What to consider when buying insurance information

Home » Trend » What to consider when buying insurance informationYour What to consider when buying insurance images are ready in this website. What to consider when buying insurance are a topic that is being searched for and liked by netizens now. You can Get the What to consider when buying insurance files here. Get all free vectors.

If you’re looking for what to consider when buying insurance images information linked to the what to consider when buying insurance topic, you have come to the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

What To Consider When Buying Insurance. However, there are a few important factors to consider before purchasing your plan. 4:00 am est february 9, 2022. However, as a general guideline, the philippine life insurance association, or plia, recommends purchasing life insurance with a face value of five to seven times your current yearly gross income. Before you extend your cover or take out a new policy, take a look at these top seven things to consider when buying life insurance.

MustRead Tips Before Buying Life Insurance Finance From affordablecebu.com

MustRead Tips Before Buying Life Insurance Finance From affordablecebu.com

Therefore, it is vital that you know what to look for when buying insurance to make sure that you make the best insurance move for yourself, your loved ones, and your business. Finances can make a stressful, saddening situation even worse. Ask about available discounts and services, consider using an insurance agent, and be truthful and accurate when comparing quotes. Funerals cost thousands of dollars. Paying off debts raising children creating financial security for family funding inheritance tax it is important that you�re clear about what you want to achieve so that the policy you choose doesn�t fall short of your expectations. This is because every insurance decision you make can change your life.

When assessing any insurance policy, kortbawi advises, it is.

Funerals cost thousands of dollars. When you buy a variable policy, you can invest a portion of the premium in a variety of ways. It’s typically for those left behind to deal with financial burdens and. It could be a possibility your insurance requirement is 5 crore and for that insurance premium amount is very high even if your annual income is. Consider these 5 important ratios before buying an insurance policy. This is because every insurance decision you make can change your life.

Source: kirkgmeyer.com

Source: kirkgmeyer.com

There are a variety of things people will want the money from a life insurance to do if they die. What does the policy cover? What to consider when buying burial insurance when you lose a loved one, you don’t want to think about finances. It could be a possibility your insurance requirement is 5 crore and for that insurance premium amount is very high even if your annual income is. Decide if you really need life insurance.

