What states have no fault car insurance Idea

Home » Trending » What states have no fault car insurance IdeaYour What states have no fault car insurance images are available. What states have no fault car insurance are a topic that is being searched for and liked by netizens today. You can Get the What states have no fault car insurance files here. Get all free photos.

If you’re looking for what states have no fault car insurance images information related to the what states have no fault car insurance interest, you have visit the ideal site. Our website always gives you hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

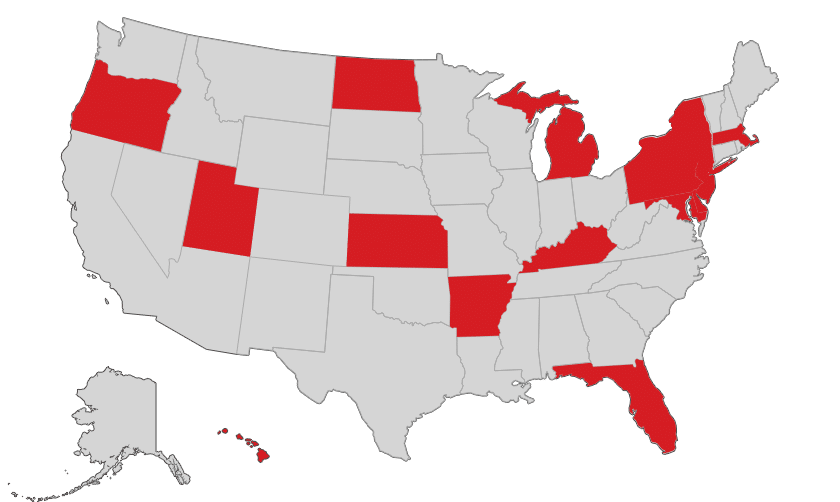

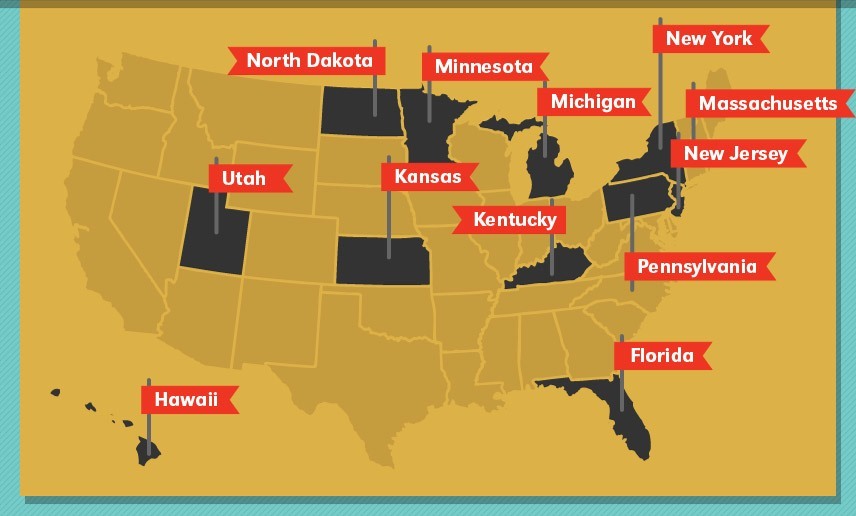

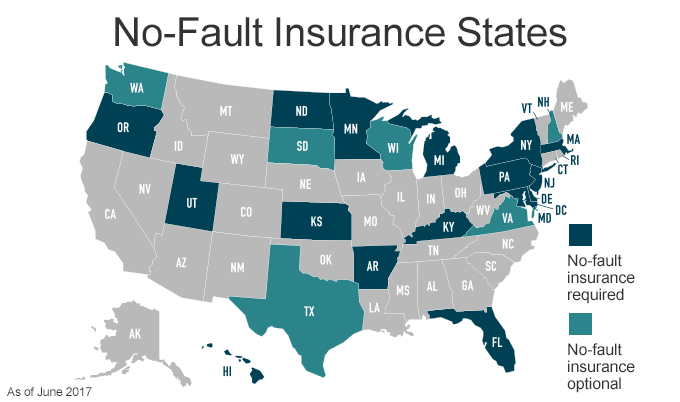

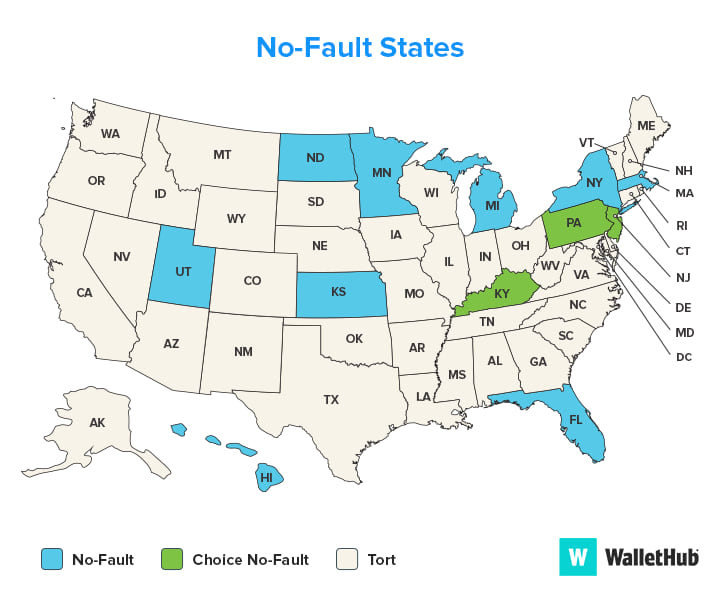

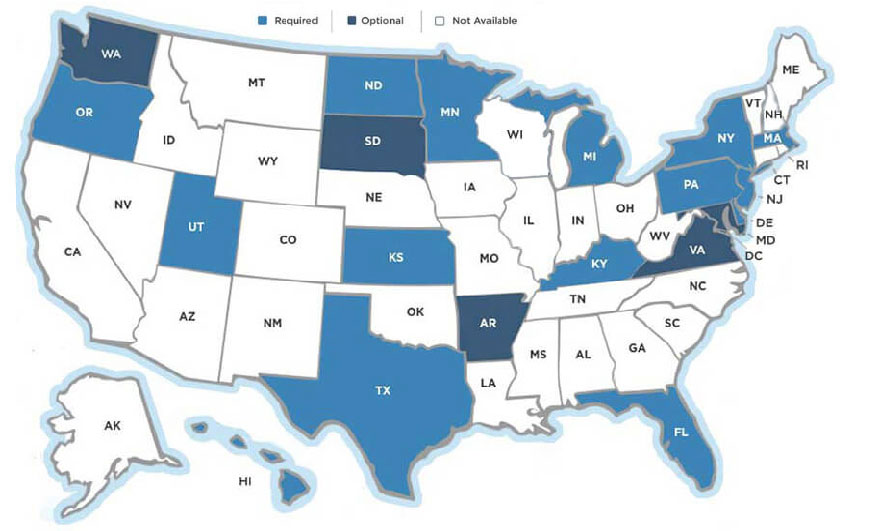

What States Have No Fault Car Insurance. In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. Florida, michigan, new jersey, new york and pennsylvania have verbal thresholds. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory.

What Is NoFault Insurance & Which States Have It? From wallethub.com

What Is NoFault Insurance & Which States Have It? From wallethub.com

The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. Find out if your state requires you to have pip coverage. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there.

In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy.

The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills. In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits.

Source: ratesforinsurance.com

Source: ratesforinsurance.com

The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills. Florida, michigan, new jersey, new york and pennsylvania have verbal thresholds. Find out if your state requires you to have pip coverage.

Source: cheapfullcoverageautoinsurance.com

Source: cheapfullcoverageautoinsurance.com

The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah. Find out if your state requires you to have pip coverage. For this reason, california is classified as a “fault state.” Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington

Source: valientemott.com

Source: valientemott.com

Find out if your state requires you to have pip coverage. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills. Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place.

