What is wage loss insurance canada information

Home » Trending » What is wage loss insurance canada informationYour What is wage loss insurance canada images are ready. What is wage loss insurance canada are a topic that is being searched for and liked by netizens today. You can Get the What is wage loss insurance canada files here. Download all royalty-free photos and vectors.

If you’re searching for what is wage loss insurance canada pictures information linked to the what is wage loss insurance canada keyword, you have visit the right blog. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

What Is Wage Loss Insurance Canada. Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. Now, icbc will pay up to $740 per week for lost wages if you have suffered injuries in a car accident that keep you from doing your job. Wage insurance is a form of proposed insurance that would provide workers with compensation if they are forced to move to a job with a lower salary. The canada revenue agency considers that any arrangement between an employer and employees that involves benefits payable on a periodic basis if an employee suffers a loss of employment income as a consequence of sickness, maternity or accident is considered a.

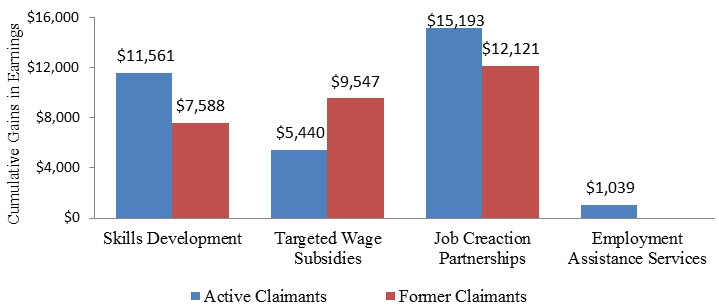

Chapter 3 Comparison of key findings by program type From canada.ca

Chapter 3 Comparison of key findings by program type From canada.ca

However, other moneys and payments for benefits not related to employment do not constitute earnings for benefit purposes, for example, alimony payments,. Your net earnings are your gross pay less probable employment insurance, canada pension plan and income tax deductions. Wage loss is paid by icbc as a no fault benefit up to a limit of either $300 per week or 75 of your gross weekly earnings in the 12 months prior to the accident, whichever is less. It is purchased by organizations who do not want to assume 100% of the liability for losses arising from the plans. Employment insurance (ei) is an unemployment insurance program in canada that allows individuals who have recently lost a job to receive temporary financial assistance. Job loss insurance can also be available in conjunction with disability insurance as one package.

In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence.

Employment insurance (ei) is an unemployment insurance program in canada that allows individuals who have recently lost a job to receive temporary financial assistance. The deductions and how the benefits are reported will depend on many factors. In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence. Compensation for lost wages that a person receives or is entitled to receive from a motor vehicle insurance plan provided under provincial law where ei benefits are not taken into account when calculating the amount of compensation under the provincial law Wage insurance is a form of proposed insurance that would provide workers with compensation if they are forced to move to a job with a lower salary. The percentage used is dependent on the date your injury occurred.

Source: canadabuzz.ca

Source: canadabuzz.ca

It is purchased by organizations who do not want to assume 100% of the liability for losses arising from the plans. Damage after a car crash, items stolen from home etc. The idea is usually proposed as a response to outsourcing and the effects of globalization , although it could equally be proposed as a response to job displacement due to increasingly productive technology (e.g. Many people worry about how they will pay their bills if they are laid off from work.if you don’t have funds in reserve to cover your expenses until you line up another job, there are companies that sell job loss insurance that will. The canada revenue agency considers that any arrangement between an employer and employees that involves benefits payable on a periodic basis if an employee suffers a loss of employment income as a consequence of sickness, maternity or accident is considered a.

Source: mexicobariatriccenter.com

Source: mexicobariatriccenter.com

Compensation for lost wages that a person receives or is entitled to receive from a motor vehicle insurance plan provided under provincial law where ei benefits are not taken into account when calculating the amount of compensation under the provincial law Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. Wsib insurance, or previously known as workers’ compensation is a type of insurance that aids in providing wage replacement and medical benefits to employers who were injured on the job site. You are obligated to obtain whatever other sources of income replacement are available to you, such as unemployment insurance. Employment insurance (ei) is an unemployment insurance program in canada that allows individuals who have recently lost a job to receive temporary financial assistance.

