What makes an insurance policy a unilateral contract Idea

Home » Trending » What makes an insurance policy a unilateral contract IdeaYour What makes an insurance policy a unilateral contract images are ready. What makes an insurance policy a unilateral contract are a topic that is being searched for and liked by netizens today. You can Download the What makes an insurance policy a unilateral contract files here. Download all free photos and vectors.

If you’re looking for what makes an insurance policy a unilateral contract images information linked to the what makes an insurance policy a unilateral contract keyword, you have pay a visit to the right site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

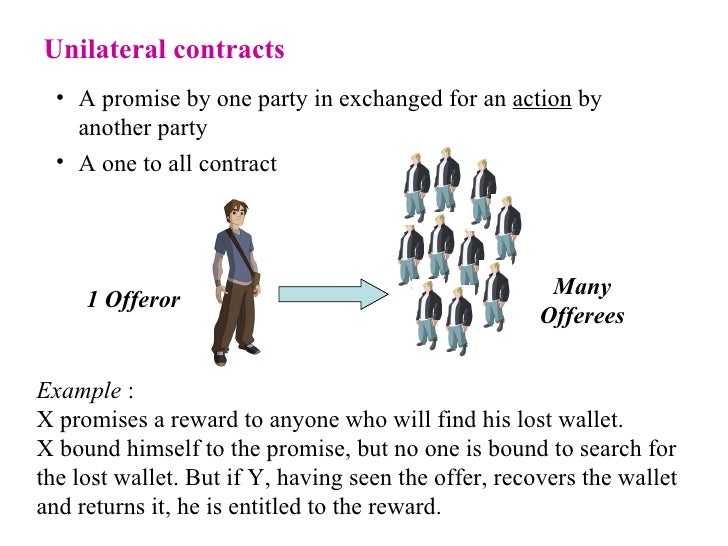

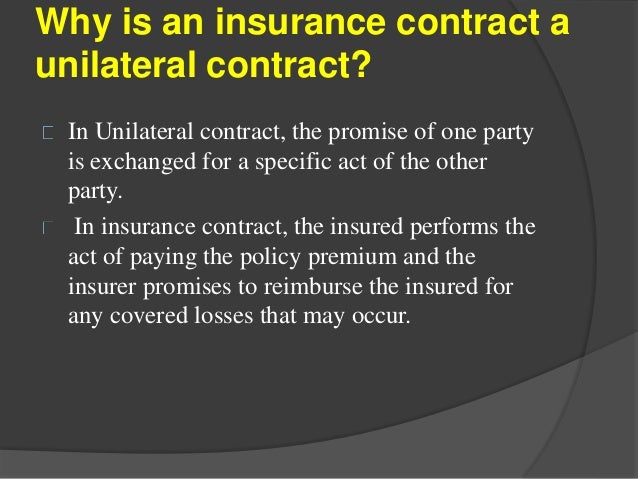

What Makes An Insurance Policy A Unilateral Contract. What makes an insurance policy a unilateral contract? Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Advertisement insuranceopedia explains unilateral contract By contrast, the insured makes few, if any, enforceable promises to the insurer.

What Makes An Insurance Policy A Unilateral Contract From iluvamericangirl.blogspot.com

What Makes An Insurance Policy A Unilateral Contract From iluvamericangirl.blogspot.com

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. The insured is not required to pay the premiums, but the insurer is required to pay the benefits under the contract if the insured has paid the premiums and met certain other basic provisions. Unlike normal bilateral contracts, for unilateral contracts, the reward is not given in exchange for a promise from the other party. By contrast, the insured makes few, if any, enforceable promises to the insurer. Enforcing bilateral or unilateral contracts in court. An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral.

Insurance policies are usually unilateral agreements.