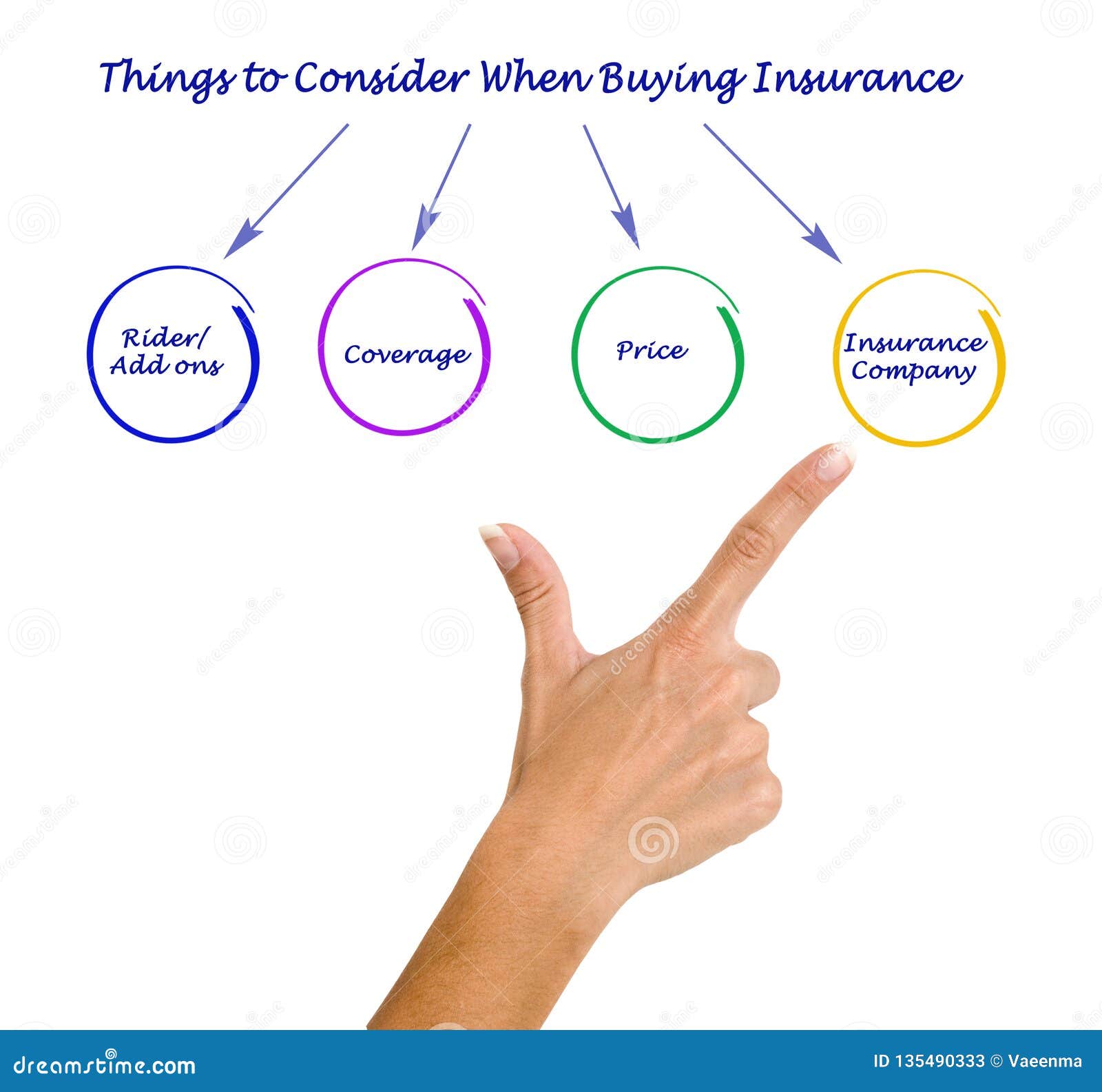

Source: dreamstime.com

Source: dreamstime.com

What to consider when buying insurance make sure you know what you want to cover and check you�re not paying for insurance you don�t need. You want to remember the person you lost and grieve for them. Before buying an insurance policy you want to assess any insurer on these 5 important ratios. Age criteria of policy and your life stage. There are a variety of things people will want the money from a life insurance to do if they die.

Source: comparepolicy.com

Source: comparepolicy.com

Premium payout means how much premium you have to pay to get life insurance coverage. Do not hide any critical information from your insurance company. You want to remember the person you lost and grieve for them. Ask about available discounts and services, consider using an insurance agent, and be truthful and accurate when comparing quotes. Your current life stage and age is the first factor that should be considered while buying a life insurance policy.

Source: pinterest.com

Source: pinterest.com

What does the policy cover? 20) modifications if you have made modifications to your car then you must state them to your insurer. Therefore, when considering to buy life insurance, it is vital for you to also consider the fact if your spouse is a “stay at home” partner. Here�s what to consider when buying pet insurance. Go through the policy wordings in detail and get your doubts clarified from the insurance company before you buy the policy.

Source: getinsurance.ng

Source: getinsurance.ng

Do not be very late because as time passes, your premium amount will also increase depending on your age and also if you develop any illness or disease, it will get tougher to get the policy later. Here�s what to consider when buying pet insurance. First and foremost, considering purchasing insurance is itself a prudent move. This will give you a good idea of the insurer�s reputation. 5)once you commence a business with partners.

Source: humana.com

Source: humana.com

If insurance is too expensive, go for minimum coverage and update later. Should the policy value remain the same? The last sort of permanent life insurance to consider is a variable life policy. Go through the policy wordings in detail and get your doubts clarified from the insurance company before you buy the policy. If you come across a policy with a surprisingly cheap premium, make sure you look into all of the above points.