Source: novainjurylaw.com

Source: novainjurylaw.com

Job loss insurance can also be available in conjunction with disability insurance as one package. Net earnings are your gross earnings less amounts representing probable deductions for income tax payable, canada. The canada revenue agency considers that any arrangement between an employer and employees that involves benefits payable on a periodic basis if an employee suffers a loss of employment income as a consequence of sickness, maternity or accident is considered a. A wage loss replacement plan is a disability income replacement program set up by your employer. If a disabled employee is not capable of

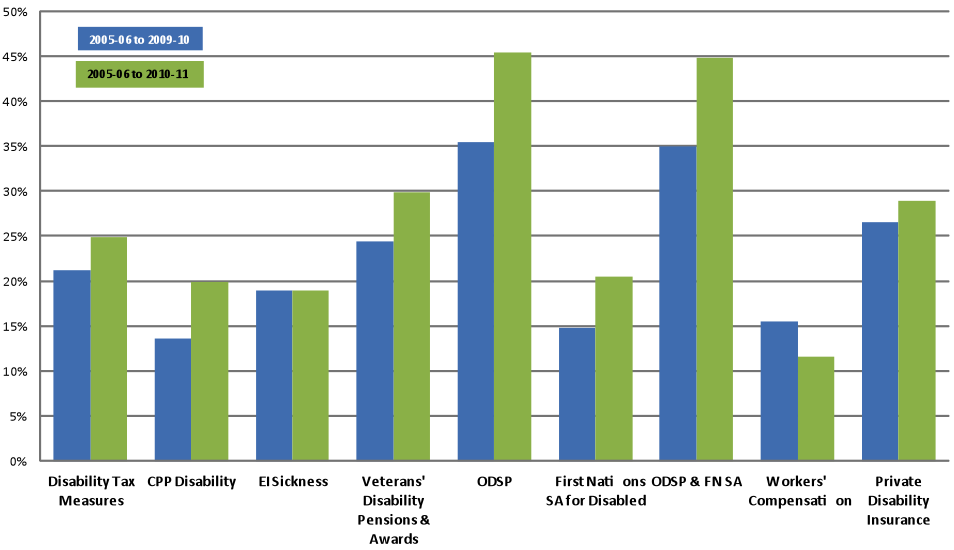

Source: ccdonline.ca

Source: ccdonline.ca

You are obligated to obtain whatever other sources of income replacement are available to you, such as unemployment insurance. Loss of earnings (loe) benefits are monthly payments from the workplace safety and insurance board (wsib) that replace some of a worker’s lost future wages after a workplace injury. However, other moneys and payments for benefits not related to employment do not constitute earnings for benefit purposes, for example, alimony payments,. A wage loss replacement plan is a disability income replacement program set up by your employer. You might find your income replacement indemnities amount or the compensation you received for the loss of financial support under a law of canada or from a province other than québec, on your t5007 slip.

Source: bariatricsurgeryworld.com

Source: bariatricsurgeryworld.com

Loss of earnings (loe) benefits are monthly payments from the workplace safety and insurance board (wsib) that replace some of a worker’s lost future wages after a workplace injury. In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence. The canada revenue agency considers that any arrangement between an employer and employees that involves benefits payable on a periodic basis if an employee suffers a loss of employment income as a consequence of sickness, maternity or accident is considered a. Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. Wage loss is paid by icbc as a no fault benefit up to a limit of either $300 per week or 75 of your gross weekly earnings in the 12 months prior to the accident, whichever is less.

Source: 2ndchanceautoinsurance.ca

Source: 2ndchanceautoinsurance.ca

It is purchased by organizations who do not want to assume 100% of the liability for losses arising from the plans. Benefits continue until you are able to. It is purchased by organizations who do not want to assume 100% of the liability for losses arising from the plans. Job loss insurance can also be available in conjunction with disability insurance as one package. A wage loss replacement plan is a disability income replacement program set up by your employer.