Insurance policies are usually unilateral agreements. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. A contract in which only one party makes an enforceable promise. What are the characteristics of an insurance contract? Instead, the insured must only fulfill certain conditions such as paying premiums and reporting. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

What is a unilateral contract? What makes it a unilateral contract is the company deciding alone all the conditions. The offer can only be accepted when the other party completely performs the requested action. An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral. Instead, the insured must only fulfill certain conditions—such as paying.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Unilateral contract — a contract in which only one party makes an enforceable promise. If you need examples of unilateral contracts, you should know that a unilateral contract is one in which the buyer intends to pay for a specified performance or legal act. When the contract, which can be modified by company, has been prepared by the insurance company with no negotiation between the applicant and the insurer, and the applicant adheres to it on a take it or leave it basis. A unilateral contract is a contract created by an offer that can only be accepted by performance. What is a one sided contract?

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral. What are the characteristics of an insurance contract? A contract in which only one party makes an enforceable promise. Unilateral contract refers to a promise of one party to another that is legally binding. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder.

Source: revisi.net

Source: revisi.net

When it comes to a unilateral agreement, only one party pays the. A unilateral contract is commonly formed in a number of cases. What is a one sided contract? Unilateral¶ insurance contracts are unilateral. Rather, the insured simply pays a premium on the policy.

Source: diederichhealthcare.com

Source: diederichhealthcare.com

In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. What are the characteristics of an insurance contract? Unilateral¶ insurance contracts are unilateral. Only the insured pays the premium b. The insured is not required to pay the premiums, but the insurer is required to pay the benefits under the contract if the insured has paid the premiums and met certain other basic provisions.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

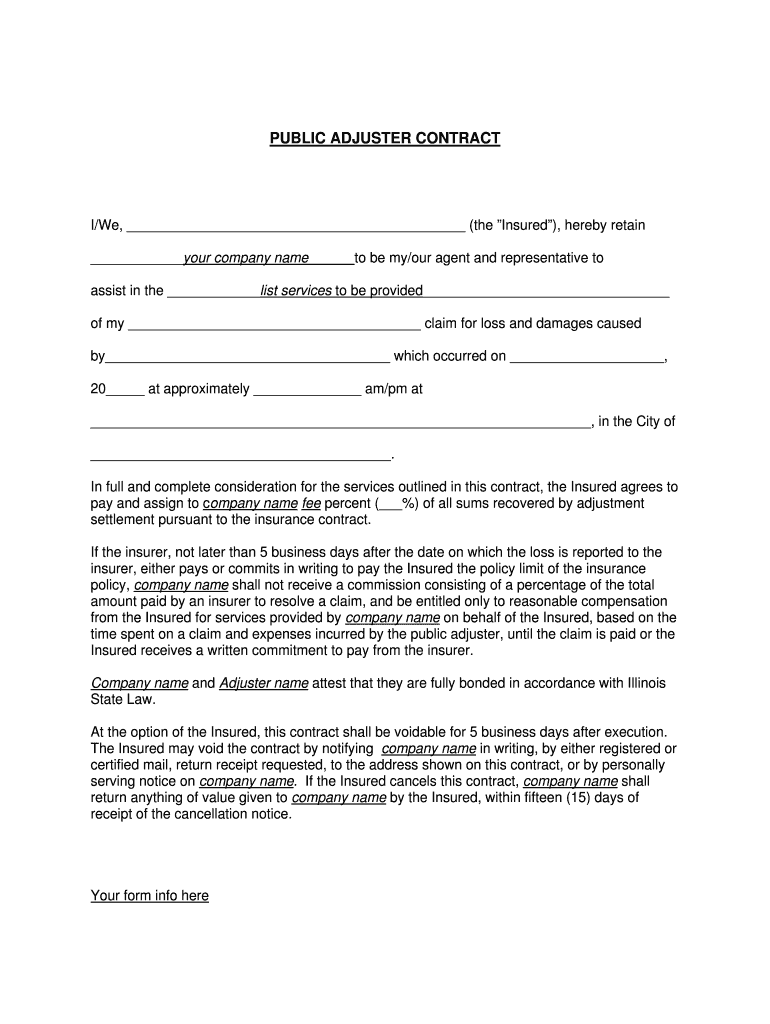

Unlike normal bilateral contracts, for unilateral contracts, the reward is not given in exchange for a promise from the other party. In a unilateral contract, the offeror is the only party with a contractual obligation. A unilateral contract is a contract agreement in which an offeror promises to pay after the occurrence of a specified act. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens. What makes an insurance policy a unilateral contract?

