebalance.com

Source: thebalance.com

It may also be less than the replacement value of the insured items. The property insurance portion covers expenses related to damage to the structure of the home and its contents while the liability portion covers things like medical bills if someone sustains an injury on your property. Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services. Let us understand some commonly used terms in life insurance: Some examples of perils include fire, a lightning strike, burglary and a hailstorm or windstorm.

Let us understand some commonly used terms in life insurance: The entry of river or seawater into the vessel, conveyance, lift van, or place of shortage. In insurance, “peril” is an event that causes damage to your home or property and consequently, results in financial loss. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. Underwriting isn’t only applicable to insurance.

Source: veryweirdnews.com

Source: veryweirdnews.com

The main difference is that it typically only covers the interior of the. It is the underwriter’s job to determine if its financially viable to take this risk on. What is marine insurance under insurance law? The property insurance portion covers expenses related to damage to the structure of the home and its contents while the liability portion covers things like medical bills if someone sustains an injury on your property. If you don’t have the right level of insurance cover, you could find yourself in financial stress or even risk losing your business.

Source: revisi.net

Source: revisi.net

Let us understand some commonly used terms in life insurance: Underwriting isn’t only applicable to insurance. Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils. The premium is paid by the insurer who has a financial interest in the asset covered. If you don’t have the right level of insurance cover, you could find yourself in financial stress or even risk losing your business.

Source: medicoverage.com

Source: medicoverage.com

It offers wide coverage as it covers all the perils. There are many types of insurance policies. Some examples of perils include fire, a lightning strike, burglary and a hailstorm or windstorm. What is marine insurance under insurance law? Click here to read about institutional cargo clause.

The insured person is termed as first party, the insurer or the insurance provider is termed as second party, and the person who is injured is considered as third party. The main difference is that it typically only covers the interior of the. Insurance is a means of protection from financial loss. This would then require you to cover a portion of the damage out of your own pocket. What is a general insurance.

Source: americandeposits.com

Source: americandeposits.com

What is marine insurance under insurance law? Adding accident insurance can help cover those expensive costs when an accident occurs. Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils. It is the person who pays the premiums of the policy. What is marine insurance under insurance law?