Source: yourequity.ca

Source: yourequity.ca

Employment insurance (ei) is an unemployment insurance program in canada that allows individuals who have recently lost a job to receive temporary financial assistance. Your net earnings are your gross pay less probable employment insurance, canada pension plan and income tax deductions. In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence. Wage loss is paid by icbc as a no fault benefit up to a limit of either $300 per week or 75 of your gross weekly earnings in the 12 months prior to the accident, whichever is less. Net earnings are your gross earnings less amounts representing probable deductions for income tax payable, canada.

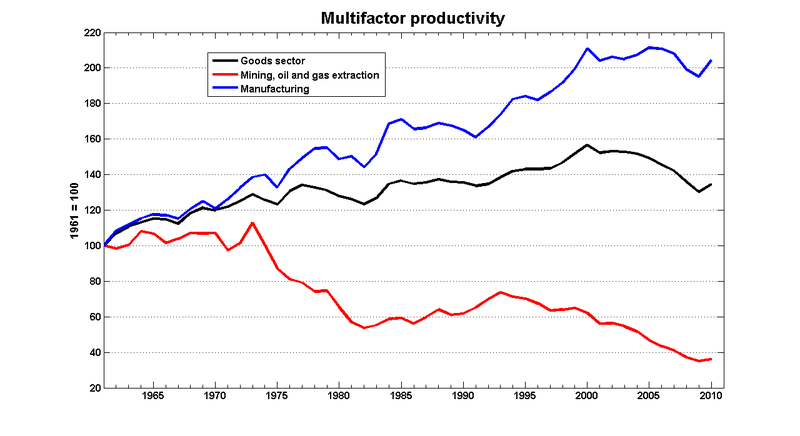

Source: marginalrevolution.com

Source: marginalrevolution.com

Insurance offers coverage to individuals or companies in the case of a loss being suffered in the future, e.g. Loss of earnings (loe) benefits are monthly payments from the workplace safety and insurance board (wsib) that replace some of a worker’s lost future wages after a workplace injury. Disability insurance wage loss replacement plan advisor guide information accurate as of october 13, 2020 not for use with clients The deductions and how the benefits are reported will depend on many factors. The percentage used is dependent on the date your injury occurred.

Source: receivablesinsurancecanada.com

Source: receivablesinsurancecanada.com

In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence. Depending on how the plan is set up, you may have to claim a taxable benefit. If a disabled employee is not capable of Benefits continue until you are able to. There is a limit on the amount of gross earnings insured, known as the maximum compensable earnings.

Source: backsinaction.ca

Source: backsinaction.ca

The idea is usually proposed as a response to outsourcing and the effects of globalization , although it could equally be proposed as a response to job displacement due to increasingly productive technology (e.g. For accidents that occurred before april 1, 2019, the insurance company of british columbia (icbc) only compensated injured motorists for up to $300 in weekly wages they lost after an accident. There is a limit on the amount of gross earnings insured, known as the maximum compensable earnings. Wsib insurance, or previously known as workers’ compensation is a type of insurance that aids in providing wage replacement and medical benefits to employers who were injured on the job site. Net earnings are your gross earnings less amounts representing probable deductions for income tax payable, canada.

Source: obesityhelp.com

Source: obesityhelp.com

Now, icbc will pay up to $740 per week for lost wages if you have suffered injuries in a car accident that keep you from doing your job. Wage insurance is a form of proposed insurance that would provide workers with compensation if they are forced to move to a job with a lower salary. Each wlrp is unique and can be structured and funded in many different ways. The deductions and how the benefits are reported will depend on many factors. The percentage used is dependent on the date your injury occurred.

Source: davismartindale.com

Source: davismartindale.com

The deductions and how the benefits are reported will depend on many factors. There is a limit on the amount of gross earnings insured, known as the maximum compensable earnings. Each wlrp is unique and can be structured and funded in many different ways. If a disabled employee is not capable of The deductions and how the benefits are reported will depend on many factors.