Source: visual.ly

Source: visual.ly

First time buyers when buying life insurance for the first time, people should do so when they are still young. Earlier you buy a term insurance plan, better it is there is no minimum or maximum age for term insurance. This type of insurance is designed to cover medical costs in the event of an emergency. 4:00 am est february 9, 2022. The cost of insurance can vary based on several factors.

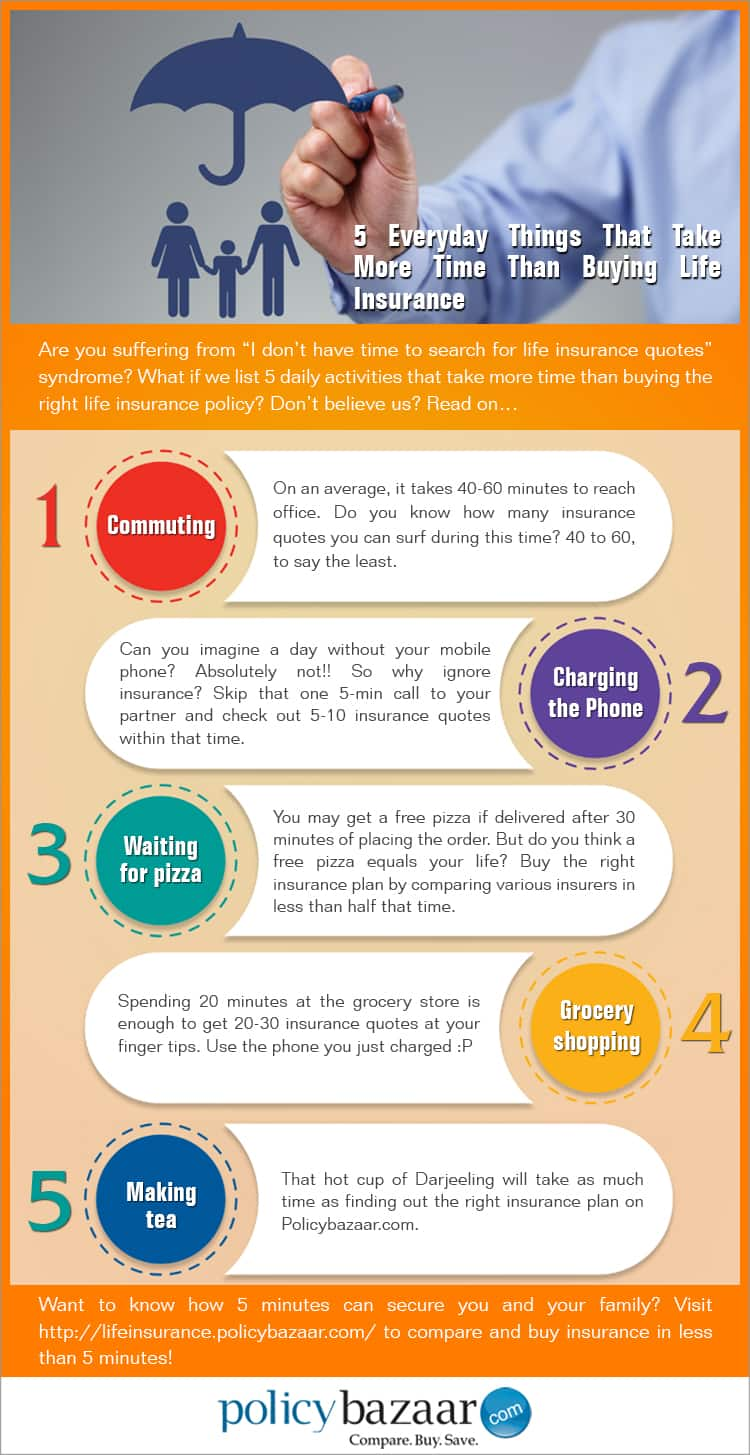

Source: policybazaar.com

Source: policybazaar.com

Do not hide any critical information from your insurance company. What is life insurance for? If insurance is too expensive, go for minimum coverage and update later. Therefore, when considering to buy life insurance, it is vital for you to also consider the fact if your spouse is a “stay at home” partner. Earlier you purchase the policy better it is.