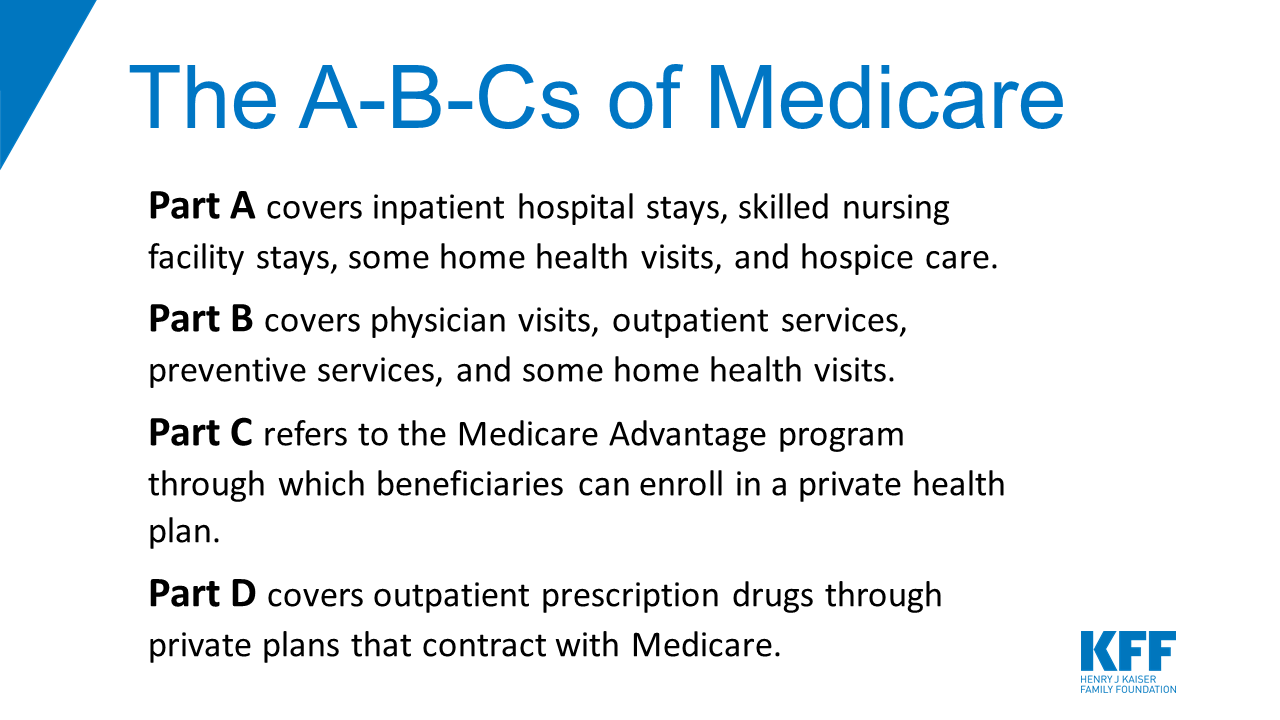

Source: kff.org

Source: kff.org

It is the responsibility of all bike owners to purchase bike insurance. It is the person who pays the premiums of the policy. Underwriter is an important role at institutions and companies that deal with financial risk. Accident insurance could be a helpful financial planning tool for many people, especially with healthcare costs rising. In simple words, insurance is a contract, a legal agreement between two parties, i.e., the individual named insured and the insurance company called insurer.

Source: newempiregroup.com

Source: newempiregroup.com

Let us understand some commonly used terms in life insurance: Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. A policy or agreement between the policyholder and the insurer which is considered only after realization of the premium. Insurance underwriting is the way an insurance company assesses the risk and profitability of offering a policy to someone. Under insurance is when your insurance cover is less than your replacement value.

Source: mycause.com.au

Source: mycause.com.au

The premium is paid by the insurer who has a financial interest in the asset covered. It may also be less than the replacement value of the insured items. Underwriting isn’t only applicable to insurance. Underwriter is an important role at institutions and companies that deal with financial risk. The property insurance portion covers expenses related to damage to the structure of the home and its contents while the liability portion covers things like medical bills if someone sustains an injury on your property.

Source: solarelleinsurance.com

Source: solarelleinsurance.com

The entry of river or seawater into the vessel, conveyance, lift van, or place of shortage. Underwriter is an important role at institutions and companies that deal with financial risk. What is a general insurance. Condo insurance is similar to homeowners insurance. Insurance underwriting is the way an insurance company assesses the risk and profitability of offering a policy to someone.

Source: slideshare.net

Source: slideshare.net

Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services. It is the person who is covered under the insurance policy. There are many types of insurance policies. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Click here to read about institutional cargo clause.

Source: pinterest.com

Source: pinterest.com

For example if a property of the actual and market value for rs. Under insurance is when your insurance cover is less than your replacement value. Under insurance is when the amount of insurance cover is less than the actual value of the insured items. Typically it means that the insured is considered to be. What is marine insurance under insurance law?

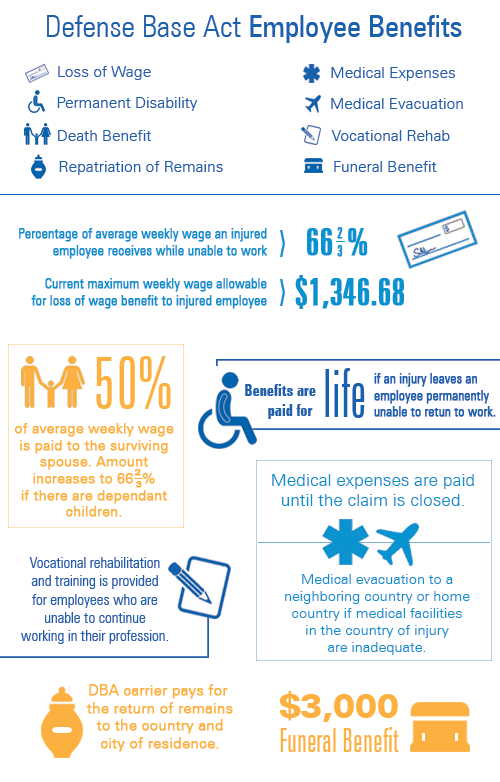

Source: dbainsuranceservices.com

Source: dbainsuranceservices.com

In fact, a recent study revealed that 26% of families have a deductible between $3,000 and $4,999 while 23% have a deductible of $5,000 or more. In fact, a recent study revealed that 26% of families have a deductible between $3,000 and $4,999 while 23% have a deductible of $5,000 or more. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. It may also be less than the replacement value of the insured items. Under insurance is when your insurance cover is less than your replacement value.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is under insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information