Source: blog.honestpolicy.com

Source: blog.honestpolicy.com

Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. Florida, michigan, new jersey, new york and pennsylvania have verbal thresholds. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits.

Source: buyautoinsurance.com

Source: buyautoinsurance.com

In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. For this reason, california is classified as a “fault state.” Florida, hawaii, kansas, kentucky, michigan, massachusetts, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills.

Source: wallethub.com

Source: wallethub.com

Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. Drivers in california do still retain their right to sue for additional damages, according to los angeles car accident attorneys. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah. The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there.

Source: infogram.com

Source: infogram.com

Find out if your state requires you to have pip coverage. Drivers in california do still retain their right to sue for additional damages, according to los angeles car accident attorneys. For this reason, california is classified as a “fault state.” In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills.

Source: allstate.com

Source: allstate.com

Drivers in california do still retain their right to sue for additional damages, according to los angeles car accident attorneys. Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah.

Source: pinterest.com

Source: pinterest.com

Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills. Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington Florida, hawaii, kansas, kentucky, michigan, massachusetts, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. The no fault insurance claim offered by the no fault car insurance states is mainly aimed to decrease the auto insurance cost of the car owners by taking out some small claims of the courts. No fault insurance states, no fault car insurance claim, cheap no fault car insurance, what does no fault state mean, no fault car insurance state, no fault insurance in michigan, florida no fault car insurance, no fault car insurance nj unsecured loans as consultants in deciding whether apparent understanding legal skills. You can, however, purchase a different type of coverage. These states include arkansas, delaware and maryland.

Source: wallethub.com

Source: wallethub.com

Florida, hawaii, kansas, kentucky, michigan, massachusetts, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. Florida, michigan, new jersey, new york and pennsylvania have verbal thresholds. You can, however, purchase a different type of coverage. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. Drivers in california do still retain their right to sue for additional damages, according to los angeles car accident attorneys.

Source: theinsurancebulletin.com

Source: theinsurancebulletin.com

The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold. Florida, hawaii, kansas, kentucky, michigan, massachusetts, minnesota, new jersey, new york, north dakota, pennsylvania, and utah. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah. Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy.

Source: wzzm13.com

Source: wzzm13.com

You can, however, purchase a different type of coverage. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there.

Source: thehartford.com

Source: thehartford.com

While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. Florida, hawaii, kansas, kentucky, michigan, massachusetts, minnesota, new jersey, new york, north dakota, pennsylvania, and utah.

Source: carsurance.net

Source: carsurance.net

The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold. Currently, 12 states—florida, hawaii, kansas, kentucky, massachusetts, michigan, minnesota, new jersey, new york, north dakota, pennsylvania, and utah—plus puerto rico have some form of mandatory. The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold. Drivers in california do still retain their right to sue for additional damages, according to los angeles car accident attorneys. For this reason, california is classified as a “fault state.”

In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy. Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington For this reason, california is classified as a “fault state.” Florida, michigan, new jersey, new york and pennsylvania have verbal thresholds. The other seven states—hawaii, kansas, kentucky, massachusetts, minnesota, north dakota and utah—use a monetary threshold.

Source: br.pinterest.com

Source: br.pinterest.com

While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. You can, however, purchase a different type of coverage. Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. In these states, your insurer covers your injury damages regardless of fault, but there are no restrictions concerning lawsuits. In cases where fault is evenly divided between the parties, each driver will collect damages against his or her own insurance policy.

Source: getcaraccident.money

Source: getcaraccident.money

Here every insurance provider compensates the policyholders for the costs of the minor injuries irrespective of who was the actual fault at the accident place. The twelve states that require pip insurance, also known as personal injury protection, are delaware, florida, hawaii, kansas, massachusetts, michigan, minnesota, new jersey, new york, north dakota, oregon, and utah. Minnesota new jersey* new york north dakota oregon pennsylvania* texas utah washington While an injured driver can still file a claim to the other driver’s insurance and that claim will have to be paid, it doesn’t end there. These states include arkansas, delaware and maryland.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what states have no fault car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information