Source: dreamstime.com

Source: dreamstime.com

However, there are a few important factors to consider before purchasing your plan. Do not be very late because as time passes, your premium amount will also increase depending on your age and also if you develop any illness or disease, it will get tougher to get the policy later. Go through the policy wordings in detail and get your doubts clarified from the insurance company before you buy the policy. In some cases, the insurer will pay the entire bill, while others will only pay a percentage. How long do you want your cover to last?

Source: indianmoney.com

Source: indianmoney.com

However, as a general guideline, the philippine life insurance association, or plia, recommends purchasing life insurance with a face value of five to seven times your current yearly gross income. Paying off debts raising children creating financial security for family funding inheritance tax it is important that you�re clear about what you want to achieve so that the policy you choose doesn�t fall short of your expectations. This type of insurance is designed to cover medical costs in the event of an emergency. Age is one of the crucial deciding factors when it comes to health insurance. When you buy a variable policy, you can invest a portion of the premium in a variety of ways.

Source: learn.everquote.com

This will give you a good idea of the insurer�s reputation. How long do you want your cover to last? Premium payout means how much premium you have to pay to get life insurance coverage. Therefore, when considering to buy life insurance, it is vital for you to also consider the fact if your spouse is a “stay at home” partner. Consider these 5 important ratios before buying an insurance policy.

Source: slideserve.com

Source: slideserve.com

5)once you commence a business with partners. While purchasing a medical policy do keep in mind the age of the family members who need to be insured. Things to remember while buying health insurance. If you are a generous spender, consider keeping a tight budget when it comes to car insurance expenses. The cost of insurance can vary based on several factors.

Source: policybazaar.com

Source: policybazaar.com

Your current life stage and age is the first factor that should be considered while buying a life insurance policy. However, as a general guideline, the philippine life insurance association, or plia, recommends purchasing life insurance with a face value of five to seven times your current yearly gross income. This is because every insurance decision you make can change your life. Therefore, when considering to buy life insurance, it is vital for you to also consider the fact if your spouse is a “stay at home” partner. When looking up and researching life insurance, here are what we think are the most important things to consider.

Source: baumgartinsurance.com

Source: baumgartinsurance.com

The cost of insurance can vary based on several factors. How long do you want your cover to last? 20) modifications if you have made modifications to your car then you must state them to your insurer. At first sight, commencing a business might appear to be a weird reason to. It could be a possibility your insurance requirement is 5 crore and for that insurance premium amount is very high even if your annual income is.

Source: youtube.com

Source: youtube.com

If you come across a policy with a surprisingly cheap premium, make sure you look into all of the above points. If you are a generous spender, consider keeping a tight budget when it comes to car insurance expenses. Here is a quick rundown of the 10 things that you can consider to buy the best health insurance plan for yourself and your family: First and foremost, considering purchasing insurance is itself a prudent move. This type of insurance is designed to cover medical costs in the event of an emergency.

Source: zanebenefits.com

Source: zanebenefits.com

Before you extend your cover or take out a new policy, take a look at these top seven things to consider when buying life insurance. The cost of insurance can vary based on several factors. Should the policy value remain the same? Before buying an insurance policy you want to assess any insurer on these 5 important ratios. Age criteria of policy and your life stage.

Source: ratelab.ca

Source: ratelab.ca

At first sight, commencing a business might appear to be a weird reason to. Things to remember while buying health insurance. How long do you want your cover to last? However, there are a few important factors to consider before purchasing your plan. Earlier you purchase the policy better it is.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what to consider when buying insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information