Source: lsminsurance.ca

Source: lsminsurance.ca

A wage loss replacement plan is a disability income replacement program set up by your employer. Many people worry about how they will pay their bills if they are laid off from work.if you don’t have funds in reserve to cover your expenses until you line up another job, there are companies that sell job loss insurance that will. Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. Each wlrp is unique and can be structured and funded in many different ways. However, other moneys and payments for benefits not related to employment do not constitute earnings for benefit purposes, for example, alimony payments,.

Source: beritamistis.com

Source: beritamistis.com

In return, the employee must comply with the companies rules and abandon their right to sue under the tort of negligence. Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. The deductions and how the benefits are reported will depend on many factors. Depending on how the plan is set up, you may have to claim a taxable benefit. Generally, a wlrp is an arrangement between an employer and employees, or an employer and a group or association of employees, where the employees receive benefits on a periodic basis for loss of employment income due to sickness, maternity, or accident.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

However, other moneys and payments for benefits not related to employment do not constitute earnings for benefit purposes, for example, alimony payments,. Now, icbc will pay up to $740 per week for lost wages if you have suffered injuries in a car accident that keep you from doing your job. Your net earnings are your gross pay less probable employment insurance, canada pension plan and income tax deductions. Compensation for lost wages that a person receives or is entitled to receive from a motor vehicle insurance plan provided under provincial law where ei benefits are not taken into account when calculating the amount of compensation under the provincial law Generally, a wlrp is an arrangement between an employer and employees, or an employer and a group or association of employees, where the employees receive benefits on a periodic basis for loss of employment income due to sickness, maternity, or accident.

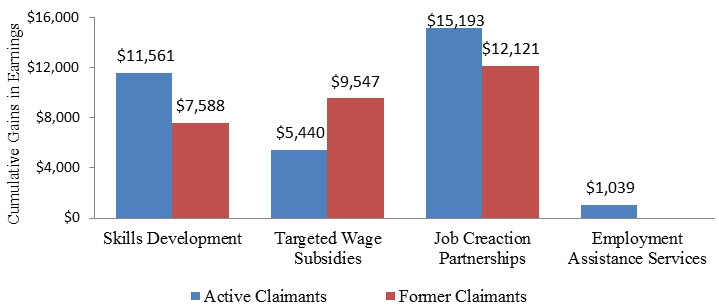

Source: canada.ca

Source: canada.ca

Wsib insurance, or previously known as workers’ compensation is a type of insurance that aids in providing wage replacement and medical benefits to employers who were injured on the job site. You might find your income replacement indemnities amount or the compensation you received for the loss of financial support under a law of canada or from a province other than québec, on your t5007 slip. Wsib insurance, or previously known as workers’ compensation is a type of insurance that aids in providing wage replacement and medical benefits to employers who were injured on the job site. The deductions and how the benefits are reported will depend on many factors. You are obligated to obtain whatever other sources of income replacement are available to you, such as unemployment insurance.

Source: intechrisk.com

Source: intechrisk.com

The percentage used is dependent on the date your injury occurred. Your wage loss benefits are equivalent to 85% of your net annual earnings up to the current maximum annual earnings limit. Net earnings are your gross earnings less amounts representing probable deductions for income tax payable, canada. The percentage used is dependent on the date your injury occurred. Wage loss is paid by icbc as a no fault benefit up to a limit of either $300 per week or 75 of your gross weekly earnings in the 12 months prior to the accident, whichever is less.

Source: pinterest.com

Source: pinterest.com

A wage loss replacement plan is a disability income replacement program set up by your employer. Employment insurance (ei) is an unemployment insurance program in canada that allows individuals who have recently lost a job to receive temporary financial assistance. Your net earnings are your gross pay less probable employment insurance, canada pension plan and income tax deductions. Job loss insurance can also be available in conjunction with disability insurance as one package. Loss of earnings (loe) benefits are monthly payments from the workplace safety and insurance board (wsib) that replace some of a worker’s lost future wages after a workplace injury.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is wage loss insurance canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information