Source: signnow.com

Source: signnow.com

An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral. The insured is not required to pay the premiums, but the insurer is required to pay the benefits under the contract if the insured has paid the premiums and met certain other basic provisions. A unilateral contract is a contract agreement in which an offeror promises to pay after the occurrence of a specified act. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. Rather, the insured simply pays a premium on the policy.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

When the contract, which can be modified by company, has been prepared by the insurance company with no negotiation between the applicant and the insurer, and the applicant adheres to it on a take it or leave it basis. In a unilateral contract, the offeror is the only party with a contractual obligation. What makes an insurance policy a unilateral contract? The applicant makes no such promise. What is a unilateral contract?

Source: slideshare.net

Source: slideshare.net

Rather, the insured simply pays a premium on the policy. By contrast, the insured makes few, if any, enforceable promises to the insurer. Insurers promise to pay benefits upon the occurrence of a specific event, such as death or disability. Insurance contracts are another example of unilateral contracts. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral. What are the characteristics of an insurance contract? Since it is a unilateral contract, the insurer is not obligated to make a payment to the insured if the event does not occur. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. An example of a unilateral contract is an insurance policy contract, which is usually partially unilateral.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Instead, the insured must only fulfill certain conditions such as paying premiums and reporting. By contrast, the insured makes few, if any, enforceable promises to the insurer. What makes an insurance policy a unilateral contract? Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. What makes an insurance policy a unilateral contract?

Source: dreamstime.com

Source: dreamstime.com

When it comes to a unilateral agreement, only one party pays the. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Only the insured can change the provisions c. The insured is not required to pay the premiums, but the insurer is required to pay the benefits under the contract if the insured has paid the premiums and met certain other basic provisions. A unilateral contract is a contract agreement in which an offeror promises to pay after the occurrence of a specified act.

Source: revisi.net

Source: revisi.net

In a unilateral contract, the offeror is the only party with a contractual obligation. Only the insured pays the premium b. In fact, the applicant does not even promise to pay premiums. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Besides open requests, insurance companies also use unilateral contracts.

Source: camerahaiphong.org

Source: camerahaiphong.org

Since it is a unilateral contract, the insurer is not obligated to make a payment to the insured if the event does not occur. What is a one sided contract? Unlike normal bilateral contracts, for unilateral contracts, the reward is not given in exchange for a promise from the other party. What makes an insurance policy a unilateral contract? Unilateral contract refers to a promise of one party to another that is legally binding.

Source: noclutter.cloud

Source: noclutter.cloud

Rather, the insured simply pays a premium on the policy. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. The insured is not required to pay the premiums, but the insurer is required to pay the benefits under the contract if the insured has paid the premiums and met certain other basic provisions. A unilateral contract is commonly formed in a number of cases. Insurers promise to pay benefits upon the occurrence of a specific event, such as death or disability.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

In a unilateral contract, the offeror is the only party with a contractual obligation. By contrast, the insured makes few, if any, enforceable promises to the insurer. In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. Unilateral contract refers to a promise of one party to another that is legally binding. When the contract, which can be modified by company, has been prepared by the insurance company with no negotiation between the applicant and the insurer, and the applicant adheres to it on a take it or leave it basis.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. A contract in which only one party makes an enforceable promise. A unilateral contract is a contract created by an offer that can only be accepted by performance. When the contract, which can be modified by company, has been prepared by the insurance company with no negotiation between the applicant and the insurer, and the applicant adheres to it on a take it or leave it basis. What makes it a unilateral contract is the company deciding alone all the conditions.

Source: slideshare.net

Source: slideshare.net

In a unilateral contract, the offeror is the only party with a contractual obligation. Only the insured pays the premium b. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what makes an insurance policy a unilateral contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information